This state-specific form must be filed with the appropriate state agency in compliance with state law in order to create a new corporation. The form contains basic information concerning the corporation, normally including the corporate name, number of shares to be issued, names of the incorporators, directors and/or officers, purpose of the corporation, corporate address, registered agent, and related information.

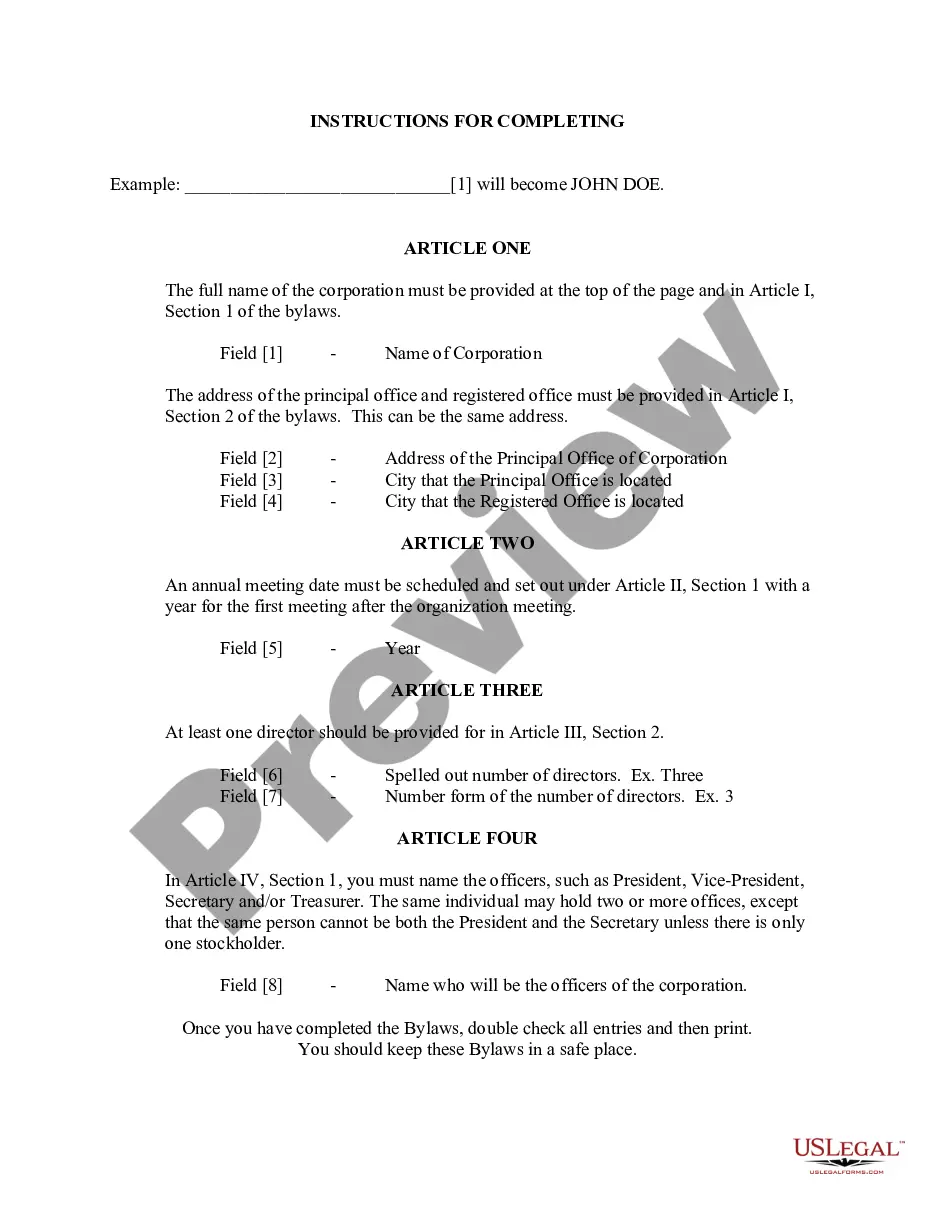

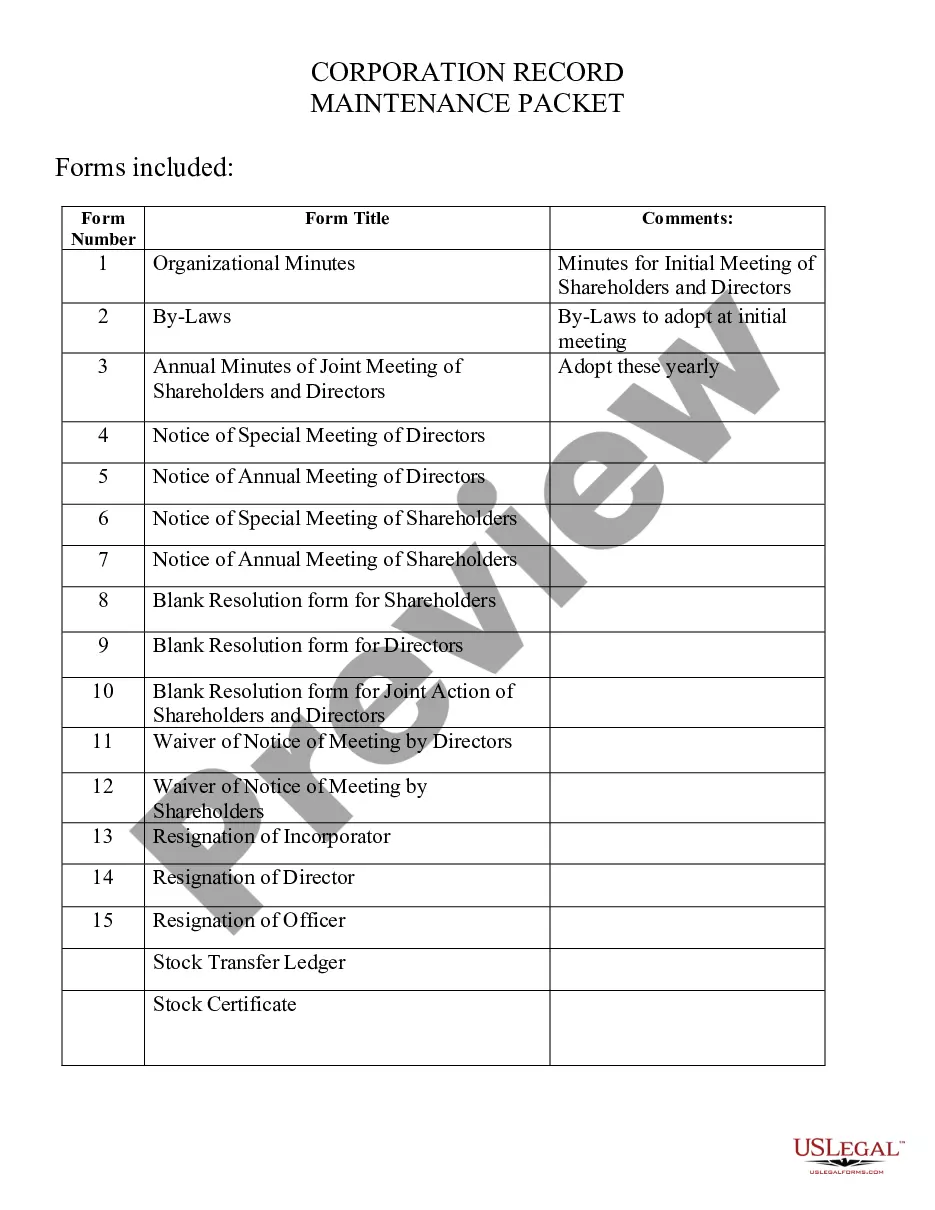

The Indianapolis Indiana Articles of Incorporation for Domestic For-Profit Corporation is an important legal document that establishes the formation of a corporation within the state of Indiana. It outlines essential information about the corporation, such as its name, purpose, structure, and other pertinent details. The Articles of Incorporation are typically filed with the Indiana Secretary of State's office, and once approved, it legally establishes the corporation as a separate legal entity from its owners or shareholders. This means that the corporation can enter into contracts, own assets, sue or be sued, and conduct business activities in its own right. The key information included in the Indianapolis Indiana Articles of Incorporation for Domestic For-Profit Corporation includes the following: 1. Corporation Name: The lawful name under which the corporation will operate must be specified. The name should include a corporate identifier, such as "Corporation," "Company," "Incorporated," or an appropriate abbreviation. 2. Registered Agent: The name and address of an individual or entity who is designated as the corporation's registered agent. This agent receives legal and official documents on behalf of the corporation. 3. Principal Office Address: The physical address of the corporation's principal place of business, which must be located within the state of Indiana. 4. Purpose: A statement describing the corporation's primary business purpose or activities. This should be sufficiently broad to allow for future growth and diversification. 