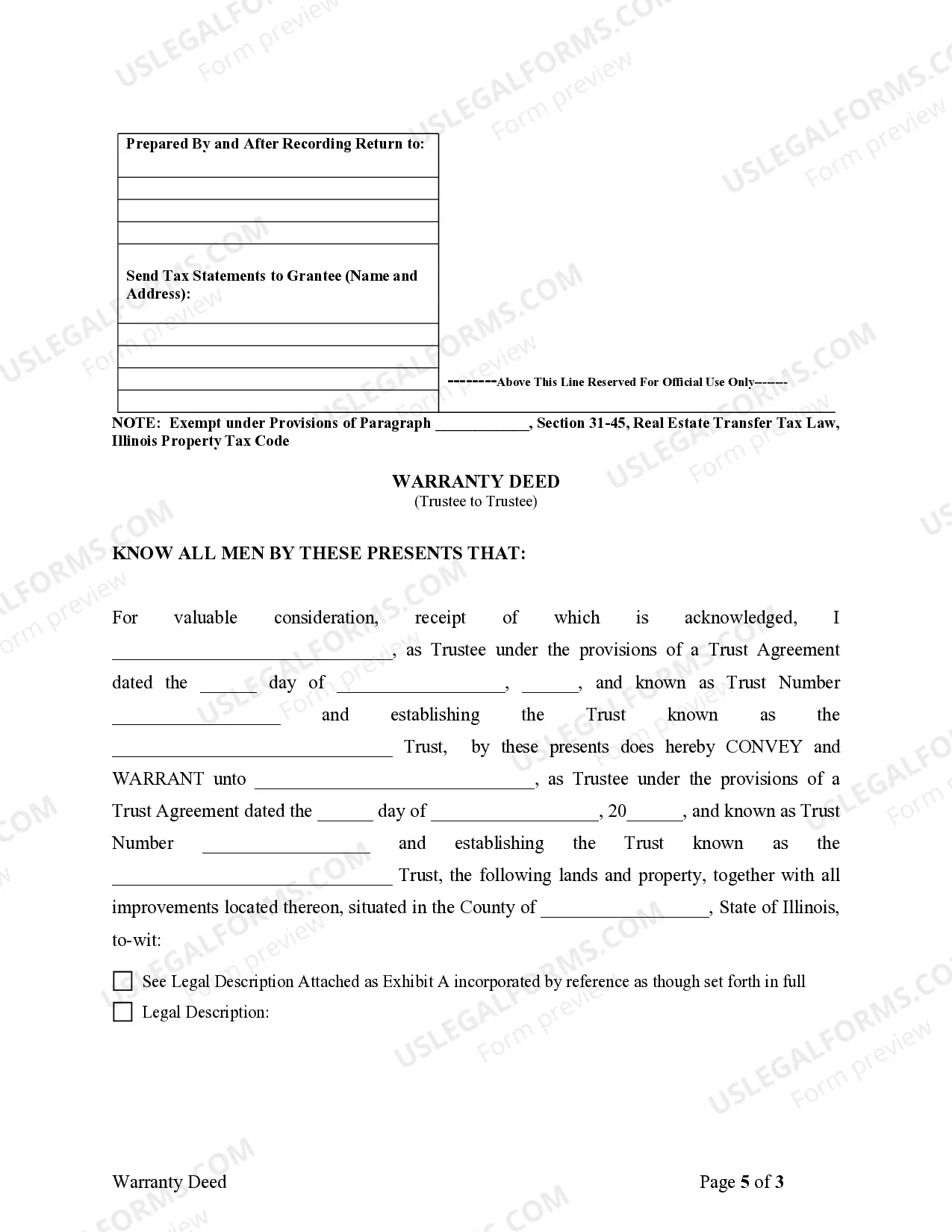

Chicago Illinois Warranty Deed from Trustee to Trustee

Description

How to fill out Illinois Warranty Deed From Trustee To Trustee?

We consistently endeavor to diminish or evade legal complications when engaging with intricate law-related or financial matters.

To achieve this, we seek legal counsel that, as a general rule, tends to be quite costly.

However, not all legal concerns are of equal intricacy.

The majority of them can be managed independently.

Leverage US Legal Forms whenever you require obtaining and downloading the Chicago Illinois Warranty Deed from Trustee to Trustee or any other document effortlessly and securely.

- US Legal Forms is an online repository of current DIY legal documents encompassing everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our platform aids you in managing your affairs independently without the necessity of consulting a lawyer.

- We offer access to legal document templates that are not always readily available.

- Our templates are tailored to specific states and regions, greatly simplifying the search process.

Form popularity

FAQ

Trustees need to ensure there are specific powers to vary the Trust Deed. Otherwise if there is no specific clause in the Trust Deed, trustees will either need all the beneficiaries' consent, or apply through the Court.

