This is a statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

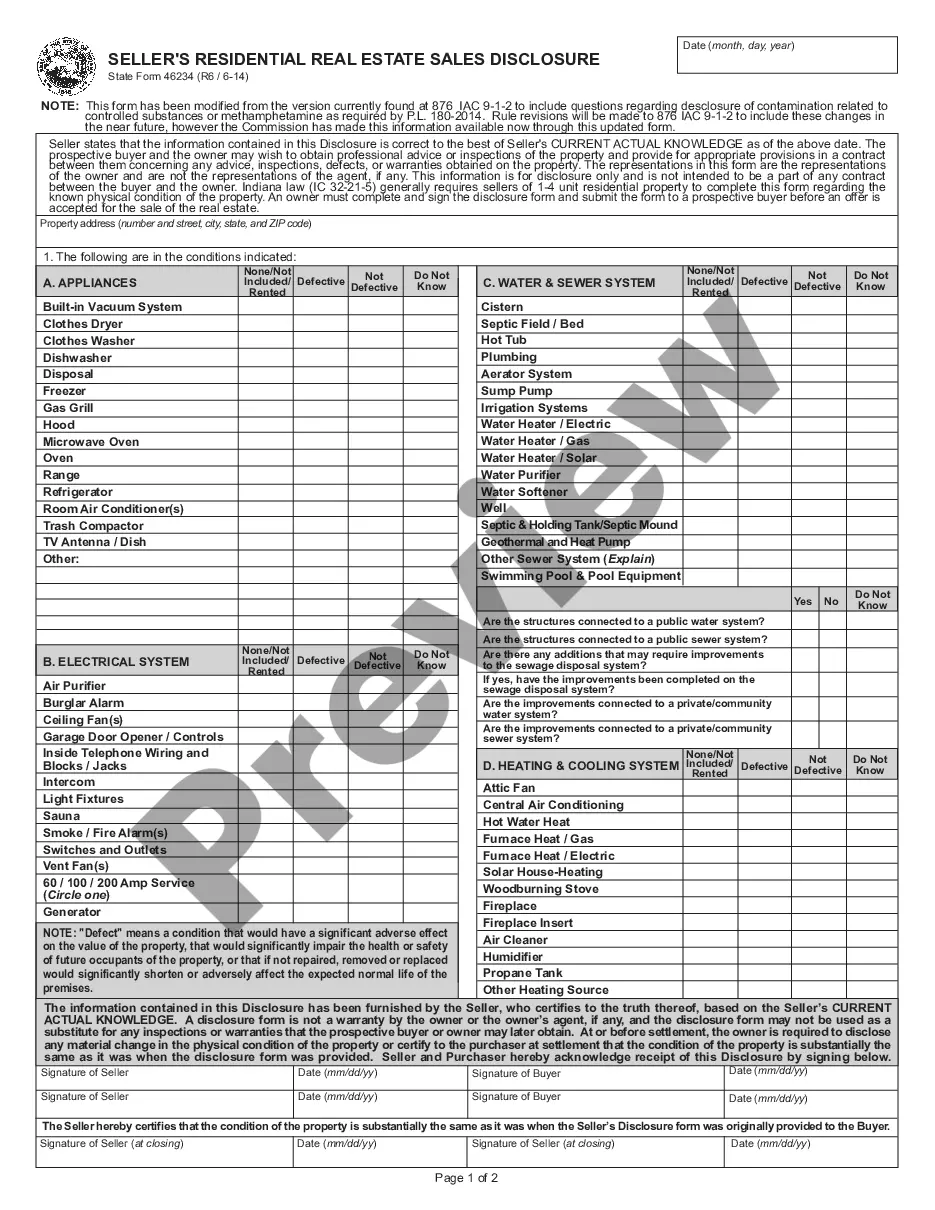

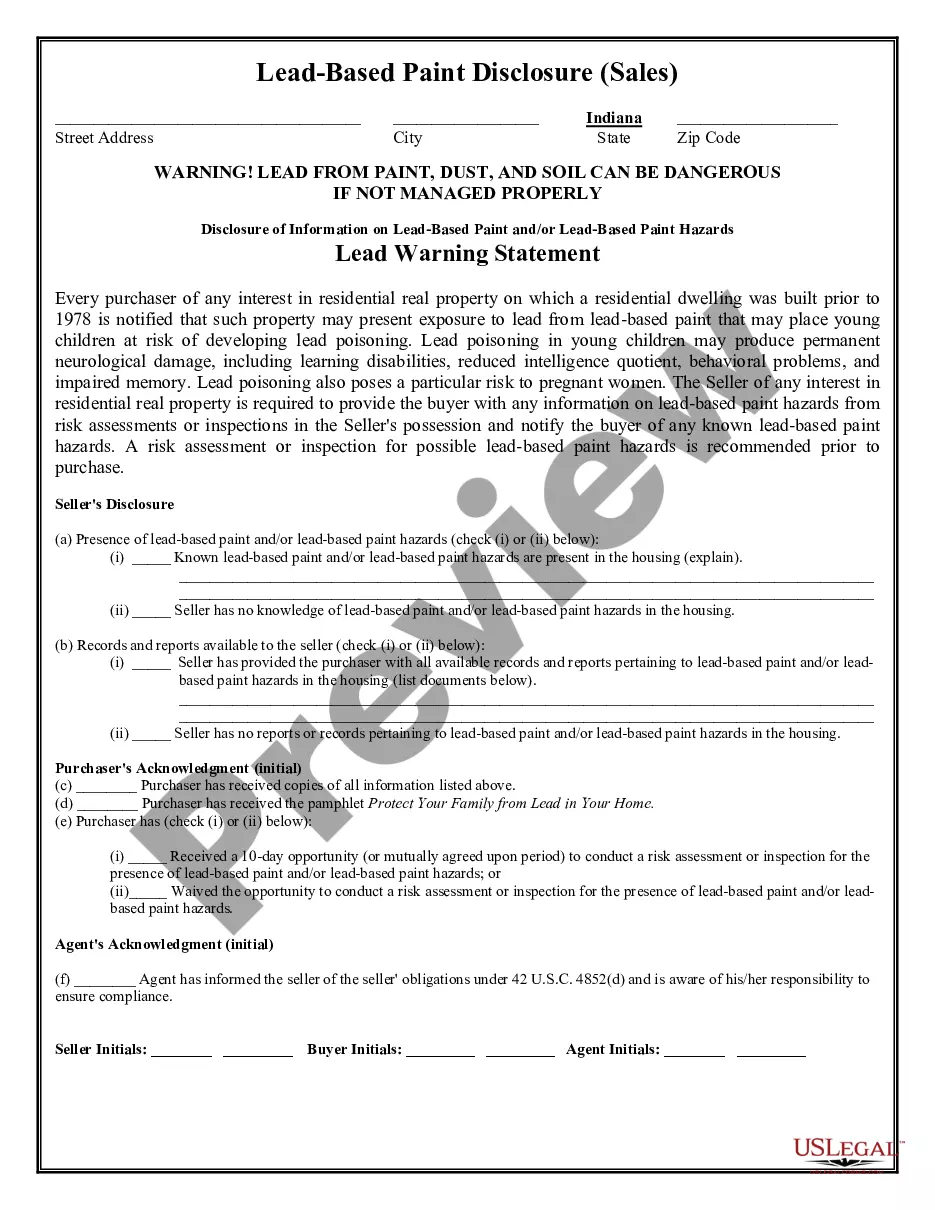

The Fort Wayne Indiana Contract for Deed Seller's Annual Accounting Statement is a comprehensive document used in real estate transactions to outline the financial details between the seller and buyer in a contract for deed agreement. This statement presents a detailed summary of the financial activities and obligations of both parties over the course of one year. Keywords: Fort Wayne Indiana, contract for deed, annual accounting statement, real estate transactions, financial details, seller, buyer, obligations. There are two main types of Fort Wayne Indiana Contract for Deed Seller's Annual Accounting Statements: 1. Basic Contract for Deed Seller's Annual Accounting Statement: This type of statement provides a concise overview of the financial transactions and obligations that occurred within the given year. It includes an itemized list of payments made by the buyer, including principal, interest, and any additional charges agreed upon within the contract. The statement also outlines any outstanding balances and provides details on any late payments or penalties incurred. 2. Detailed Contract for Deed Seller's Annual Accounting Statement: This type of statement offers a more comprehensive breakdown of the financial activities within the contract for deed agreement. It includes an itemized list of all payments made by the buyer, along with a detailed breakdown of principal, interest, taxes, and insurance. Additionally, it may provide specific information on any contingencies, such as repairs or maintenance costs, and outline any adjustments made to the original agreement. Overall, the Fort Wayne Indiana Contract for Deed Seller's Annual Accounting Statement serves as a vital tool to track and document the financial aspects of a contract for deed agreement. It ensures transparency, accountability, and legal compliance between