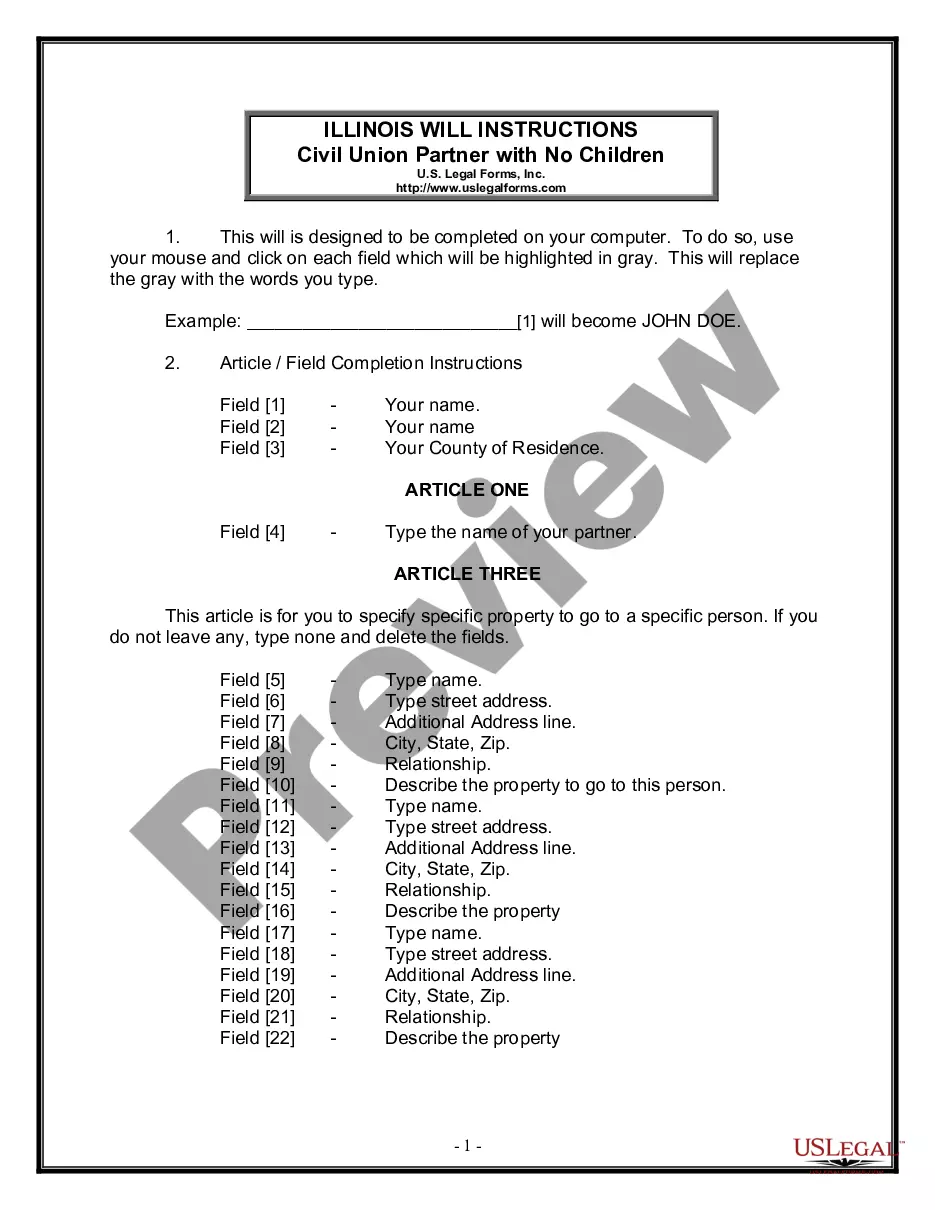

The Will you have found is for a civil union partner with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions, including provisions for your partner.

