This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

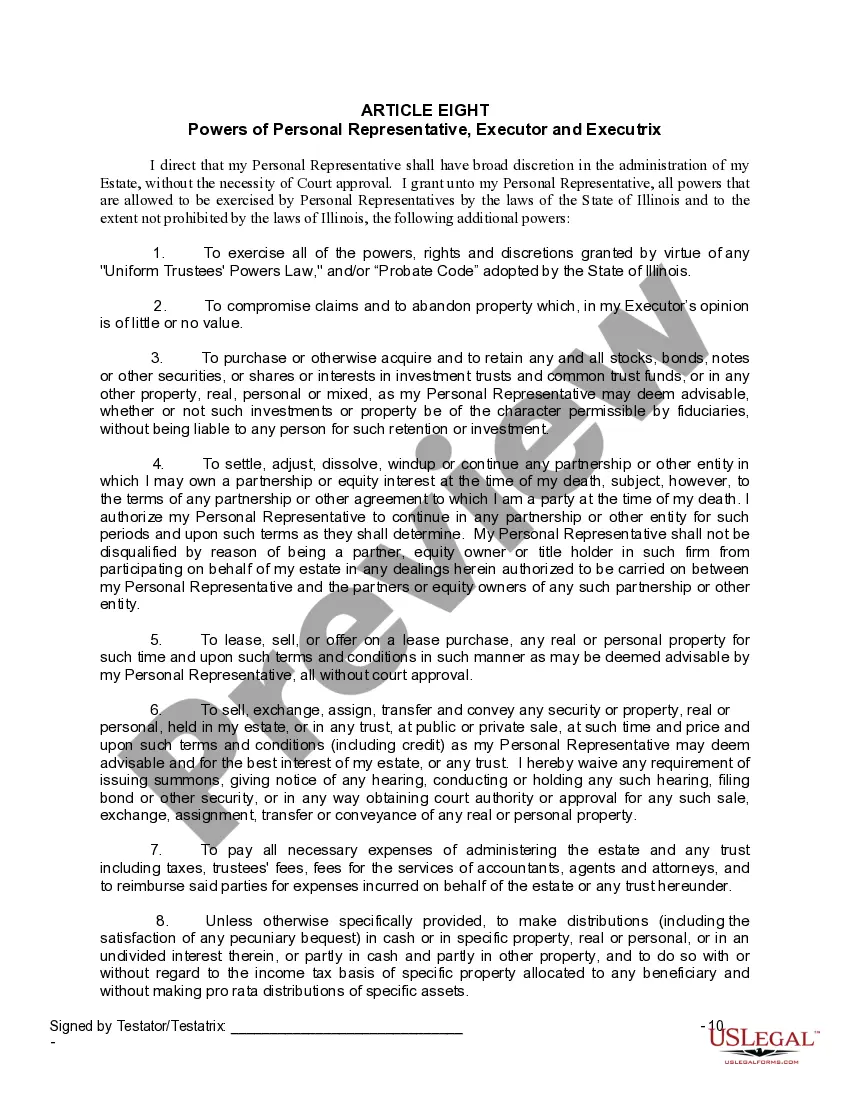

Chicago Illinois Last Will and Testament for a Widow or Widower with Adult Children

