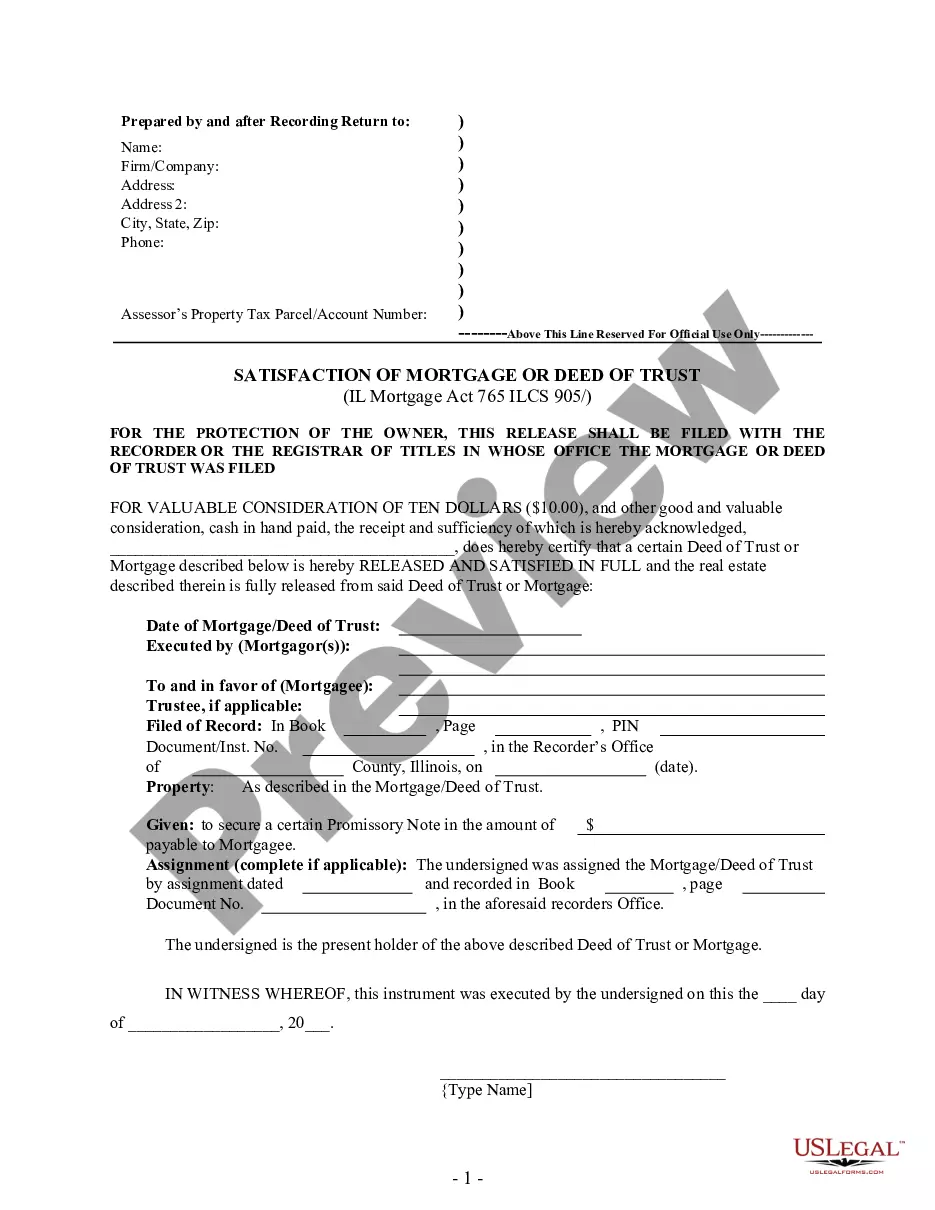

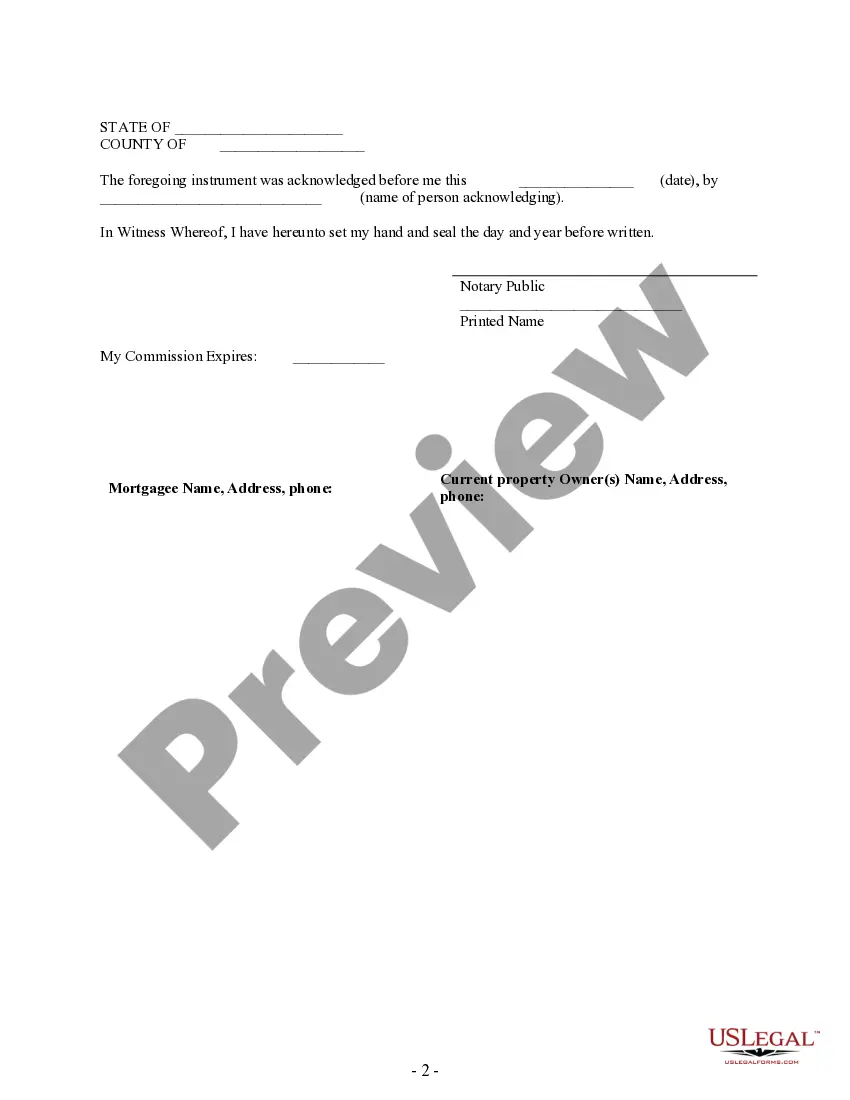

Rockford Illinois Satisfaction, Release or Cancellation of Mortgage by Individual: A Comprehensive Guide to Mortgage Termination In Rockford, Illinois, the Satisfaction, Release, or Cancellation of Mortgage by Individual refers to the legal process of terminating a mortgage on a property by an individual borrower. This signifies that the loan has been fully paid off, allowing the borrower to gain full ownership and clear the property title from any encumbrances. This article aims to provide a detailed description of the process and highlight different types of Satisfaction, Release, or Cancellation of Mortgage by Individual in Rockford, Illinois. 1. Rockford Illinois Satisfaction, Release or Cancellation of Mortgage by Individual Process: The process of satisfying, releasing, or canceling a mortgage in Rockford, Illinois involves the following steps: — Loan Repayment Completion: The individual borrower must ensure that the entire mortgage loan has been paid in full, including any outstanding principal, interest, and associated fees. — Requesting the Mortgage Release: Once the mortgage is fully paid off, the borrower needs to contact their lender or mortgage company to initiate the release or satisfaction process. — Preparation of Legal Documents: The lender or mortgage company prepares appropriate legal documents, such as a Satisfaction of Mortgage or Release of Mortgage, stating that the loan has been satisfied and the mortgage is hereby canceled. — Notarization: The borrower must sign the satisfaction or release document in the presence of a notary public to validate the legality of the process. — Recording with County Recorder's Office: After notarization, the lender or borrower submits the satisfaction or release document to the County Recorder's Office in Rockford, Illinois. This step is crucial for officially removing the mortgage lien from the property's title records. 