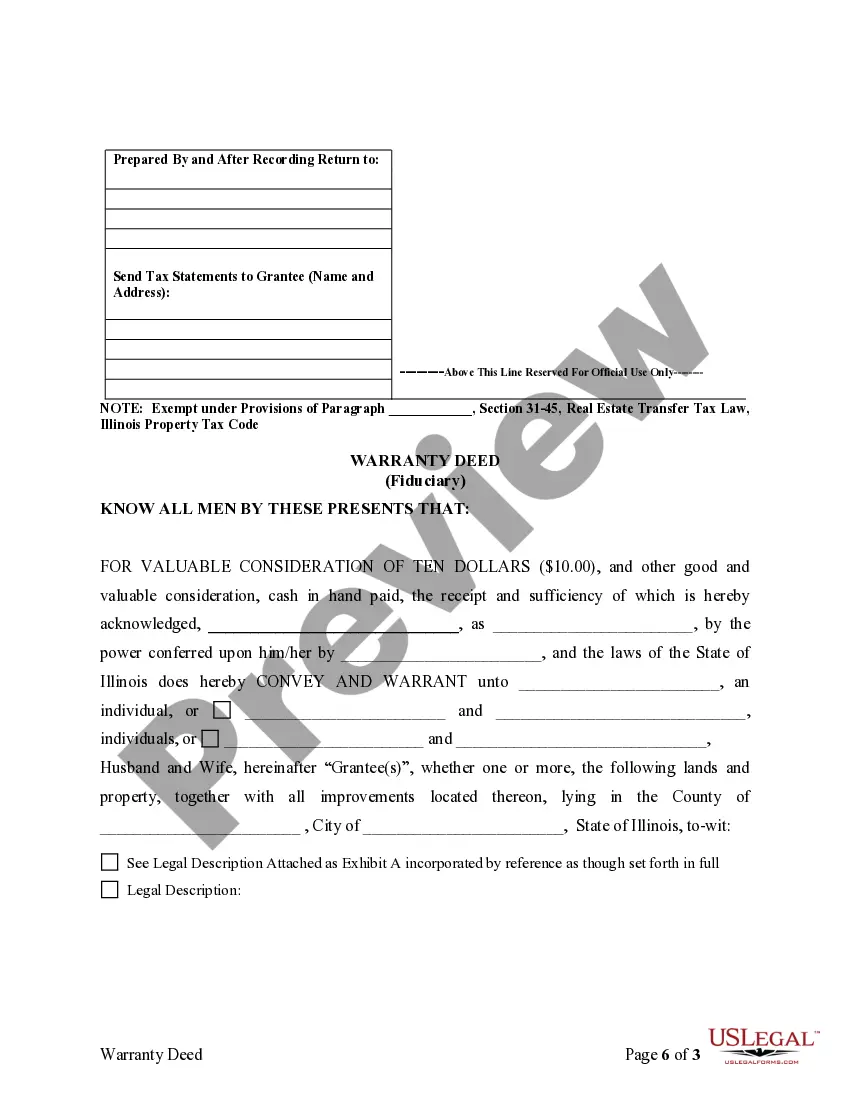

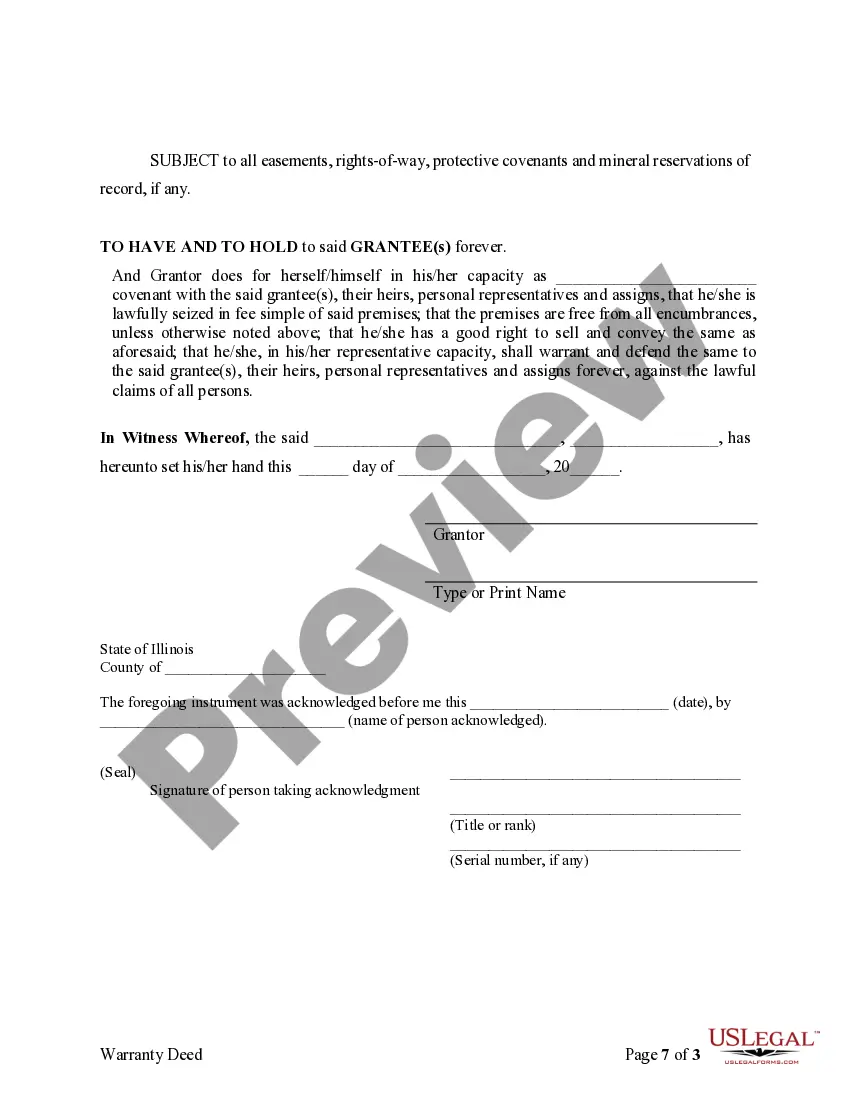

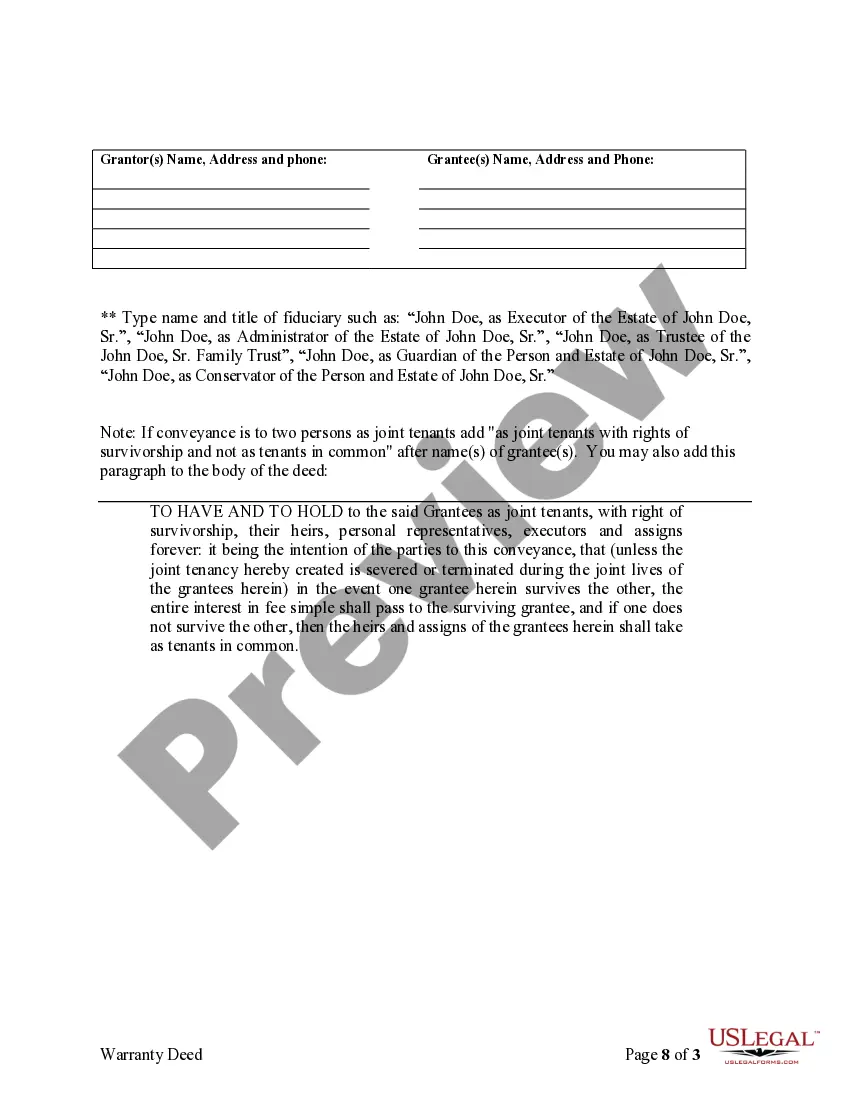

Elgin Illinois Fiduciary Deed is a legal document used by Executors, Trustees, Trustees, Administrators, and other Fiduciaries to transfer property ownership in Elgin, Illinois. This detailed description will provide information about the purpose, types, and importance of the Elgin Illinois Fiduciary Deed, while incorporating relevant keywords for search engine optimization. The Elgin Illinois Fiduciary Deed serves as a critical instrument for the transfer of property from a fiduciary, who holds a legal responsibility to manage and distribute assets, to the intended beneficiary or buyer. Often used in situations involving estates, trusts, or probate proceedings, this deed ensures a smooth and lawful property transfer while adhering to the specific laws and regulations of Elgin, Illinois. There are several types of Elgin Illinois Fiduciary Deed designed to cater to different scenarios faced by Executors, Trustees, Trustees, Administrators, and other Fiduciaries: 1. Executor's Fiduciary Deed: This deed is used by an executor, appointed by a decedent's will, to convey real estate property from the estate to the legatee or beneficiary. 2. Trustee's Fiduciary Deed: Trustees, appointed to oversee and manage a trust, utilize this form to transfer property included in the trust to the named beneficiaries. 