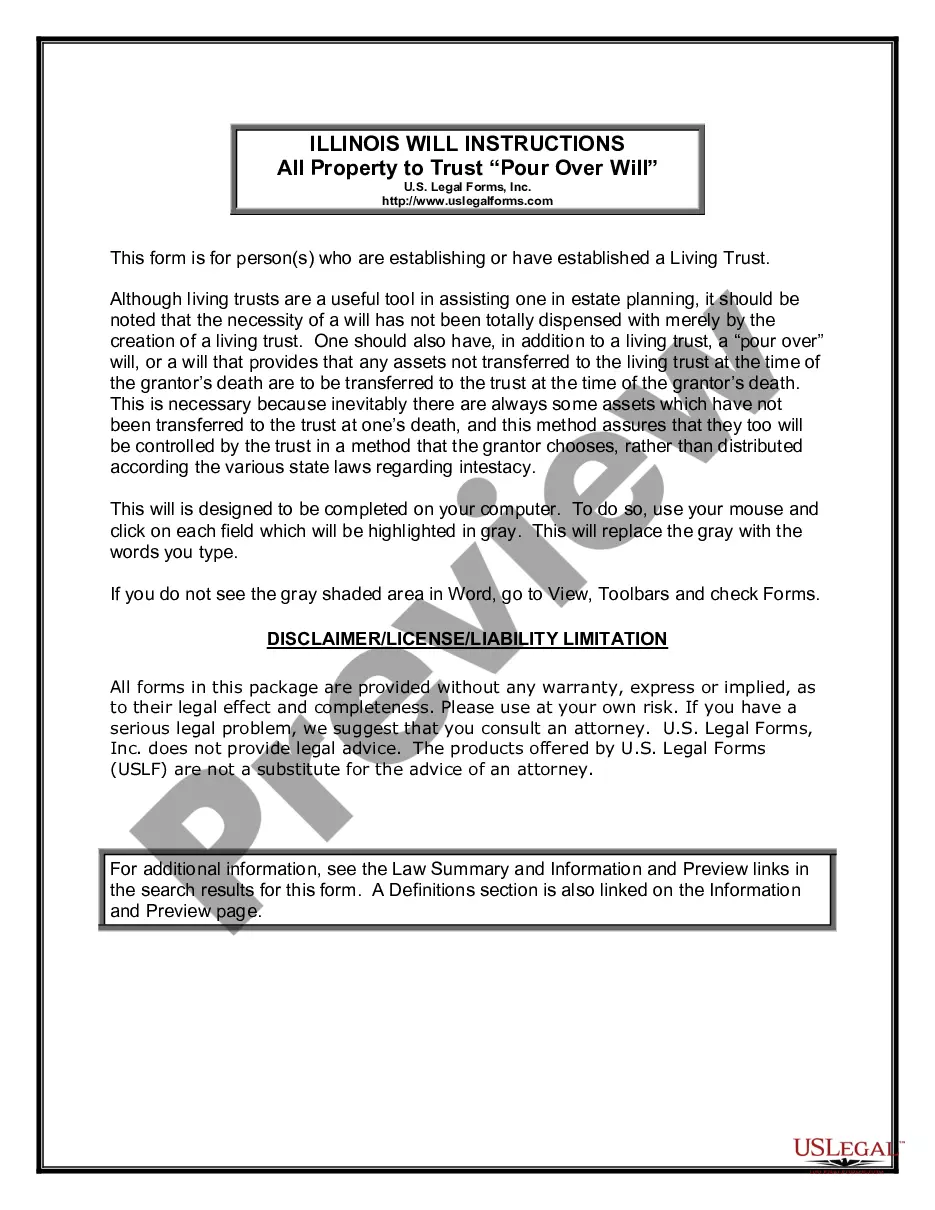

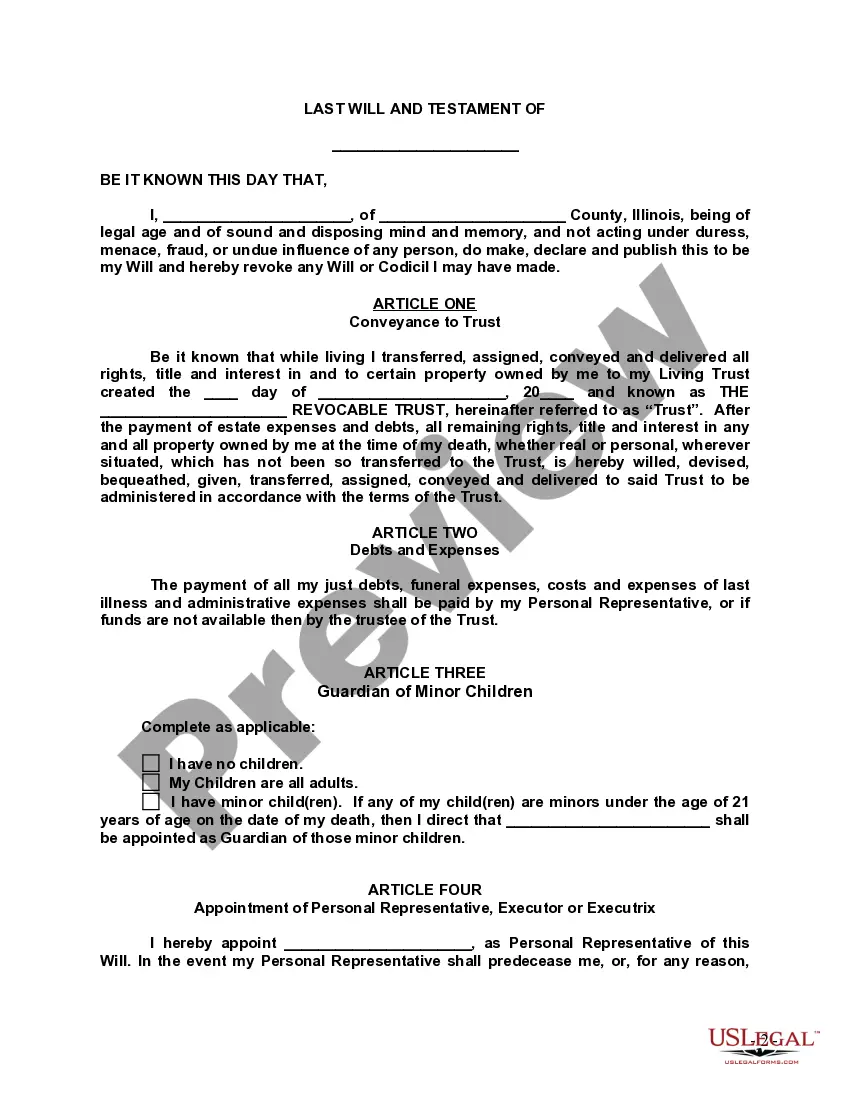

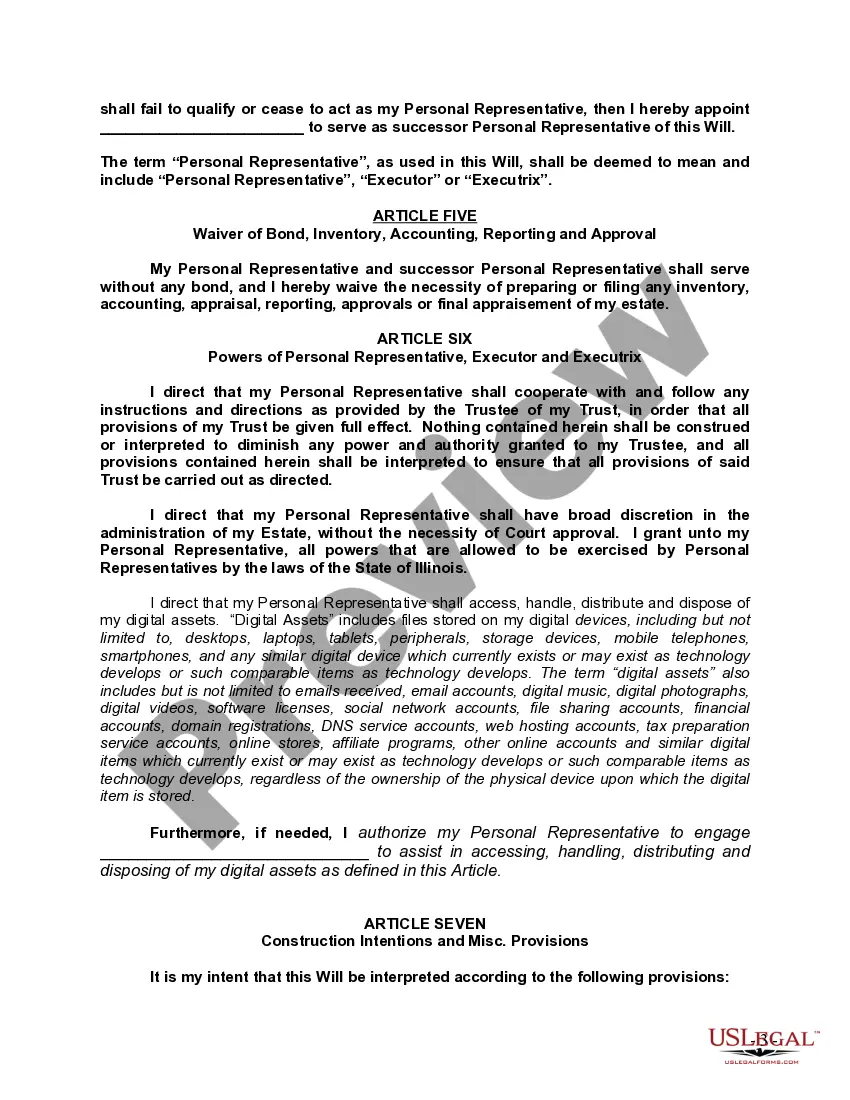

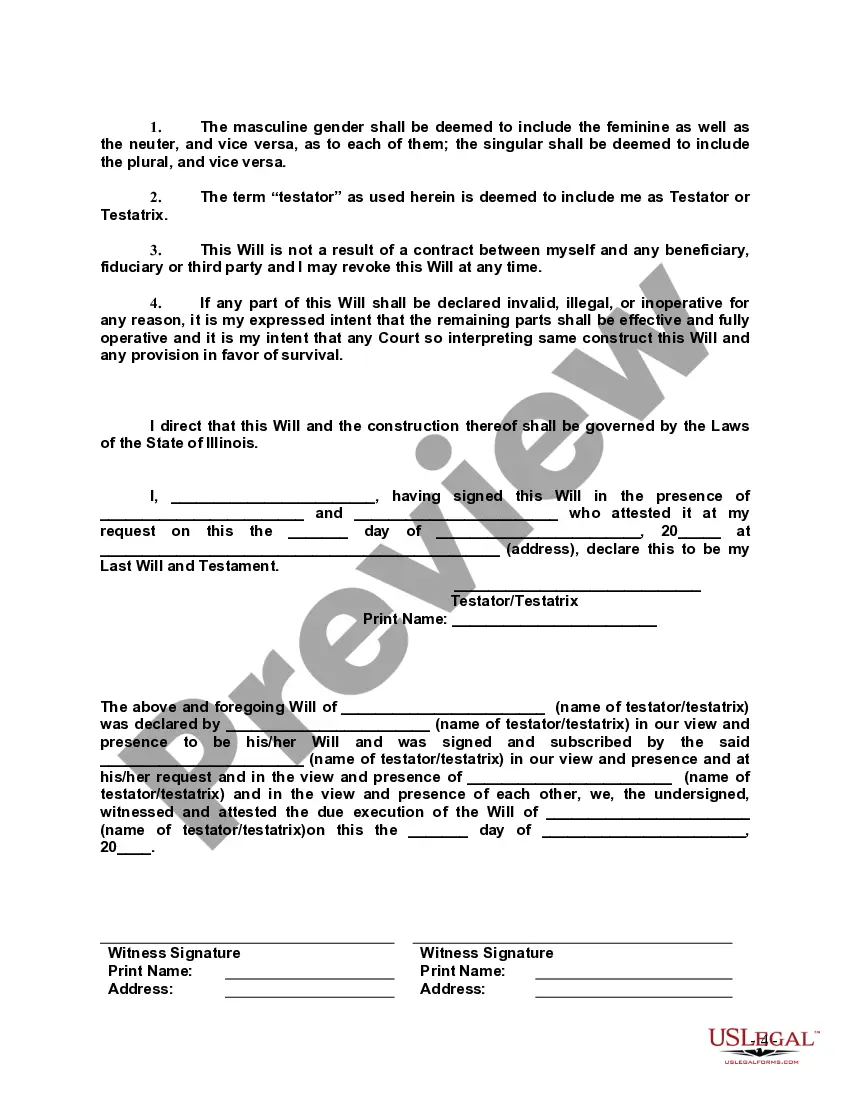

A Chicago Illinois Legal Last Will and Testament Form with All Property to Trust, known as a Pour Over Will, is a legal document that outlines the distribution of a person's assets upon their death. This type of will is commonly used in estate planning to ensure that all the individual's property transfers smoothly into a revocable living trust. Keywords: Chicago Illinois, Legal Last Will and Testament Form, All Property to Trust, Pour Over Will, estate planning, assets, death, revocable living trust. A Pour Over Will serves as a safety net to catch any assets that were not properly transferred into the trust during the individual's lifetime. It acts as a backup plan, allowing any remaining property to "pour over" into the trust upon their death, hence the name. This way, all assets, including those forgotten or acquired after creating the trust, will be included in the trust's