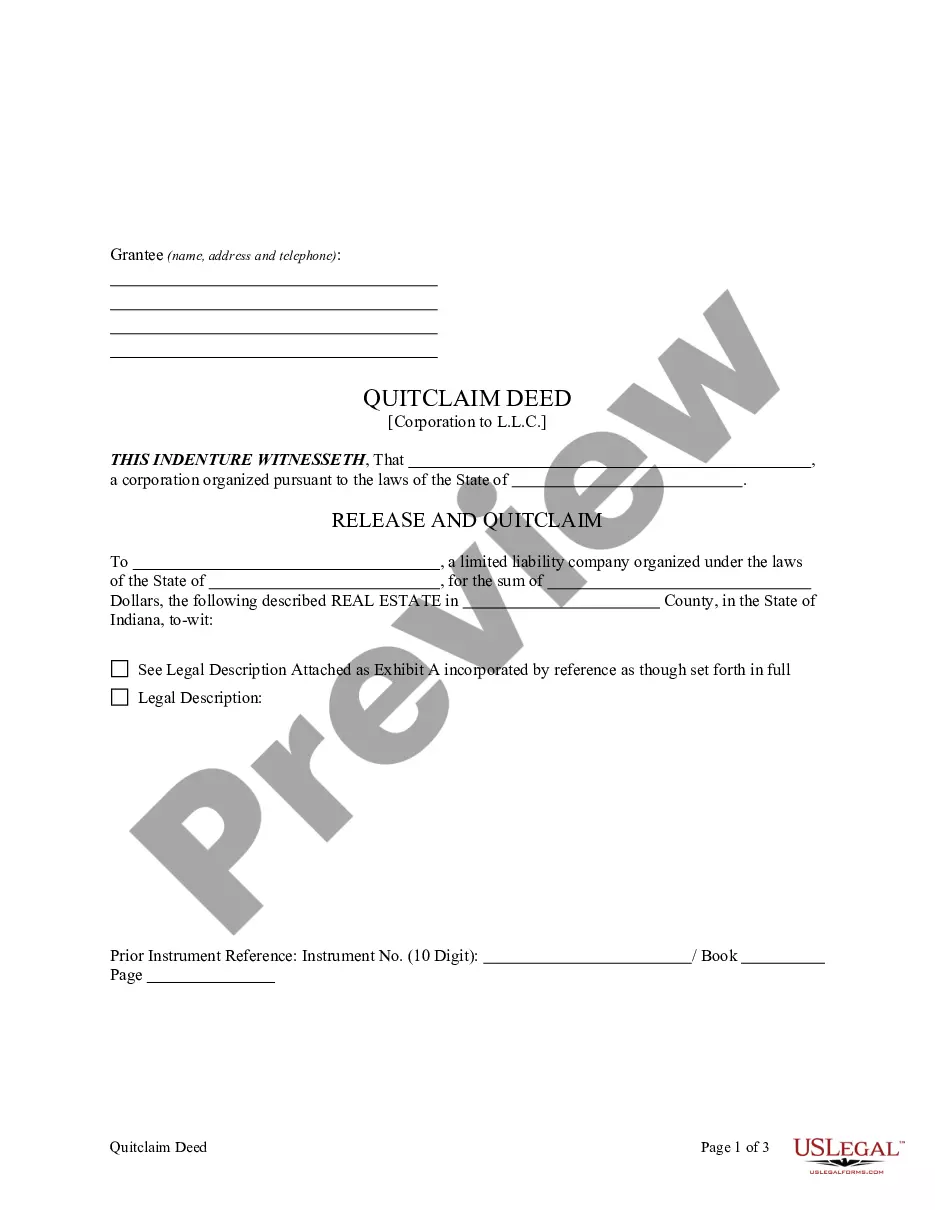

This form is a Quitclaim Deed where the grantor is a corporation and the grantee is a limited liability company. Upon ordering, you may download the form in Word, Rich Text or Wordperfect formats.

Carmel Indiana Quitclaim Deed from Corporation to LLC

Description

How to fill out Indiana Quitclaim Deed From Corporation To LLC?

If you’ve previously availed yourself of our service, Log In to your account and store the Carmel Indiana Quitclaim Deed from Corporation to LLC on your device by clicking the Download button. Ensure your subscription is current. If not, renew it based on your payment plan.

If this is your initial interaction with our service, follow these straightforward steps to obtain your document.

You have ongoing access to every document you have purchased: you can find it in your profile within the My documents section whenever you need to access it again. Take advantage of the US Legal Forms service to effortlessly locate and save any template for your personal or business needs!

