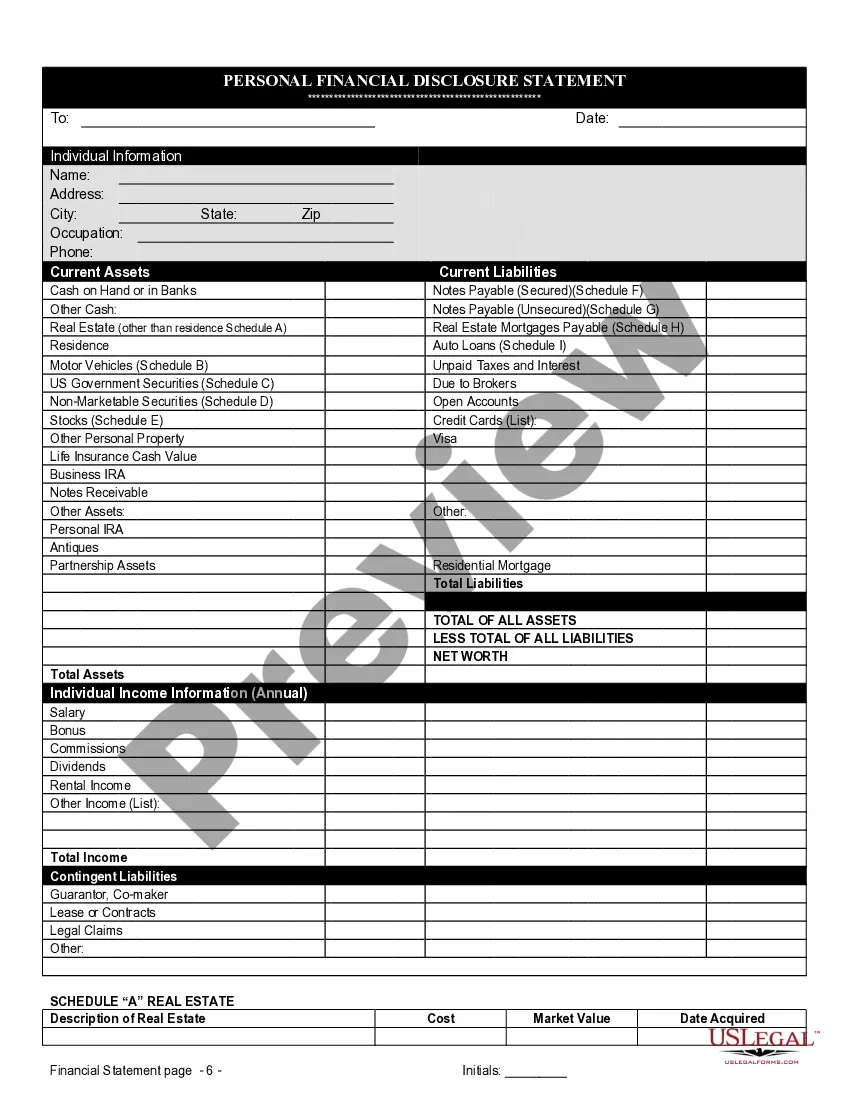

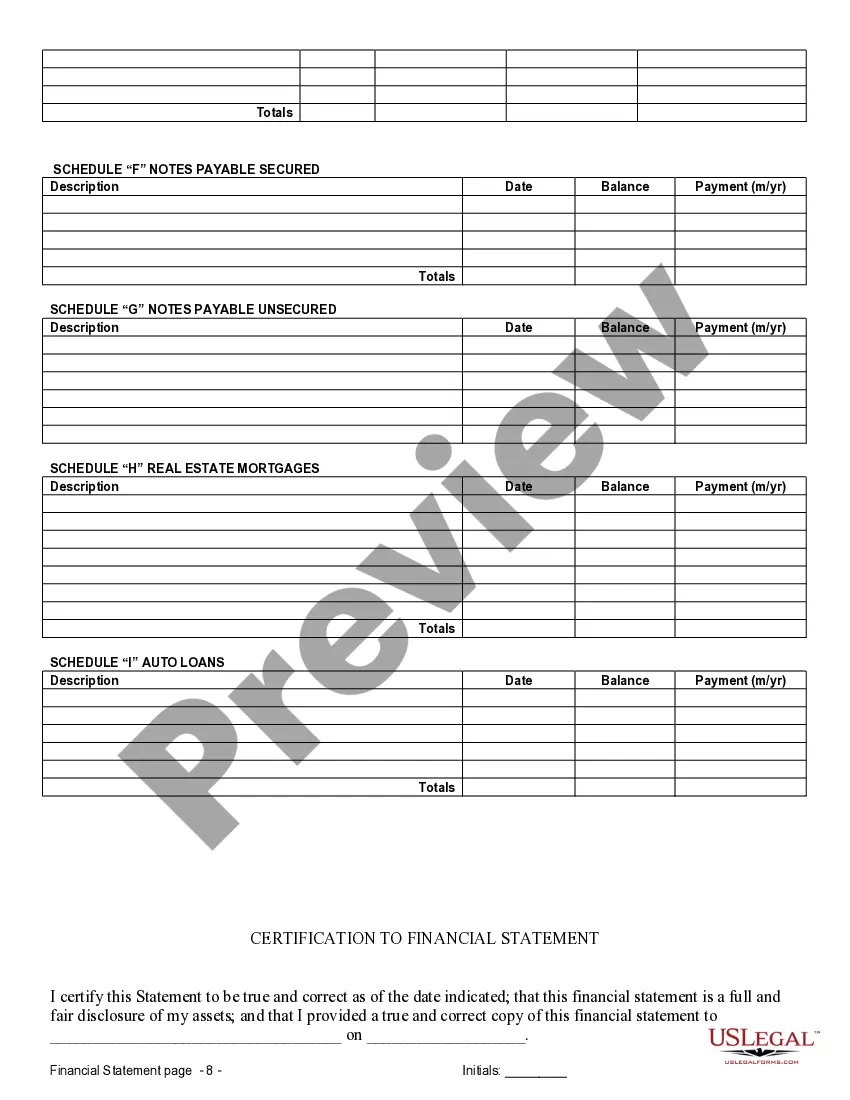

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

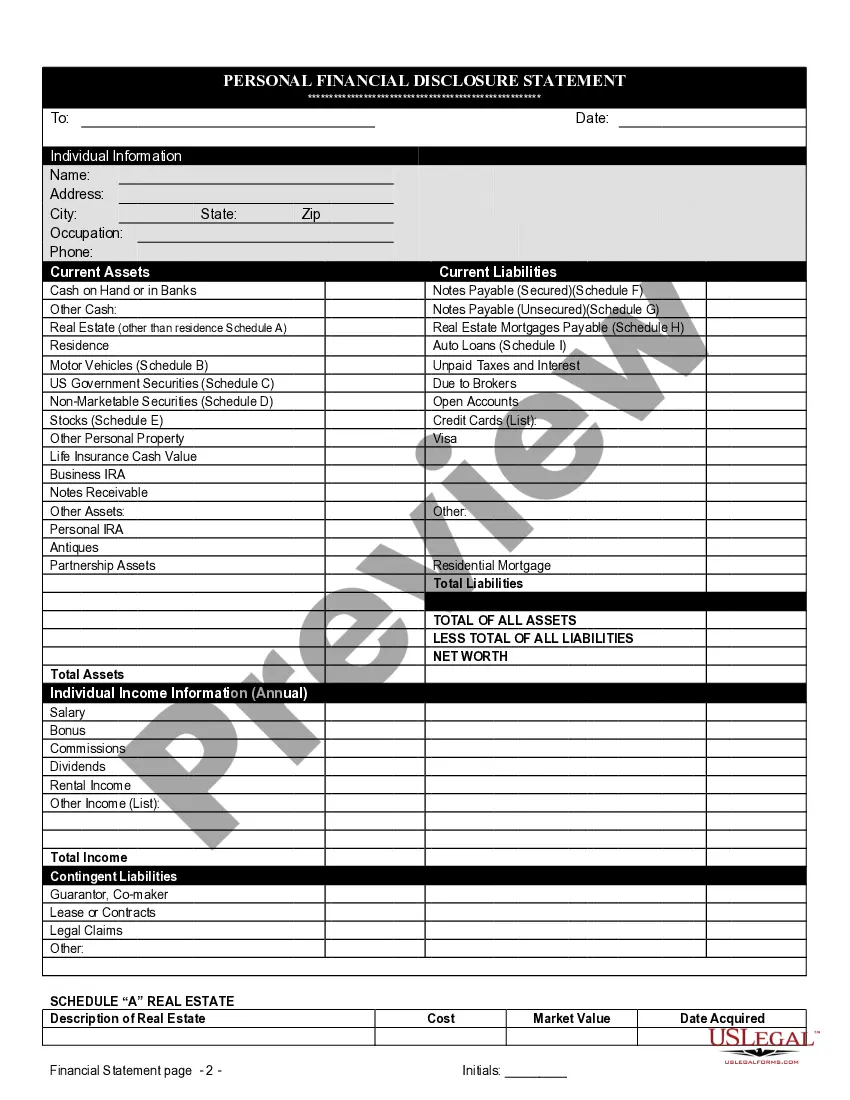

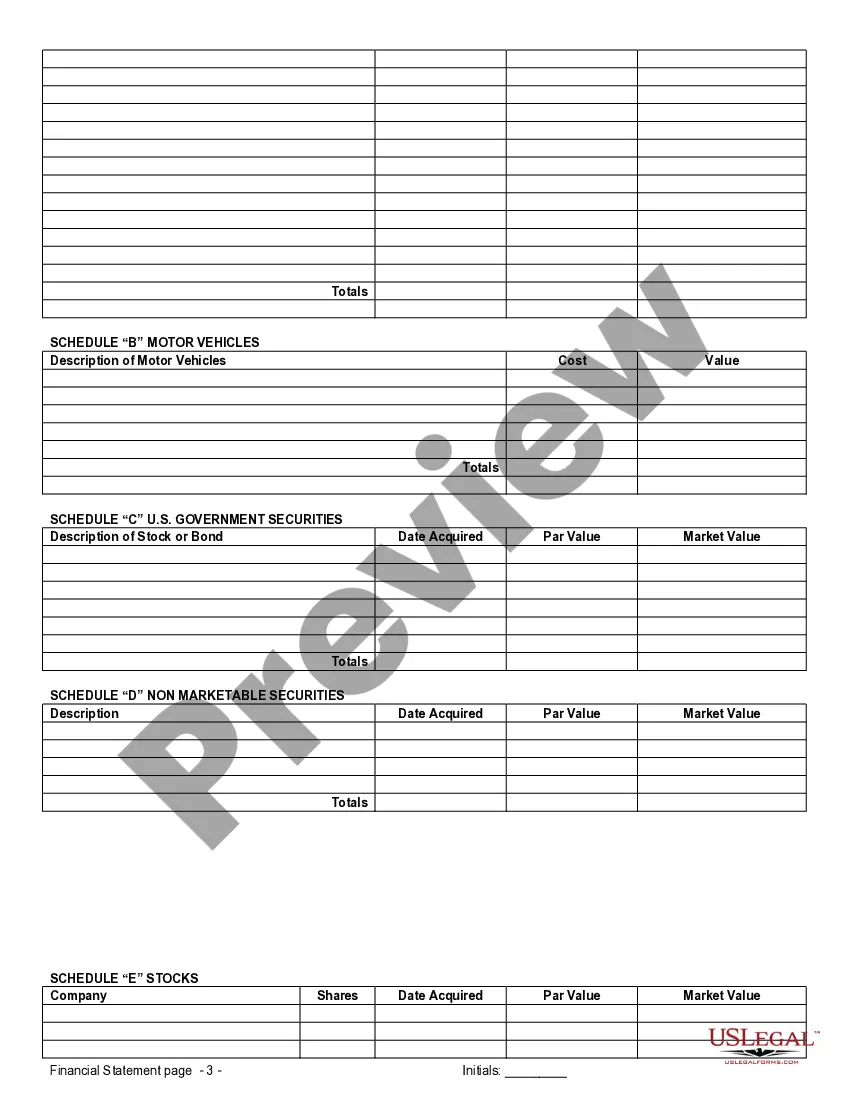

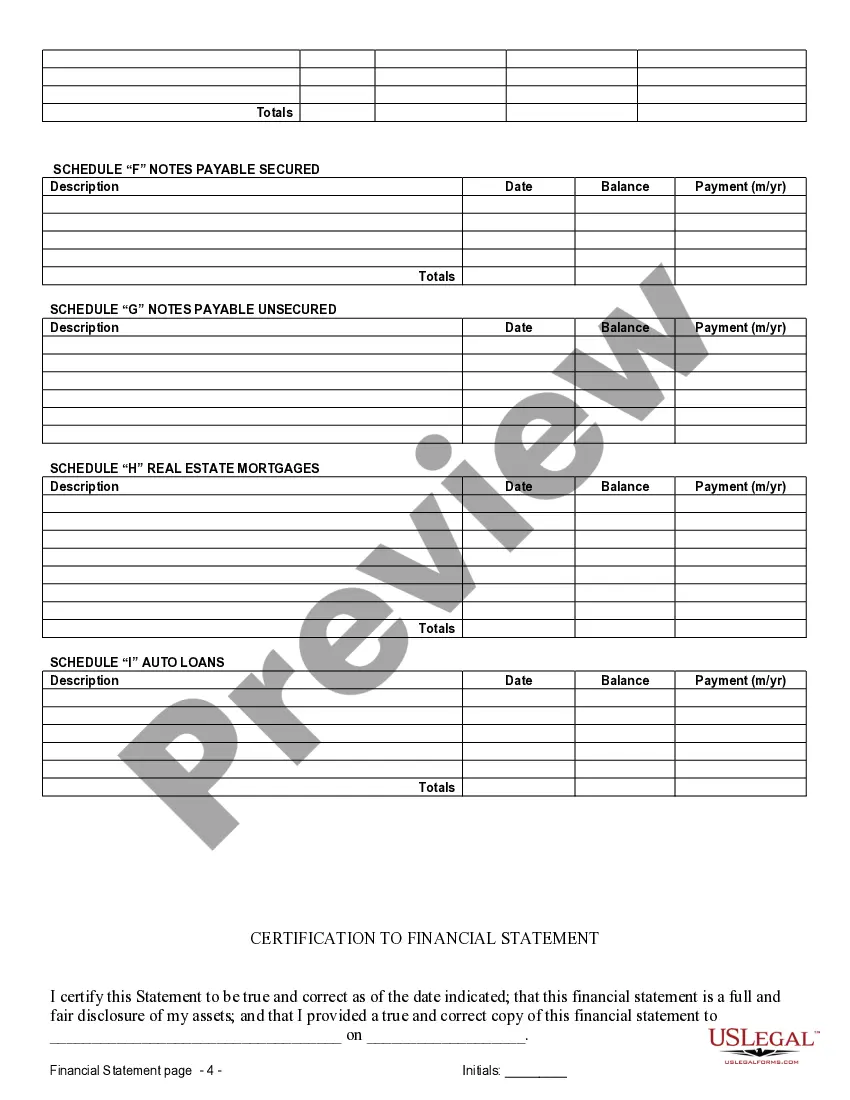

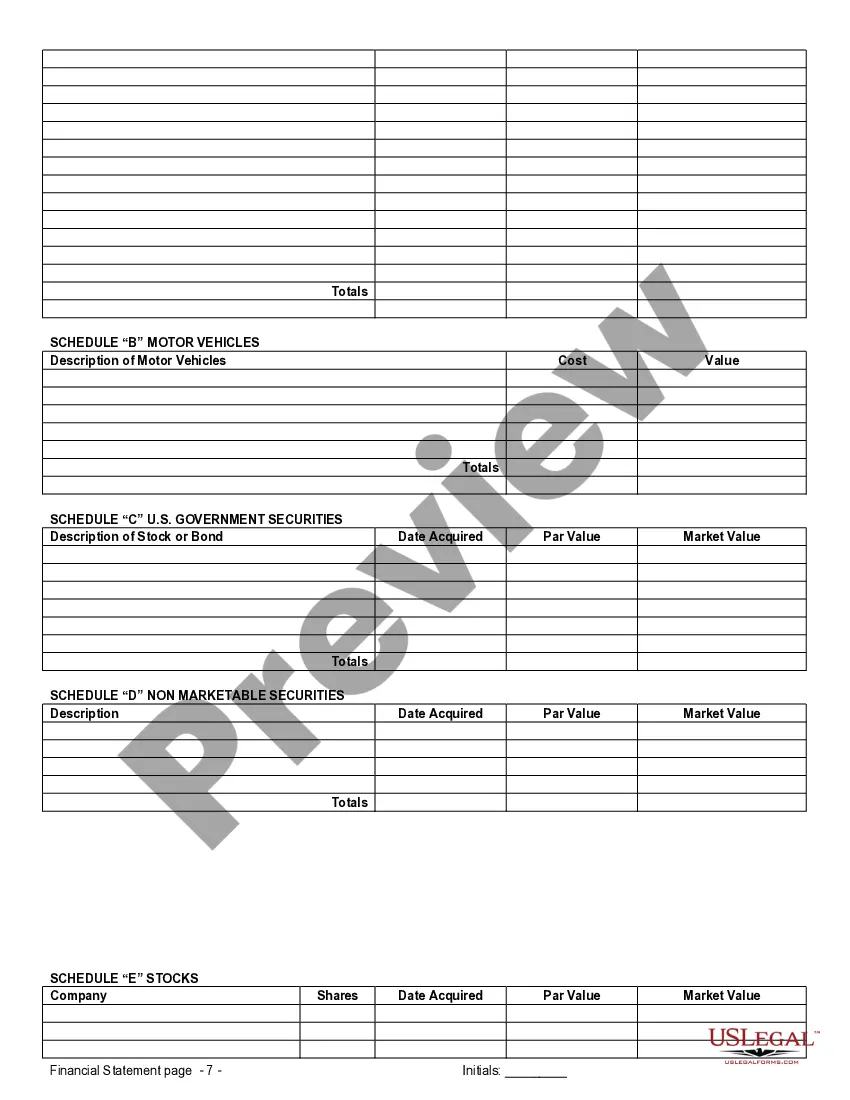

Fort Wayne Indiana Financial Statements provide crucial information related to a Prenuptial Premarital Agreement in the city of Fort Wayne, Indiana. These statements serve as essential documents that outline the financial situation, assets, liabilities, and fiscal agreements between couples before entering into a marital union. By detailing the financial status of each party, Financial Statements ensure transparency, uphold fairness, and safeguard the interests of both partners. There are different types of Financial Statements relevant to Prenuptial Premarital Agreements in Fort Wayne, Indiana: 1. Personal Balance Sheet: This statement presents an individual's assets, including cash, real estate, investments, and personal property, as well as liabilities such as