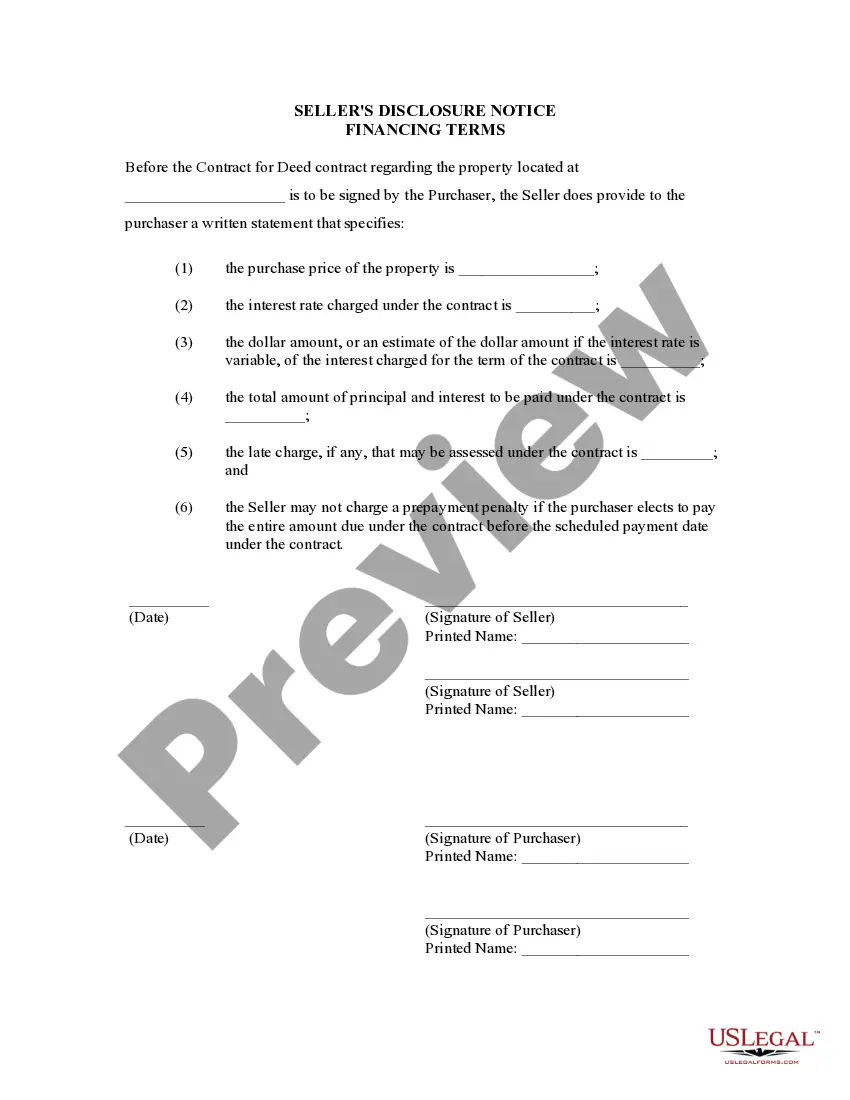

This document serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. It should be completed by Seller of property and provided to Purchaser at or before the signing of the contract for deed.

Fort Wayne, Indiana is known for its thriving real estate market, attracting buyers and sellers alike. When it comes to selling residential properties through contracts or agreements for deed, also known as land contracts, sellers are required to provide a Seller's Disclosure of Financing Terms. This document outlines the specific financing terms associated with the property, ensuring transparency and clarity for both the seller and the buyer. The Fort Wayne Indiana Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed encompasses various key aspects that need to be disclosed. These can include the following details: 1. Purchase Price: The document should clearly state the agreed-upon purchase price for the property under the land contract. 2. Down Payment: Sellers must disclose the amount of the down payment required from the buyer at the time of entering into the land contract. 3. Interest Rate: The Seller's Disclosure should clearly indicate the interest rate to be applied to the outstanding balance of the purchase price. This ensures that both parties are aware of the financial implications and obligations. 4. Amortization Schedule: It is essential to outline the repayment schedule for the land contract. The disclosure should provide details regarding the frequency and amount of installment payments required from the buyer. 5. Balloon Payment: If there is a balloon payment involved in the land contract, the Seller's Disclosure must highlight this aspect. A balloon payment typically involves a large final payment due at the end of a specified term. 6. Late Payment Penalty: Sellers should disclose any penalties or additional charges imposed on the buyer in case of late or missed payments. This ensures that buyers are aware of their financial responsibilities and encourages timely payments. 7. Terms and Conditions: The Seller's Disclosure should cover any additional terms and conditions relevant to the financing agreement, such as default clauses, early repayment options, or the right to prepay without penalty. 8. Title Transfer: If there are any specific conditions or restrictions pertaining to the transfer of title, the Seller's Disclosure should outline them. This may include provisions related to the release of the deed once the contract is fulfilled. Different types of Seller's Disclosure of Financing Terms may vary based on the specific requirements of the buyer and seller. However, the disclosure should always provide detailed information about the purchase price, down payment, interest rate, amortization schedule, balloon payment, late payment penalty, terms and conditions, and title transfer. In summary, the Fort Wayne Indiana Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed is a crucial document that ensures transparency and clarity in land contract transactions. By laying out the financing terms in detail, both the buyer and the seller can make informed decisions and avoid any potential misunderstandings or disputes.Fort Wayne, Indiana is known for its thriving real estate market, attracting buyers and sellers alike. When it comes to selling residential properties through contracts or agreements for deed, also known as land contracts, sellers are required to provide a Seller's Disclosure of Financing Terms. This document outlines the specific financing terms associated with the property, ensuring transparency and clarity for both the seller and the buyer. The Fort Wayne Indiana Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed encompasses various key aspects that need to be disclosed. These can include the following details: 1. Purchase Price: The document should clearly state the agreed-upon purchase price for the property under the land contract. 2. Down Payment: Sellers must disclose the amount of the down payment required from the buyer at the time of entering into the land contract. 3. Interest Rate: The Seller's Disclosure should clearly indicate the interest rate to be applied to the outstanding balance of the purchase price. This ensures that both parties are aware of the financial implications and obligations. 4. Amortization Schedule: It is essential to outline the repayment schedule for the land contract. The disclosure should provide details regarding the frequency and amount of installment payments required from the buyer. 5. Balloon Payment: If there is a balloon payment involved in the land contract, the Seller's Disclosure must highlight this aspect. A balloon payment typically involves a large final payment due at the end of a specified term. 6. Late Payment Penalty: Sellers should disclose any penalties or additional charges imposed on the buyer in case of late or missed payments. This ensures that buyers are aware of their financial responsibilities and encourages timely payments. 7. Terms and Conditions: The Seller's Disclosure should cover any additional terms and conditions relevant to the financing agreement, such as default clauses, early repayment options, or the right to prepay without penalty. 8. Title Transfer: If there are any specific conditions or restrictions pertaining to the transfer of title, the Seller's Disclosure should outline them. This may include provisions related to the release of the deed once the contract is fulfilled. Different types of Seller's Disclosure of Financing Terms may vary based on the specific requirements of the buyer and seller. However, the disclosure should always provide detailed information about the purchase price, down payment, interest rate, amortization schedule, balloon payment, late payment penalty, terms and conditions, and title transfer. In summary, the Fort Wayne Indiana Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed is a crucial document that ensures transparency and clarity in land contract transactions. By laying out the financing terms in detail, both the buyer and the seller can make informed decisions and avoid any potential misunderstandings or disputes.