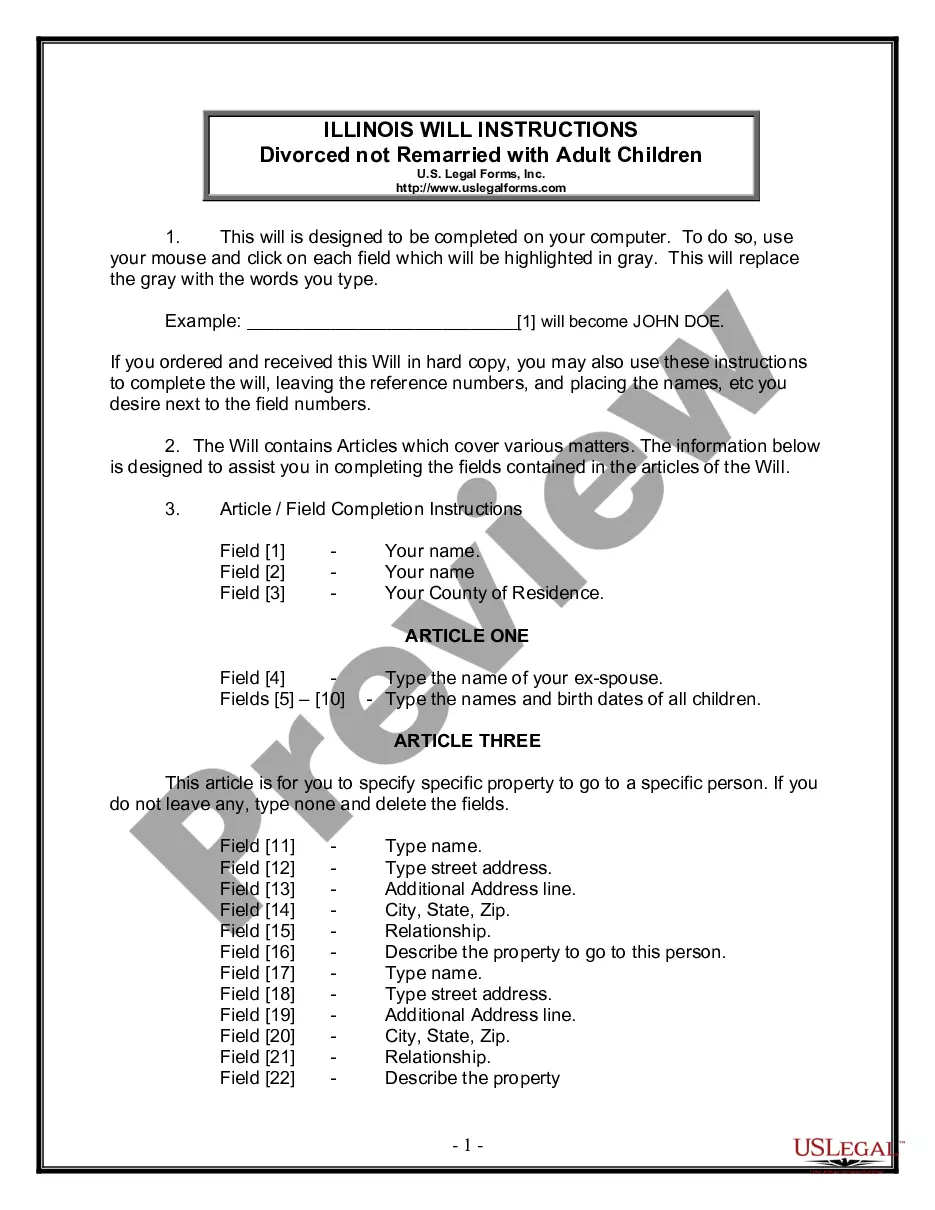

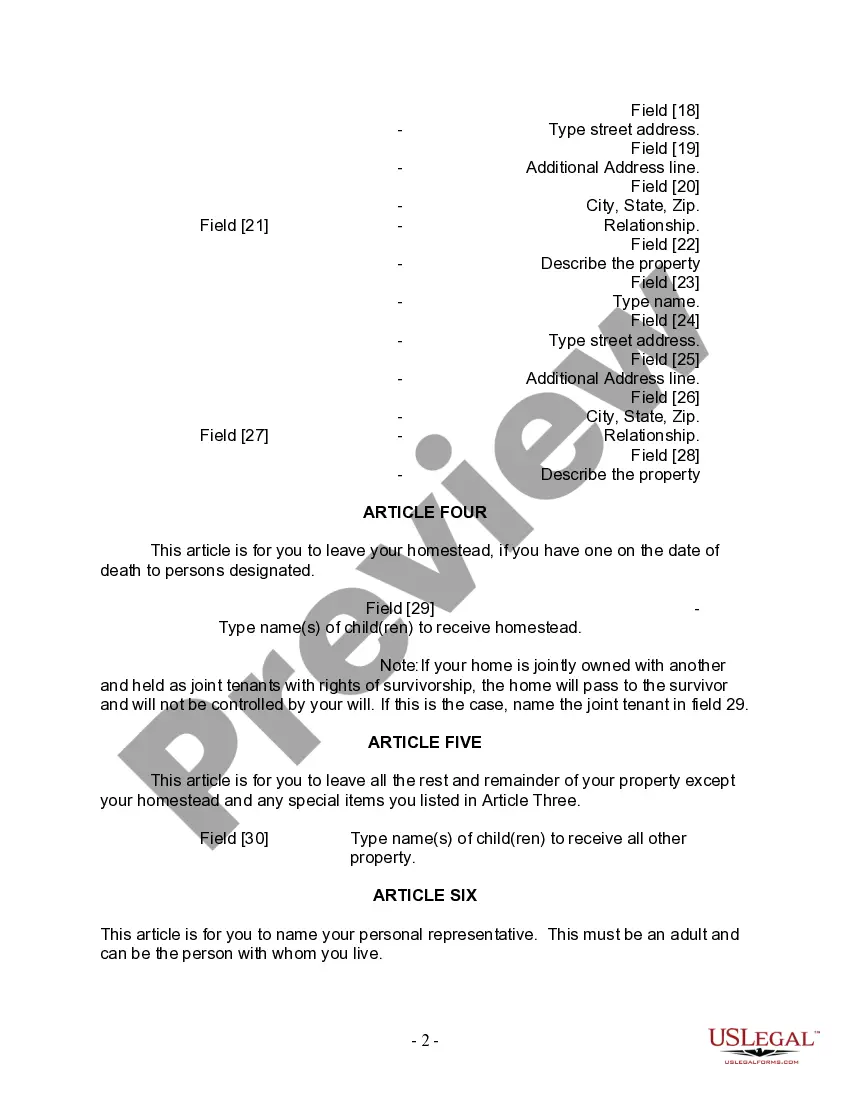

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will. The Elgin Illinois Legal Last Will and Testament Form for Divorced person not Remarried with Adult Children is a legal document that allows individuals who have gone through a divorce and have adult children to clearly outline their wishes regarding how their assets, property, and debts should be distributed upon their death. This form specifically caters to divorced individuals who have not remarried and have adult children. Choosing to create a legally valid Last Will and Testament is essential for divorced individuals with adult children to ensure that their assets and property are distributed according to their wishes and to provide clarity to their loved ones during the probate process. By utilizing this form, individuals can customize their will to reflect their unique circumstances and relationships. Some important keywords to include in this description are: — Elgin Illinois: This highlights the specific jurisdiction where this legal form is applicable. — Legal Last Will and Testament Form: This term clarifies that the document is legally binding and covers the distribution of assets after death. — Divorced person: Indicates that this form is designed for individuals who have gone through a divorce. — Not Remarried: Specifies that the form is intended for divorced individuals who have not entered into a subsequent marriage. — Adult Children: Denotes that the form takes into account the presence of adult children. — Assets, Property, and Debts: Encompasses the comprehensive scope of the document, addressing how the individual's estate will be distributed, including all property, assets, and debts. It is worth noting that while this description specifies the primary focus of the form, there may be variations of the Elgin Illinois Legal Last Will and Testament Form specifically designed for divorced individuals with adult children, such as those with complex assets or unique family dynamics.

