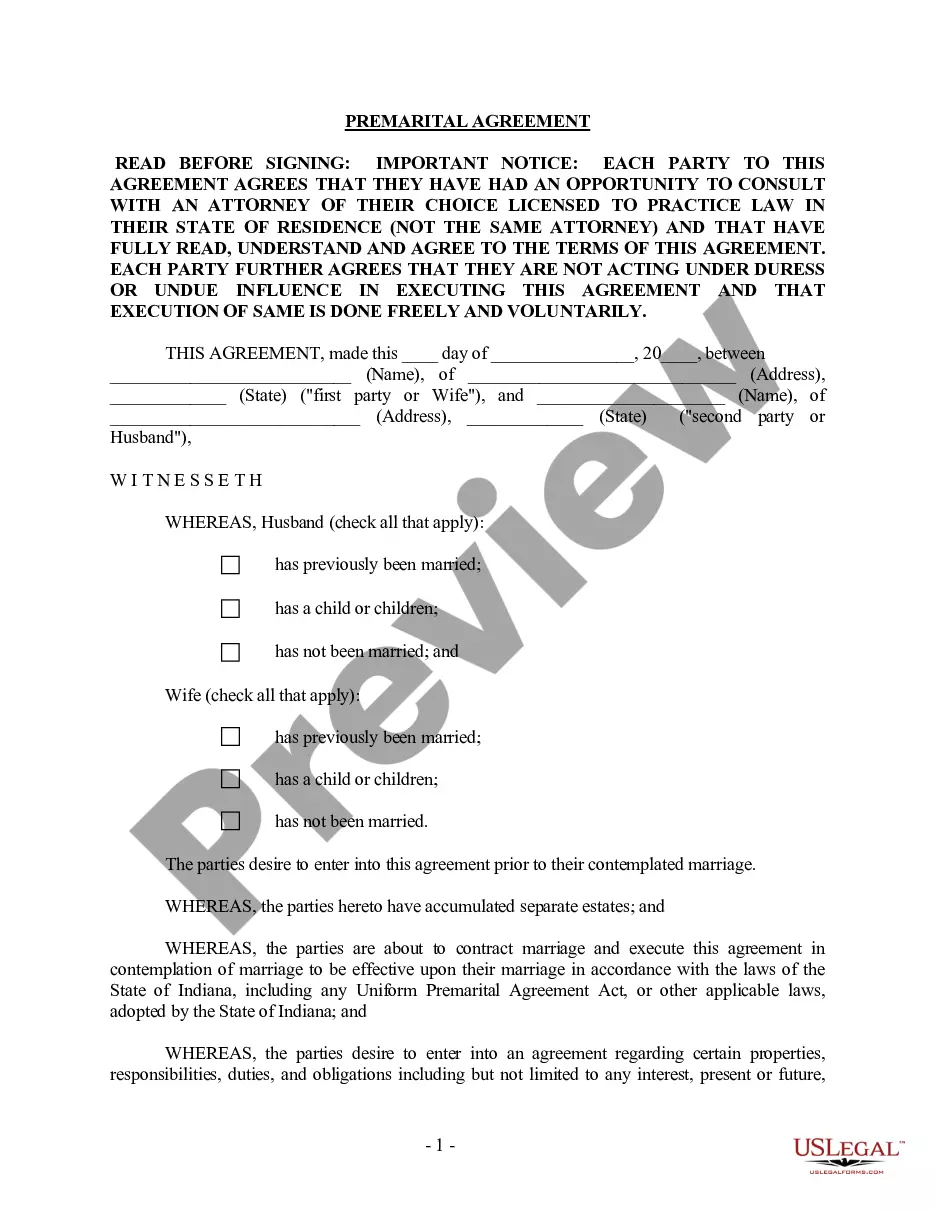

This Prenuptial Premarital Agreement with Financial Statements form package contains a premarital agreement and financial statements for your state. The agreement can be used by persons who have been previously married, or by persons who have never been married. It includes provisions regarding the contemplated marriage, assets and debts disclosure and property rights after the marriage. The agreement describes the rights, duties and obligations of prospective parties during and upon termination of marriage through death or divorce. These contracts are often used by individuals who want to ensure the proper and organized disposition of their assets in the event of death or divorce. Among the benefits that prenuptial agreements provide are avoidance of costly litigation, protection of family and/or business assets, protection against creditors and assurance that the marital property will be disposed of properly.

