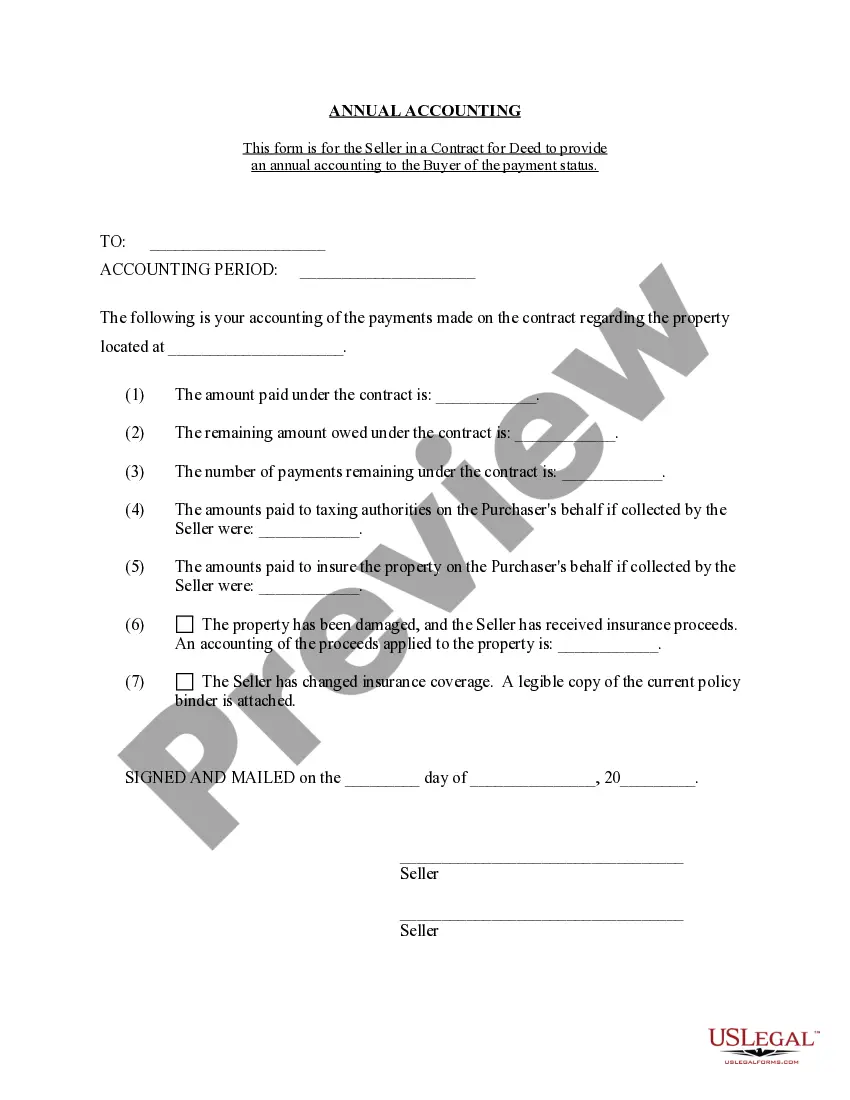

This is a statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

The Indianapolis Indiana Contract for Deed Seller's Annual Accounting Statement is a document that outlines the financial transactions between the seller and the buyer in a contract for deed agreement. This statement serves as an annual summary of all the payments received and expenses incurred by the seller throughout the year. Keywords: Indianapolis Indiana, Contract for Deed, Seller's Annual Accounting Statement, financial transactions, seller, buyer, payments, expenses. The Contract for Deed Seller's Annual Accounting Statement provides a comprehensive overview of the financial aspects of the contract for deed agreement in Indianapolis, Indiana. The statement is typically prepared by the seller and presented to the buyer once a year. It enables both parties to track and monitor the financial progress of the agreement. The statement includes detailed information about all the payments made by the buyer to the seller, including principal and interest payments. It also includes any additional charges or fees associated with the contract, such as taxes and insurance. These payments are categorized and listed separately for clarity. Moreover, the statement outlines any expenses incurred by the seller during the year, such as maintenance and repair costs, property taxes, and insurance premiums. These expenses are also categorized and summarized to provide a clear understanding of the financial obligations of the seller. The Indianapolis Indiana Contract for Deed Seller's Annual Accounting Statement is important for several reasons. Firstly, it ensures transparency and accountability between the buyer and the seller. Secondly, it helps both parties to accurately assess the financial status of the contract and make informed decisions regarding its continuation. While there may not be different types of Contract for Deed Seller's Annual Accounting Statements specific to Indianapolis, Indiana, it's worth noting that the format and contents of the statement may vary depending on the specific terms and conditions outlined in the contract for deed agreement. Some statements may include additional information, such as escrow balances or property-specific details, while others may be more simplified. In summary, the Indianapolis Indiana Contract for Deed Seller's Annual Accounting Statement is a crucial financial document that provides an overview of the financial transactions and obligations between the buyer and seller in a contract for deed agreement. It ensures transparency, accountability, and allows both parties to assess the progress and financial status of the agreement accurately.The Indianapolis Indiana Contract for Deed Seller's Annual Accounting Statement is a document that outlines the financial transactions between the seller and the buyer in a contract for deed agreement. This statement serves as an annual summary of all the payments received and expenses incurred by the seller throughout the year. Keywords: Indianapolis Indiana, Contract for Deed, Seller's Annual Accounting Statement, financial transactions, seller, buyer, payments, expenses. The Contract for Deed Seller's Annual Accounting Statement provides a comprehensive overview of the financial aspects of the contract for deed agreement in Indianapolis, Indiana. The statement is typically prepared by the seller and presented to the buyer once a year. It enables both parties to track and monitor the financial progress of the agreement. The statement includes detailed information about all the payments made by the buyer to the seller, including principal and interest payments. It also includes any additional charges or fees associated with the contract, such as taxes and insurance. These payments are categorized and listed separately for clarity. Moreover, the statement outlines any expenses incurred by the seller during the year, such as maintenance and repair costs, property taxes, and insurance premiums. These expenses are also categorized and summarized to provide a clear understanding of the financial obligations of the seller. The Indianapolis Indiana Contract for Deed Seller's Annual Accounting Statement is important for several reasons. Firstly, it ensures transparency and accountability between the buyer and the seller. Secondly, it helps both parties to accurately assess the financial status of the contract and make informed decisions regarding its continuation. While there may not be different types of Contract for Deed Seller's Annual Accounting Statements specific to Indianapolis, Indiana, it's worth noting that the format and contents of the statement may vary depending on the specific terms and conditions outlined in the contract for deed agreement. Some statements may include additional information, such as escrow balances or property-specific details, while others may be more simplified. In summary, the Indianapolis Indiana Contract for Deed Seller's Annual Accounting Statement is a crucial financial document that provides an overview of the financial transactions and obligations between the buyer and seller in a contract for deed agreement. It ensures transparency, accountability, and allows both parties to assess the progress and financial status of the agreement accurately.