The Elgin Illinois Legal Last Will and Testament Form for Divorced person not Remarried with Adult Children is a legal document that allows individuals who have gone through a divorce and have adult children to clearly outline their wishes regarding how their assets, property, and debts should be distributed upon their death. This form specifically caters to divorced individuals who have not remarried and have adult children. Choosing to create a legally valid Last Will and Testament is essential for divorced individuals with adult children to ensure that their assets and property are distributed according to their wishes and to provide clarity to their loved ones during the probate process. By utilizing this form, individuals can customize their will to reflect their unique circumstances and relationships. Some important keywords to include in this description are: — Elgin Illinois: This highlights the specific jurisdiction where this legal form is applicable. — Legal Last Will and Testament Form: This term clarifies that the document is legally binding and covers the distribution of assets after death. — Divorced person: Indicates that this form is designed for individuals who have gone through a divorce. — Not Remarried: Specifies that the form is intended for divorced individuals who have not entered into a subsequent marriage. — Adult Children: Denotes that the form takes into account the presence of adult children. — Assets, Property, and Debts: Encompasses the comprehensive scope of the document, addressing how the individual's estate will be distributed, including all property, assets, and debts. It is worth noting that while this description specifies the primary focus of the form, there may be variations of the Elgin Illinois Legal Last Will and Testament Form specifically designed for divorced individuals with adult children, such as those with complex assets or unique family dynamics.