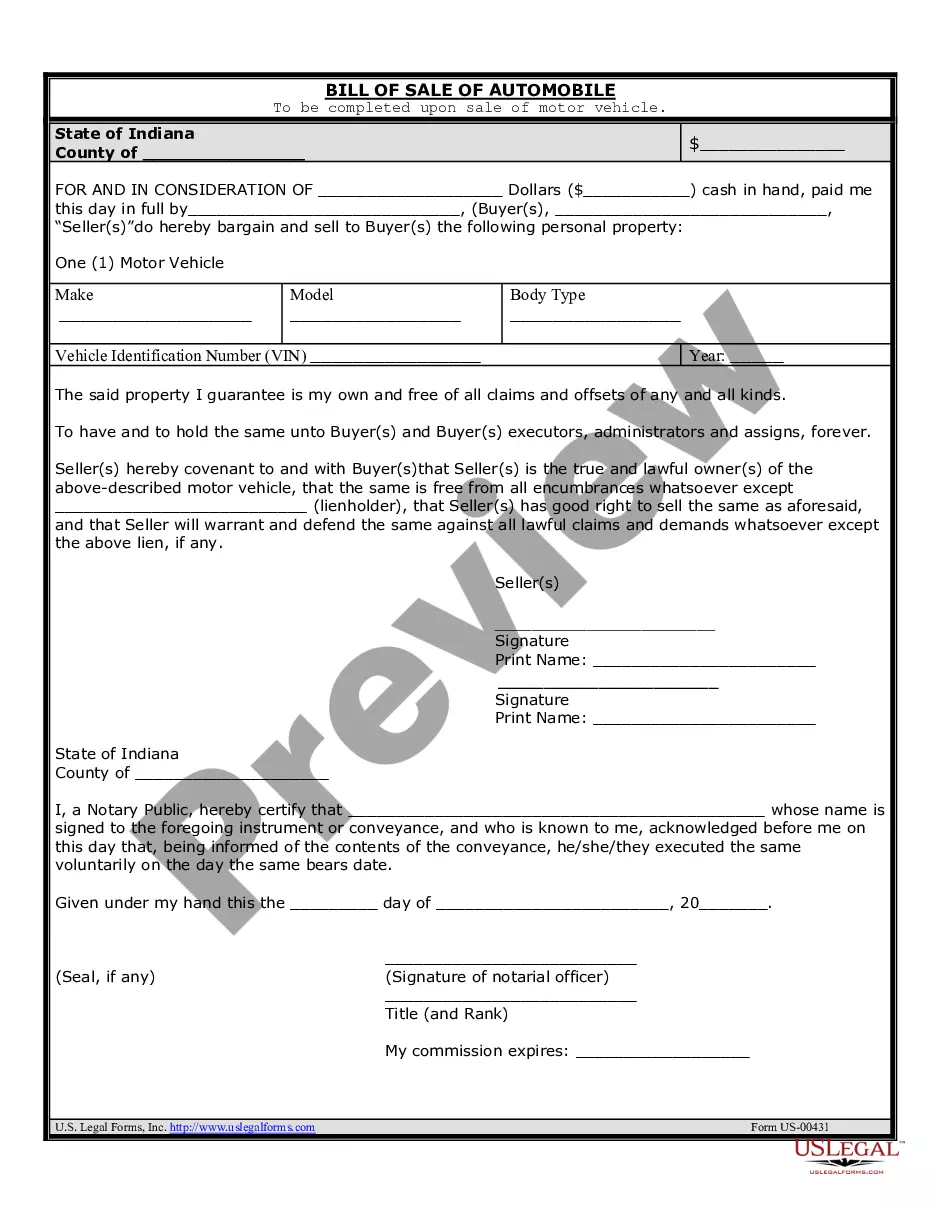

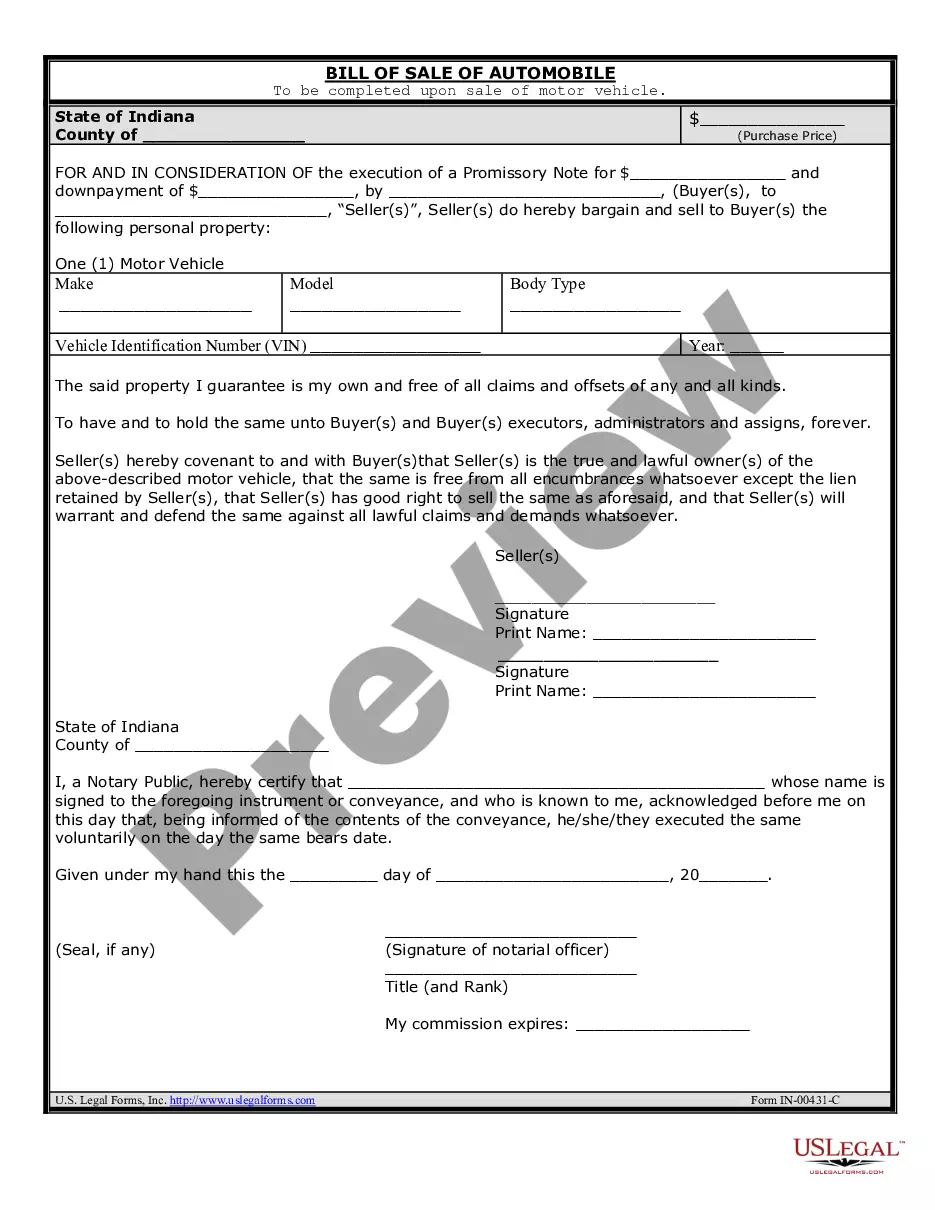

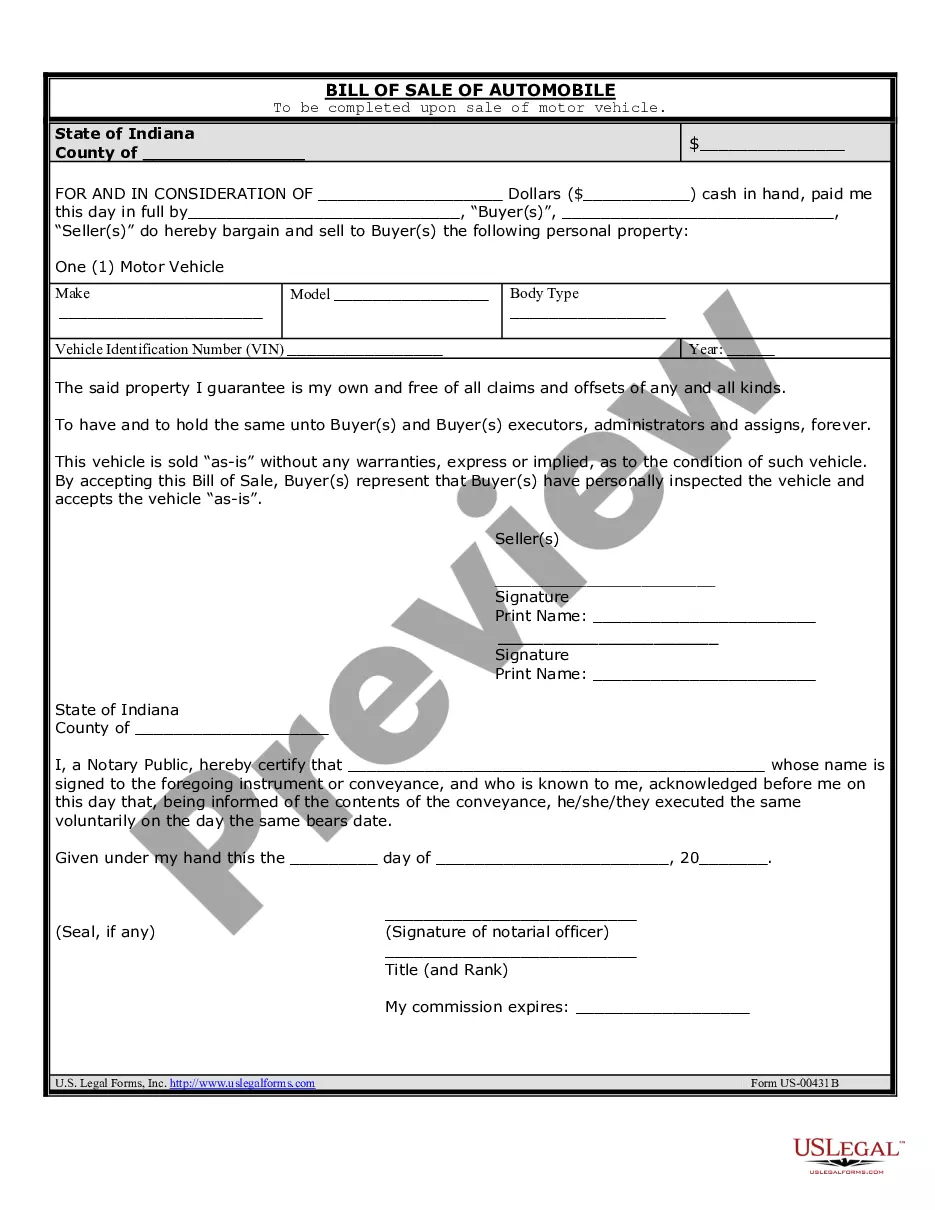

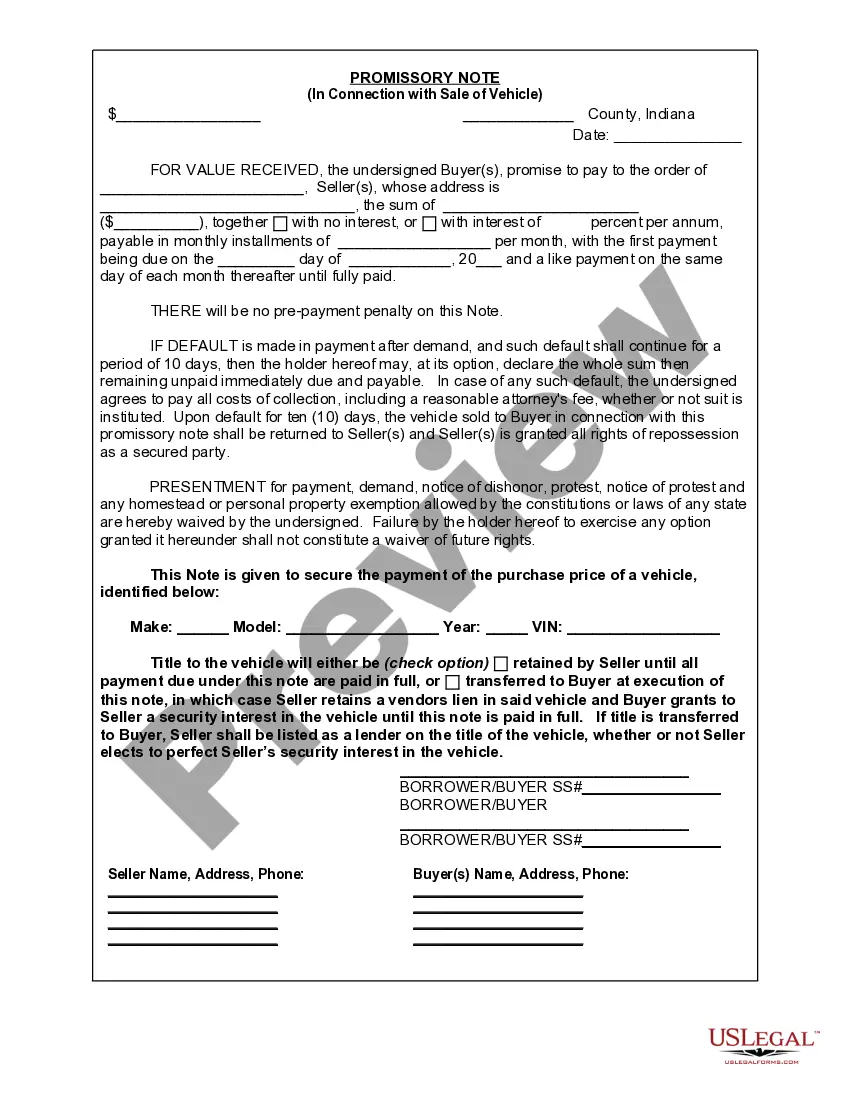

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A South Bend Indiana Promissory Note in Connection with Sale of Vehicle or Automobile is a legal document that outlines the terms and conditions of a financial agreement between a buyer and seller in the purchase of a vehicle. This written contract serves as evidence of the loan amount, repayment schedule, and any other financial obligations associated with the transaction. A Promissory Note is generally used when the buyer cannot make the complete payment upfront and needs to set up a payment plan instead. Here are some relevant keywords related to the South Bend Indiana Promissory Note in Connection with Sale of Vehicle or Automobile: 1. South Bend: The Promissory Note is specific to South Bend, Indiana, indicating that it follows the legal requirements and regulations of the city. 2. Promissory Note: This refers to the legally binding contract between the buyer and seller. It outlines the loan terms and the parties' obligations. 3. Sale of Vehicle or Automobile: The Promissory Note is used specifically for the purchase and sale of a vehicle or automobile, defining the conditions agreed upon by both parties. 4. Payment Schedule: The Promissory Note includes a detailed repayment plan, specifying when and how the buyer will make the payments over a specified period. 