A deed of trust has a borrower, lender and a ?trustee.? The trustee is a neutral third party that holds the title to a property until the loan is completely paid off by the borrower. In most cases, the trustee is an escrow If you don't repay your loan, the escrow company's attorney must begin the foreclosure process.

What is a trust deed. A trust deed is a voluntary agreement between you and the people you owe money to (also called your creditors). You agree to pay a regular amount of money towards your debts and at the end of a fixed time the rest of your debts will be written off.

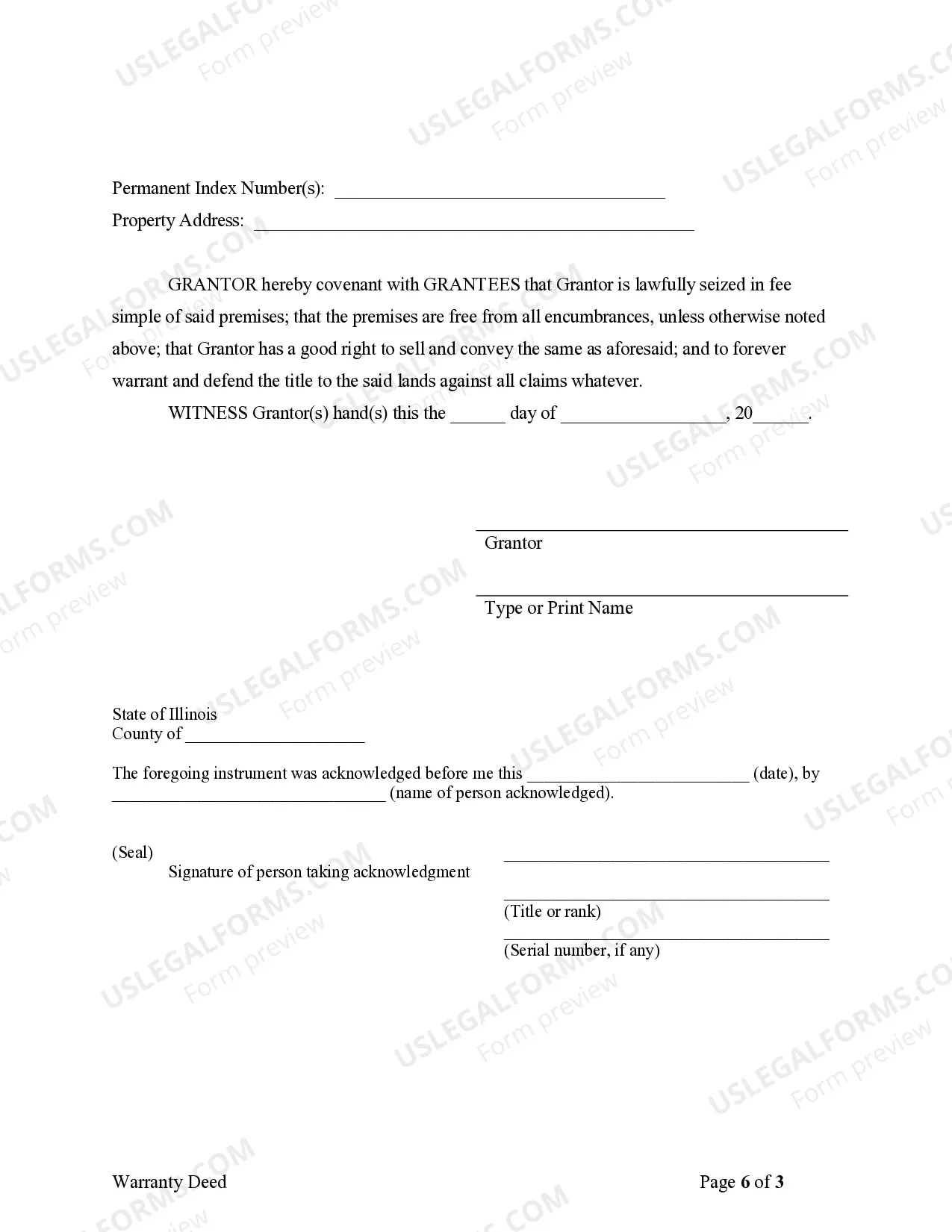

In Illinois, the real estate transfer process usually involves four steps: Locate the most recent deed to the property.Create the new deed.Sign and notarize the new deed.Record the deed in the Illinois land records.

If you want to transfer real estate in Illinois to a relative or a friend, you might consider doing this yourself by using a quitclaim deed. A quitclaim deed in Illinois is often used to transfer property between close family members or trusted friends.