5. Stock: The number of shares authorized, their par value (if any), and any other relevant information about stock issuance and classes, if applicable. 6. Directors and Officers: The name and address of the initial directors and officers. Typically, a minimum of one director and three officers (President, Secretary, and Treasurer) are required. However, specific requirements may vary based on the corporation's size and structure. 7. Incorporated(s): The name(s) and address(BS) of the individual(s) or entity(IES) responsible for preparing and filing the Articles of Incorporation. In Indianapolis, Indiana, there is typically only one type of Articles of Incorporation for a Domestic For-Profit Corporation. However, it is important to note that there may be variations in the format or language used, depending on the specific law revisions or updates. Overall, the Indianapolis Indiana Articles of Incorporation for Domestic For-Profit Corporation serves as a critical legal document in the establishment and registration of a corporation in the state. It provides necessary information about the corporation's identity, purpose, structure, and initial governance, ensuring compliance with state laws and regulations.The Indianapolis Indiana Articles of Incorporation for Domestic For-Profit Corporation is an important legal document that establishes the formation of a corporation within the state of Indiana. It outlines essential information about the corporation, such as its name, purpose, structure, and other pertinent details. The Articles of Incorporation are typically filed with the Indiana Secretary of State's office, and once approved, it legally establishes the corporation as a separate legal entity from its owners or shareholders. This means that the corporation can enter into contracts, own assets, sue or be sued, and conduct business activities in its own right. The key information included in the Indianapolis Indiana Articles of Incorporation for Domestic For-Profit Corporation includes the following: 1. Corporation Name: The lawful name under which the corporation will operate must be specified. The name should include a corporate identifier, such as "Corporation," "Company," "Incorporated," or an appropriate abbreviation. 