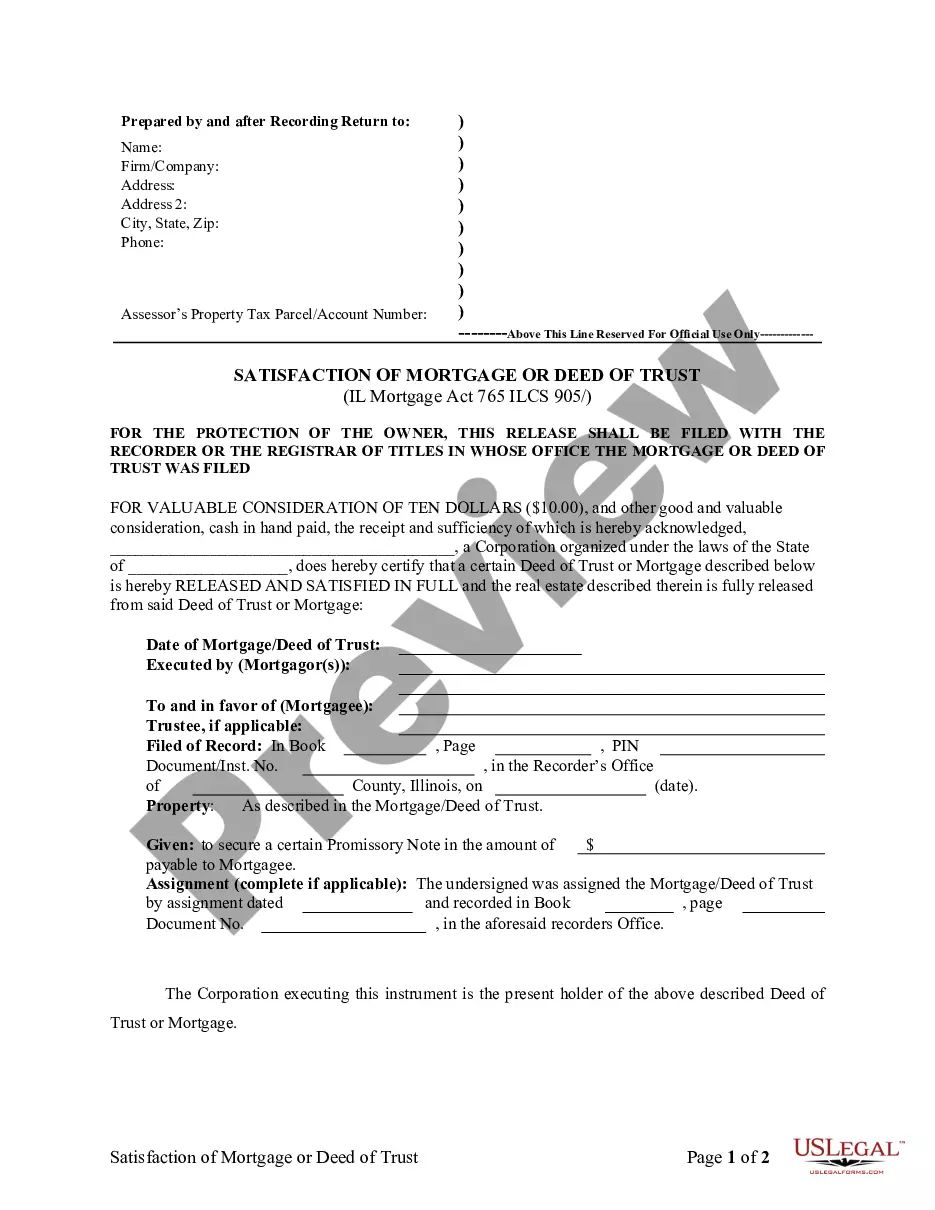

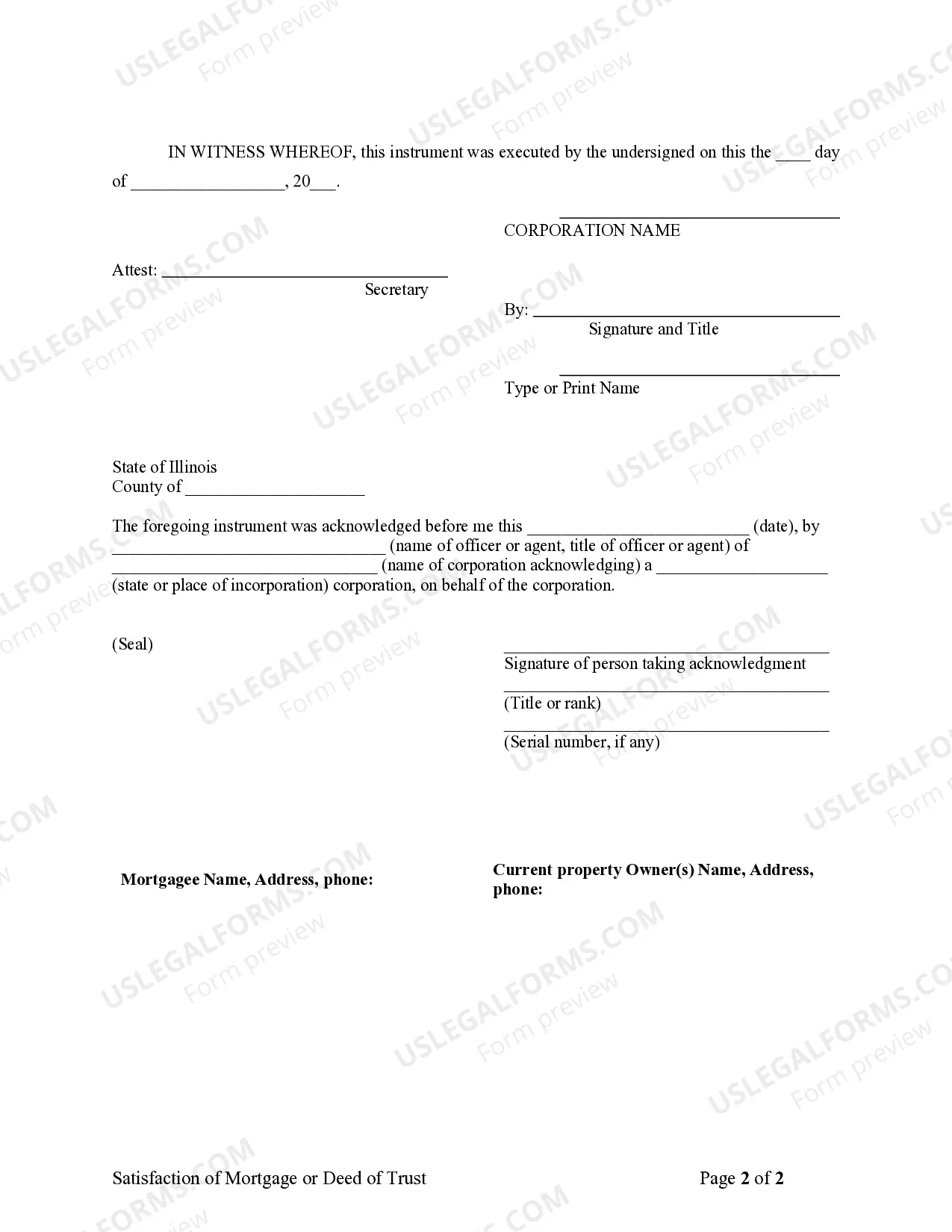

Joliet Illinois Satisfaction, Release, or Cancellation of Mortgage by Corporation refers to the legal process of fully releasing a mortgage on a property owned by a corporation based in Joliet, Illinois. This document signifies that the outstanding debt related to the mortgage has been paid off and the lien against the property has been lifted. The Joliet Illinois Satisfaction, Release, or Cancellation of Mortgage by Corporation is an essential step in the property ownership transfer process. Once the mortgage has been satisfied, released, or canceled, the corporation gains complete ownership of the property, free from any encumbrances linked to the mortgage. This allows the corporation to exercise its rights to sell, transfer, or trade the property without any legal restrictions. Keywords: Joliet Illinois, Satisfaction, Release, Cancellation, Mortgage, Corporation, Property, Ownership, Lien, Debt, Transfer, Encumbrances, Legal, Restrictions. Types of Joliet Illinois Satisfaction, Release, or Cancellation of Mortgage by Corporation: 1. Voluntary Satisfaction, Release, or Cancellation: This occurs when the corporation willingly repays the mortgage in full, fulfilling all financial obligations related to the loan. This type of satisfaction is typically the result of the corporation's financial capability to clear the debt, either through regular payments or a lump-sum payment. 2. Involuntary Satisfaction, Release, or Cancellation: This type of satisfaction happens when the mortgage debt is paid off in an unexpected manner, such as through insurance proceeds, condemnation, or eminent domain. Involuntary satisfactions occur primarily due to external circumstances beyond the corporation's control. 