Signing a warranty deed guarantees that the property being sold is legally yours to transfer, that it's in the same condition as advertised, and that there are no undisclosed mortgages or liens tied to it.

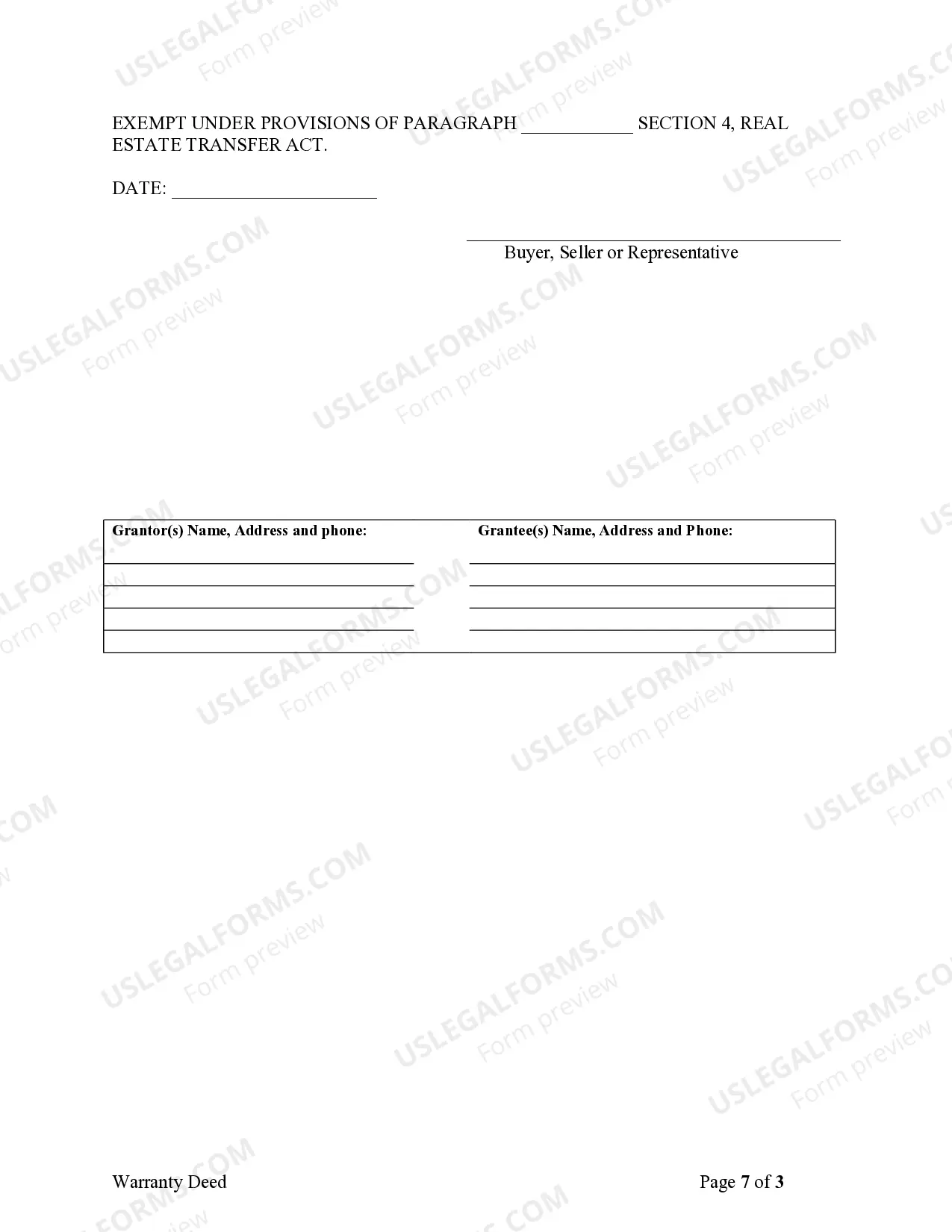

Overview of Illinois Real Estate Transfer Tax State real estate transfer tax are imposed at a rate of $0.50 per $500 of value stated in the Transfer Tax Return. County real estate transfer tax are imposed at a rate of $0.25 per $500 of value stated in the Transfer Tax Return.

A trust deed is used in place of a mortgage. A person (the lendee) buys a home and finances it through a bank (the lender). A third party?the trustee, usually an escrow company?legally holds title to the home for the lender as security against the loan.

All parties just need to sign the transfer deed (TR1 form) and file it with the land registry. This needs to be accompanied by the land registry's AP1 form, and if the value of the transaction amounts to more than £40,000, then a stamp duty land tax certificate may also be required.

Like a mortgage, a deed of trust establishes real property as collateral for a loan. A trustee holds legal title to the real property under the trust deed until the borrower repays the lender.