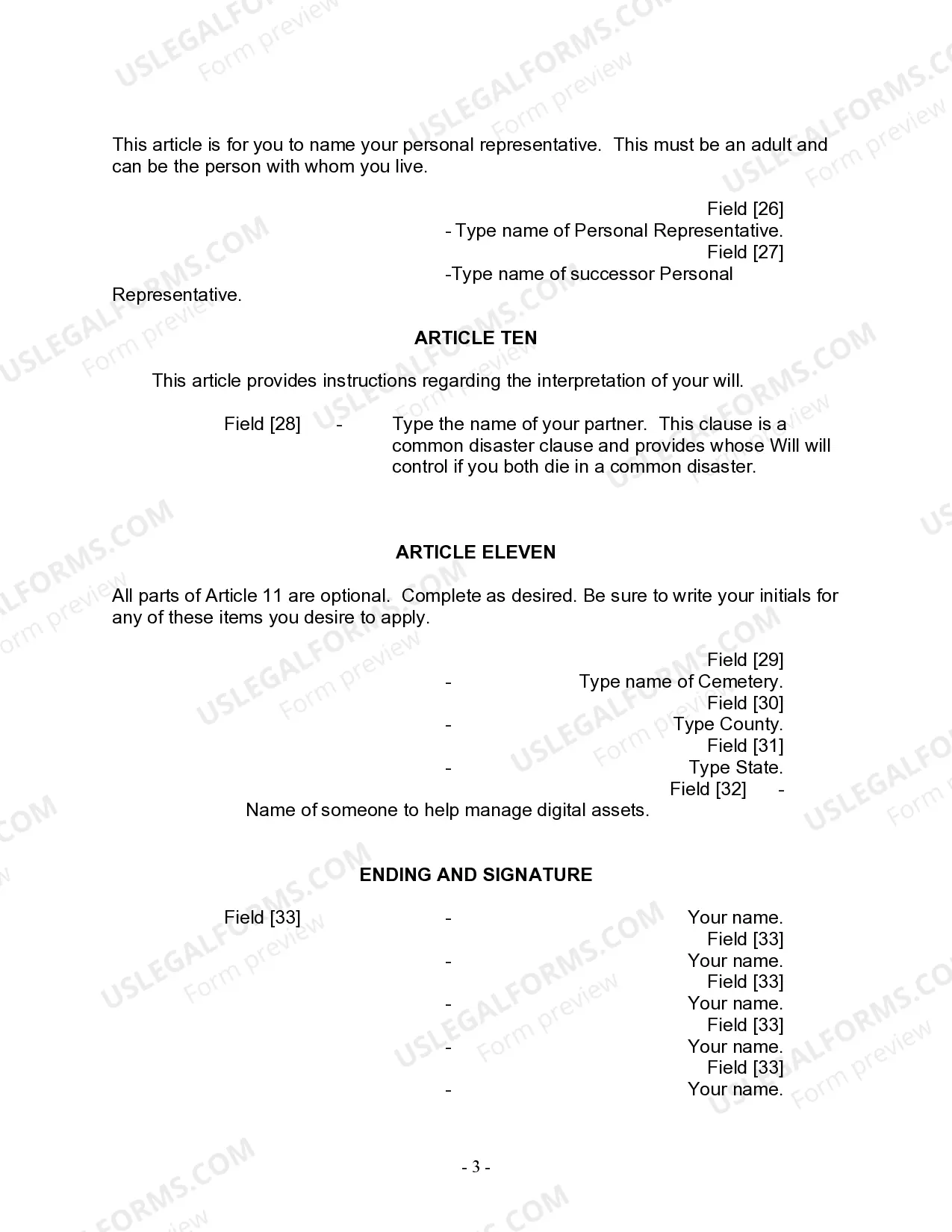

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

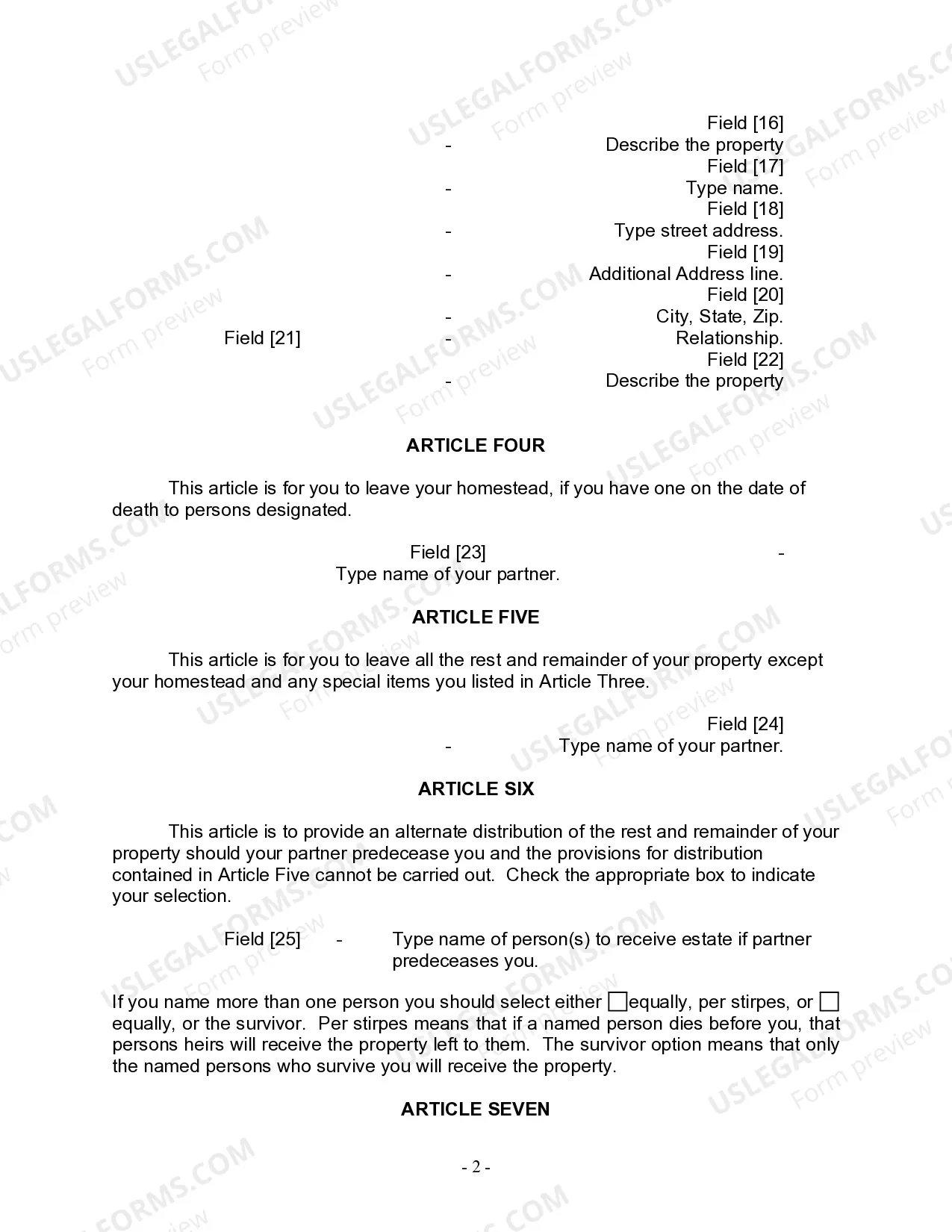

The Chicago Illinois Legal Last Will and Testament Form for a Civil Union Partner with No Children is a legal document that allows individuals in a civil union partnership to outline their final wishes and distribute their assets in the event of their death. This form is specifically designed for civil union partners who do not have any children. The purpose of this form is to provide legal clarity and ensure that the assets and properties of the deceased individual are distributed according to their wishes. It serves as a legally binding document that can be used in the probate court to settle any disputes or concerns that may arise after the person's death. This form typically includes several key sections. The first section usually deals with the identification of the individual creating the will, including their full name, civil union partner's name, and any other necessary contact information. It may also include a statement declaring the individual's mental competence to create a will. The second section of the form focuses on the appointment of an executor. The executor is the person responsible for carrying out the instructions outlined in the will and managing the deceased person's estate. The testator (the person creating the will) must designate someone they trust to fulfill this role. It is important to choose someone who is both willing and capable of handling these responsibilities. Next, the form typically includes provisions for the distribution of assets and properties. This section allows the testator to specify how their estate should be divided among their beneficiaries. It may include specifics about personal belongings, real estate, financial accounts, investments, and any other assets. The testator can state whether they would like their assets to be divided equally among their beneficiaries or specify different shares for each beneficiary. Additionally, the form may include provisions for alternate beneficiaries in case the primary beneficiaries are unable or unwilling to inherit the assets. Other important sections of the form typically include provisions for funeral arrangements, including burial or cremation preferences, as well as any specific wishes regarding organ donation or other medical directives. It is vital for the testator to sign and date the document in the presence of at least two witnesses who are not named as beneficiaries in the will. This ensures the document is executed correctly and helps prevent any potential challenges to its validity. Different variations or versions of the Chicago Illinois Legal Last Will and Testament Form for a Civil Union Partner with No Children may exist. These variations may differ in format or language, but they all serve the same purpose of outlining the final wishes and distribution of assets for a civil union partner with no children. It is important to follow the specific guidelines and