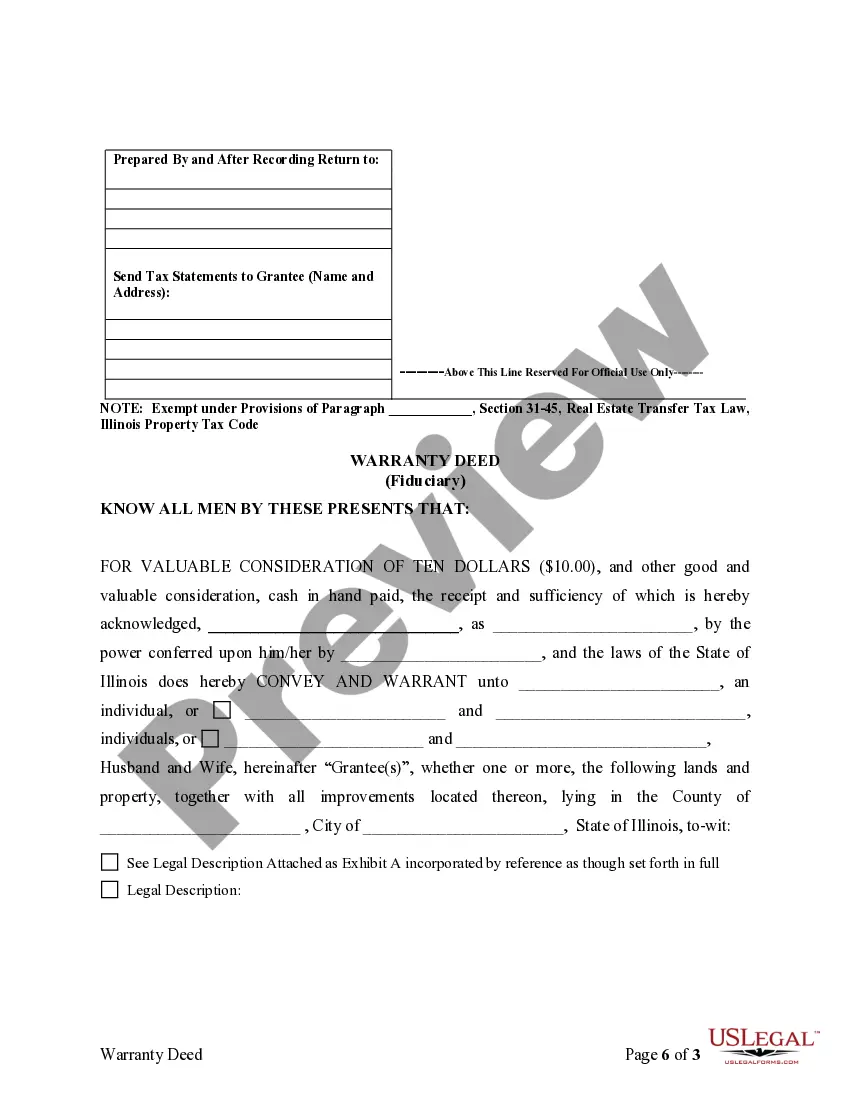

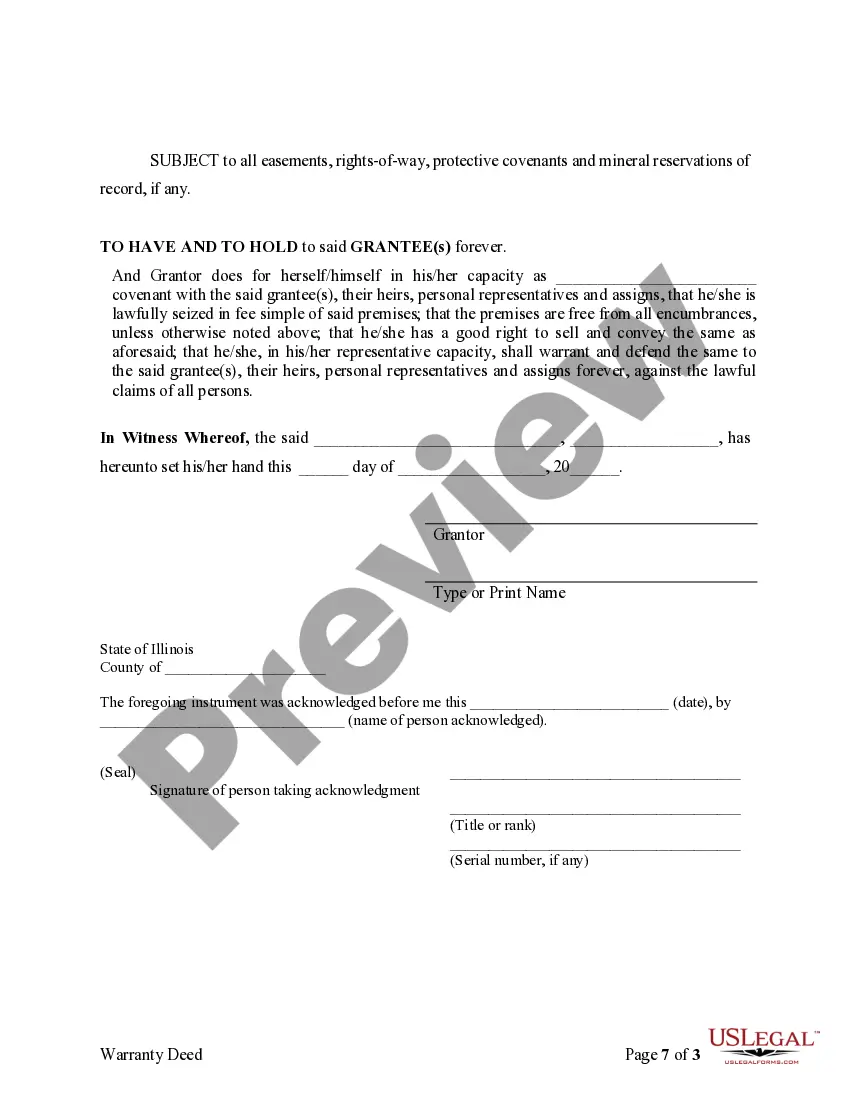

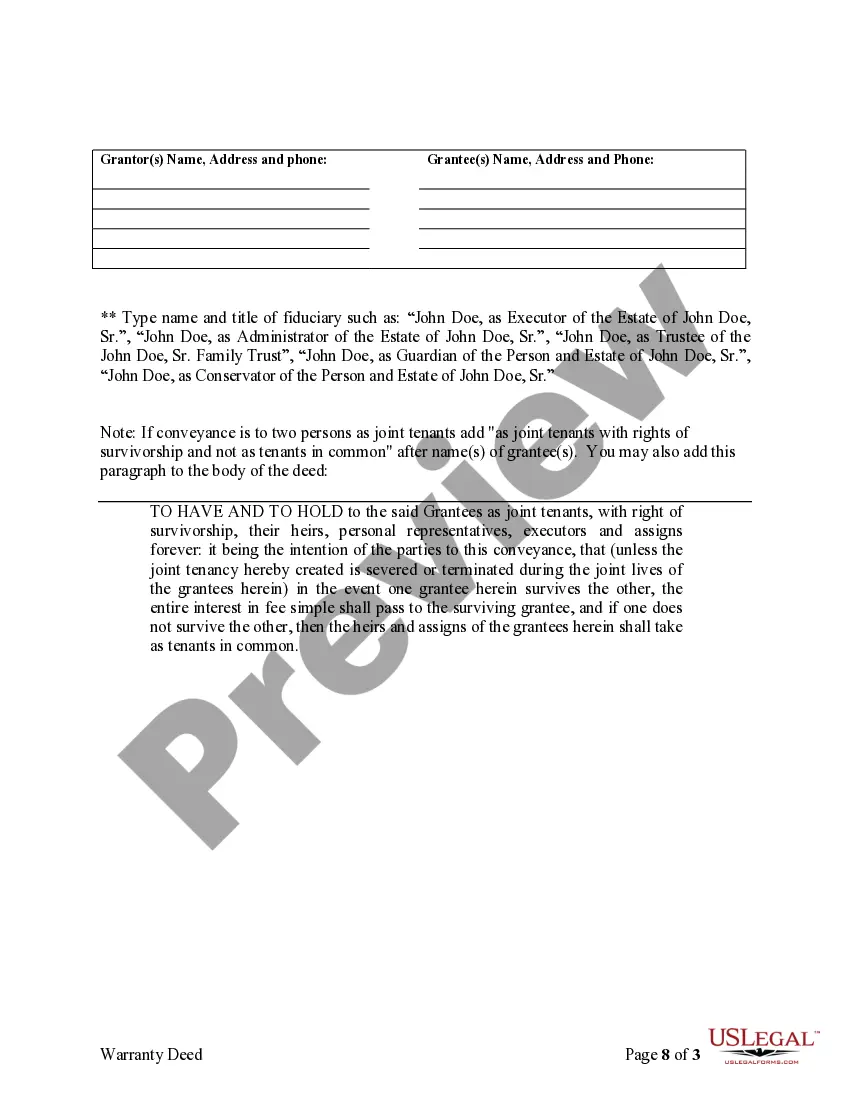

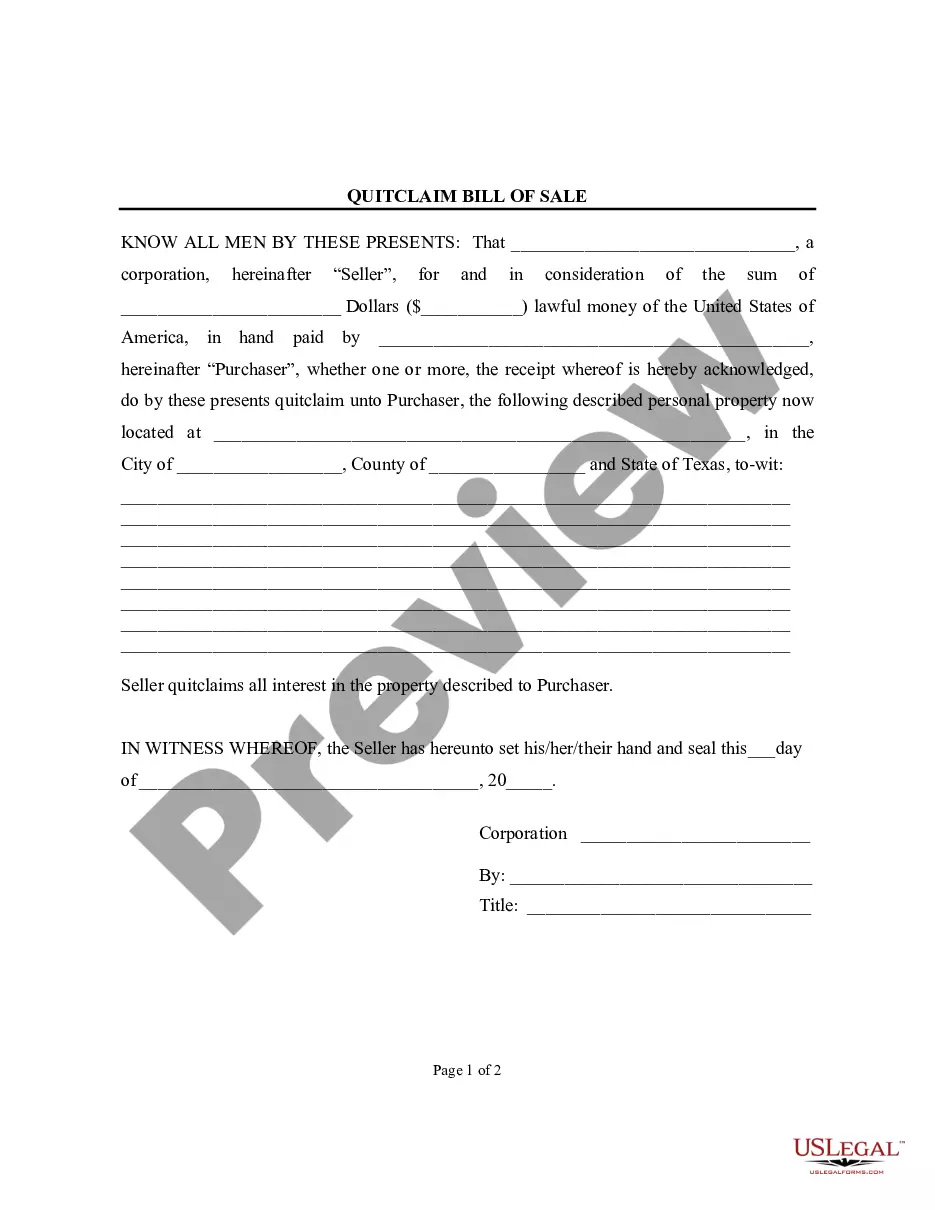

A Chicago Illinois Fiduciary Deed is a legal document used by Executors, Trustees, Trustees, Administrators, and other Fiduciaries to transfer real estate ownership from an estate or trust to a designated recipient or buyer. It is an important tool that facilitates the transfer of assets in accordance with the wishes of the deceased or the terms of a trust. This type of deed is specifically tailored to meet the needs and responsibilities of fiduciaries, who are entrusted with managing and distributing assets on behalf of another party. Executors are assigned the responsibility of managing an estate, while Trustees oversee assets held in a trust. Trustees are individuals