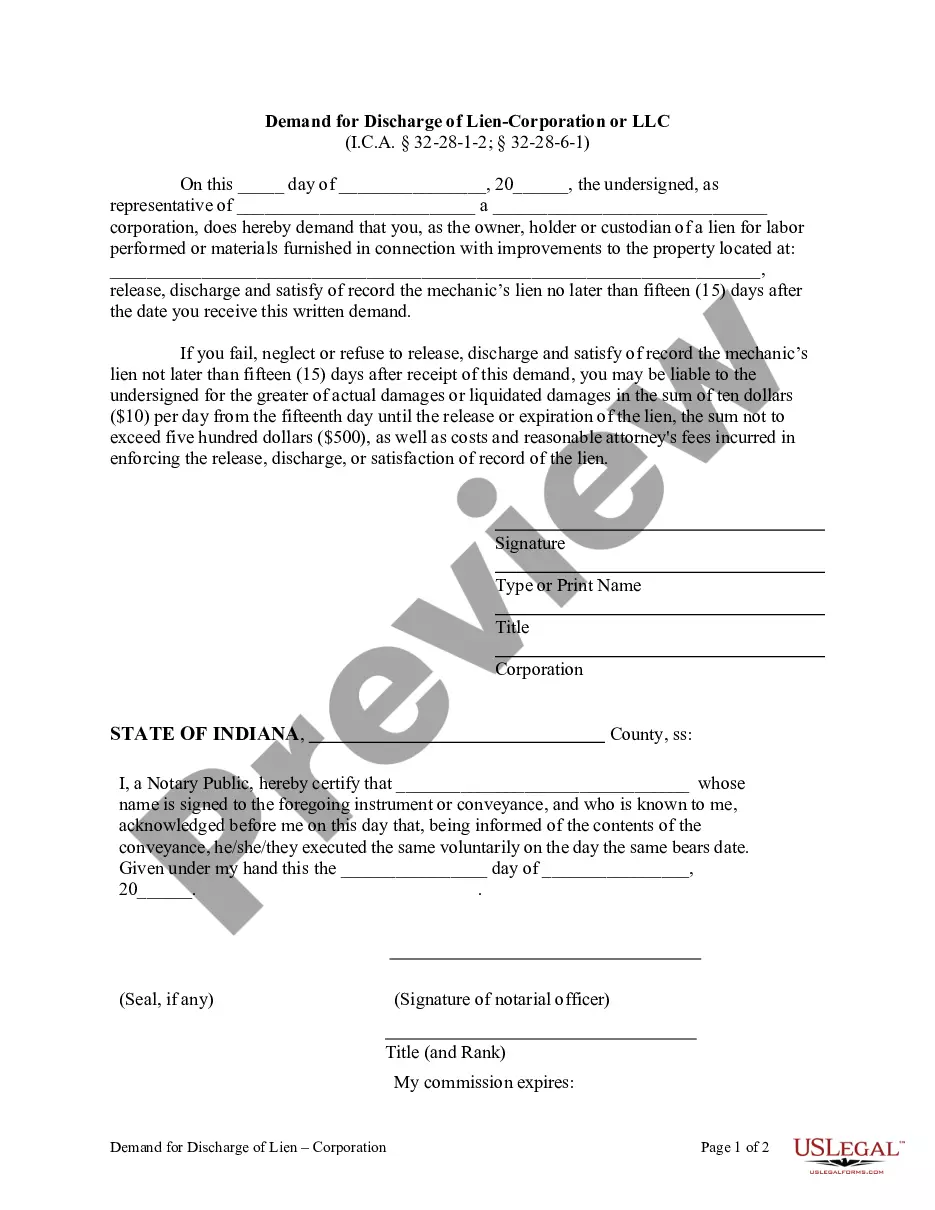

This Demand for Discharge of Lien is for use by a corporation to demand from an owner, holder or custodian of a lien for labor performed or materials furnished in connection with improvements to property to release, discharge and satisfy of record the mechanic's lien no later than 15 days after the date the demand is received.

