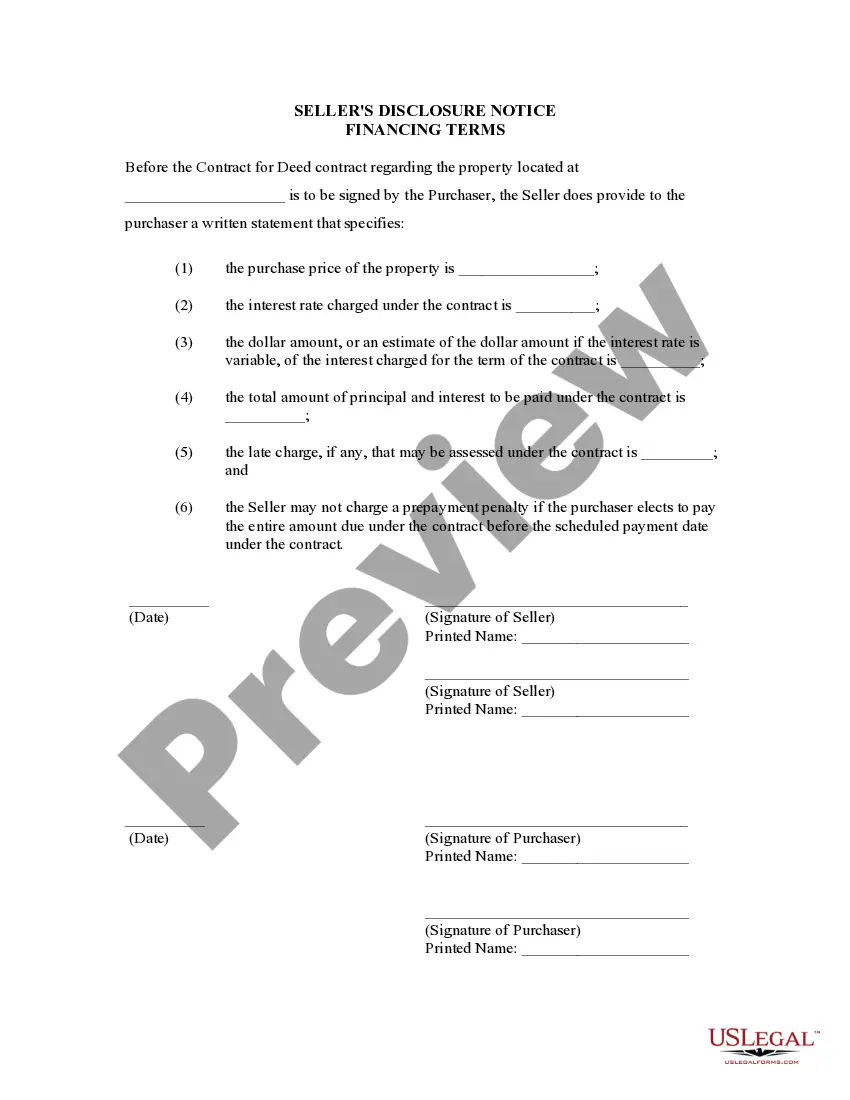

This document serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. It should be completed by Seller of property and provided to Purchaser at or before the signing of the contract for deed.

The Carmel Indiana Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed, also known as a Land Contract, is an essential document that outlines the specific terms and conditions related to financing a residential property. This disclosure ensures that both the seller and buyer have a comprehensive understanding of the financial aspects involved in the transaction. Here, we will explore the main elements covered in this disclosure and discuss different types that may exist. The Carmel Indiana Seller's Disclosure of Financing Terms for Residential Property outlines the various financing terms that the seller agrees to offer to the buyer. This document will typically include details such as the purchase price of the property, the down payment required, and the interest rate that will be applied to the outstanding balance. It may also include information regarding any balloon payments that will be due during the term of the contract, as well as any penalties for late or missed payments. In addition to the basic financial terms, this disclosure may provide insight into the duration of the contract. It will specify the length of time agreed upon for the buyer to repay the balance in full, as well as any provisions for early repayment or refinancing. Furthermore, the disclosure may include specifics about insurance requirements, property taxes, and maintenance responsibilities during the contract period. Regarding different types of Carmel Indiana Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed, there may be variations based on the preferences of the parties involved or the specific characteristics of the residential property. For example, a seller may choose to offer different financing options, such as an adjustable rate mortgage or a fixed rate mortgage. Each option would have its own distinct terms and conditions that would be detailed in the disclosure. Additionally, variations may arise depending on the property's location, size, or market conditions. Therefore, it is essential for potential buyers to carefully review the specific terms outlined in the disclosure document to ensure that they align with their financial capabilities and goals. In conclusion, the Carmel Indiana Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed is a vital document in the process of purchasing a property through a land contract. It's important for both buyers and sellers to carefully review the disclosure in order to fully understand the financial obligations and conditions associated with the transaction. By doing so, both parties can ensure a transparent and mutually beneficial agreement that meets their respective needs.The Carmel Indiana Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed, also known as a Land Contract, is an essential document that outlines the specific terms and conditions related to financing a residential property. This disclosure ensures that both the seller and buyer have a comprehensive understanding of the financial aspects involved in the transaction. Here, we will explore the main elements covered in this disclosure and discuss different types that may exist. The Carmel Indiana Seller's Disclosure of Financing Terms for Residential Property outlines the various financing terms that the seller agrees to offer to the buyer. This document will typically include details such as the purchase price of the property, the down payment required, and the interest rate that will be applied to the outstanding balance. It may also include information regarding any balloon payments that will be due during the term of the contract, as well as any penalties for late or missed payments. In addition to the basic financial terms, this disclosure may provide insight into the duration of the contract. It will specify the length of time agreed upon for the buyer to repay the balance in full, as well as any provisions for early repayment or refinancing. Furthermore, the disclosure may include specifics about insurance requirements, property taxes, and maintenance responsibilities during the contract period. Regarding different types of Carmel Indiana Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed, there may be variations based on the preferences of the parties involved or the specific characteristics of the residential property. For example, a seller may choose to offer different financing options, such as an adjustable rate mortgage or a fixed rate mortgage. Each option would have its own distinct terms and conditions that would be detailed in the disclosure. Additionally, variations may arise depending on the property's location, size, or market conditions. Therefore, it is essential for potential buyers to carefully review the specific terms outlined in the disclosure document to ensure that they align with their financial capabilities and goals. In conclusion, the Carmel Indiana Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed is a vital document in the process of purchasing a property through a land contract. It's important for both buyers and sellers to carefully review the disclosure in order to fully understand the financial obligations and conditions associated with the transaction. By doing so, both parties can ensure a transparent and mutually beneficial agreement that meets their respective needs.