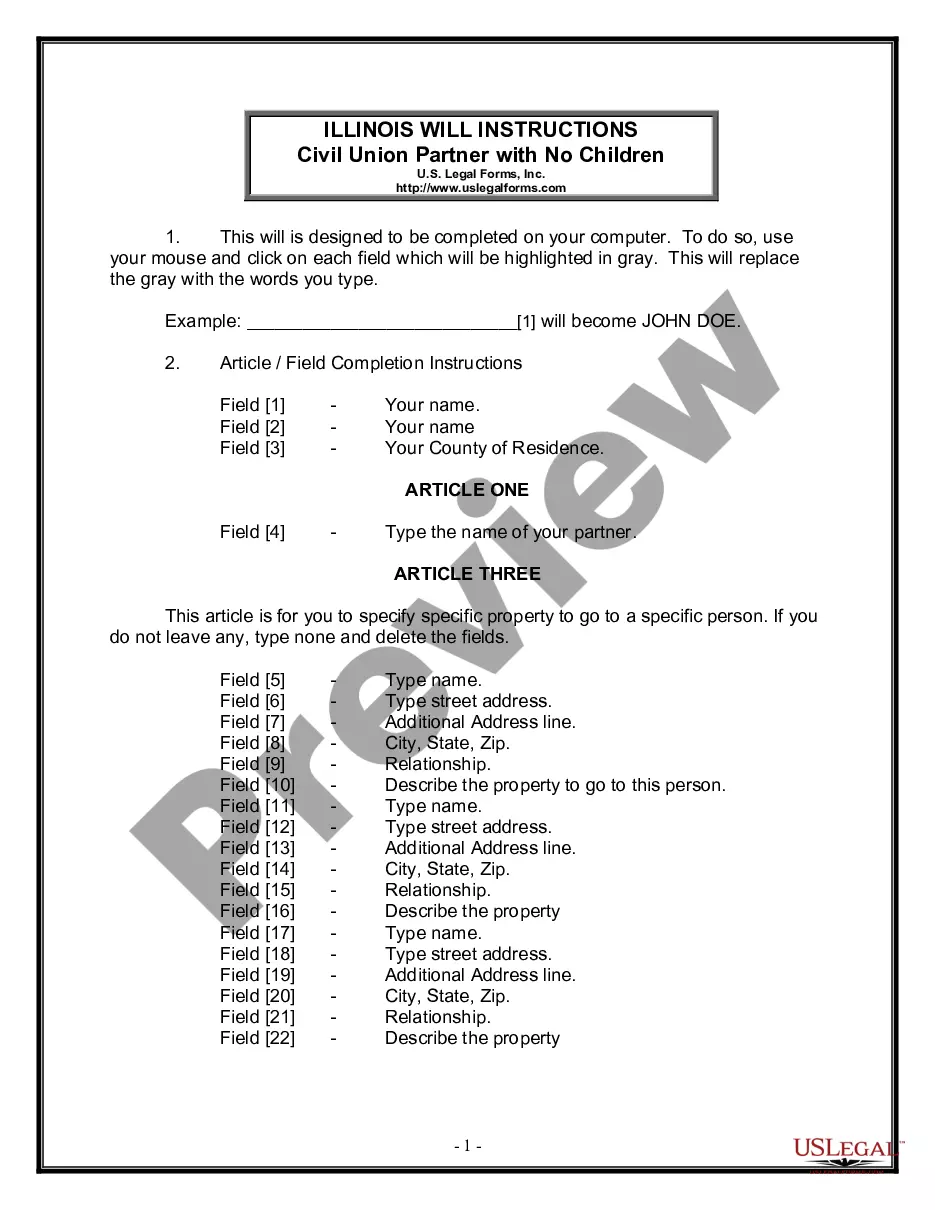

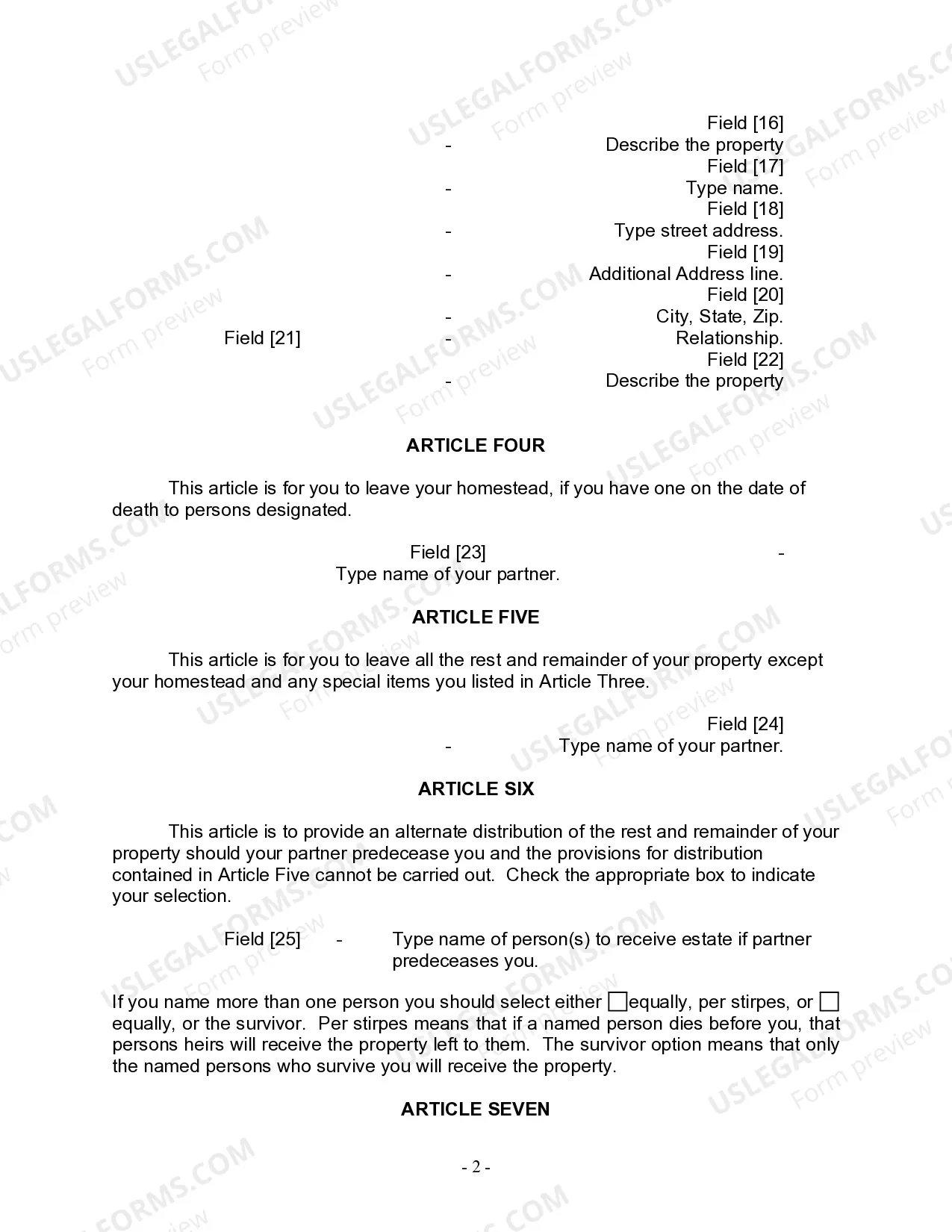