2. Registered Agent: The name and address of an individual or entity who is designated as the corporation's registered agent. This agent receives legal and official documents on behalf of the corporation. 3. Principal Office Address: The physical address of the corporation's principal place of business, which must be located within the state of Indiana. 4. Purpose: A statement describing the corporation's primary business purpose or activities. This should be sufficiently broad to allow for future growth and diversification. 5. Stock: The number of shares authorized, their par value (if any), and any other relevant information about stock issuance and classes, if applicable. 6. Directors and Officers: The name and address of the initial directors and officers. Typically, a minimum of one director and three officers (President, Secretary, and Treasurer) are required. However, specific requirements may vary based on the corporation's size and structure. 7. Incorporated(s): The name(s) and address(BS) of the individual(s) or entity(IES) responsible for preparing and filing the Articles of Incorporation. In Indianapolis, Indiana, there is typically only one type of Articles of Incorporation for a Domestic For-Profit Corporation. However, it is important to note that there may be variations in the format or language used, depending on the specific law revisions or updates. Overall, the Indianapolis Indiana Articles of Incorporation for Domestic For-Profit Corporation serves as a critical legal document in the establishment and registration of a corporation in the state. It provides necessary information about the corporation's identity, purpose, structure, and initial governance, ensuring compliance with state laws and regulations.