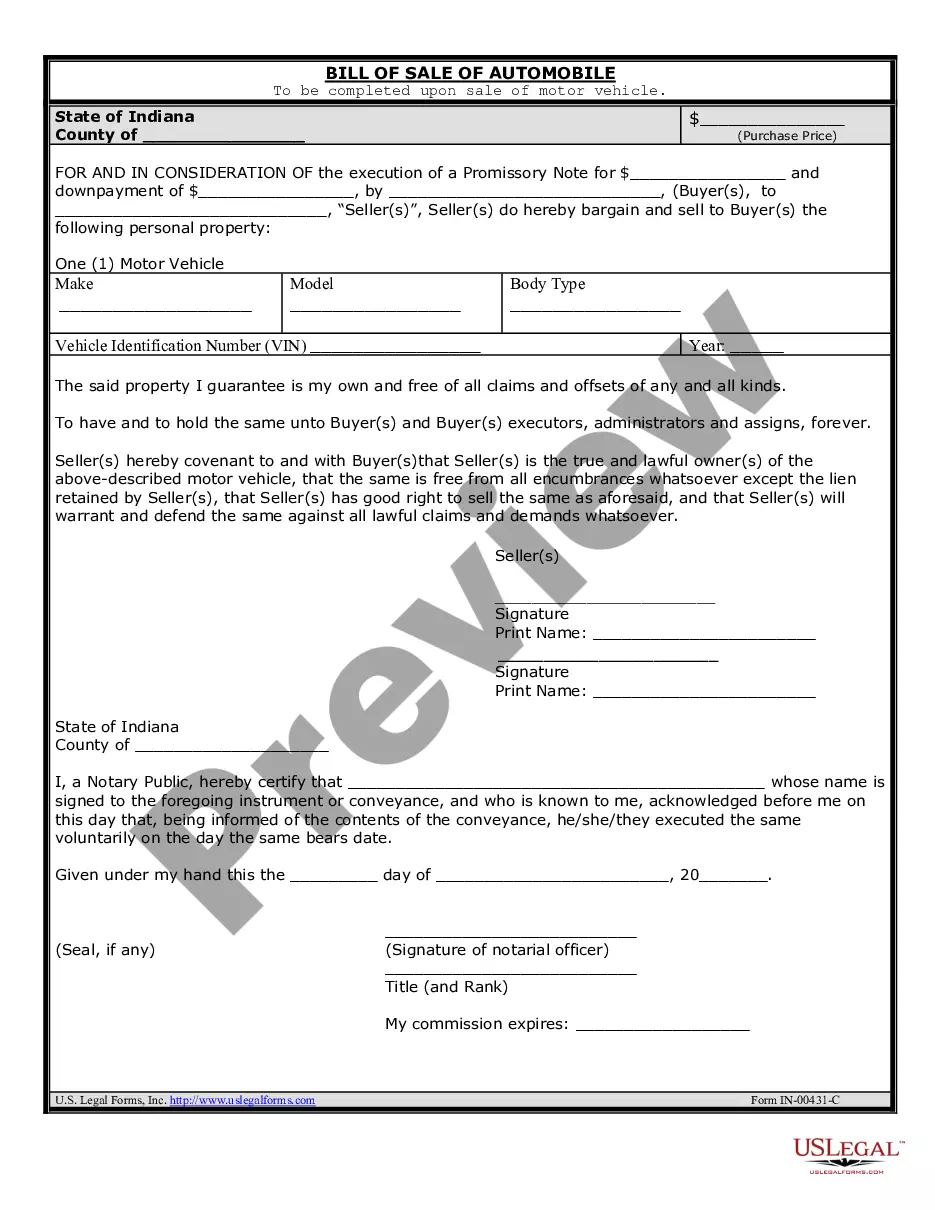

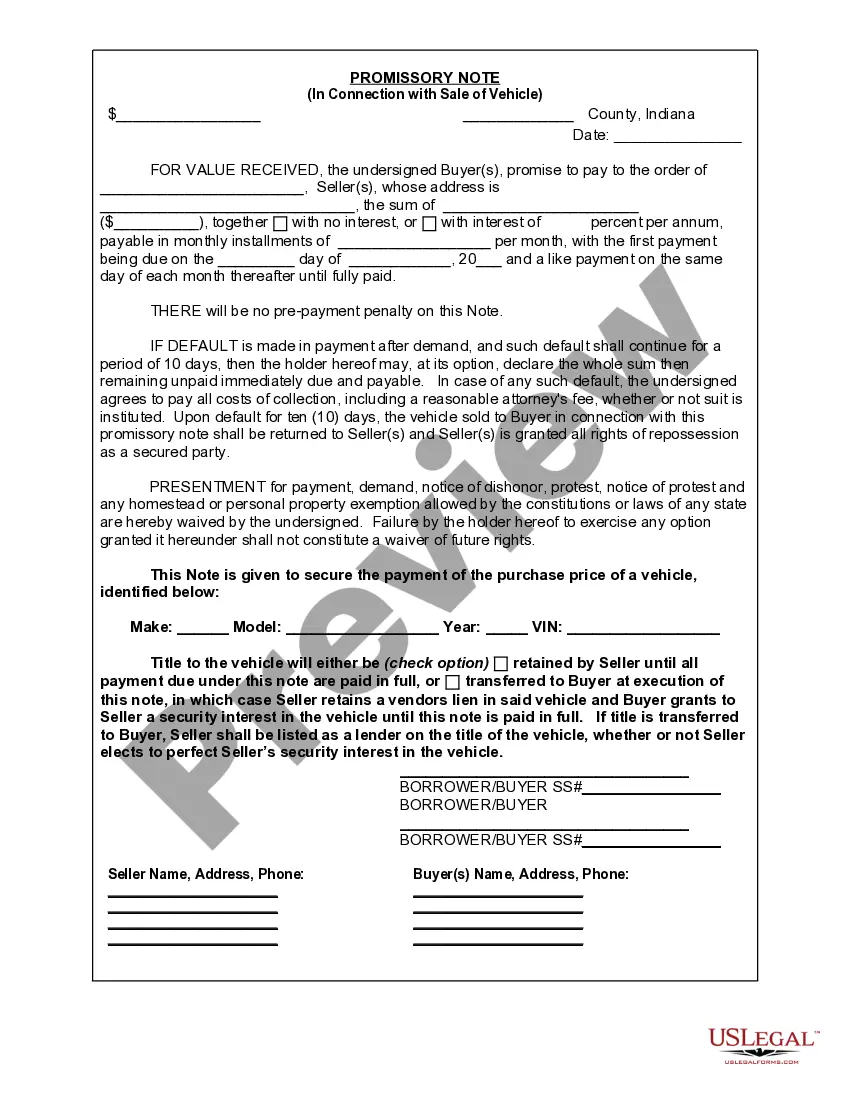

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

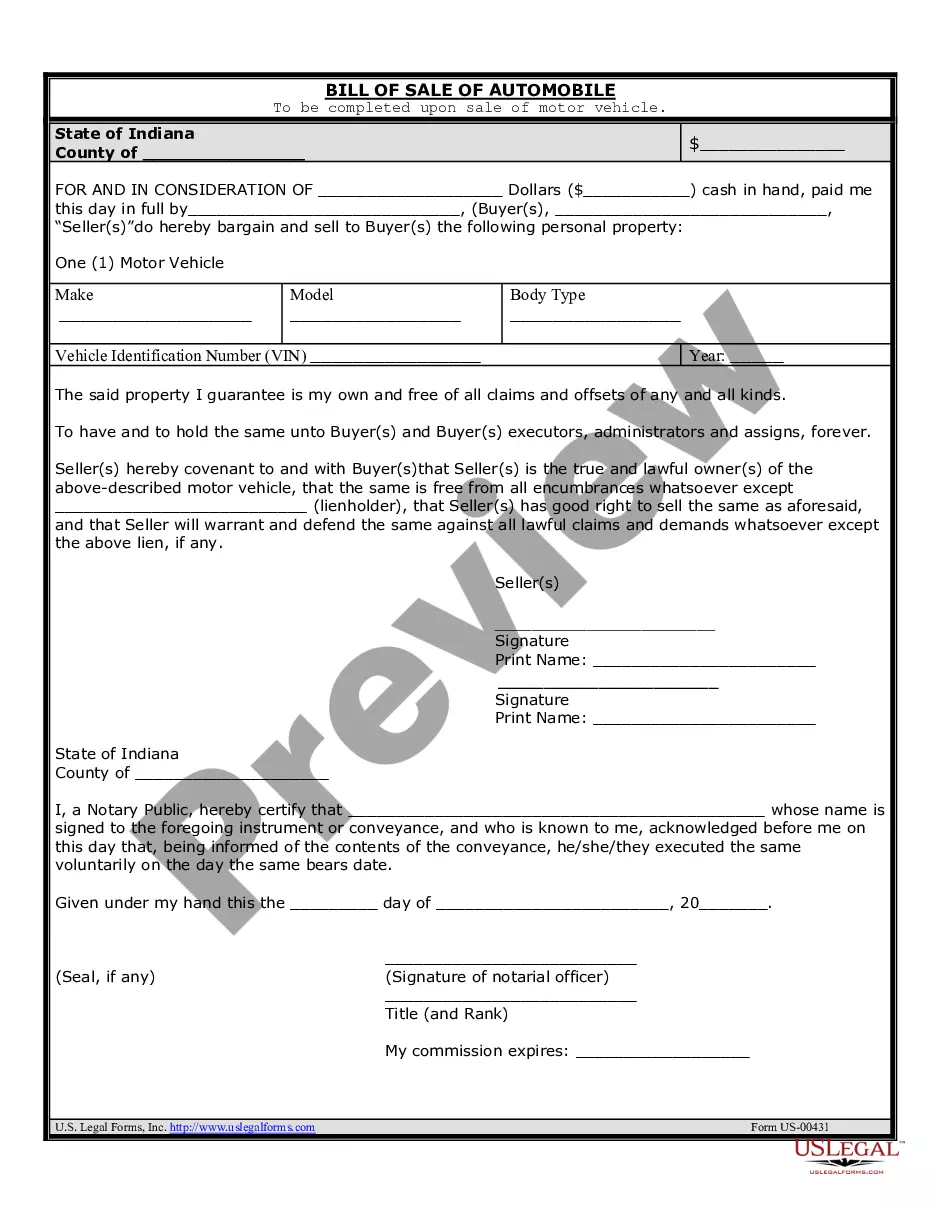

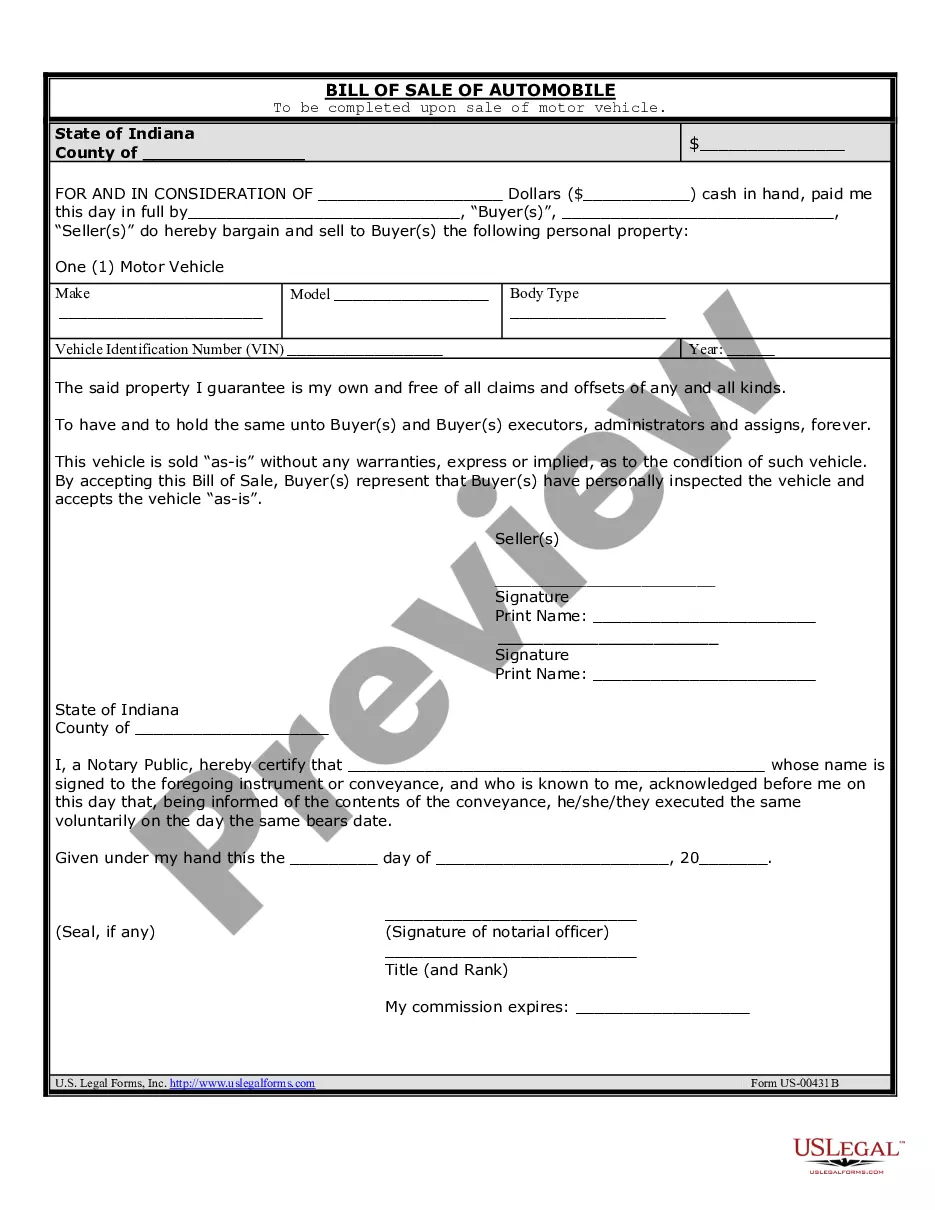

A Promissory Note in Connection with Sale of Vehicle or Automobile in Indianapolis, Indiana is a legal document that outlines the terms and conditions of a loan agreement between a seller and a buyer for the purchase of a vehicle. It serves as evidence of the debt owed by the buyer and the repayment obligations. This promissory note lists important details such as the names and addresses of the parties