2. Types of Rockford Illinois Satisfaction, Release, or Cancellation of Mortgage by Individual: There are various types of Satisfaction, Release, or Cancellation of Mortgage by an Individual in Rockford, Illinois, based on specific situations. These include: — Voluntary Satisfaction: This occurs when the borrower has completely paid off the mortgage loan, as per the agreed-upon terms and conditions. — Satisfaction through Refinancing: If the borrower decides to refinance their mortgage with another lender, it involves satisfying the existing mortgage and replacing it with a new one. — Satisfaction due to Sale: When the borrower sells the property, the mortgage is satisfied through the proceeds of the sale, allowing for the release of the lien on the property. — Satisfaction through Loan Assumption: In some cases, the borrower might transfer the mortgage responsibility to another party, known as a loan assumption. Once the assumption is legally completed, the existing mortgage can be satisfied. — Satisfaction as per Court Order: In certain legal circumstances, such as divorce settlements or foreclosure proceedings, a court order may require the satisfaction or release of a mortgage by an individual. Keywords: Rockford Illinois, Satisfaction, Release, Cancellation of Mortgage, individual, legal process, termination, loan repayment completion, mortgage release, legal documents, notarization, County Recorder's Office, voluntary satisfaction, refinancing, sale, loan assumption, court order. Note: The information provided here is intended for informational purposes only and should not be considered as legal advice. It is advised to consult with a legal professional or relevant authorities for accurate and customized guidance in matters related to Satisfaction, Release, or Cancellation of Mortgage by Individual in Rockford, Illinois.