3. Trust or's Fiduciary Deed: A trust or, the creator of a trust, may employ this deed to transfer property into the trust, making it an asset managed and distributed by the trustee. 4. Administrator's Fiduciary Deed: When an individual passes away without leaving a valid will (intestate), an administrator is appointed by the court. This deed allows the administrator to convey property from the estate to the rightful heirs based on intestate succession laws. The Elgin Illinois Fiduciary Deed requires accurate and comprehensive information to ensure a valid transfer of property. This includes the legal description of the property, the fiduciary's name and contact information, the beneficiary's details, and any relevant supporting documentation. It is crucial for the fiduciary to consult with legal professionals or real estate agents experienced in Elgin, Illinois property laws to ensure compliance and proper execution of the fiduciary deed. By utilizing the appropriate type of Elgin Illinois Fiduciary Deed, Executors, Trustees, Trustees, Administrators, and other Fiduciaries can effectively and lawfully transfer property ownership while fulfilling their fiduciary duties. It is advisable to keep multiple copies of the executed deed for record-keeping purposes, as it serves as proof of the transfer and can be relied upon for future reference, if required. In summary, the Elgin Illinois Fiduciary Deed is a vital legal tool for Executors, Trustees, Trustees, Administrators, and other Fiduciaries involved in property transfers. Its various types cater to specific roles and circumstances, ensuring the seamless transfer of assets while complying with Elgin, Illinois laws. Fiduciaries should seek expert advice to draft, execute, and retain a copy of the Fiduciary Deed for their records.

Elgin Illinois Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

Description

How to fill out Elgin Illinois Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries?

Getting verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Elgin Illinois Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries gets as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, obtaining the Elgin Illinois Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries takes just a couple of clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. The process will take just a couple of more actions to make for new users.

Follow the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make certain you’ve chosen the right one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, utilize the Search tab above to find the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Elgin Illinois Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!