5. Loan Amount: It states the total amount that the buyer owes to the seller, which includes the agreed-upon purchase price and any additional fees or charges. 6. Interest Rate: If applicable, the Promissory Note may include an interest rate, indicating the extra amount the buyer needs to pay in addition to the loan amount. 7. Collateral: In some cases, the Promissory Note may mention collateral, allowing the seller to repossess the vehicle if the buyer fails to fulfill their payment obligations. Different types of South Bend Indiana Promissory Note in Connection with Sale of Vehicle or Automobile: 1. Simple Promissory Note: A basic Promissory Note that outlines the loan amount, payment schedule, and interest rate (if applicable). 2. Secured Promissory Note: This note is used if the seller requires collateral to secure the loan. It specifies the details of the collateral and the right to repossess the vehicle if the buyer defaults on payments. 3. Installment Promissory Note: This type of note breaks down the payment schedule into equal installments, making it easier for the buyer to manage the repayment. 4. Balloon Promissory Note: A note that includes smaller monthly payments for a specified period but requires a large final payment (balloon payment) at the end of the term. It is essential to consult with a legal professional or an attorney to ensure the Promissory Note complies with South Bend, Indiana laws and fully represents the agreement between the buyer and seller.A South Bend Indiana Promissory Note in Connection with Sale of Vehicle or Automobile is a legal document that outlines the terms and conditions of a financial agreement between a buyer and seller in the purchase of a vehicle. This written contract serves as evidence of the loan amount, repayment schedule, and any other financial obligations associated with the transaction. A Promissory Note is generally used when the buyer cannot make the complete payment upfront and needs to set up a payment plan instead. Here are some relevant keywords related to the South Bend Indiana Promissory Note in Connection with Sale of Vehicle or Automobile: 1. South Bend: The Promissory Note is specific to South Bend, Indiana, indicating that it follows the legal requirements and regulations of the city. 2. Promissory Note: This refers to the legally binding contract between the buyer and seller. It outlines the loan terms and the parties' obligations. 3. Sale of Vehicle or Automobile: The Promissory Note is used specifically for the purchase and sale of a vehicle or automobile, defining the conditions agreed upon by both parties. 4. Payment Schedule: The Promissory Note includes a detailed repayment plan, specifying when and how the buyer will make the payments over a specified period. 5. Loan Amount: It states the total amount that the buyer owes to the seller, which includes the agreed-upon purchase price and any additional fees or charges. 6. Interest Rate: If applicable, the Promissory Note may include an interest rate, indicating the extra amount the buyer needs to pay in addition to the loan amount. 7. Collateral: In some cases, the Promissory Note may mention collateral, allowing the seller to repossess the vehicle if the buyer fails to fulfill their payment obligations. Different types of South Bend Indiana Promissory Note in Connection with Sale of Vehicle or Automobile: 1. Simple Promissory Note: A basic Promissory Note that outlines the loan amount, payment schedule, and interest rate (if applicable). 2. Secured Promissory Note: This note is used if the seller requires collateral to secure the loan. It specifies the details of the collateral and the right to repossess the vehicle if the buyer defaults on payments. 3. Installment Promissory Note: This type of note breaks down the payment schedule into equal installments, making it easier for the buyer to manage the repayment. 4. Balloon Promissory Note: A note that includes smaller monthly payments for a specified period but requires a large final payment (balloon payment) at the end of the term. It is essential to consult with a legal professional or an attorney to ensure the Promissory Note complies with South Bend, Indiana laws and fully represents the agreement between the buyer and seller.