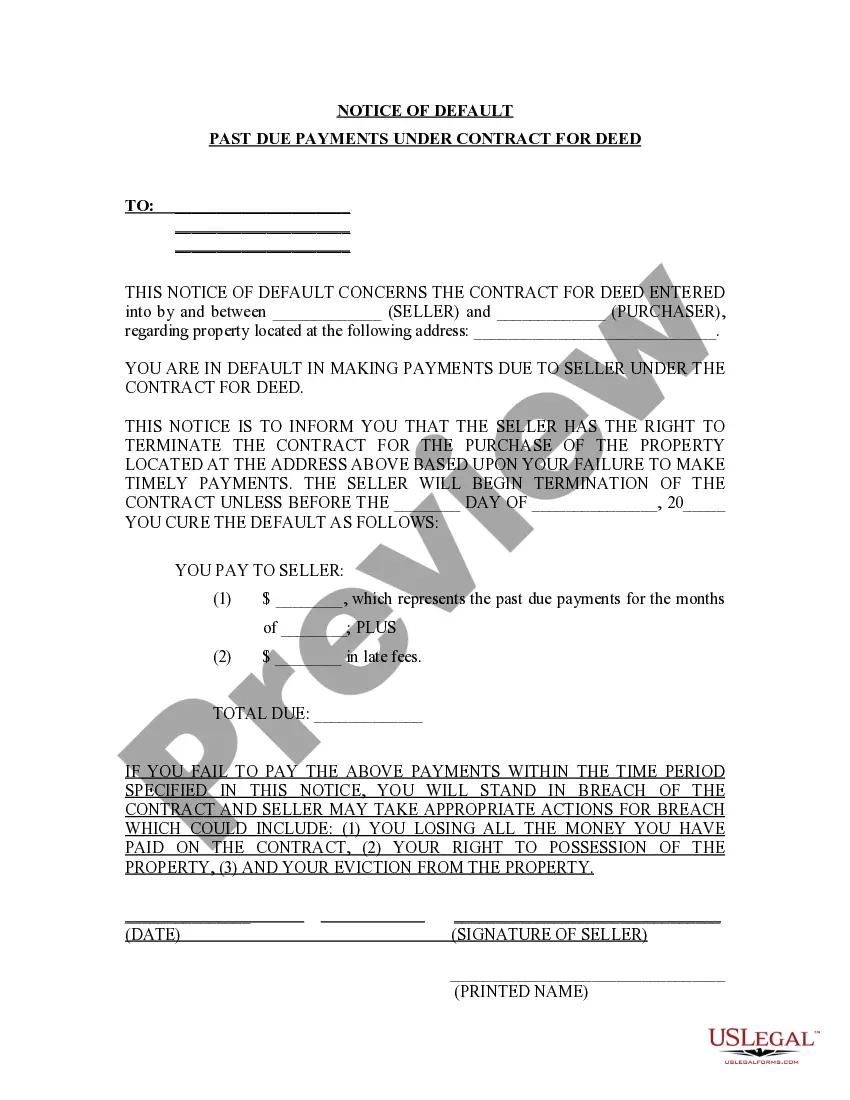

This form acts as the Seller's initial notice to Purchaser of late payment toward the purchase price of the contract for deed property. Seller will use this document to provide the necessary notice to Purchaser that payment terms have not been met in accordance with the contract for deed, and failure to timely comply with demands of notice will result in default of the contract for deed.