loans, mortgages, and credit card debt. 2. Income Statement: This document provides an overview of an individual's income from various sources, including employment, investments, rents, or business revenues. It also includes deductions, expenses, and taxes paid. 3. Bank Statements: These statements display a comprehensive record of an individual's banking transactions, including deposits, withdrawals, and account balances, offering clear insights into their financial activities. 4. Investments and Securities Statements: This type of statement highlights an individual's portfolio of stocks, bonds, mutual funds, or other investment instruments and showcases their current value and any associated liabilities or gains. 5. Retirement Account Statements: These statements, including 401(k) or IRA account summaries, detail an individual's retirement savings, contributions, accruals, and investment performance, allowing both parties to consider future financial planning. 6. Business Financial Statements: If either partner owns a business, audited financial statements, including income statements, balance sheets, and cash flow statements, can provide vital information on the worth and liabilities of the enterprise. 7. Real Estate Documentation: This includes property ownership records, mortgage agreements, property tax assessments, and appraisals, which help determine the worth and financial obligations tied to real estate assets. When pursuing a Prenuptial Premarital Agreement in Fort Wayne, Indiana, it is critical to compile accurate and comprehensive Financial Statements to establish a clear understanding of each individual's financial standing. These statements contribute to a fair and equitable marital agreement while helping construct a solid foundation for the relationship.Fort Wayne Indiana Financial Statements provide crucial information related to a Prenuptial Premarital Agreement in the city of Fort Wayne, Indiana. These statements serve as essential documents that outline the financial situation, assets, liabilities, and fiscal agreements between couples before entering into a marital union. By detailing the financial status of each party, Financial