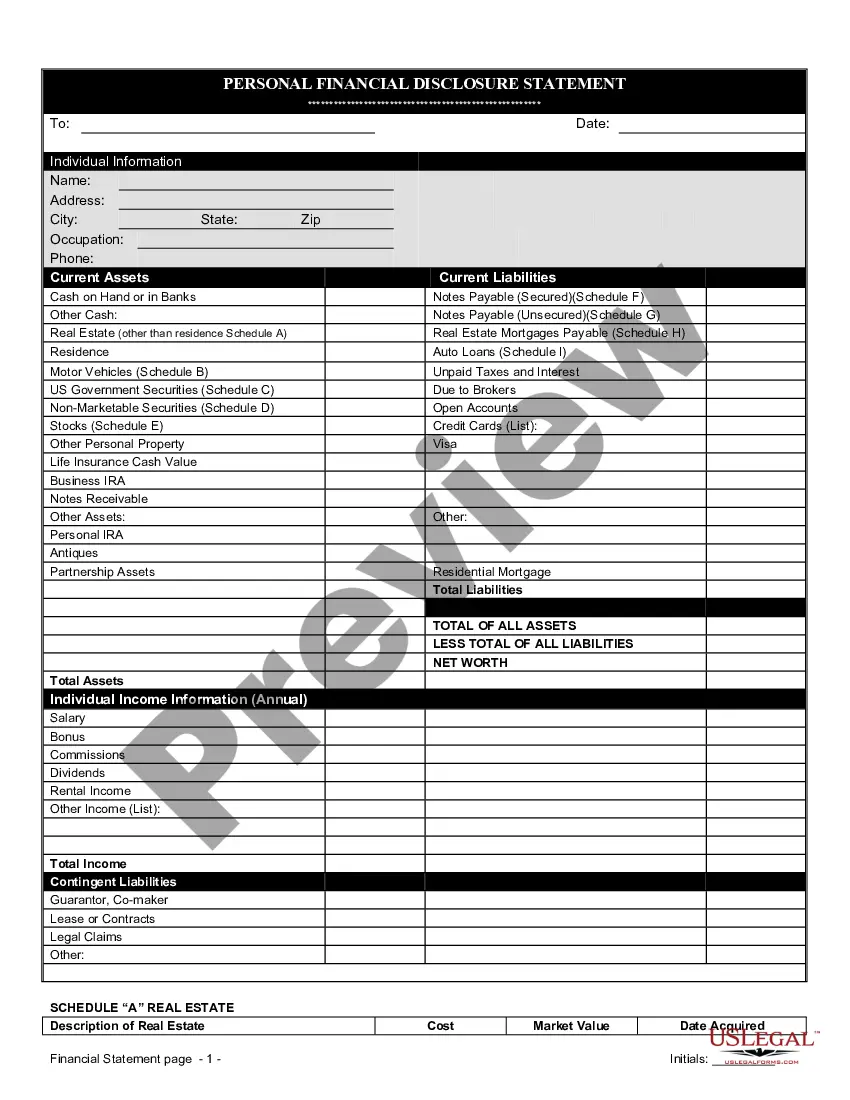

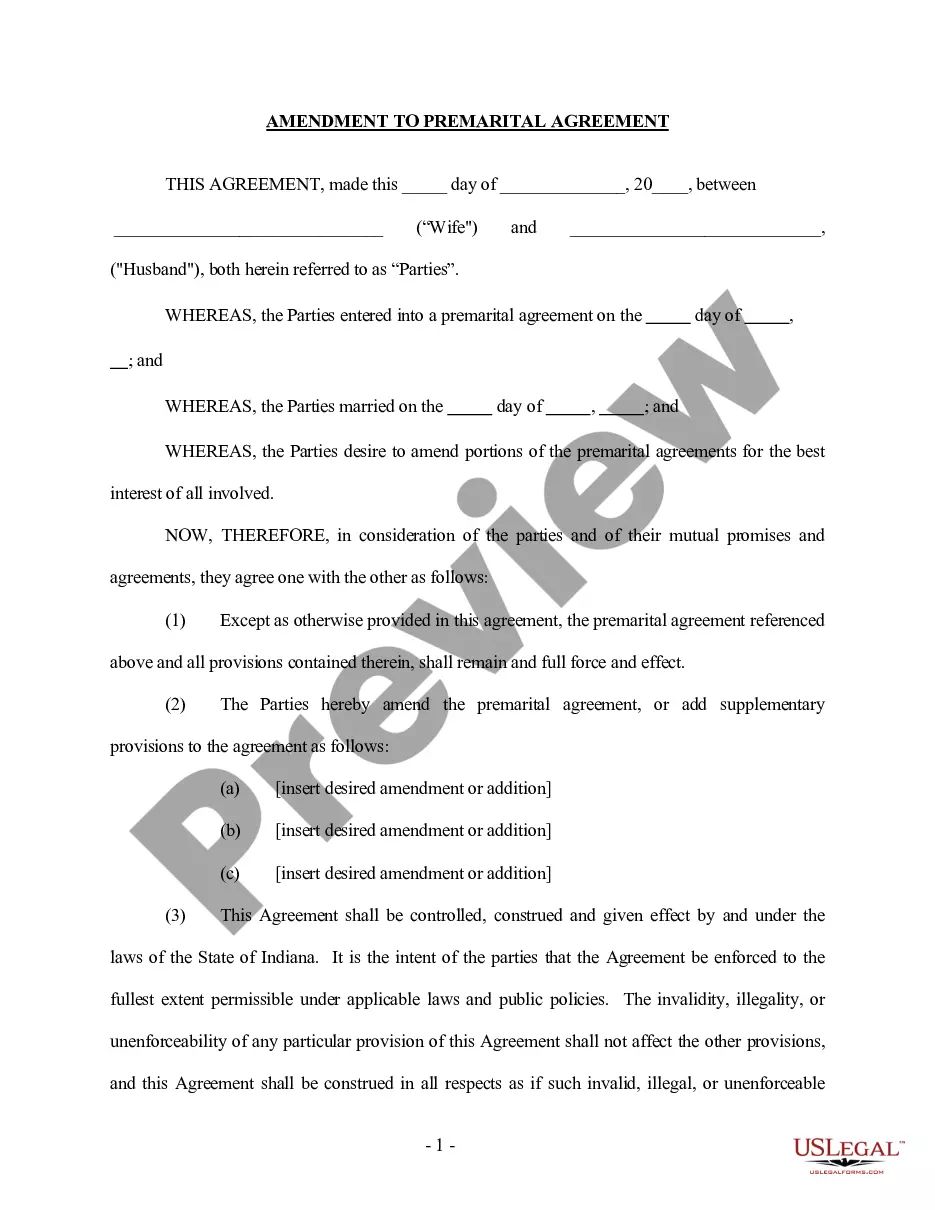

The Indianapolis Indiana Prenuptial Premarital Agreement refers to a legal contract entered into by a couple in the state of Indiana before their marriage. This agreement is governed by the Uniform Premarital Agreement Act (UAA), which sets forth the guidelines and requirements for such agreements in the state. The purpose of a prenuptial agreement is to establish and clarify the rights and responsibilities of each spouse in the event of a divorce or legal separation. It allows the couple to determine how their assets will be divided, how debts will be handled, and can also address other important issues, such as spousal support and division of property. The Indianapolis Indiana Prenuptial Premarital Agreement typically includes a section on financial statements. This section requires both parties to disclose their financial information, including income, assets, and liabilities. Providing these statements is crucial in ensuring transparency and fairness during the negotiation and drafting process of the prenuptial agreement. There can be different types of Indianapolis Indiana Prenuptial Premarital Agreements, depending on the specific needs and preferences of the couple. Some common types include: 1. Traditional Prenuptial Agreement: This type of agreement typically focuses on asset division and financial matters. It may include provisions for the division of property, spousal support, and protection of individual assets acquired before the marriage. 2. Sunset Clause Agreement: This type of agreement is designed to expire or terminate after a certain period of time, typically after a specific number of years of marriage. It allows the couple to reassess their financial arrangements and modify the agreement accordingly if desired. 3. Cohabitation Agreement: In cases where a couple is not legally married but intends to live together, a cohabitation agreement can be used to establish financial and property rights similar to a prenuptial agreement. This type of agreement can be beneficial for couples in long-term relationships who wish to protect their individual assets and clarify their financial responsibilities. The Indianapolis Indiana Prenuptial Premarital Agreement with Financial Statements not only allows couples to safeguard their financial interests but also provides a framework for open and honest communication about money matters. By including financial statements, the agreement ensures that both parties are fully informed about each other's financial circumstances, enabling them to make informed decisions regarding their future together. It is important to consult with a qualified attorney when drafting and executing a prenuptial agreement to ensure that all legal requirements are met and that the document adequately addresses the