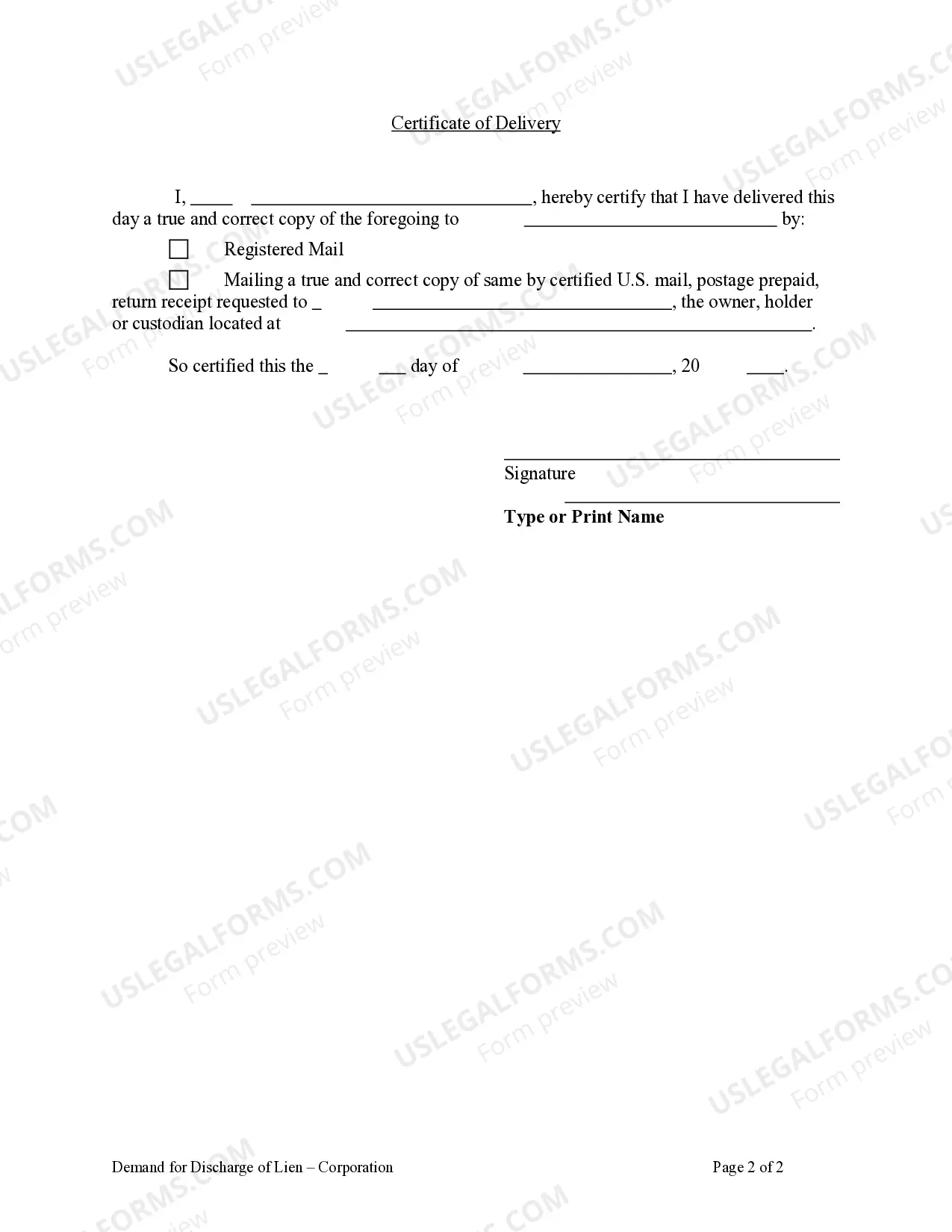

A Carmel Indiana Demand for Discharge of Lien is a legal document that corporations or limited liability companies (LCS) can utilize to resolve any outstanding liens on their property or assets. This document is specifically tailored for businesses operating in Carmel, Indiana, and adheres to the state's lien discharge requirements. There are various types of Carmel Indiana Demand for Discharge of Lien forms based on the specific circumstances of the lien. These may include: 1. Mechanics Lien Discharge for Corporations or LCS: This type of discharge is relevant when a contractor, subcontractor, or supplier files a lien against the business for unpaid work, materials, or services related to a construction or renovation project. The Carmel Indiana Demand for Discharge of Lien for mechanics' liens helps companies resolve these claims and remove any encumbrances on their property. 2. Judgment Lien Discharge for Corporations or LCS: If a corporation or LLC has a judgment lien filed against them due to a legal dispute, this type of discharge comes into play. The Carmel Indiana Demand for Discharge of Lien for judgment liens allows businesses to settle the matter and remove the encumbrance on their assets or properties. 3. Tax Lien Discharge for Corporations or LCS: When a business faces a tax lien imposed by the Internal Revenue Service (IRS) or the Indiana Department of Revenue, they can utilize the Carmel Indiana Demand for Discharge of Lien to address the issue. This discharge aims to resolve any outstanding tax debts and release the lien on the company's assets. 4. Mortgage Lien Discharge for Corporations or LCS: In case a corporation or LLC has a mortgage lien imposed on their property by a lender, they can employ the Carmel Indiana Demand for Discharge of Lien to resolve the lien and clear title to the property. These Carmel Indiana Demand for Discharge of Lien forms typically require the business to provide specific details, such as the nature of the lien, the lien holder's information, the date of the lien filing, and any relevant supporting documents. Additionally, the discharge document will require the authorized representative of the corporation or LLC to sign and submit an affidavit confirming the accuracy of the provided information. It is important to consult with legal professionals or use approved templates and forms specific to Carmel, Indiana, when handling a Demand for Discharge of Lien. Filing this document accurately and timely allows businesses to protect their assets, maintain a good standing, and resolve any legal