Rockford Illinois Satisfaction, Release or Cancellation of Mortgage by Individual

Description

How to fill out Illinois Satisfaction, Release Or Cancellation Of Mortgage By Individual?

If you have previously utilized our service, access your account and store the Rockford Illinois Satisfaction, Release or Cancellation of Mortgage by Individual on your device by selecting the Download button. Ensure your subscription remains active. If not, renew it according to your payment plan.

If this is your initial interaction with our service, follow these straightforward steps to acquire your document.

You have continual access to all documents you’ve acquired: you can find it in your profile under the My documents menu whenever you wish to use it again. Utilize the US Legal Forms service to effortlessly discover and store any template for your personal or business needs!

- Ensure you’ve found the correct document. Browse the description and use the Preview feature, if accessible, to verify if it aligns with your requirements. If it doesn't meet your expectations, use the Search tab above to find the right one.

- Purchase the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Establish an account and complete a payment. Provide your credit card information or select the PayPal option to finalize the transaction.

- Obtain your Rockford Illinois Satisfaction, Release or Cancellation of Mortgage by Individual. Choose the file format for your document and save it to your device.

- Complete your template. Print it or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

In Rockford, Illinois, the time it takes to receive a mortgage lien release can vary, but it typically takes a few weeks after submission. Once the satisfaction document is filed, the county recorder's office will process it. Factors such as office workload can influence the timeline. Being organized and using US Legal Forms can help expedite your experience.

Filing a release of a mortgage in Rockford, Illinois, involves submitting the satisfaction document to the county recorder's office. You can obtain the necessary forms online or through local resources. It's crucial to ensure that the document is complete and properly notarized for smooth processing. US Legal Forms offers easy-to-use resources for this purpose, guiding you through the entire process.

Yes, a satisfaction of a mortgage typically needs to be notarized to be legally binding. In Rockford, Illinois, the notary confirms the identity of the individuals involved. This notarization ensures that the document meets all legal requirements for proper release. For added peace of mind, consider using US Legal Forms to access templates and guidance.

To obtain a mortgage release in Rockford, Illinois, you typically need to start by contacting your lender. They can guide you through the required paperwork, which often includes proof of payment and a formal request for the release. After they process your application, you may receive a Satisfaction, Release or Cancellation of Mortgage by Individual once all obligations are met. For a smooth experience, consider using the US Legal Forms platform, which provides easy access to the necessary forms and guidance.

You can get a satisfaction of a mortgage in Rockford, Illinois, from your mortgage lender. Typically, lenders file this document with the county clerk or recorder's office once you complete the mortgage payments. If you experience difficulty obtaining it from your lender, you may visit the local recording office to check the status of your mortgage satisfaction.

To determine if your mortgage is satisfied, check for a satisfaction of mortgage document from your lender. You may also verify with the county recorder’s office to see if the satisfaction has been officially recorded. If you have doubts about the status of your mortgage, consult your lender or utilize services like US Legal Forms for assistance in confirming the details.

Filling out a satisfaction of mortgage involves completing specific details, such as your name, the lender's name, and the mortgage details. Ensure you include accurate identification information and the legal description of the property. For guidance, you can use the resources available on the US Legal Forms platform to simplify this process.

The process of receiving a mortgage satisfaction letter in Rockford, Illinois, usually takes about two to four weeks. Your lender processes the request after confirming the mortgage payoff, which may take additional time. If you haven't received it within a reasonable timeframe, it’s advisable to reach out to your lender for an update.

In Rockford, Illinois, the time it takes to receive a satisfaction of a mortgage varies. Generally, it can take anywhere from a few days to a few weeks, depending on the lender's processing speed and the workload at the county recorder's office. It’s important to follow up with your lender to ensure the process is moving along.