requirements outlined in the form to ensure its legality and validity.The Chicago Illinois Legal Last Will and Testament Form for a Civil Union Partner with No Children is a legal document that allows individuals in a civil union partnership to outline their final wishes and distribute their assets in the event of their death. This form is specifically designed for civil union partners who do not have any children. The purpose of this form is to provide legal clarity and ensure that the assets and properties of the deceased individual are distributed according to their wishes. It serves as a legally binding document that can be used in the probate court to settle any disputes or concerns that may arise after the person's death. This form typically includes several key sections. The first section usually deals with the identification of the individual creating the will, including their full name, civil union partner's name, and any other necessary contact information. It may also include a statement declaring the individual's mental competence to create a will. The second section of the form focuses on the appointment of an executor. The executor is the person responsible for carrying out the instructions outlined in the will and managing the deceased person's estate. The testator (the person creating the will) must designate someone they trust to fulfill this role. It is important to choose someone who is both willing and capable of handling these responsibilities. Next, the form typically includes provisions for the distribution of assets and properties. This section allows the testator to specify how their estate should be divided among their beneficiaries. It may include specifics about personal belongings, real estate, financial accounts, investments, and any other assets. The testator can state whether they would like their assets to be divided equally among their beneficiaries or specify different shares for each beneficiary. Additionally, the form may include provisions for alternate beneficiaries in case the primary beneficiaries are unable or unwilling to inherit the assets. Other important sections of the form typically include provisions for funeral arrangements, including burial or cremation preferences, as well as any specific wishes regarding organ donation or other medical directives. It is vital for the testator to sign and date the document in the presence of at least two witnesses who are not named as beneficiaries in the will. This ensures the document is executed correctly and helps prevent any potential challenges to its validity. Different variations or versions of the Chicago Illinois Legal Last Will and Testament Form for a Civil Union Partner with No Children may exist. These variations may differ in format or language, but they all serve the same purpose of outlining the final wishes and distribution of assets for a civil union partner with no children. It is important to follow the specific guidelines and requirements outlined in the form to ensure its legality and validity.