3. Partial Satisfaction, Release, or Cancellation: In some cases, the corporation may choose to pay off only a portion of the outstanding mortgage debt. This partial satisfaction occurs when the corporation negotiates with the lender to settle a reduced amount, typically after a mutual agreement has been reached. 4. Satisfaction, Release, or Cancellation through Refinancing: When a corporation refinances its mortgage, it takes out a new loan to repay the existing mortgage debt owed by the corporation. Upon successful completion of the refinancing process, the new loan replaces the old mortgage, resulting in the satisfaction, release, or cancellation of the original mortgage. 5. Release or Cancellation due to Loan Assumption: If another party assumes the mortgage liability from the corporation, such as a new buyer or a third-party entity, the corporation may request the release or cancellation of the mortgage. This allows the new party to assume the responsibility of the mortgage, while the corporation is freed from any further obligations.

Joliet Illinois Satisfaction, Release or Cancellation of Mortgage by Corporation

Description

How to fill out Joliet Illinois Satisfaction, Release Or Cancellation Of Mortgage By Corporation?

If you are searching for a valid form, it’s impossible to choose a better service than the US Legal Forms site – probably the most considerable libraries on the internet. Here you can get a large number of templates for business and individual purposes by categories and regions, or key phrases. With the advanced search function, finding the most up-to-date Joliet Illinois Satisfaction, Release or Cancellation of Mortgage by Corporation is as easy as 1-2-3. Additionally, the relevance of every document is verified by a team of skilled lawyers that regularly check the templates on our website and revise them according to the newest state and county regulations.

If you already know about our system and have a registered account, all you need to get the Joliet Illinois Satisfaction, Release or Cancellation of Mortgage by Corporation is to log in to your user profile and click the Download button.

If you utilize US Legal Forms the very first time, just follow the guidelines below:

- Make sure you have found the form you want. Check its explanation and make use of the Preview feature to see its content. If it doesn’t meet your requirements, utilize the Search option at the top of the screen to find the appropriate document.

- Confirm your decision. Select the Buy now button. Next, pick the preferred pricing plan and provide credentials to sign up for an account.

- Process the purchase. Make use of your credit card or PayPal account to complete the registration procedure.

- Obtain the template. Select the format and download it on your device.

- Make adjustments. Fill out, edit, print, and sign the obtained Joliet Illinois Satisfaction, Release or Cancellation of Mortgage by Corporation.

Each and every template you add to your user profile has no expiration date and is yours permanently. It is possible to access them via the My Forms menu, so if you need to get an additional copy for editing or creating a hard copy, you may return and export it once more whenever you want.

Make use of the US Legal Forms extensive library to get access to the Joliet Illinois Satisfaction, Release or Cancellation of Mortgage by Corporation you were seeking and a large number of other professional and state-specific templates in a single place!