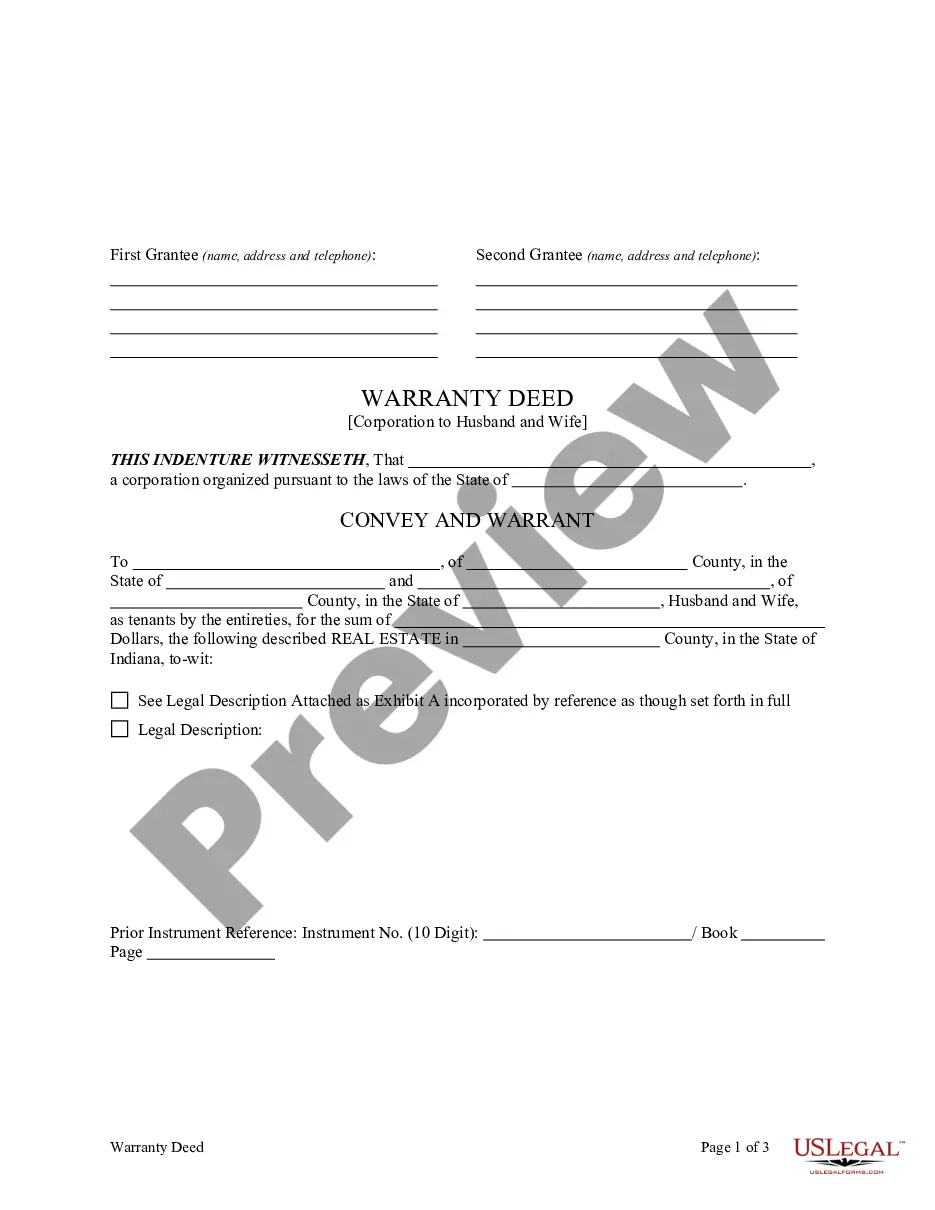

This is a Warranty Deed in which the Grantor is a corporation and the Grantees are Husband and Wife. Upon ordering, you may download the form in Word, Rich Text or Wordperfect formats.

A South Bend Indiana Warranty Deed from Corporation to Husband and Wife is a legal document used to transfer property ownership from a corporation to a married couple. It provides a guarantee to the new owners that the property being transferred is free of any liens or claims. In South Bend, Indiana, there are two common types of Warranty Deeds from Corporation to Husband and Wife: 1. General Warranty Deed: This type of deed provides the broadest level of protection to the husband and wife buyers. It guarantees that the corporation transferring the property has complete legal ownership and has the right to sell it. It also promises that the property is free from any hidden debts, encumbrances, or other legal issues that might affect the new owners' rights to the property. 2. Special Warranty Deed: Unlike the general warranty deed, a special warranty deed only guarantees that the corporation transferring the property has not caused any defects or claims during their ownership. This means that any issues existing before their ownership are not covered under this type of deed. It's important for the husband and wife buyers to conduct a thorough title search to ensure there are no pre-existing issues affecting the property. When completing a South Bend Indiana Warranty Deed from a Corporation to Husband and Wife, several key elements must be included: 1. Granter: The corporation selling the property is known as the granter. 2. Grantees: The husband and wife buyers are the grantees, and their complete legal names must be specified. 3. Legal Property Description: The warranty deed must provide a detailed and accurate description of the property being transferred. This typically includes the complete address, lot number, and any other identifying information needed to uniquely identify the property. 4. Consideration: The deed should clearly state the monetary consideration, such as the purchase price the husband and wife paid to acquire the property. 5. Signature and Notarization: The deed must be signed by an authorized representative of the corporation, such as a director or officer. Additionally, the signatures of the husband and wife buyers must be notarized to attest to their identity and willingness to accept the property. It is crucial for the husband and wife buyers to consult with a qualified real estate attorney while preparing and executing a South Bend Indiana Warranty Deed from Corporation to Husband and Wife. This ensures that all legal requirements are met, and the transfer of property ownership is completed smoothly and accurately.