issues related to liens.A Carmel Indiana Demand for Discharge of Lien is a legal document that corporations or limited liability companies (LCS) can utilize to resolve any outstanding liens on their property or assets. This document is specifically tailored for businesses operating in Carmel, Indiana, and adheres to the state's lien discharge requirements. There are various types of Carmel Indiana Demand for Discharge of Lien forms based on the specific circumstances of the lien. These may include: 1. Mechanics Lien Discharge for Corporations or LCS: This type of discharge is relevant when a contractor, subcontractor, or supplier files a lien against the business for unpaid work, materials, or services related to a construction or renovation project. The Carmel Indiana Demand for Discharge of Lien for mechanics' liens helps companies resolve these claims and remove any encumbrances on their property. 2. Judgment Lien Discharge for Corporations or LCS: If a corporation or LLC has a judgment lien filed against them due to a legal dispute, this type of discharge comes into play. The Carmel Indiana Demand for Discharge of Lien for judgment liens allows businesses to settle the matter and remove the encumbrance on their assets or properties. 3. Tax Lien Discharge for Corporations or LCS: When a business faces a tax lien imposed by the Internal Revenue Service (IRS) or the Indiana Department of Revenue, they can utilize the Carmel Indiana Demand for Discharge of Lien to address the issue. This discharge aims to resolve any outstanding tax debts and release the lien on the company's assets. 4. Mortgage Lien Discharge for Corporations or LCS: In case a corporation or LLC has a mortgage lien imposed on their property by a lender, they can employ the Carmel Indiana Demand for Discharge of Lien to resolve the lien and clear title to the property. These Carmel Indiana Demand for Discharge of Lien forms typically require the business to provide specific details, such as the nature of the lien, the lien holder's information, the date of the lien filing, and any relevant supporting documents. Additionally, the discharge document will require the authorized representative of the corporation or LLC to sign and submit an affidavit confirming the accuracy of the provided information. It is important to consult with legal professionals or use approved templates and forms specific to Carmel, Indiana, when handling a Demand for Discharge of Lien. Filing this document accurately and timely allows businesses to protect their assets, maintain a good standing, and resolve any legal issues related to liens.