Joliet Illinois Satisfaction, Release or Cancellation of Mortgage by Individual

Description

How to fill out Illinois Satisfaction, Release Or Cancellation Of Mortgage By Individual?

Obtaining validated templates tailored to your local laws can be difficult unless you utilize the US Legal Forms database.

This is an online repository of over 85,000 legal documents for both personal and professional requirements, covering various real-life situations.

All the forms are adequately organized by purpose and jurisdictional categories, making it as straightforward as ABC to find the Joliet Illinois Satisfaction, Release or Cancellation of Mortgage by Individual.

Input your credit card details or use your PayPal account to finalize the payment for the service.

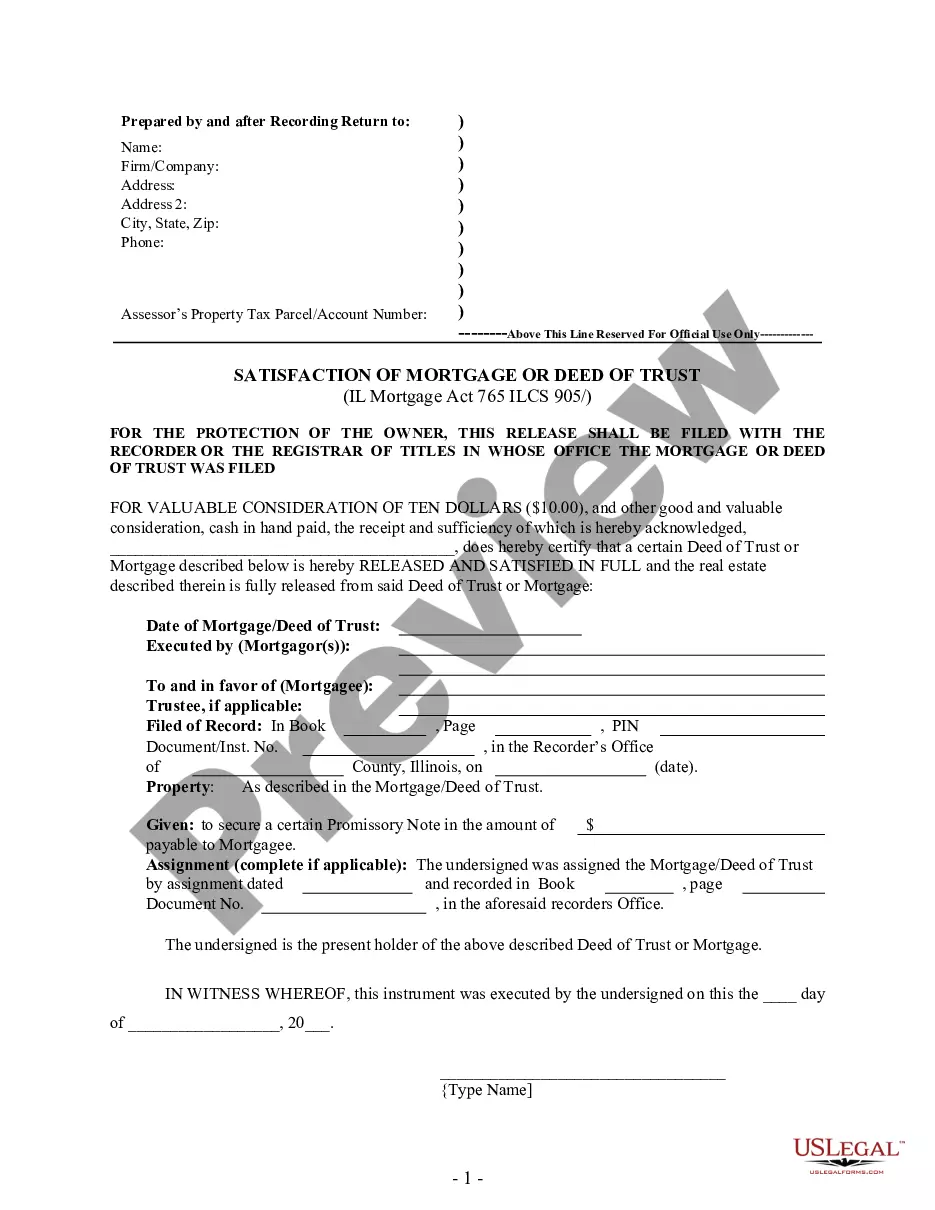

- Review the Preview mode and document description.

- Ensure you’ve chosen the correct form that aligns with your needs and fully adheres to your local jurisdiction stipulations.

- Look for another template, if necessary.

- If you notice any discrepancies, make use of the Search tab above to find the appropriate one. If it meets your requirements, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

Filling out a mortgage release form in Joliet, Illinois, involves entering specific information such as the property details and lender's information. You should carefully ensure all required fields are correctly filled out to avoid delays. Platforms like uslegalforms can make this process smoother, providing templates and guidance to ensure your form is completed accurately and efficiently.

If a satisfaction of mortgage is not recorded in Joliet, Illinois, the mortgage remains active in public records, which can affect your property's title. This may lead to complications if you decide to sell or refinance since potential buyers or lenders might see the mortgage as still outstanding. It's crucial to ensure this document is filed after repayment to avoid any future issues.