Title: South Bend Indiana Notice of Default for Past Due Payments in Connection with Contract for Deed Keywords: South Bend Indiana, Notice of Default, Past Due Payments, Contract for Deed Introduction: In South Bend Indiana, a Notice of Default for Past Due Payments in connection with a Contract for Deed is a legal document that serves as a formal notification to the borrower when they are in default and have failed to make timely payments as required by the contract. This notice outlines the consequences of default and provides the borrower with an opportunity to remedy the situation. Let's explore the various types of South Bend Indiana Notice of Default for Past Due Payments in connection with a Contract for Deed. 1. General Notice of Default: A General Notice of Default is issued when the borrower fails to make the required payments on time as agreed upon in the Contract for Deed. This document informs the borrower of their default status and outlines the subsequent actions that the lender may take if the default is not rectified within a specified timeframe. 2. Acceleration Notice of Default: An Acceleration Notice of Default is issued when the borrower has consistently failed to make multiple payments, resulting in a significant amount of past-due payments. This notice informs the borrower that the entire loan balance has been accelerated, meaning the lender can demand full payment of the remaining debt. It serves as a warning that failure to pay the entire balance may result in foreclosure proceedings. 3. Cure or Quit Notice of Default: A Cure or Quit Notice of Default is issued when the borrower has failed to make timely payments, but it also provides an opportunity to remedy the default within a specific timeframe. This notice gives the borrower a chance to catch up on their missed payments and avoid further legal actions, such as foreclosure. 4. Foreclosure Notice of Default: If the borrower fails to resolve the default or comply with any cure period, a Foreclosure Notice of Default may be issued. This notice officially begins the foreclosure process, notifying the borrower that the property will be sold to satisfy the outstanding debt if the default is not resolved by a certain deadline. 5. Redemption Notice of Default: A Redemption Notice of Default may be issued after a foreclosure sale, offering the borrower a redemption period during which they can repurchase the property by paying the outstanding debt, interest, and any additional costs incurred during the foreclosure process. Conclusion: A South Bend Indiana Notice of Default for Past Due Payments in connection with a Contract for Deed is a vital legal document that serves to inform and warn borrowers about their default status. It outlines the consequences of failing to make timely payments and provides various options, such as curing the default, in order to avoid foreclosure proceedings. Understanding the different types of notices of default can help borrowers take appropriate action and possibly resolve their default status in a timely manner.Title: South Bend Indiana Notice of Default for Past Due Payments in Connection with Contract for Deed Keywords: South Bend Indiana, Notice of Default, Past Due Payments, Contract for Deed Introduction: In South Bend Indiana, a Notice of Default for Past Due Payments in connection with a Contract for Deed is a legal document that serves as a formal notification to the borrower when they are in default and have failed to make timely payments as required by the contract. This notice outlines the consequences of default and provides the borrower with an opportunity to remedy the situation. Let's explore the various types of South Bend Indiana Notice of Default for Past Due Payments in connection with a Contract for Deed. 1. General Notice of Default: A General Notice of Default is issued when the borrower fails to make the required payments on time as agreed upon in the Contract for Deed. This document informs the borrower of their default status and outlines the subsequent actions that the lender may take if the default is not rectified within a specified timeframe. 2. Acceleration Notice of Default: An Acceleration Notice of Default is issued when the borrower has consistently failed to make multiple payments, resulting in a significant amount of past-due payments. This notice informs the borrower that the entire loan balance has been accelerated, meaning the lender can demand full payment of the remaining debt. It serves as a warning that failure to pay the entire balance may result in foreclosure proceedings. 3. Cure or Quit Notice of Default: A Cure or Quit Notice of Default is issued when the borrower has failed to make timely payments, but it also provides an opportunity to remedy the default within a specific timeframe. This notice gives the borrower a chance to catch up on their missed payments and avoid further legal actions, such as foreclosure. 4. Foreclosure Notice of Default: If the borrower fails to resolve the default or comply with any cure period, a Foreclosure Notice of Default may be issued. This notice officially begins the foreclosure process, notifying the borrower that the property will be sold to satisfy the outstanding debt if the default is not resolved by a certain deadline. 5. Redemption Notice of Default: A Redemption Notice of Default may be issued after a foreclosure sale, offering the borrower a redemption period during which they can repurchase the property by paying the outstanding debt, interest, and any additional costs incurred during the foreclosure process. Conclusion: A South Bend Indiana Notice of Default for Past Due Payments in connection with a Contract for Deed is a vital legal document that serves to inform and warn borrowers about their default status. It outlines the consequences of failing to make timely payments and provides various options, such as curing the default, in order to avoid foreclosure proceedings. Understanding the different types of notices of default can help borrowers take appropriate action and possibly resolve their default status in a timely manner.