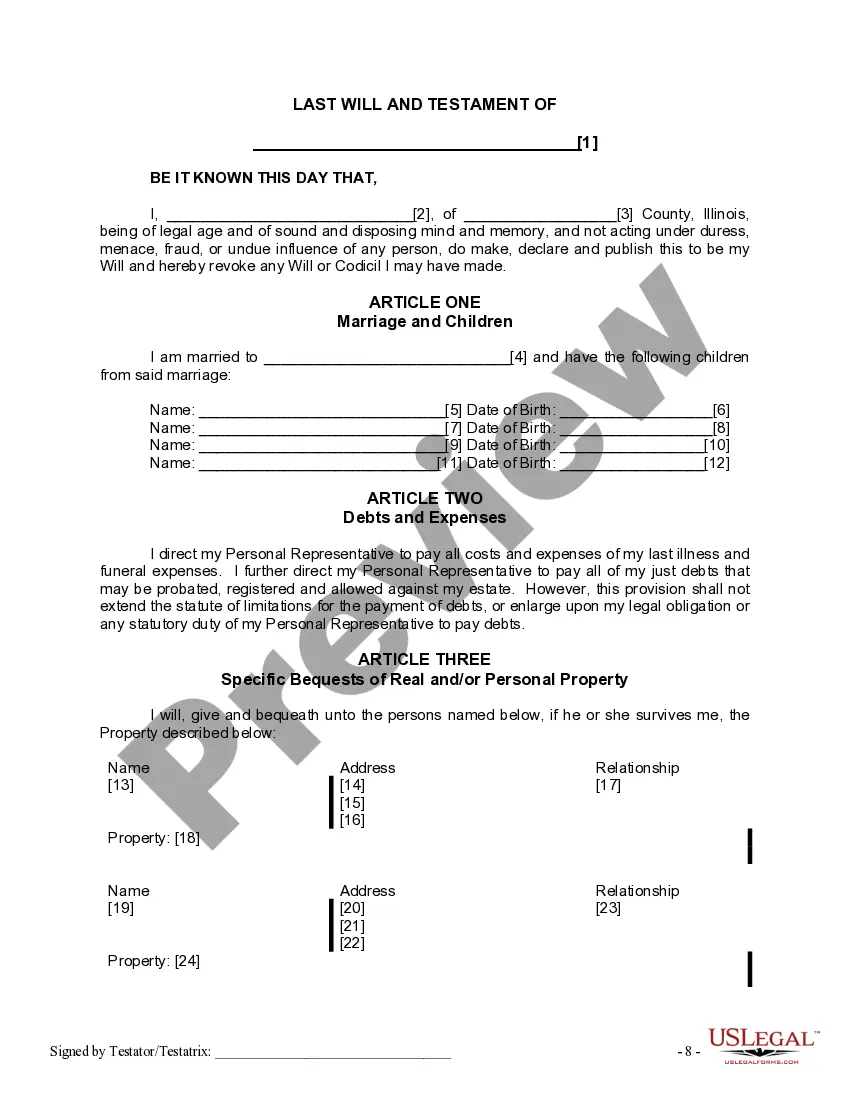

This is a Last Will and Testament Form for Married Person with Adult and Minor Children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions, including provisions for your spouse and children. It also establishes a trust and provides for the appointment of a trustee for the estate of the minor children.

