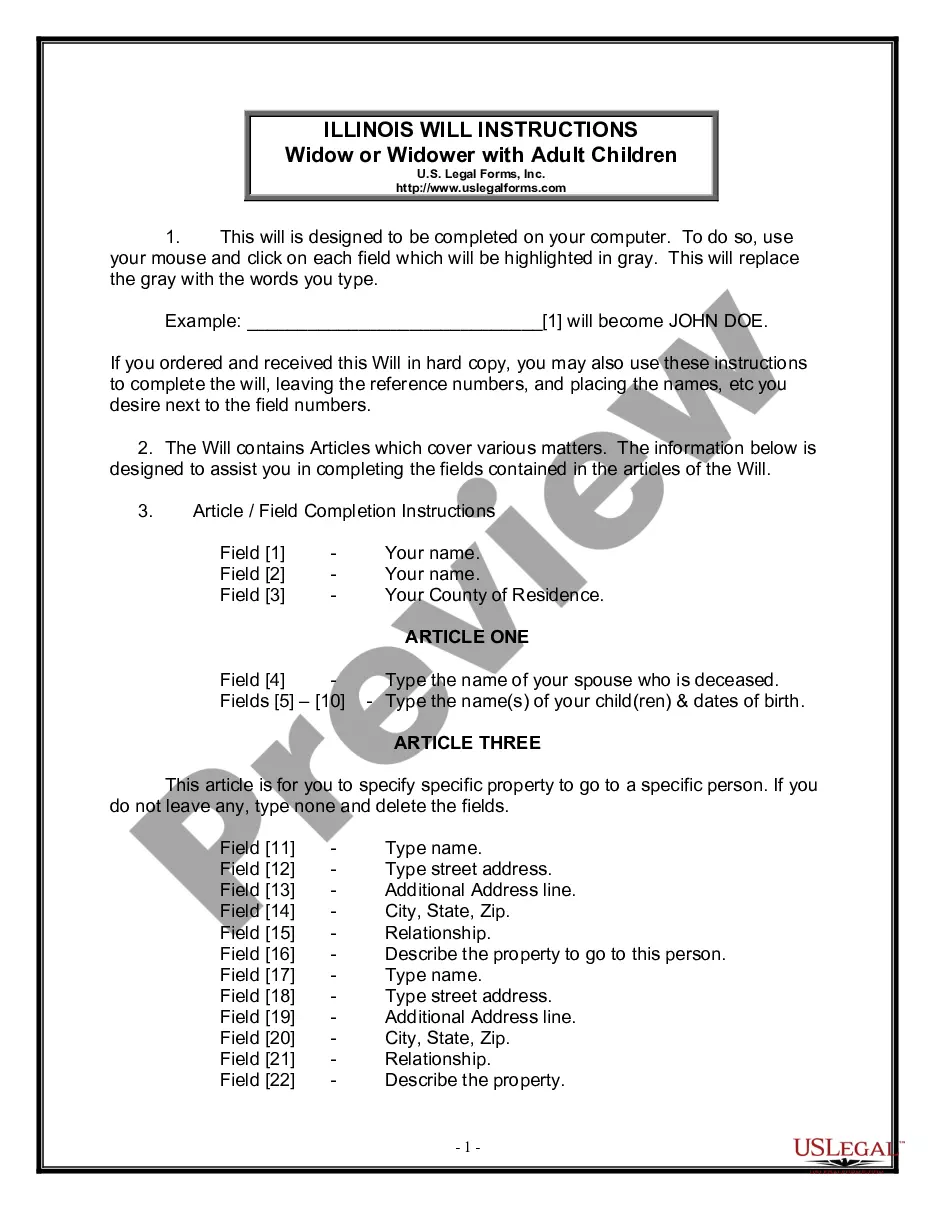

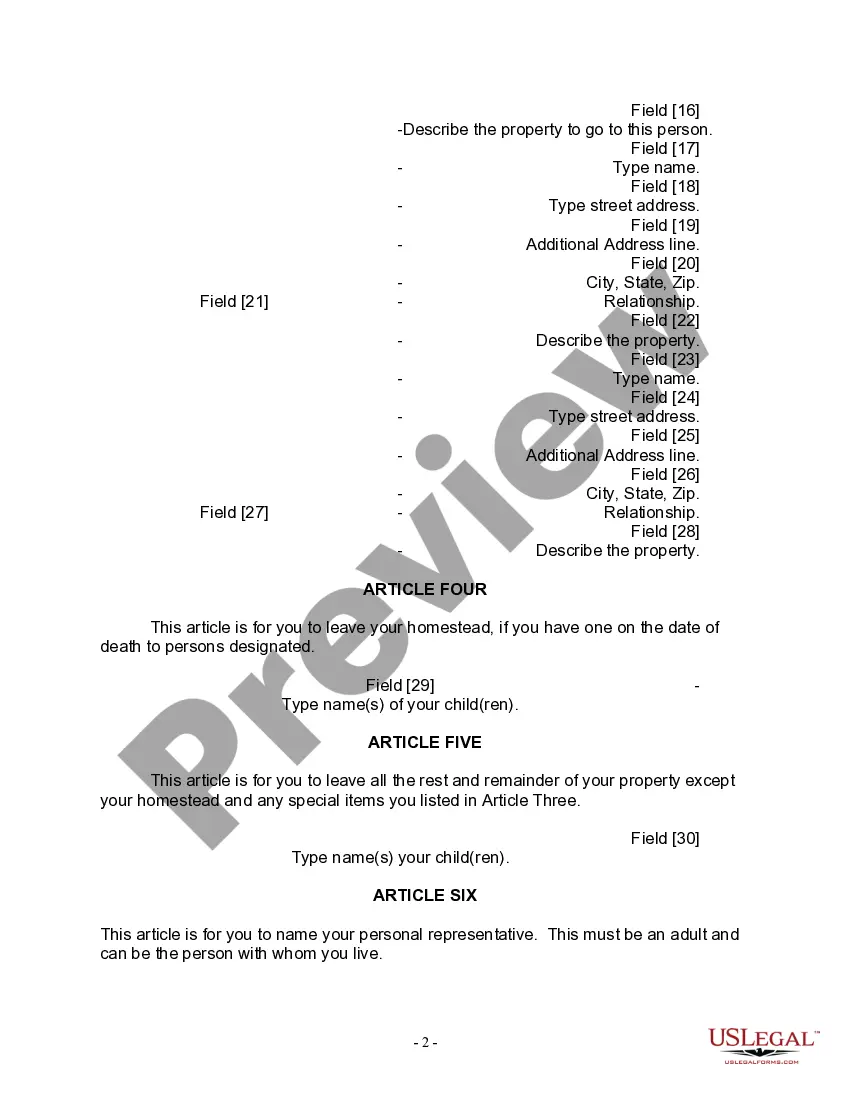

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will. Cook Illinois Legal Last Will and Testament Form for a Widow or Widower with Adult Children is a legal document that helps individuals outline their wishes regarding the distribution of their assets upon their death. This will form is specifically designed for widows or widowers who have adult children. It ensures that their assets, property, and possessions are transferred according to their desires and in compliance with Illinois state laws. Keywords: Cook Illinois Legal Last Will and Testament Form, Widow, Widower, Adult Children, legal document, assets, property, possessions, distribution, death, desires, compliance, Illinois state laws. Different types of Cook Illinois Legal Last Will and Testament Forms for a Widow or Widower with Adult Children may include: 1. Basic Last Will and Testament Form: This form allows the widow or widower to outline their wishes for asset distribution, appoint an executor for their estate, name a guardian for any minor children, and specify any specific instructions or conditions for the distribution of their assets to their adult children. 2. Living Will and Testament Form: This form includes additional provisions that allow the widow or widower to express their wishes regarding medical treatment, life support measures, and end-of-life decisions, in addition to asset distribution and other matters related to their estate. 3. Testamentary Trust Will Form: This type of will form allows the widow or widower to establish a trust within their will for the benefit of their adult children. This trust can hold and manage assets on behalf of the children until they reach a certain age or milestone specified by the testator. 4. Pour-Over Will Form: This form is used when the widow or widower already has a revocable living trust in place. It ensures that any assets not already transferred to the trust during their lifetime are "poured over" into the trust upon their death, thereby simplifying the distribution process and avoiding probate. It is important for widows or widowers with adult children to consult with an attorney or legal professional to determine which specific Cook Illinois Legal Last Will and Testament Form for a Widow or Widower with Adult Children best suits their needs and reflects their desires for asset distribution and other important matters.