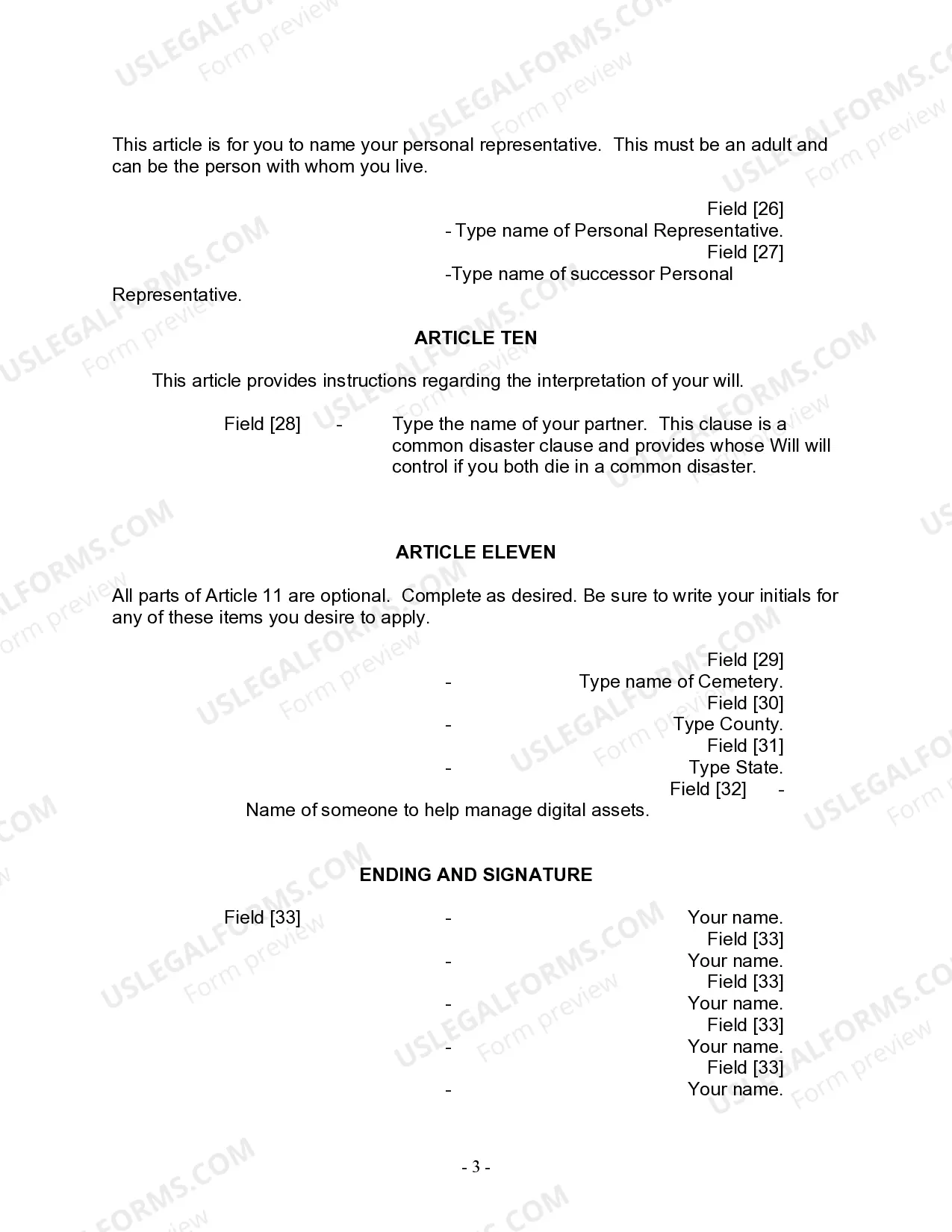

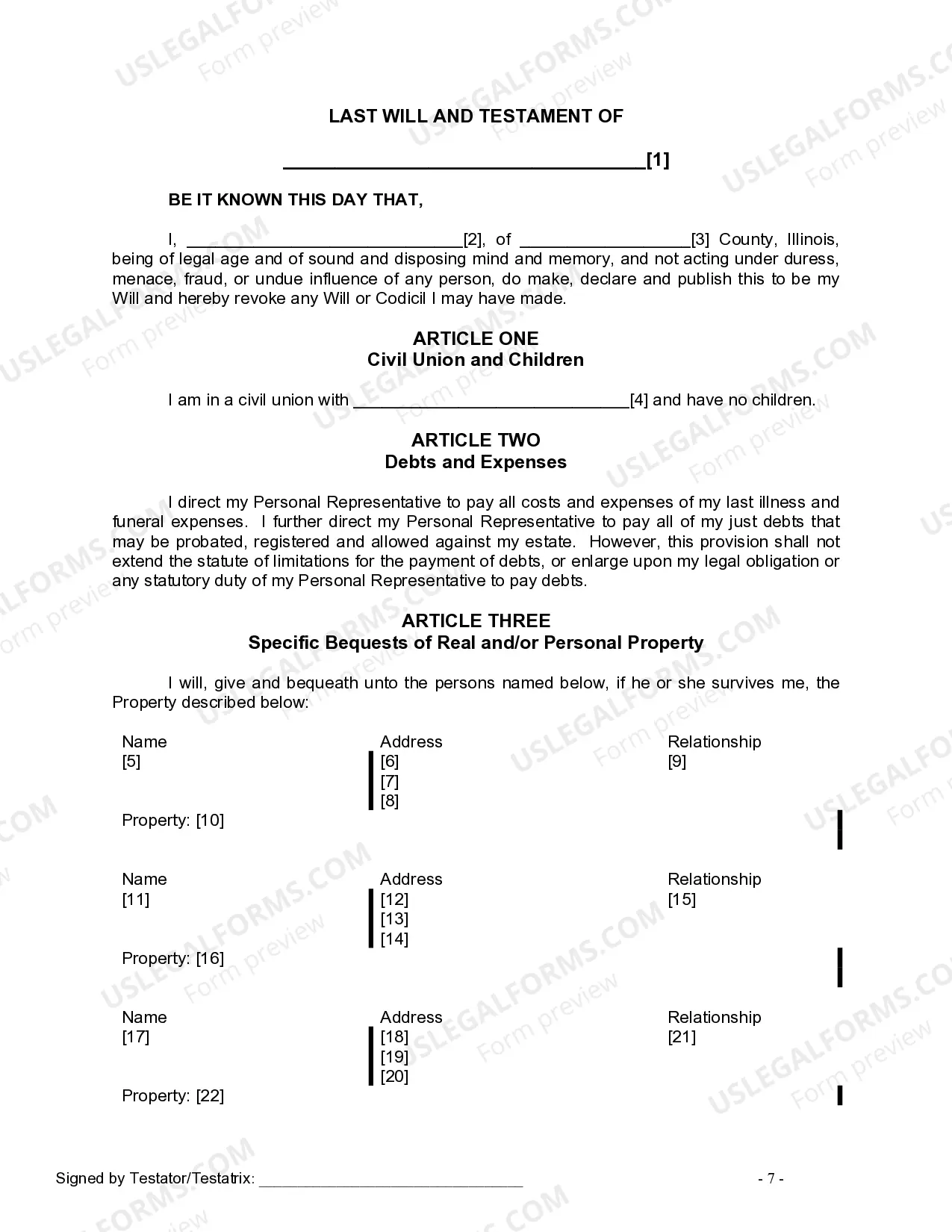

The Will you have found is for a civil union partner with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions, including provisions for your partner.