terms and distributed according to the individual's wishes. By utilizing a Pour Over Will, individuals can have peace of mind knowing that their entire estate plan is comprehensive and seamless. The Pour Over Will is designed to work in conjunction with the revocable living trust, providing an additional level of protection and ensuring that the trust becomes the ultimate beneficiary of their assets. Different variations or types of Chicago Illinois Legal Last Will and Testament Forms with All Property to Trust called a Pour Over Will might include specific provisions tailored to various scenarios or personal preferences. These may include provisions for guardianship of minor children, disposition of sentimental or unique items, instructions for the distribution of remaining assets, or naming of specific beneficiaries and their respective shares. It is important to consult with a qualified attorney when creating a Chicago Illinois Legal Last Will and Testament Form with All Property to Trust called a Pour Over Will. They can provide guidance, ensure compliance with state laws, and tailor the document to suit individual circumstances. This will help in achieving the desired estate plan and effectively transferring all assets into the designated revocable living trust, thereby simplifying the distribution process after the individual's passing.

Illinois Will Forms

Description

How to fill out Chicago Illinois Last Will And Testament With All Property To Trust Called A Pour Over Will?

Do you need a reliable and inexpensive legal forms supplier to buy the Chicago Illinois Legal Last Will and Testament Form with All Property to Trust called a Pour Over Will? US Legal Forms is your go-to solution.

No matter if you require a basic arrangement to set rules for cohabitating with your partner or a package of documents to move your divorce through the court, we got you covered. Our platform provides over 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t universal and framed based on the requirements of specific state and area.

To download the document, you need to log in account, locate the required form, and hit the Download button next to it. Please take into account that you can download your previously purchased form templates at any time in the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the Chicago Illinois Legal Last Will and Testament Form with All Property to Trust called a Pour Over Will conforms to the laws of your state and local area.

- Go through the form’s description (if provided) to learn who and what the document is good for.

- Restart the search in case the form isn’t suitable for your legal scenario.

Now you can create your account. Then pick the subscription plan and proceed to payment. Once the payment is completed, download the Chicago Illinois Legal Last Will and Testament Form with All Property to Trust called a Pour Over Will in any provided format. You can get back to the website when you need and redownload the document free of charge.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a go today, and forget about spending your valuable time learning about legal paperwork online for good.