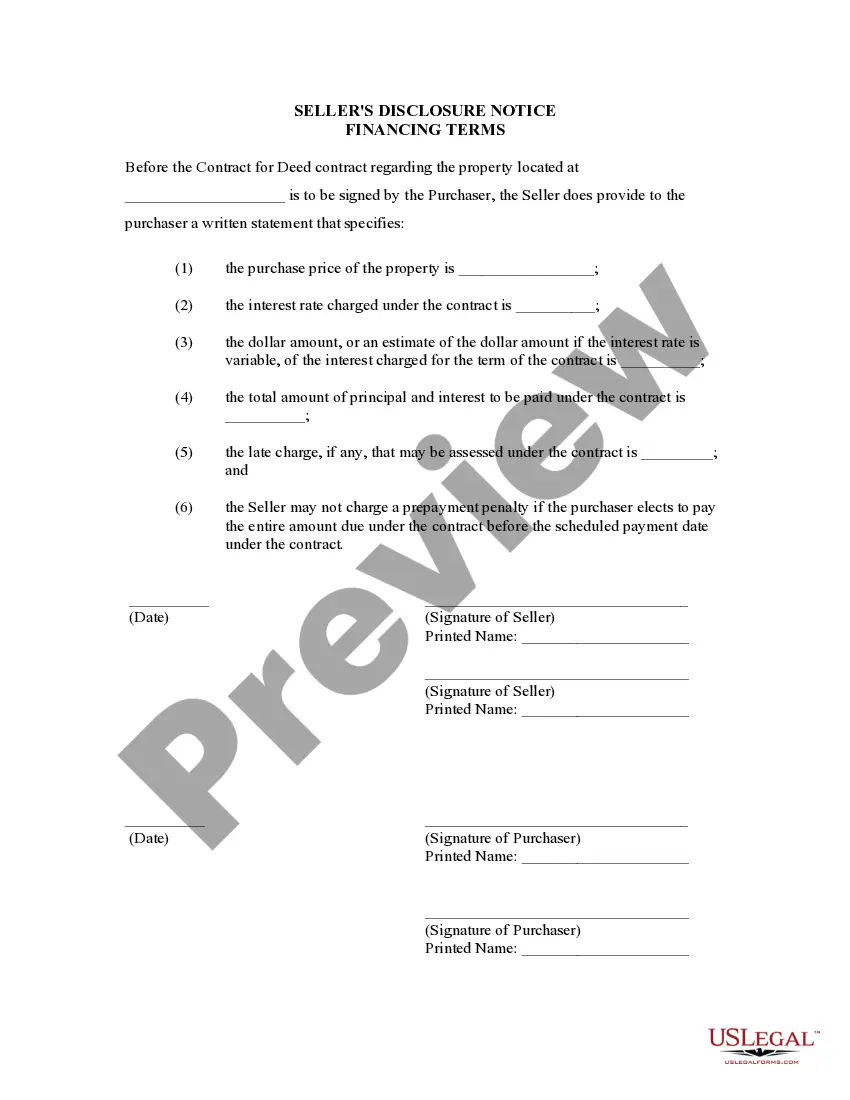

This document serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. It should be completed by Seller of property and provided to Purchaser at or before the signing of the contract for deed.

The Indianapolis Indiana Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, also known as a Land Contract, is a legally required document designed to inform potential buyers about the specific financing terms related to the purchase of residential property. This disclosure is relevant in Indianapolis, Indiana region and applies specifically to properties being sold through a land contract or agreement for deed. A land contract, also known as a contract for deed, is a type of seller financing arrangement where the buyer makes regular installment payments directly to the seller, instead of obtaining a traditional mortgage loan from a bank. In such cases, the seller acts as the lender and retains legal ownership of the property until the buyer fulfills the agreed-upon payment terms. The Seller's Disclosure of Financing Terms for Residential Property contains important information that the seller must provide to the buyer before entering into a land contract agreement. It typically includes details such as: 1. Purchase Price: The total amount agreed upon for the property, which may include any down payment or earnest money provided by the buyer. 2. Interest Rate: The interest rate applied to the balance owed by the buyer, which will determine the amount of interest paid over the course of the loan. 3. Payment Terms: The specific terms outlining the payment schedule, frequency, and method agreed upon by the buyer and seller. 4. Balloon Payment: In some cases, a balloon payment may be required at a certain point during the contract term, which is a larger payment due at once, typically after a set number of years. 5. Duration: The length of time over which the buyer is expected to make installment payments to the seller, which is the duration of the land contract agreement. 6. Taxes and Insurance: Disclosure of whether the buyer or seller is responsible for property taxes, insurance premiums, or any other related costs during the contract term. 7. Default and Remedies: The actions that may occur in the event of the buyer's default or failure to meet the payment terms, including potential remedies or actions the seller may take. There may be variations or additional disclosures specific to different types of residential properties or unique contract terms, but the key information outlined above generally applies to any Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed, also known as a Land Contract, in Indianapolis, Indiana.The Indianapolis Indiana Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, also known as a Land Contract, is a legally required document designed to inform potential buyers about the specific financing terms related to the purchase of residential property. This disclosure is relevant in Indianapolis, Indiana region and applies specifically to properties being sold through a land contract or agreement for deed. A land contract, also known as a contract for deed, is a type of seller financing arrangement where the buyer makes regular installment payments directly to the seller, instead of obtaining a traditional mortgage loan from a bank. In such cases, the seller acts as the lender and retains legal ownership of the property until the buyer fulfills the agreed-upon payment terms. The Seller's Disclosure of Financing Terms for Residential Property contains important information that the seller must provide to the buyer before entering into a land contract agreement. It typically includes details such as: 1. Purchase Price: The total amount agreed upon for the property, which may include any down payment or earnest money provided by the buyer. 2. Interest Rate: The interest rate applied to the balance owed by the buyer, which will determine the amount of interest paid over the course of the loan. 3. Payment Terms: The specific terms outlining the payment schedule, frequency, and method agreed upon by the buyer and seller. 4. Balloon Payment: In some cases, a balloon payment may be required at a certain point during the contract term, which is a larger payment due at once, typically after a set number of years. 5. Duration: The length of time over which the buyer is expected to make installment payments to the seller, which is the duration of the land contract agreement. 6. Taxes and Insurance: Disclosure of whether the buyer or seller is responsible for property taxes, insurance premiums, or any other related costs during the contract term. 7. Default and Remedies: The actions that may occur in the event of the buyer's default or failure to meet the payment terms, including potential remedies or actions the seller may take. There may be variations or additional disclosures specific to different types of residential properties or unique contract terms, but the key information outlined above generally applies to any Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed, also known as a Land Contract, in Indianapolis, Indiana.