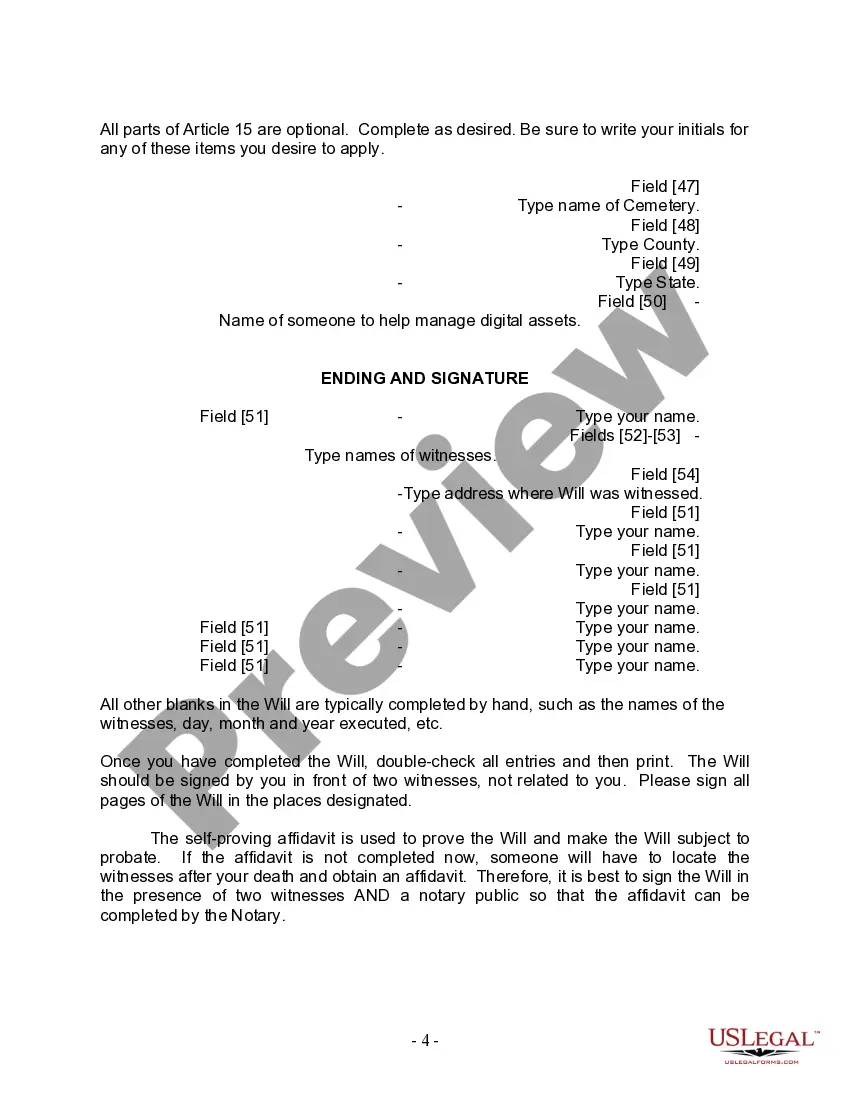

This will must be signed in the presence of two witnesses, not related to you or named in your will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the will.

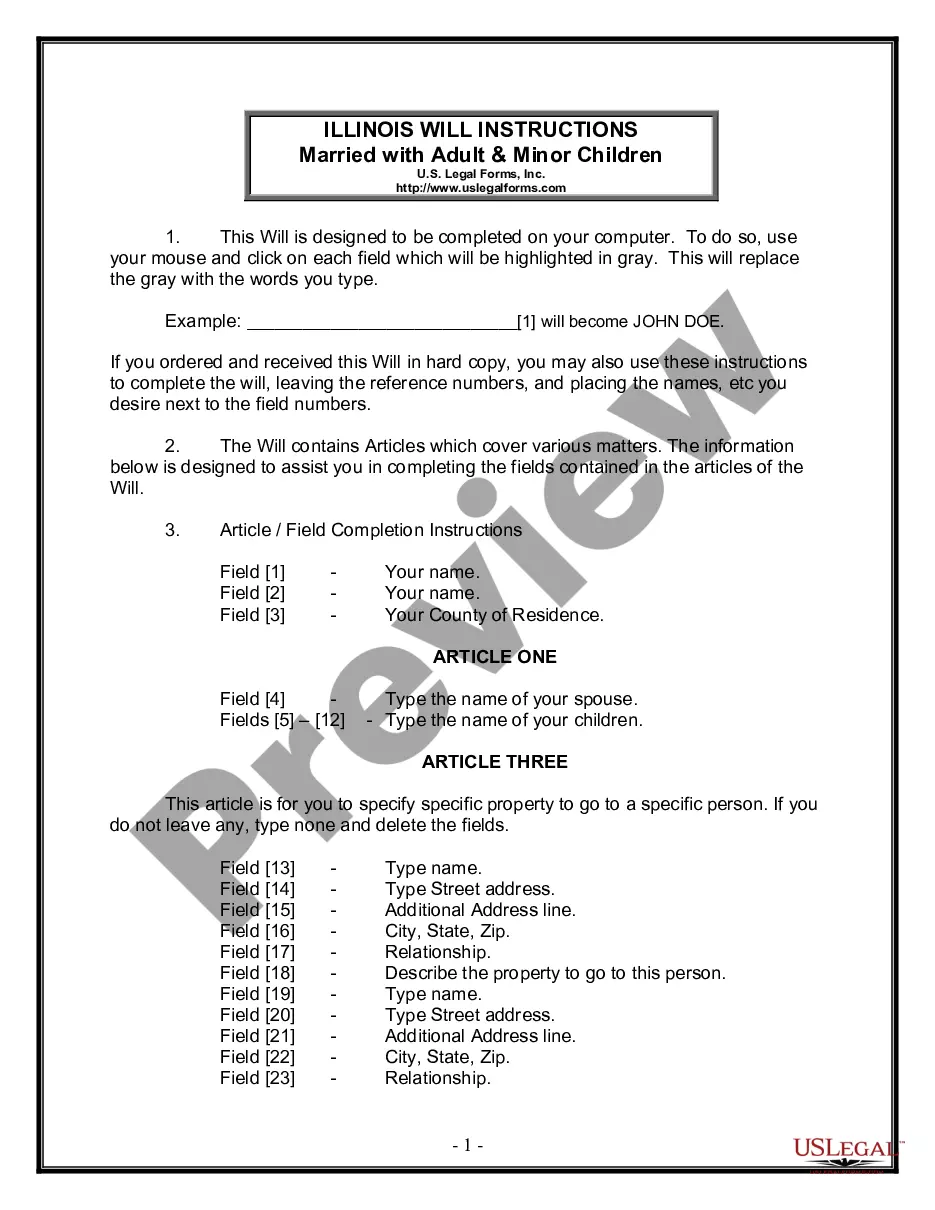

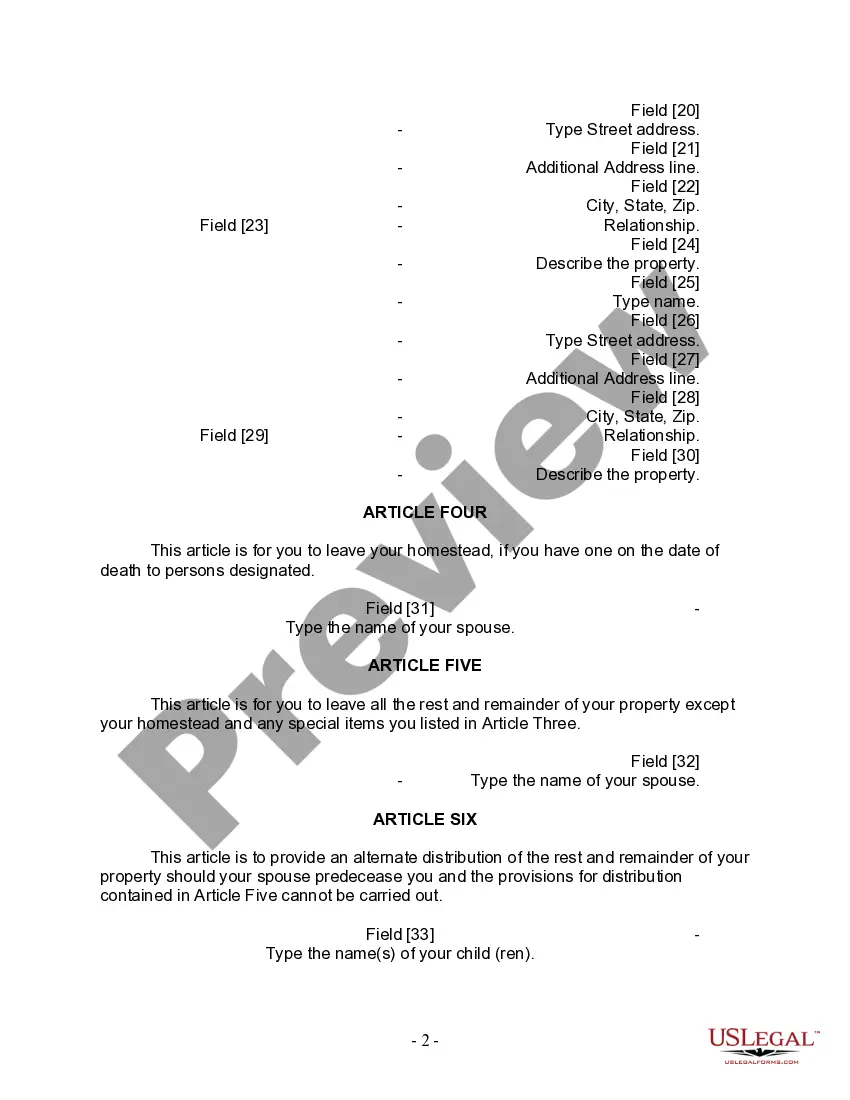

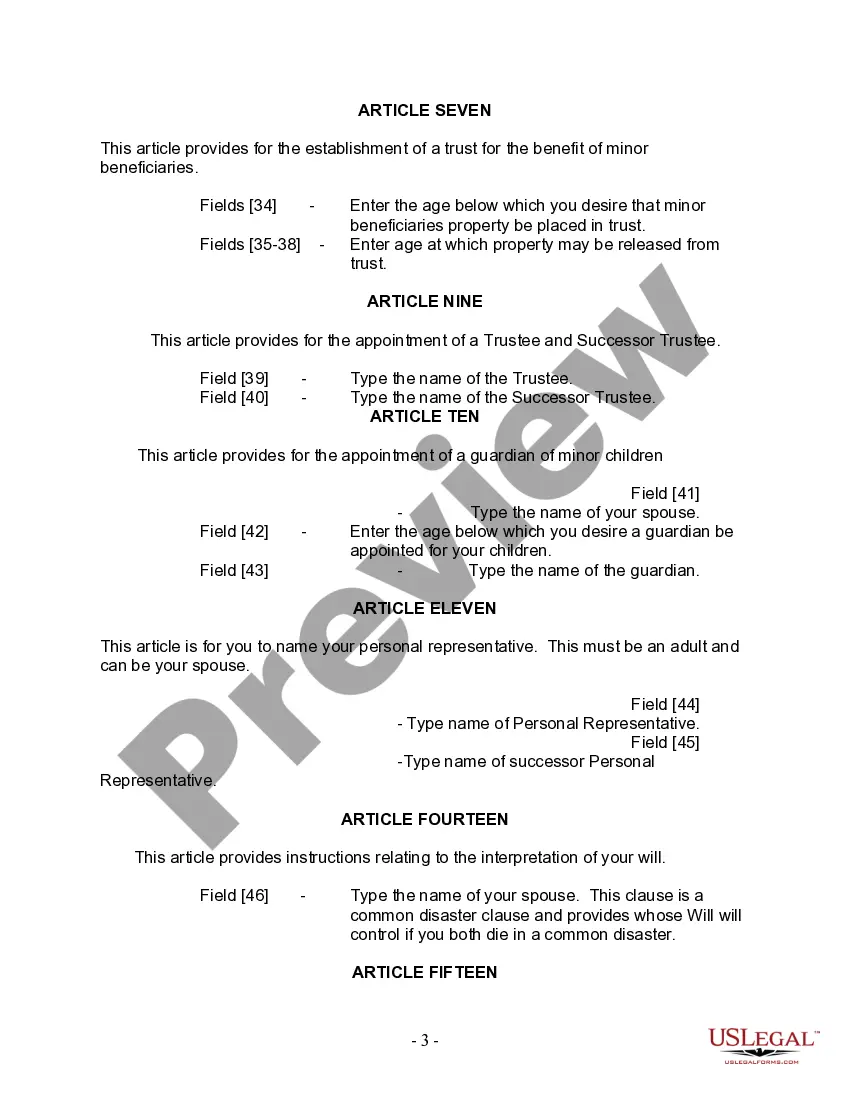

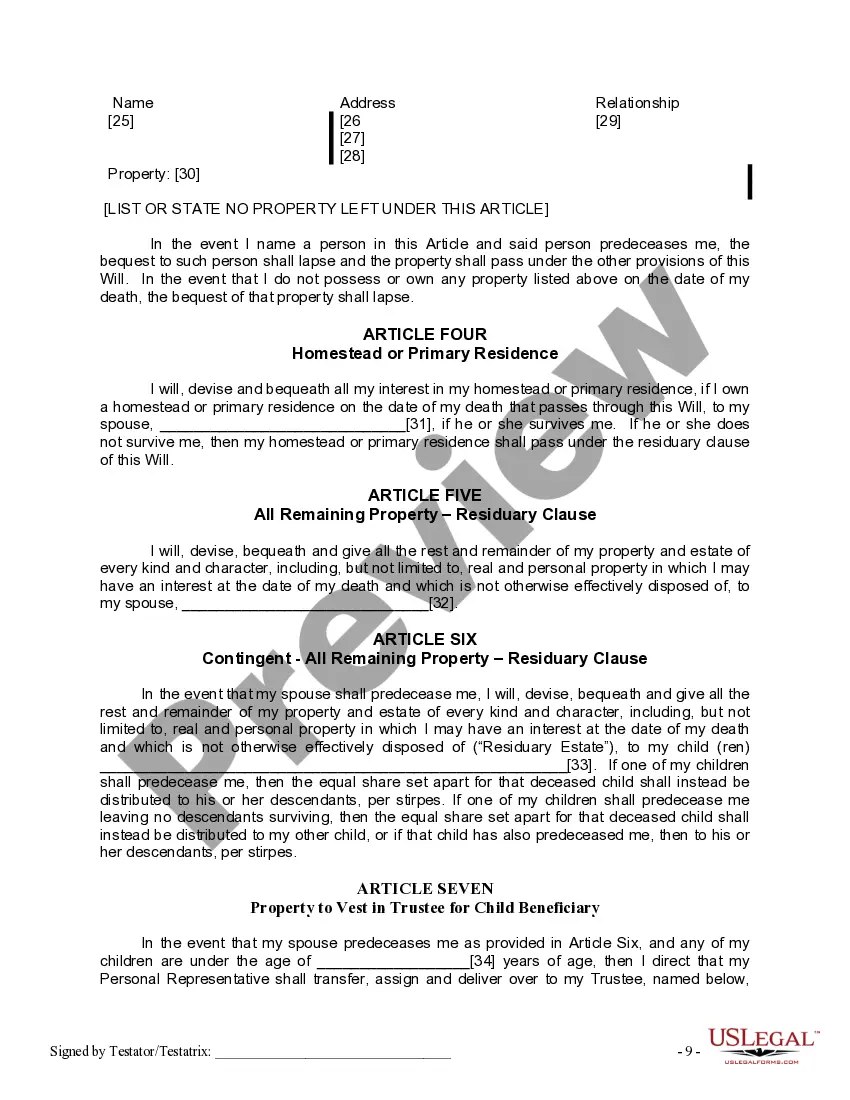

The Elgin Illinois Legal Last Will and Testament Form for Married Person with Adult and Minor Children is a legally binding document that allows married individuals residing in Elgin, Illinois, to outline their final wishes concerning the distribution of assets, guardianship of minor children, and other important matters after their passing. This comprehensive form ensures that your estate is handled according to your preferences, providing peace of mind and clarity for your loved ones during an emotionally challenging time. Key features of the Elgin Illinois Legal Last Will and Testament Form for Married Person with Adult and Minor Children: 1. Asset Distribution: This form enables you to specify how your assets, including property, investments, finances, and personal belongings, should be distributed among your beneficiaries. You can make specific bequests or determine percentage allocations as per your preferences. 