Statements ensure transparency, uphold fairness, and safeguard the interests of both partners. There are different types of Financial Statements relevant to Prenuptial Premarital Agreements in Fort Wayne, Indiana: 1. Personal Balance Sheet: This statement presents an individual's assets, including cash, real estate, investments, and personal property, as well as liabilities such as loans, mortgages, and credit card debt. 2. Income Statement: This document provides an overview of an individual's income from various sources, including employment, investments, rents, or business revenues. It also includes deductions, expenses, and taxes paid. 3. Bank Statements: These statements display a comprehensive record of an individual's banking transactions, including deposits, withdrawals, and account balances, offering clear insights into their financial activities. 4. Investments and Securities Statements: This type of statement highlights an individual's portfolio of stocks, bonds, mutual funds, or other investment instruments and showcases their current value and any associated liabilities or gains. 5. Retirement Account Statements: These statements, including 401(k) or IRA account summaries, detail an individual's retirement savings, contributions, accruals, and investment performance, allowing both parties to consider future financial planning. 6. Business Financial Statements: If either partner owns a business, audited financial statements, including income statements, balance sheets, and cash flow statements, can provide vital information on the worth and liabilities of the enterprise. 7. Real Estate Documentation: This includes property ownership records, mortgage agreements, property tax assessments, and appraisals, which help determine the worth and financial obligations tied to real estate assets. When pursuing a Prenuptial Premarital Agreement in Fort Wayne, Indiana, it is critical to compile accurate and comprehensive Financial Statements to establish a clear understanding of each individual's financial standing. These statements contribute to a fair and equitable marital agreement while helping construct a solid foundation for the relationship.