involved, the description of the vehicle being sold, the purchase price, and the payment terms. It also includes the interest rate (if applicable), the due date(s) of the payments, and any late fees or penalties for missed or delayed payments. In Indianapolis, Indiana, there may be different types of promissory notes in connection with the sale of a vehicle. These types may include: 1. Secured Promissory Note: This type of promissory note includes a collateral agreement, wherein the vehicle being purchased is used as security for the loan. If the buyer defaults on their payments, the seller has the right to repossess the vehicle. 2. Unsecured Promissory Note: Unlike a secured promissory note, an unsecured note does not involve any collateral. In this case, if the buyer defaults on their payments, the seller cannot repossess the vehicle by legal means. This type of note usually has a higher interest rate to compensate for the increased risk. 3. Balloon Promissory Note: A balloon note is structured such that the buyer makes smaller monthly payments for a certain period, with a large final payment known as the "balloon payment" due on a specified date. This final payment usually consists of the remaining principal amount plus any accrued interest. 4. Installment Promissory Note: An installment note is the most common type of promissory note for a vehicle purchase. It specifies equal monthly payments over a fixed period until the full debt is repaid, including both principal and interest. When creating an Indianapolis Indiana Promissory Note in Connection with Sale of Vehicle or Automobile, it is crucial to consult with a legal professional to ensure that the document abides by all applicable laws and regulations. Additionally, both parties should carefully review and understand the terms before signing to avoid any potential disputes or legal issues in the future.