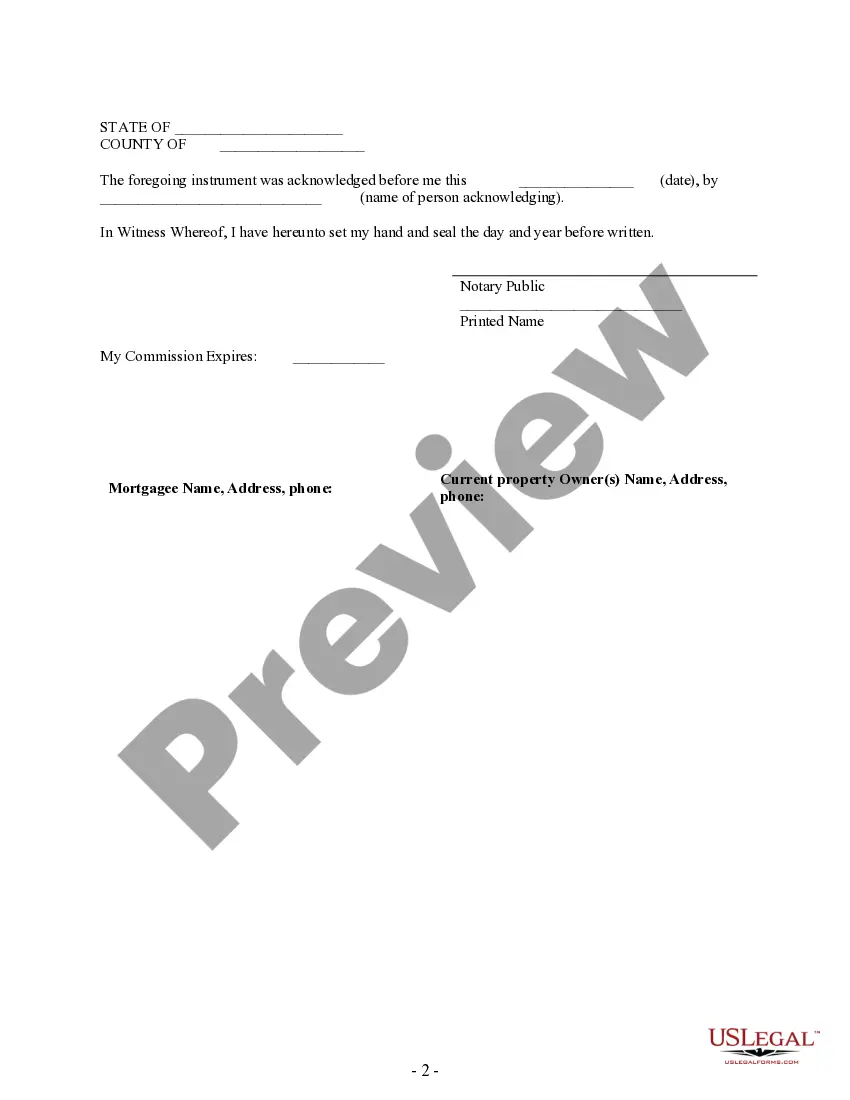

To record a release of your mortgage in Joliet, Illinois, you need to obtain a Satisfaction of Mortgage document from your lender. After filling it out and signing, you can file it with the county recorder's office. This formal step ensures that your mortgage is officially released, reflecting your complete ownership of the property.

Finding the satisfaction of your mortgage involves contacting your lender or checking public property records in Joliet, Illinois. Your lender should maintain records of all mortgage transactions, including satisfaction documents. If you experience difficulties in locating this information, USLegalForms offers solutions to assist you in obtaining a copy of your mortgage satisfaction, ensuring that you have access to all necessary documentation.

The timeline for receiving a satisfaction of mortgage can vary in Joliet, Illinois, but it typically takes a few weeks after your final payment is processed. Once your lender confirms the payoff, they will issue the satisfaction document. Keeping track of your communications with your lender will help ensure the process moves smoothly. You can also use USLegalForms to streamline this process, making it easier to manage your Joliet Illinois Satisfaction, Release or Cancellation of Mortgage by Individual.

Yes, a satisfaction of mortgage usually requires notarization in Joliet, Illinois, to remain valid. The notarization process adds an extra layer of legitimacy, ensuring that the document is officially recognized and enforceable. Make sure to gather all necessary identification and documentation when arranging a notarization. If you're looking for help with this, USLegalForms provides resources to assist you in obtaining a satisfaction of mortgage.

To obtain a mortgage satisfaction letter, contact your lender after you have fully repaid your mortgage. The lender will review your account and issue a letter confirming that the mortgage has been satisfied. For further assistance, uSlegalforms provides tools to help you draft requests for these important documents related to Joliet Illinois Satisfaction, Release or Cancellation of Mortgage by Individual.

Yes, a satisfaction of a mortgage and a release of a mortgage generally refer to the same conclusion; both signify that a mortgage obligation has been met. The satisfaction document serves as proof that the debt is cleared, while the release ensures the lien on the property is lifted. This clarity is vital for achieving Joliet Illinois Satisfaction, Release or Cancellation of Mortgage by Individual, streamlining your property ownership.

The terms 'lien release' and 'satisfied' often overlap, but they focus on different aspects of property rights. A lien release means that the lender officially removes their claim on the property, while 'satisfaction' confirms that the mortgage payments are completed. Recognizing these distinctions is important for those seeking Joliet Illinois Satisfaction, Release or Cancellation of Mortgage by Individual.

A mortgage release form is a legal document used to indicate that a mortgage has been satisfied and the lender no longer has a claim on the property. In Joliet, Illinois, this form is crucial for the homeowner, as it formally releases them from any further obligations tied to the mortgage. By submitting this form to the appropriate authorities, you enhance your property records. The uslegalforms platform offers easy access to the necessary templates and guidance for the Joliet Illinois Satisfaction, Release or Cancellation of Mortgage by Individual, making the process straightforward.