2. Nomination of Executors: You can appoint one or more trusted individuals to serve as executors of your estate. These executors will be responsible for managing your assets, paying off debts, and ensuring your estate goes through the probate process smoothly. 3. Guardian Appointment: If you have minor children, the form allows you to designate a guardian who will be responsible for their care and upbringing in the event of your passing. This ensures that your children are placed under the care of someone you trust and who shares your values and beliefs. 4. Testamentary Trusts: This form offers the option to create testamentary trusts, which can be beneficial for minor children or adult beneficiaries who may require assistance managing their inheritance. The testamentary trust can provide guidelines on how the funds should be used until beneficiaries reach a certain age or meet specific milestones. Different types of Elgin Illinois Legal Last Will and Testament Form for Married Person with Adult and Minor Children may include: 1. Basic Last Will and Testament: This form covers the essential aspects of asset distribution and guardianship appointment for married individuals with adult and minor children. 2. Last Will and Testament with Testamentary Trust: This form includes provisions for setting up testamentary trusts to safeguard and manage assets for minor children or beneficiaries who may not be financially mature. 3. Last Will and Testament with Specific Bequests: This form permits you to allocate specific items or sums of money to designated individuals, charities, or organizations, in addition to outlining the general distribution of your assets. It is crucial to consult with a qualified attorney or estate planning professional when drafting and executing these forms to ensure compliance with Illinois state laws and to address any unique circumstances or complexities specific to your situation.The Elgin Illinois Legal Last Will and Testament Form for Married Person with Adult and Minor Children is a legally binding document that allows married individuals residing in Elgin, Illinois, to outline their final wishes concerning the distribution of assets, guardianship of minor children, and other important matters after their passing. This comprehensive form ensures that your estate is handled according to your