Description

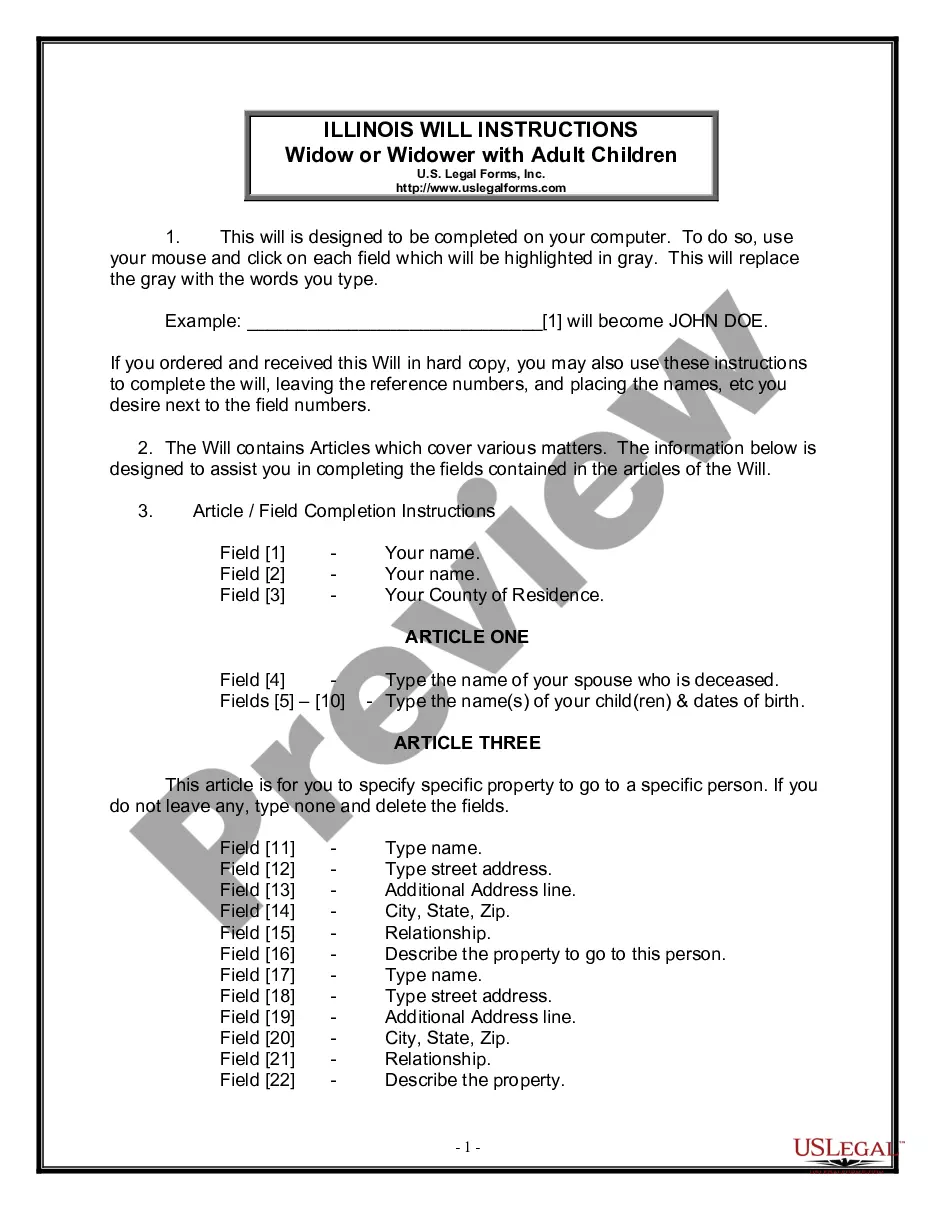

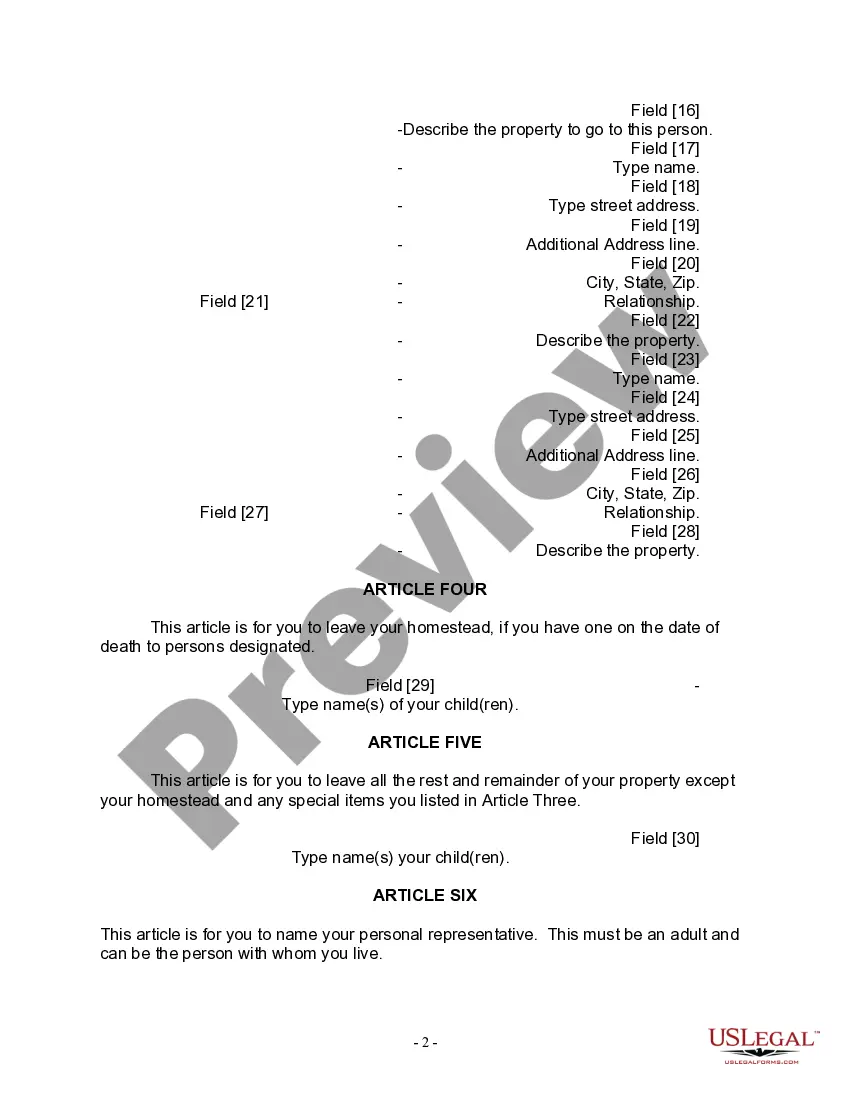

How to fill out Illinois Last Will And Testament For A Widow Or Widower With Adult Children?

We consistently aim to reduce or evade legal complications when handling intricate law-related or financial matters.

To achieve this, we seek attorney services that are typically very costly.

Nonetheless, not every legal issue is that complicated.

Many of them can be managed independently.

Utilize US Legal Forms whenever you need to quickly and securely obtain and download the Chicago Illinois Legal Last Will and Testament Form for a Widow or Widower with Adult Children or any other form. Just Log In to your account and click the Get button next to it. If you misplace the document, you can always re-download it in the My documents tab. The process is equally simple if you’re unfamiliar with the site! You can set up your account in minutes. Ensure to verify if the Chicago Illinois Legal Last Will and Testament Form for a Widow or Widower with Adult Children complies with your state's laws and regulations. Additionally, it’s important to review the form’s outline (if available), and if you notice any inconsistencies with your initial requirements, look for an alternative form. Once you’ve confirmed that the Chicago Illinois Legal Last Will and Testament Form for a Widow or Widower with Adult Children suits your needs, you can choose the subscription plan and process your payment. Then you can download the document in any preferred format. For over 24 years, we’ve supported millions by offering customizable and current legal forms. Take full advantage of US Legal Forms now to save time and resources!

- US Legal Forms is a digital repository of current DIY legal documents encompassing everything from wills and powers of attorney to incorporation articles and dissolution petitions.

- Our library empowers you to manage your affairs without the need for legal representation.

- We offer access to legal form templates that are not always publicly available.

- Our templates are specific to states and regions, greatly easing the search process.

Form popularity

FAQ

A handwritten will that meets all of Illinois' requirements is legally valid.

A handwritten will meets the definition of a written will as far the law is concerned. This means that any will that is appropriately signed and witnessed is a valid will. A handwritten will that is not witnessed is known as a holographic will and is not valid under Illinois law.