both parties involved in a real estate transaction in Fort Wayne, Indiana.The Fort Wayne Indiana Contract for Deed Seller's Annual Accounting Statement is a comprehensive document used in real estate transactions to outline the financial details between the seller and buyer in a contract for deed agreement. This statement presents a detailed summary of the financial activities and obligations of both parties over the course of one year. Keywords: Fort Wayne Indiana, contract for deed, annual accounting statement, real estate transactions, financial details, seller, buyer, obligations. There are two main types of Fort Wayne Indiana Contract for Deed Seller's Annual Accounting Statements: 1. Basic Contract for Deed Seller's Annual Accounting Statement: This type of statement provides a concise overview of the financial transactions and obligations that occurred within the given year. It includes an itemized list of payments made by the buyer, including principal, interest, and any additional charges agreed upon within the contract. The statement also outlines any outstanding balances and provides details on any late payments or penalties incurred. 2. Detailed Contract for Deed Seller's Annual Accounting Statement: This type of statement offers a more comprehensive breakdown of the financial activities within the contract for deed agreement. It includes an itemized list of all payments made by the buyer, along with a detailed breakdown of principal, interest, taxes, and insurance. Additionally, it may provide specific information on any contingencies, such as repairs or maintenance costs, and outline any adjustments made to the original agreement. Overall, the Fort Wayne Indiana Contract for Deed Seller's Annual Accounting Statement serves as a vital tool to track and document the financial aspects of a contract for deed agreement. It ensures transparency, accountability, and legal compliance between both parties involved in a real estate transaction in Fort Wayne, Indiana.