preferences, providing peace of mind and clarity for your loved ones during an emotionally challenging time. Key features of the Elgin Illinois Legal Last Will and Testament Form for Married Person with Adult and Minor Children: 1. Asset Distribution: This form enables you to specify how your assets, including property, investments, finances, and personal belongings, should be distributed among your beneficiaries. You can make specific bequests or determine percentage allocations as per your preferences. 2. Nomination of Executors: You can appoint one or more trusted individuals to serve as executors of your estate. These executors will be responsible for managing your assets, paying off debts, and ensuring your estate goes through the probate process smoothly. 3. Guardian Appointment: If you have minor children, the form allows you to designate a guardian who will be responsible for their care and upbringing in the event of your passing. This ensures that your children are placed under the care of someone you trust and who shares your values and beliefs. 4. Testamentary Trusts: This form offers the option to create testamentary trusts, which can be beneficial for minor children or adult beneficiaries who may require assistance managing their inheritance. The testamentary trust can provide guidelines on how the funds should be used until beneficiaries reach a certain age or meet specific milestones. Different types of Elgin Illinois Legal Last Will and Testament Form for Married Person with Adult and Minor Children may include: 1. Basic Last Will and Testament: This form covers the essential aspects of asset distribution and guardianship appointment for married individuals with adult and minor children. 2. Last Will and Testament with Testamentary Trust: This form includes provisions for setting up testamentary trusts to safeguard and manage assets for minor children or beneficiaries who may not be financially mature. 3. Last Will and Testament with Specific Bequests: This form permits you to allocate specific items or sums of money to designated individuals, charities, or organizations, in addition to outlining the general distribution of your assets. It is crucial to consult with a qualified attorney or estate planning professional when drafting and executing these forms to ensure compliance with Illinois state laws and to address any unique circumstances or complexities specific to your situation.