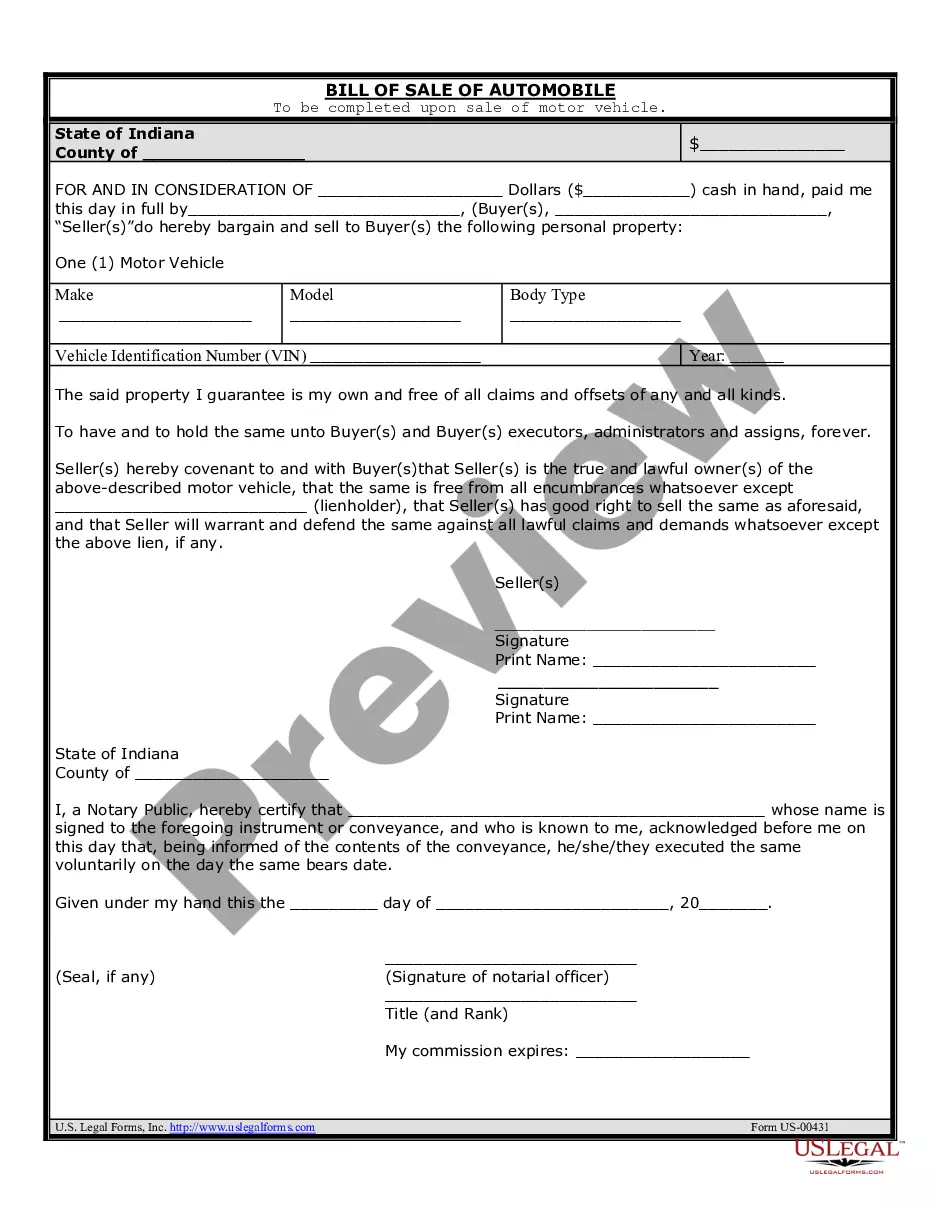

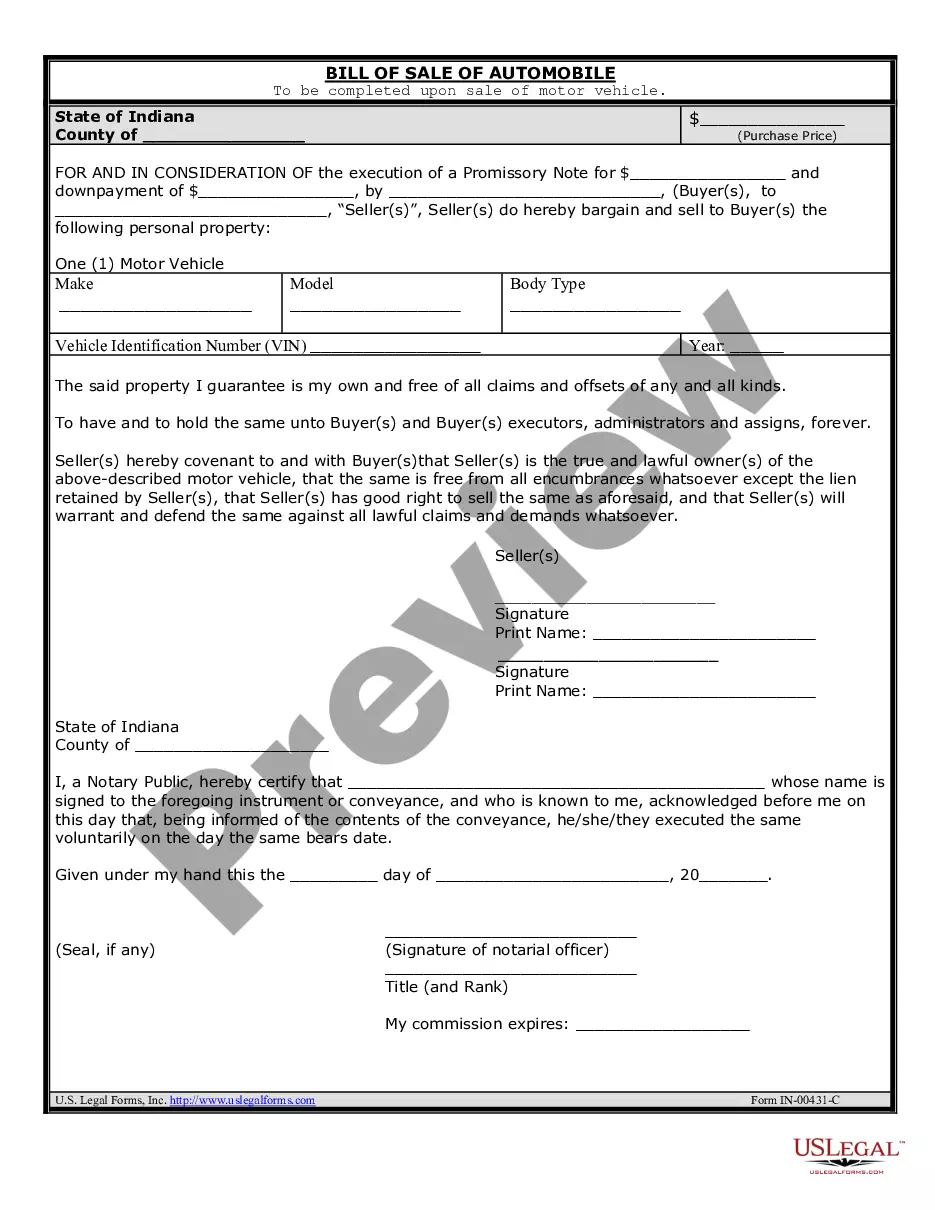

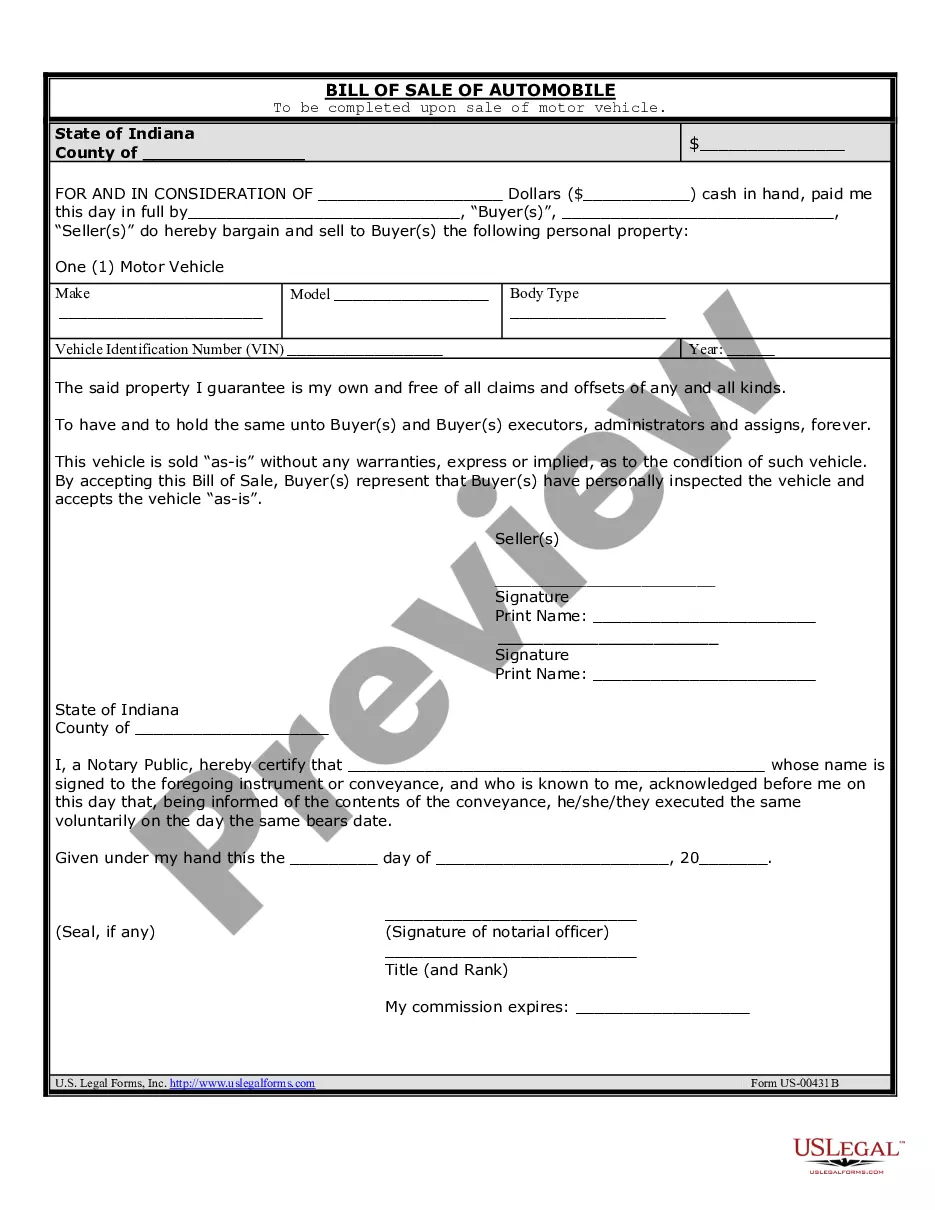

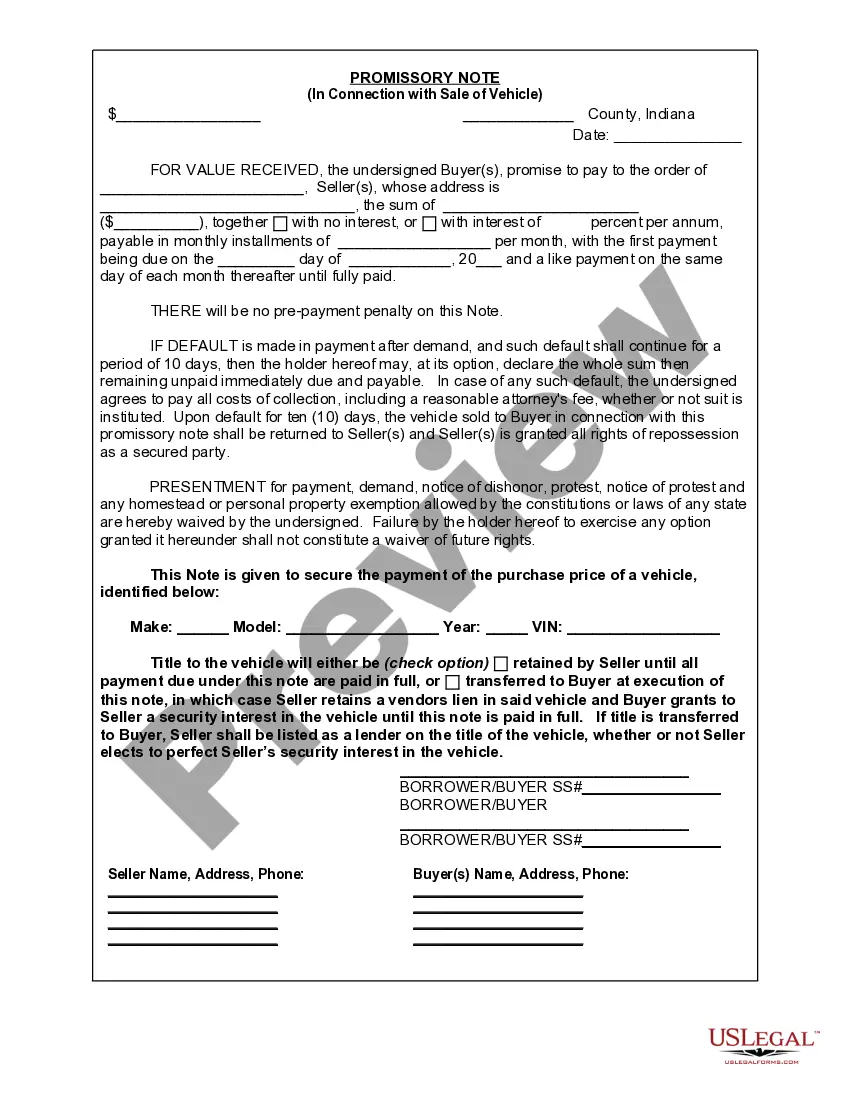

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

Evansville Indiana Promissory Note in Connection with Sale of Vehicle or Automobile is a legal document that outlines the terms and conditions of a financial agreement between the buyer and seller of a vehicle. It acts as a written contract, ensuring that both parties understand their obligations and the terms of the sale. Keywords: Evansville Indiana, Promissory Note, Sale of Vehicle, Automobile, legal document, terms and conditions, financial agreement, buyer, seller, contract, obligations, terms of sale. There are several types of Evansville Indiana Promissory Notes in Connection with Sale of Vehicle or Automobile, including: 1. Standard Promissory Note: This is the most common type of promissory note used in Evansville, Indiana. It outlines the basic terms of the transaction, such as the purchase price, payment due dates, interest rate (if applicable), and consequences of default. 