who create a trust to hold their assets, and administrators are appointed to handle the affairs of an estate if there is no designated executor. Typically, a Chicago Illinois Fiduciary Deed contains specific language and provisions to comply with the applicable laws and regulations in the state of Illinois. It includes details about the fiduciary, such as their name, position, and the authority granted to them by the court or the terms of the trust. The deed also describes the property being transferred, often including its legal description and unique identifier. Different types of Chicago Illinois Fiduciary Deeds include: 1. Executor's Deed: Used by an executor to transfer property from an estate to a named beneficiary or buyer. This deed is utilized when a deceased person's will includes provisions for the distribution of real estate. 2. Trustee's Deed: Used by a trustee to convey property held in a trust to a recipient or buyer. Assets held in a trust are managed and distributed by the trustee in accordance with the trust document. 3. Trust or's Deed: Created by a trust or when establishing a trust, this deed transfers ownership of property into the trust. It is executed at the time of trust creation and names the trust as the new owner of the property. 4. Administrator's Deed: Similar to an Executor's Deed, this document is used by an administrator to transfer property in the absence of a designated executor. Administrators are appointed by the court to handle the affairs of an estate when there is no valid will or executor. By utilizing the appropriate type of Chicago Illinois Fiduciary Deed, Executors, Trustees, Trustees, Administrators, and other Fiduciaries can ensure a smooth and legally compliant transfer of real estate assets. It is crucial to consult with an attorney or legal professional to ensure the correct type of fiduciary deed is utilized and to navigate the specific requirements and procedures of the state of Illinois.

Chicago Illinois Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

Description

How to fill out Chicago Illinois Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries?

Regardless of one's social or professional standing, filling out legal documents is an unfortunate obligation in the modern world.

Often, it is nearly unattainable for individuals without a legal background to formulate such documents from scratch, primarily due to the intricate jargon and legal nuances they entail.

This is where US Legal Forms can be a lifesaver.