Cook Illinois Legal Last Will and Testament Form for a Widow or Widower with Adult Children is a legal document that helps individuals outline their wishes regarding the distribution of their assets upon their death. This will form is specifically designed for widows or widowers who have adult children. It ensures that their assets, property, and possessions are transferred according to their desires and in compliance with Illinois state laws. Keywords: Cook Illinois Legal Last Will and Testament Form, Widow, Widower, Adult Children, legal document, assets, property, possessions, distribution, death, desires, compliance, Illinois state laws. Different types of Cook Illinois Legal Last Will and Testament Forms for a Widow or Widower with Adult Children may include: 1. Basic Last Will and Testament Form: This form allows the widow or widower to outline their wishes for asset distribution, appoint an executor for their estate, name a guardian for any minor children, and specify any specific instructions or conditions for the distribution of their assets to their adult children. 2. Living Will and Testament Form: This form includes additional provisions that allow the widow or widower to express their wishes regarding medical treatment, life support measures, and end-of-life decisions, in addition to asset distribution and other matters related to their estate. 3. Testamentary Trust Will Form: This type of will form allows the widow or widower to establish a trust within their will for the benefit of their adult children. This trust can hold and manage assets on behalf of the children until they reach a certain age or milestone specified by the testator. 4. Pour-Over Will Form: This form is used when the widow or widower already has a revocable living trust in place. It ensures that any assets not already transferred to the trust during their lifetime are "poured over" into the trust upon their death, thereby simplifying the distribution process and avoiding probate. It is important for widows or widowers with adult children to consult with an attorney or legal professional to determine which specific Cook Illinois Legal Last Will and Testament Form for a Widow or Widower with Adult Children best suits their needs and reflects their desires for asset distribution and other important matters.