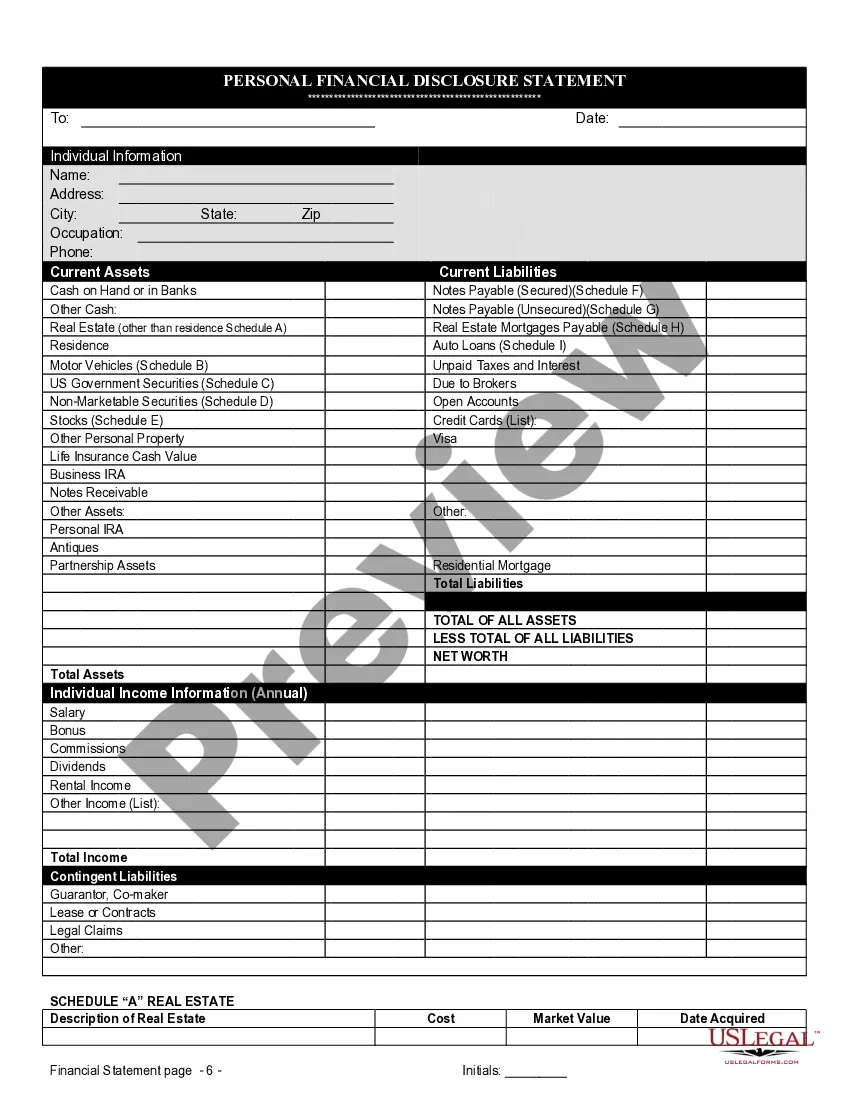

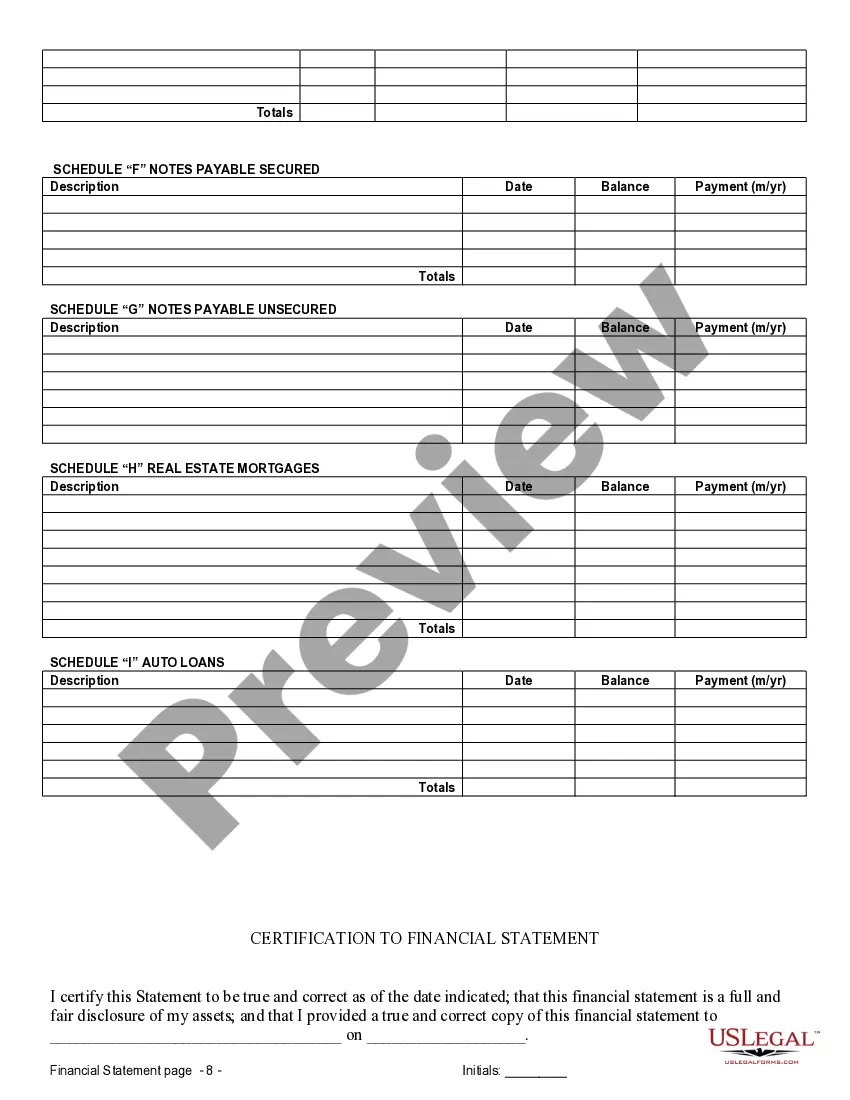

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

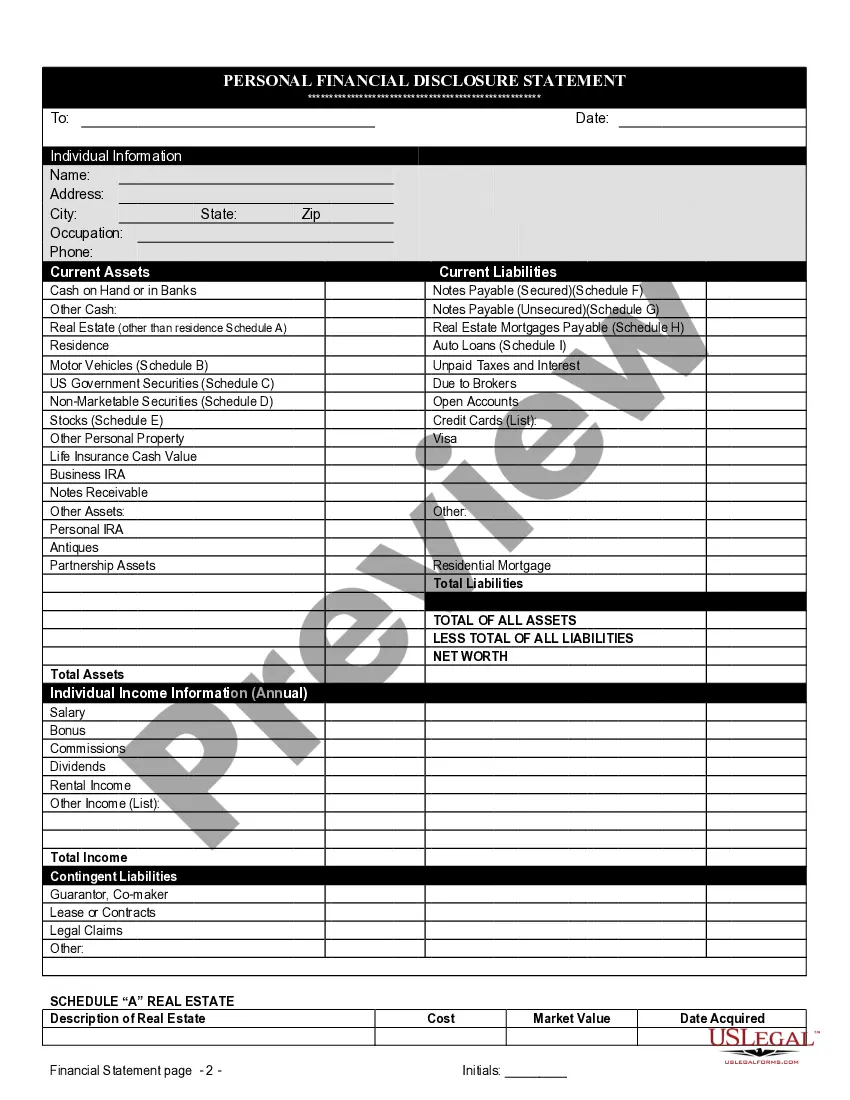

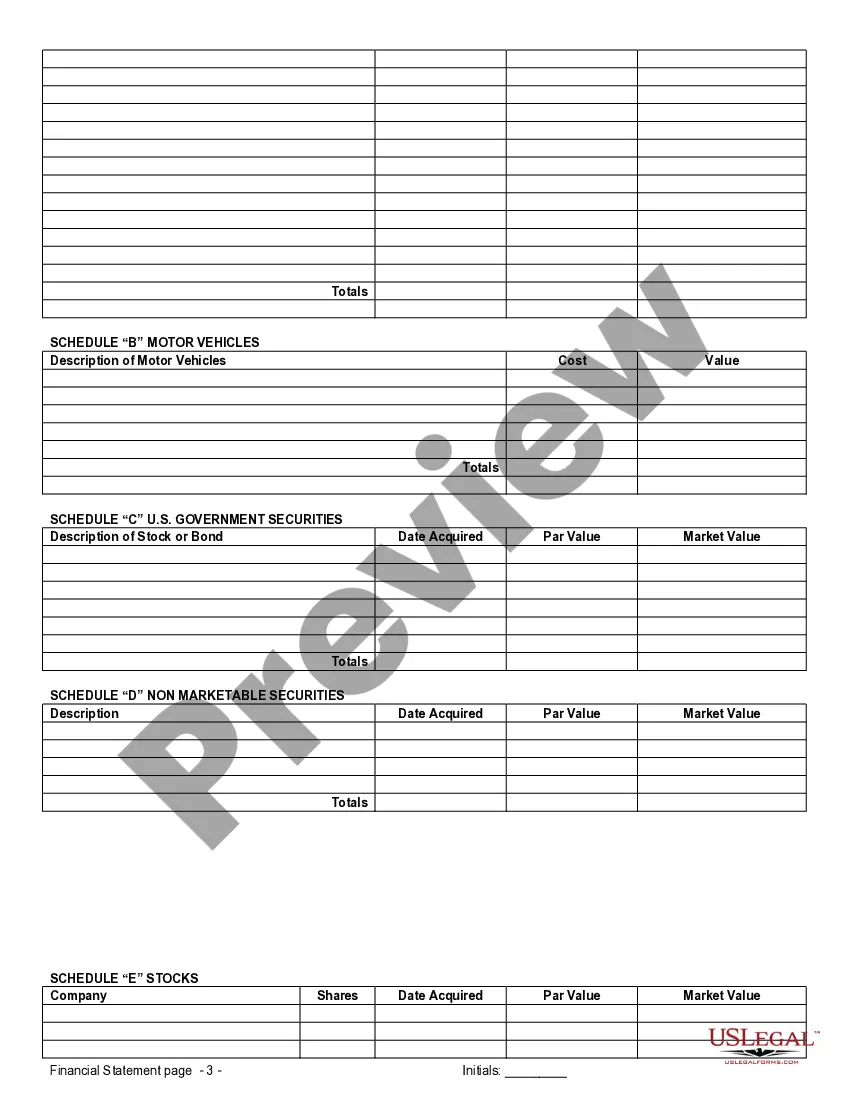

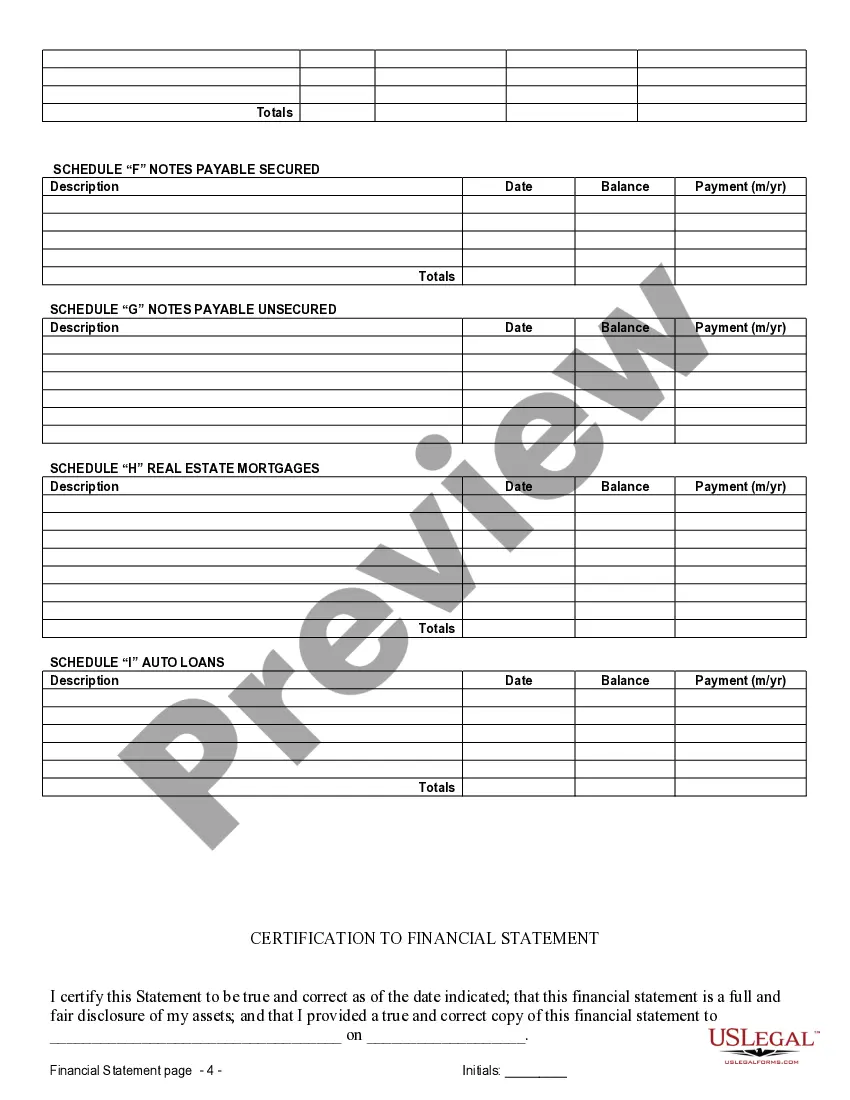

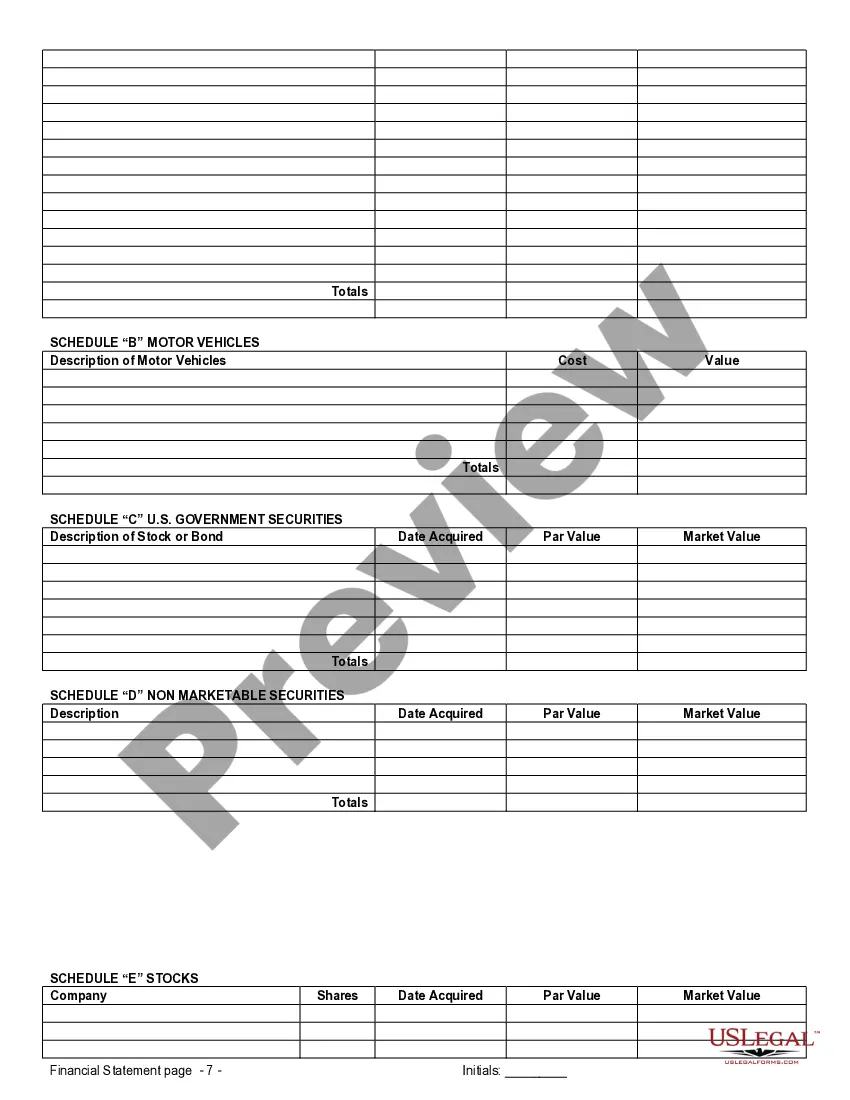

Indianapolis Indiana Financial Statements in Connection with Prenuptial Premarital Agreement: Financial statements play a crucial role in prenuptial or premarital agreements, especially in Indianapolis, Indiana, where the use of such statements is common practice. These statements provide a comprehensive overview of the financial situation of each party entering into the agreement and aim to protect their respective interests in case of divorce or separation. In the context of prenuptial or premarital agreements, Indianapolis Indiana requires financial statements from both parties to ensure transparency and fairness in the agreement. These statements must accurately depict their financial standing and assets, including income, debts, investments, and real estate holdings, among other relevant financial information. There are different types of Indianapolis Indiana Financial Statements used