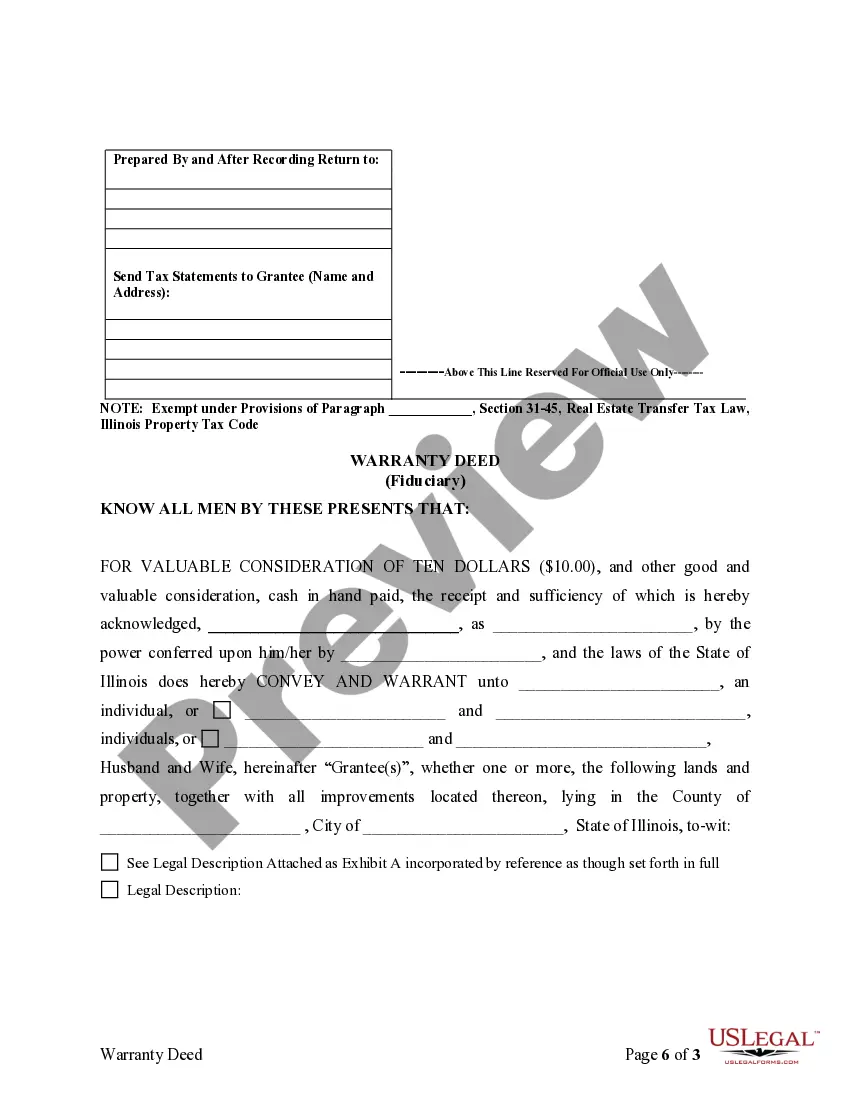

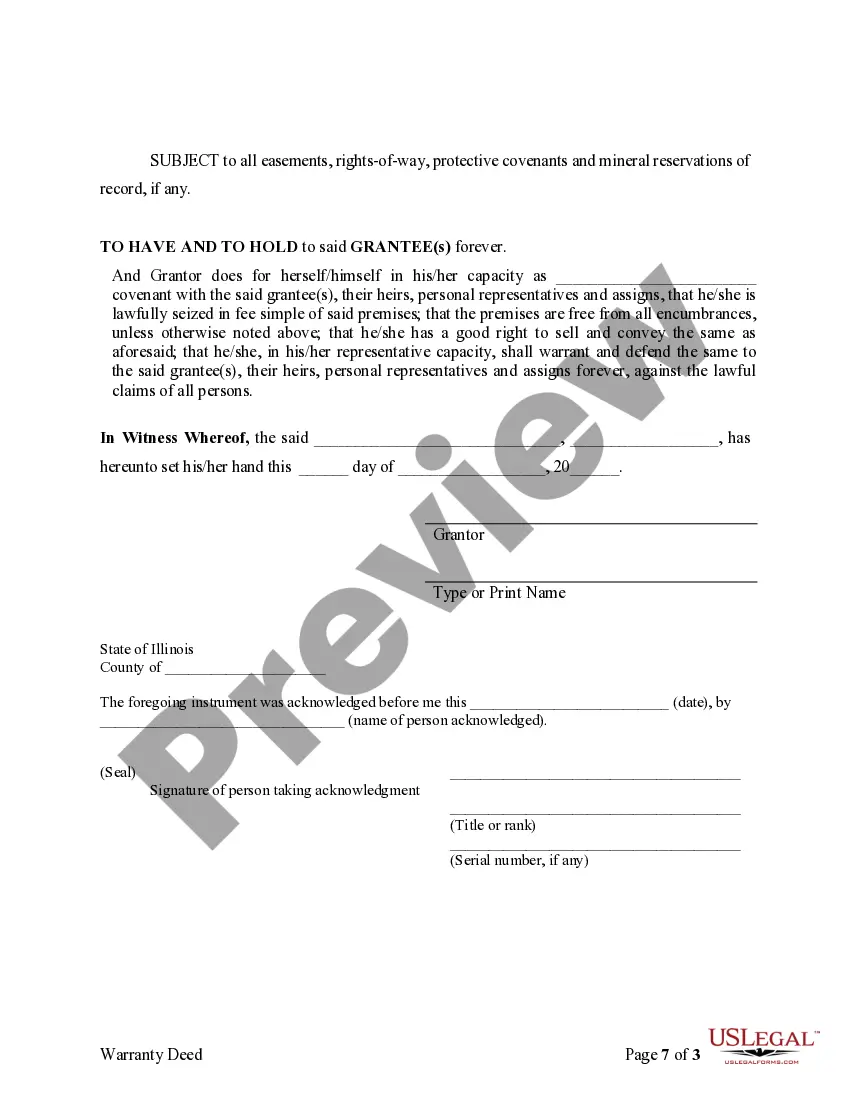

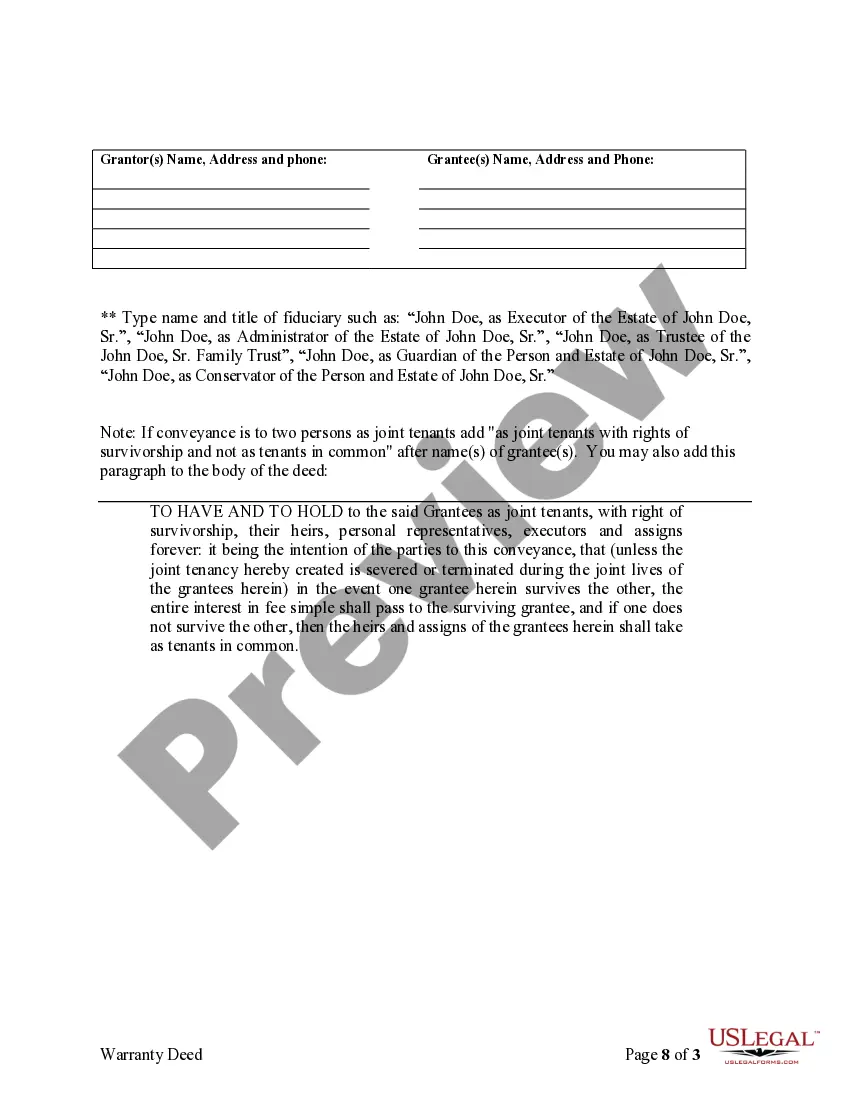

Cook Illinois Fiduciary Deed is a legal document specifically designed for use by Executors, Trustees, Trustees, Administrators, and other Fiduciaries to facilitate the transfer of real estate property within Cook County, Illinois. This detailed description aims to provide insights into the purpose, significance, and types of Cook Illinois Fiduciary Deed available. A Cook Illinois Fiduciary Deed serves as a means through which a Fiduciary, typically someone appointed to manage the assets or property of a deceased individual or estate, can transfer ownership of real estate from the estate to designated beneficiaries or interested parties. This document ensures a smooth and legally compliant transfer, providing transparency and security in real estate transactions involving Fiduciaries. Key features and provisions commonly associated with Cook Illinois Fiduciary Deeds include: 1. Granter: The Granter is the Fiduciary responsible for overseeing the transfer of the property. This individual bears the legal authority to execute the deed on behalf of the estate or trust. 2. Grantee: The Grantee is the recipient or beneficiaries of the property who will acquire the title and ownership rights. They may be individuals, corporations, or organizations appropriately designated in the deed. 3. Property description: The Cook Illinois Fiduciary Deed must include an accurate and comprehensive description of the property being transferred. This description typically includes legal identifiers such as the property's address, legal description, lot number, and boundary details. 