A handwritten will may be valid in Illinois if it meets the legal requirements. Illinois probate requirements for a valid will are: The testator (the creator of the will) must be at least 18 years old. The testator must be of sound mind and have the mental capacity to understand the consequences of his or her actions.

You can use an online will making service to do so USLegalWills is our recommendation to make a will online in Illinois. Here are the legal requirements for a will to be valid in Illinois: The person writing the will, known as the Testator, must be at least 18 years of age and of sound mind.

In Illinois, to have a valid will it is required that two or more credible witnesses validate or attest the will. This means each witness must watch the testator (person making his or her will) sign or acknowledge the will, determine the testator is of sound mind, and sign the will in front of the testator.

In Illinois, to have a valid will it is required that two or more credible witnesses validate or attest the will. This means each witness must watch the testator (person making his or her will) sign or acknowledge the will, determine the testator is of sound mind, and sign the will in front of the testator.

The Grounds for Contesting a Will The grounds for invalidating wills in Illinois include undue influence, lack of testamentary capacity, and fraud or forgery. Undue influence occurs when something or someone prevents people from exercising their own rights and wishes when crafting their wills.

Signing and attestation. (a) Every will shall be in writing, signed by the testator or by some person in his presence and by his direction and attested in the presence of the testator by 2 or more credible witnesses.

An attorney is not required to make a will in Illinois. For the vast majority of people, an attorney will simply do the same things that a good will-making software does ? ask you questions and then create documents for you based on your information and wishes.

A handwritten will may be valid in Illinois if it meets the legal requirements. Illinois probate requirements for a valid will are: The testator (the creator of the will) must be at least 18 years old. The testator must be of sound mind and have the mental capacity to understand the consequences of his or her actions.