However, if you are unfamiliar with our platform, make sure to adhere to these steps before downloading the Chicago Illinois Fiduciary Deed for Executors, Trustees, Trustors, Administrators, and other Fiduciaries.

Ensure that the template selected is appropriate for your region since the laws in one state or county do not apply in another state or county.

- Our service provides a vast repository of over 85,000 ready-to-use state-specific documents suitable for nearly any legal circumstance.

- US Legal Forms is also a valuable resource for paralegals or legal advisors seeking to conserve time by utilizing our do-it-yourself templates.

- Whether you require the Chicago Illinois Fiduciary Deed for Executors, Trustees, Trustors, Administrators, and other Fiduciaries or any other documentation valid in your state or county, US Legal Forms has everything readily available.

- Here's how you can swiftly obtain the Chicago Illinois Fiduciary Deed for Executors, Trustees, Trustors, Administrators, and other Fiduciaries using our trustworthy service.

- If you are already a customer, you may proceed to Log In to your account to acquire the relevant form.

Form popularity

FAQ

A Fiduciary refers to any individual acting on behalf of another, and in Estate Planning this often means in a legal capacity. An Executor, on the other hand, is a much more narrow responsibility. Executors can only act on the terms laid out in a Will.

A trust can remain open for up to 21 years after the death of anyone living at the time the trust is created, but most trusts end when the trustor dies and the assets are distributed immediately.

A trustee does not need beneficiary approval to sell trust property. However, a trustee who wants to avoid litigation would be wise to at least seek approval of the trust beneficiaries, and, at a minimum, be able to substantiate why the property was sold and how that sale benefited the trust beneficiaries.

An executor must be impartial. Neither he/she, nor his/her family, friends, may benefit unfairly (for example from the sale of an asset). He/She must carry out the instructions in the will, as well as reasonable instructions of the heirs. Quarrels with heirs should not interfere with his or her duties.

A Fiduciary is the guardian, trustee, executor, administrator, receiver, conservator, or any person who accepts the responsibility for taking care of the needs or property of another person for the benefit of that person. The term usually refers to the executor or administrator of an estate or the trustee of a trust.

Specifically, fiduciary duties may include the duties of care, confidentiality, loyalty, obedience, and accounting. 5. Association Leaders must avoid, disclose, and resolve any conflicts of interest prior to voting or otherwise participating in any deliberations concerning an association matter.

A breach of fiduciary duty occurs when the fiduciary acts in the interest of themselves, rather than the best interest of the employer or principal. A fiduciary's actions must be free of conflicts of interest and self-dealing. As a fiduciary, you can't use the principal for your own personal advantage.

The goal of the TRUST Act is to foster confidence between law enforcement agencies and the state's immigrant communities by ensuring that interactions between immigrants and law enforcement do not lead to immigration detention or deportation.

In addition to adopting the UTC, the ITC codifies numerous concepts of Illinois common law on trusts, including those with respect to fiduciary duties of trustees, creditors' rights, capacity to create a trust, and remedies for breach of trust.

On August 10, 2012, Illinois Governor Quinn signed into law House Bill 4662, which amends the Illinois Trusts and Trustees Act to grant trustees of certain trusts a discretionary power to appoint the principal of one trust to the trustee of a second trust.

Interesting Questions

More info

A Trustee. • The following persons can be trustees of a trust. · a person or corporation is eligible to become a trustee of a joint or separate trust. If the Trustee has a principal residence in Illinois and a place of business in the State of Illinois, the Trustee may remain a resident of Illinois for purposes of state income taxation and may also be subject to the income and gift taxes of the State of Illinois. • In the case of a state trust established in lieu of the will, the following persons are eligible to become independent persons, independent trustees or trustees for the estate † a person who was domiciled in Illinois as of the date of death of the decedent, but who was absent from Illinois on the date of death of the decedent, but who, upon application by the heir may be certified as an independent trustee for the estate. A guardian or administrator of the estate may not qualify for this designation. The Independent Trustee for a State-Incorporated Trust.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.