specifically in connection with prenuptial or premarital agreements. Some of these types may include: 1. Personal Financial Statements: These statements provide an individual's financial information, detailing their assets, liabilities, income, and expenses. Personal financial statements are commonly used in prenuptial or premarital agreements to disclose the financial situation of each party. 2. Business Financial Statements: If one or both parties own a business, it is essential to include business financial statements in the prenuptial or premarital agreement. These statements outline the financial health of the business, including its assets, liabilities, revenue, and expenses. Business financial statements help determine the value of the business and establish the rights and obligations of each party concerning the business in case of divorce or separation. 3. Bank Statements: Bank statements are crucial documents that provide detailed information about an individual's cash flow, account balances, and transactions. These statements are necessary to assess an individual's income, savings, and expenses, which are vital considerations when formulating a prenuptial or premarital agreement. 4. Tax Returns: Tax returns provide valuable insights into an individual's income, deductions, and overall financial position. These documents help determine the accuracy of the financial information provided in other financial statements and offer a comprehensive understanding of the individual's financial circumstances. By incorporating these different types of financial statements into a prenuptial or premarital agreement, couples in Indianapolis, Indiana can ensure that both parties are making informed decisions about their assets, debts, and obligations. The use of these statements provides transparency, validates the accuracy of financial claims, and allows for fair negotiation and division of assets in the event of divorce or separation.Indianapolis Indiana Financial Statements in Connection with Prenuptial Premarital Agreement: Financial statements play a crucial role in prenuptial or premarital agreements, especially in Indianapolis, Indiana, where the use of such statements is common practice. These statements provide a comprehensive overview of the financial situation of each party entering into the agreement and aim to protect their respective interests in case of divorce or