specific needs and circumstances of the couple.The Indianapolis Indiana Prenuptial Premarital Agreement refers to a legal contract entered into by a couple in the state of Indiana before their marriage. This agreement is governed by the Uniform Premarital Agreement Act (UAA), which sets forth the guidelines and requirements for such agreements in the state. The purpose of a prenuptial agreement is to establish and clarify the rights and responsibilities of each spouse in the event of a divorce or legal separation. It allows the couple to determine how their assets will be divided, how debts will be handled, and can also address other important issues, such as spousal support and division of property. The Indianapolis Indiana Prenuptial Premarital Agreement typically includes a section on financial statements. This section requires both parties to disclose their financial information, including income, assets, and liabilities. Providing these statements is crucial in ensuring transparency and fairness during the negotiation and drafting process of the prenuptial agreement. There can be different types of Indianapolis Indiana Prenuptial Premarital Agreements, depending on the specific needs and preferences of the couple. Some common types include: 1. Traditional Prenuptial Agreement: This type of agreement typically focuses on asset division and financial matters. It may include provisions for the division of property, spousal support, and protection of individual assets acquired before the marriage. 2. Sunset Clause Agreement: This type of agreement is designed to expire or terminate after a certain period of time, typically after a specific number of years of marriage. It allows the couple to reassess their financial arrangements and modify the agreement accordingly if desired. 3. Cohabitation Agreement: In cases where a couple is not legally married but intends to live together, a cohabitation agreement can be used to establish financial and property rights similar to a prenuptial agreement. This type of agreement can be beneficial for couples in long-term relationships who wish to protect their individual assets and clarify their financial responsibilities. The Indianapolis Indiana Prenuptial Premarital Agreement with Financial Statements not only allows couples to safeguard their financial interests but also provides a framework for open and honest communication about money matters. By including financial statements, the agreement ensures that both parties are fully informed about each other's financial circumstances, enabling them to make informed decisions regarding their future together. It is important to consult with a qualified attorney when drafting and executing a prenuptial agreement to ensure that all legal requirements are met and that the document adequately addresses the specific needs and circumstances of the couple.