2. Secured Promissory Note: This type of promissory note is used when the seller wants to secure the loan with collateral, such as the vehicle being sold. It provides additional protection to the seller in case the buyer fails to make payments as agreed. 3. Unsecured Promissory Note: Unlike a secured promissory note, this type does not require any collateral to secure the loan. It is often used in cases where the buyer has a good credit history or when the seller trusts the buyer's ability to make timely payments. 4. Installment Promissory Note: If the buyer and seller agree to a payment plan spread over a specific period, an installment promissory note would be used. It specifies the amount and frequency of each installment payment until the debt is fully repaid. 5. Conditional Promissory Note: In certain situations, the seller may require the buyer to fulfill certain conditions before the debt is deemed fully satisfied. This type of note outlines the conditions and terms that must be met for the note to be considered paid in full. It is important to note that the aforementioned promissory notes should be customized to comply with the specific laws and regulations of Evansville, Indiana. Consulting with a professional legal advisor is advisable when creating or reviewing any legal document.Evansville Indiana Promissory Note in Connection with Sale of Vehicle or Automobile is a legal document that outlines the terms and conditions of a financial agreement between the buyer and seller of a vehicle. It acts as a written contract, ensuring that both parties understand their obligations and the terms of the sale. Keywords: Evansville Indiana, Promissory Note, Sale of Vehicle, Automobile, legal document, terms and conditions, financial agreement, buyer, seller, contract, obligations, terms of sale. There are several types of Evansville Indiana Promissory Notes in Connection with Sale of Vehicle or Automobile, including: 1. Standard Promissory Note: This is the most common type of promissory note used in Evansville, Indiana. It outlines the basic terms of the transaction, such as the purchase price, payment due dates, interest rate (if applicable), and consequences of default. 2. Secured Promissory Note: This type of promissory note is used when the seller wants to secure the loan with collateral, such as the vehicle being sold. It provides additional protection to the seller in case the buyer fails to make payments as agreed. 3. Unsecured Promissory Note: Unlike a secured promissory note, this type does not require any collateral to secure the loan. It is often used in cases where the buyer has a good credit history or when the seller trusts the buyer's ability to make timely payments. 4. Installment Promissory Note: If the buyer and seller agree to a payment plan spread over a specific period, an installment promissory note would be used. It specifies the amount and frequency of each installment payment until the debt is fully repaid. 5. Conditional Promissory Note: In certain situations, the seller may require the buyer to fulfill certain conditions before the debt is deemed fully satisfied. This type of note outlines the conditions and terms that must be met for the note to be considered paid in full. It is important to note that the aforementioned promissory notes should be customized to comply with the specific laws and regulations of Evansville, Indiana. Consulting with a professional legal advisor is advisable when creating or reviewing any legal document.