separation. In the context of prenuptial or premarital agreements, Indianapolis Indiana requires financial statements from both parties to ensure transparency and fairness in the agreement. These statements must accurately depict their financial standing and assets, including income, debts, investments, and real estate holdings, among other relevant financial information. There are different types of Indianapolis Indiana Financial Statements used specifically in connection with prenuptial or premarital agreements. Some of these types may include: 1. Personal Financial Statements: These statements provide an individual's financial information, detailing their assets, liabilities, income, and expenses. Personal financial statements are commonly used in prenuptial or premarital agreements to disclose the financial situation of each party. 2. Business Financial Statements: If one or both parties own a business, it is essential to include business financial statements in the prenuptial or premarital agreement. These statements outline the financial health of the business, including its assets, liabilities, revenue, and expenses. Business financial statements help determine the value of the business and establish the rights and obligations of each party concerning the business in case of divorce or separation. 3. Bank Statements: Bank statements are crucial documents that provide detailed information about an individual's cash flow, account balances, and transactions. These statements are necessary to assess an individual's income, savings, and expenses, which are vital considerations when formulating a prenuptial or premarital agreement. 4. Tax Returns: Tax returns provide valuable insights into an individual's income, deductions, and overall financial position. These documents help determine the accuracy of the financial information provided in other financial statements and offer a comprehensive understanding of the individual's financial circumstances. By incorporating these different types of financial statements into a prenuptial or premarital agreement, couples in Indianapolis, Indiana can ensure that both parties are making informed decisions about their assets, debts, and obligations. The use of these statements provides transparency, validates the accuracy of financial claims, and allows for fair negotiation and division of assets in the event of divorce or separation.