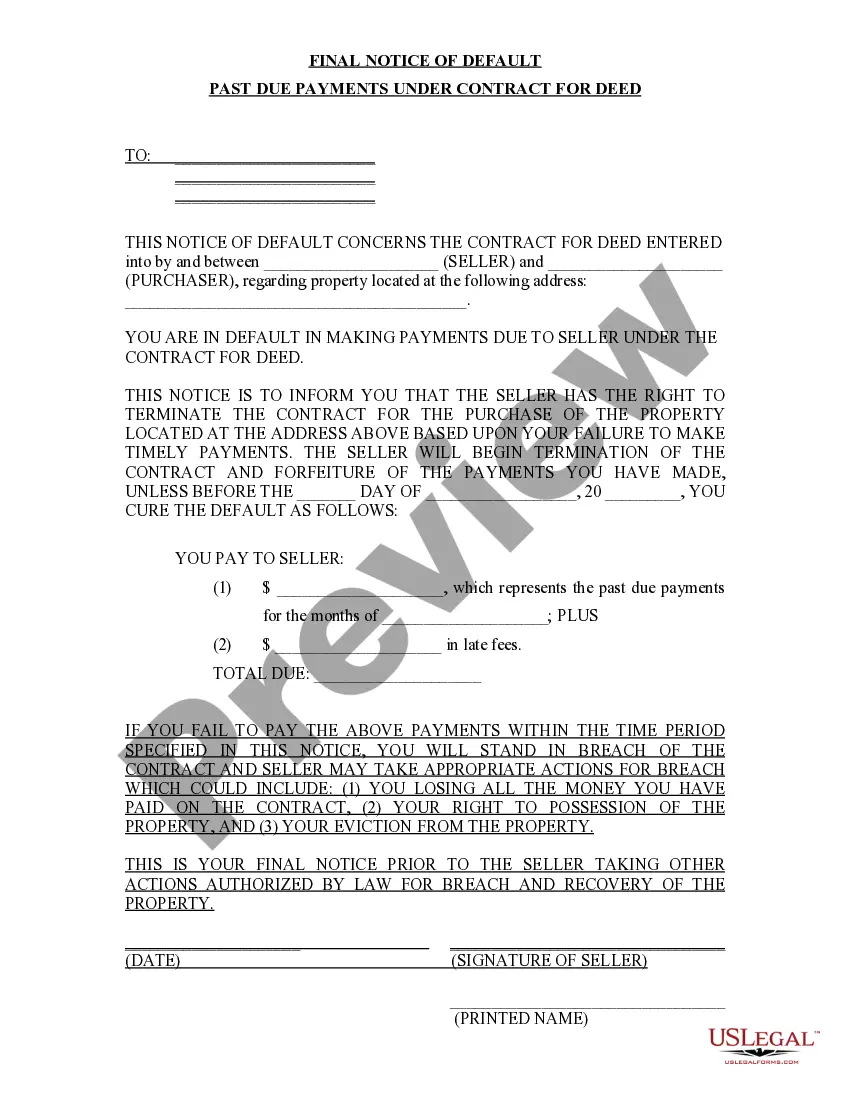

This is the Seller's final notice to Purchaser of failure to make payment toward the purchase price of the contract for deed property. It provides notice to Seller that without making payment by the date set in the notice, the contract for deed will stand in default.

South Bend Indiana Final Notice of Default for Past Due Payments in connection with Contract for Deed is an important legal document that addresses the issue of outstanding payments related to a Contract for Deed agreement. It serves as a formal notification to the debtor that they have breached their contractual obligations by failing to make timely payments on the property. The Final Notice of Default is typically sent after multiple payment reminders and grace periods have been provided to the debtor. It outlines the specific details of the default, including the amount of unpaid payments, the due dates, and any applicable penalties or late fees. The notice also specifies the next steps that will be taken if the debt remains unpaid. In South Bend, Indiana, there are various types of Final Notice of Default for Past Due Payments in connection with Contract for Deed depending on the specific circumstances of the default: 1. Acceleration Notice: This type of notice is issued when the entire remaining balance of the contract becomes due and payable. It demands immediate payment of the total outstanding amount, including any interest, penalties, or fees. 2. Cure or Quit Notice: This notice gives the debtor a specific period to cure the default by paying the outstanding amounts. If the debtor fails to make the necessary payments within the provided timeframe, the contract may be terminated, and legal action may be pursued. 3. Notice of Intent to Foreclose: If the default persists even after the Cure or Quit Notice, this notice is sent to inform the debtor about the lender's intention to foreclose on the property. It provides a final opportunity for the debtor to settle the debt and avoid foreclosure proceedings. It is crucial for both the parties involved in a Contract for Deed to understand the terms and conditions, including the consequences of defaulting on payments. Failing to honor the financial obligations outlined in the agreement can lead to severe legal consequences, including the loss of the property through foreclosure. If you have received a South Bend Indiana Final Notice of Default for Past Due Payments in connection with a Contract for Deed, it is highly advisable to seek legal counsel promptly. An attorney experienced in real estate and contract law can provide valuable guidance and help explore potential options to resolve the default situation.South Bend Indiana Final Notice of Default for Past Due Payments in connection with Contract for Deed is an important legal document that addresses the issue of outstanding payments related to a Contract for Deed agreement. It serves as a formal notification to the debtor that they have breached their contractual obligations by failing to make timely payments on the property. The Final Notice of Default is typically sent after multiple payment reminders and grace periods have been provided to the debtor. It outlines the specific details of the default, including the amount of unpaid payments, the due dates, and any applicable penalties or late fees. The notice also specifies the next steps that will be taken if the debt remains unpaid. In South Bend, Indiana, there are various types of Final Notice of Default for Past Due Payments in connection with Contract for Deed depending on the specific circumstances of the default: 1. Acceleration Notice: This type of notice is issued when the entire remaining balance of the contract becomes due and payable. It demands immediate payment of the total outstanding amount, including any interest, penalties, or fees. 2. Cure or Quit Notice: This notice gives the debtor a specific period to cure the default by paying the outstanding amounts. If the debtor fails to make the necessary payments within the provided timeframe, the contract may be terminated, and legal action may be pursued. 3. Notice of Intent to Foreclose: If the default persists even after the Cure or Quit Notice, this notice is sent to inform the debtor about the lender's intention to foreclose on the property. It provides a final opportunity for the debtor to settle the debt and avoid foreclosure proceedings. It is crucial for both the parties involved in a Contract for Deed to understand the terms and conditions, including the consequences of defaulting on payments. Failing to honor the financial obligations outlined in the agreement can lead to severe legal consequences, including the loss of the property through foreclosure. If you have received a South Bend Indiana Final Notice of Default for Past Due Payments in connection with a Contract for Deed, it is highly advisable to seek legal counsel promptly. An attorney experienced in real estate and contract law can provide valuable guidance and help explore potential options to resolve the default situation.