4. Consideration: Cook Illinois Fiduciary Deeds must indicate the consideration or payment involved in the property transfer. Although this amount may be nominal or explicitly specified, it is required for the proper execution of the deed. 5. Fiduciary Certifications: To ensure the authenticity and legality of the deed, certain certifications are often included. These may include affirmations by the Fiduciary regarding their authority to act and sign on behalf of the estate, acknowledging the accuracy of information provided, and confirming the absence of any encumbrances or liens on the property. Different types of Cook Illinois Fiduciary Deeds may exist based on the specific circumstances or nature of the fiduciary role. Some potential variations include: 1. Executor's Fiduciary Deed: This deed is specifically used by an Executor appointed by a decedent's will to transfer property to designated beneficiaries or heirs. 2. Trustee's Fiduciary Deed: Trustees, typically acting on behalf of trust beneficiaries, can utilize this deed to effectively transfer trust-owned real estate to beneficiaries or other specified parties. 3. Administrator's Fiduciary Deed: Administrators, who are appointed by the court to manage an estate in cases without a will, may employ this deed to transfer property to rightful heirs or others as directed by the court. Overall, Cook Illinois Fiduciary Deed provides a legally binding solution for Fiduciaries to facilitate the transfer of real estate properties within Cook County. These deeds help ensure a seamless transfer of ownership, maintaining transparency, and meeting all legal requirements.

Cook Illinois Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

Description

How to fill out Cook Illinois Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries?

We always strive to minimize or avoid legal issues when dealing with nuanced legal or financial matters. To do so, we sign up for attorney services that, usually, are extremely costly. Nevertheless, not all legal matters are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online library of updated DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without turning to an attorney. We provide access to legal form templates that aren’t always publicly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Cook Illinois Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries or any other form quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always re-download it in the My Forms tab.

The process is equally effortless if you’re new to the website! You can register your account within minutes.

- Make sure to check if the Cook Illinois Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s outline (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve made sure that the Cook Illinois Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries is proper for you, you can choose the subscription plan and make a payment.

- Then you can download the document in any suitable file format.

For more than 24 years of our existence, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!