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

Title: Joliet Illinois Legal Last Will and Testament Form for a Civil Union Partner with No Children Description: A Joliet Illinois Legal Last Will and Testament Form for a Civil Union Partner with No Children is a crucial legal document that offers a comprehensive plan for the distribution of assets and estate after the death of one or both partners in a civil union. This article provides a detailed description of this legal form, highlighting its purpose, key features, and types available. Keywords: Joliet Illinois, legal last will and testament, form, civil union partner, no children, distribution of assets, estate, types 1. Purpose of the Joliet Illinois Legal Last Will and Testament Form: The purpose of this legal form is to ensure that the wishes and intentions of civil union partners, who have no children, regarding the division and allocation of their assets and estate after their demise are legally documented and enforced. 2. Key Features of the Joliet Illinois Legal Last Will and Testament Form: — Distribution of Assets: The form allows civil union partners to specify how they want their assets, such as properties, funds, investments, personal belongings, and sentimental items, to be distributed among beneficiaries or charitable organizations. — Executor Appointment: It enables the partners to appoint an executor, responsible for overseeing the distribution process according to the will's instructions. — Debts and Taxes: The form also covers provisions for settling outstanding debts, funeral expenses, and addressing potential tax obligations. — Alternate Beneficiaries: In case the primary chosen beneficiaries predecease the partners, the form can designate alternate beneficiaries to ensure a smooth transition of assets. — Guardianship Designation: If applicable, the form can be used to name a guardian for any minor children of the civil union partners. 3. Types of Joliet Illinois Legal Last Will and Testament Form for a Civil Union Partner with No Children: Though multiple variations may exist based on individual preferences and specific legal requirements, there are generally two main types: — Basic Will: This standard form covers the partners' intentions for asset distribution, executor appointment, and potential guardianship designations. — Living Will: Also known as an "Advance Directive," this type of will address healthcare-related decisions and medical treatments in the event of severe illness or incapacitation. By utilizing a Joliet Illinois Legal Last Will and Testament Form for a Civil Union Partner with No Children, civil union partners can control the distribution of their assets, preserve family harmony, and ensure their estate is handled according to their wishes. It is highly recommended consulting with a legal professional to ensure compliance with Joliet Illinois state laws and to customize the will to individual circumstances.Title: Joliet Illinois Legal Last Will and Testament Form for a Civil Union Partner with No Children Description: A Joliet Illinois Legal Last Will and Testament Form for a Civil Union Partner with No Children is a crucial legal document that offers a comprehensive plan for the distribution of assets and estate after the death of one or both partners in a civil union. This article provides a detailed description of this legal form, highlighting its purpose, key features, and types available. Keywords: Joliet Illinois, legal last will and testament, form, civil union partner, no children, distribution of assets, estate, types 1. Purpose of the Joliet Illinois Legal Last Will and Testament Form: The purpose of this legal form is to ensure that the wishes and intentions of civil union partners, who have no children, regarding the division and allocation of their assets and estate after their demise are legally documented and enforced. 2. Key Features of the Joliet Illinois Legal Last Will and Testament Form: — Distribution of Assets: The form allows civil union partners to specify how they want their assets, such as properties, funds, investments, personal belongings, and sentimental items, to be distributed among beneficiaries or charitable organizations. — Executor Appointment: It enables the partners to appoint an executor, responsible for overseeing the distribution process according to the will's instructions. — Debts and Taxes: The form also covers provisions for settling outstanding debts, funeral expenses, and addressing potential tax obligations. — Alternate Beneficiaries: In case the primary chosen beneficiaries predecease the partners, the form can designate alternate beneficiaries to ensure a smooth transition of assets. — Guardianship Designation: If applicable, the form can be used to name a guardian for any minor children of the civil union partners. 3. Types of Joliet Illinois Legal Last Will and Testament Form for a Civil Union Partner with No Children: Though multiple variations may exist based on individual preferences and specific legal requirements, there are generally two main types: — Basic Will: This standard form covers the partners' intentions for asset distribution, executor appointment, and potential guardianship designations. — Living Will: Also known as an "Advance Directive," this type of will address healthcare-related decisions and medical treatments in the event of severe illness or incapacitation. By utilizing a Joliet Illinois Legal Last Will and Testament Form for a Civil Union Partner with No Children, civil union partners can control the distribution of their assets, preserve family harmony, and ensure their estate is handled according to their wishes. It is highly recommended consulting with a legal professional to ensure compliance with Joliet Illinois state laws and to customize the will to individual circumstances.