- Verify you’ve selected the correct document. Review the description and utilize the Preview option, if available, to determine if it fulfills your requirements. If it doesn’t, use the Search tab above to discover the right one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and process a payment. Use your credit card information or the PayPal option to finalize the purchase.

- Acquire your Carmel Indiana Quitclaim Deed from Corporation to LLC. Select the file format for your document and save it to your device.

- Complete your document. Print it or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

A corporation conveys real estate by executing a deed, such as a Carmel Indiana Quitclaim Deed from Corporation to LLC. The corporation acts as the grantor, signing the deed to transfer property rights. This process typically involves board approval, ensuring the transaction aligns with corporate bylaws. By utilizing professional services like US Legal Forms, you can ensure all necessary documentation is properly prepared for the transfer.

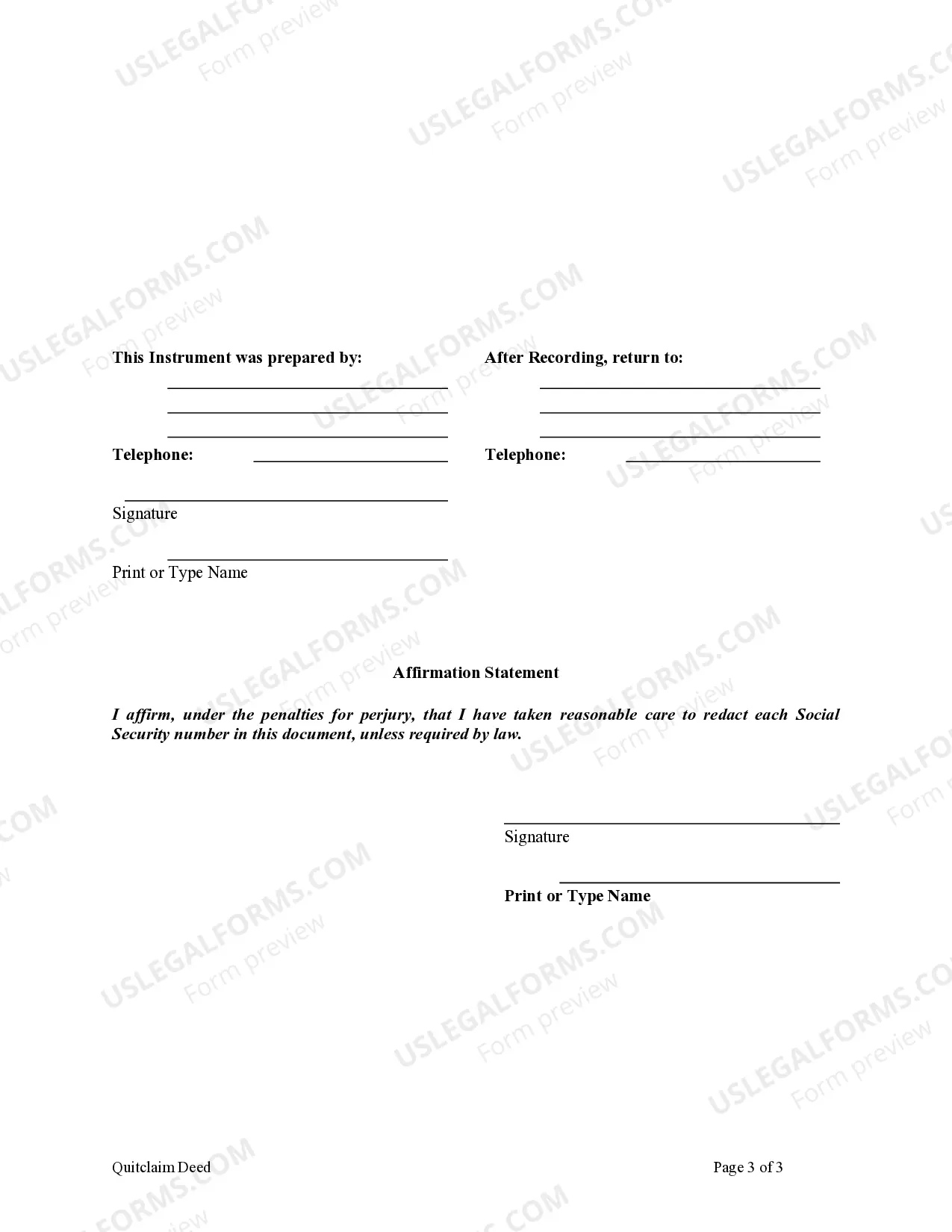

To file a Carmel Indiana Quitclaim Deed from Corporation to LLC, you must submit the document to the County Recorder’s office in the county where the property is located. This ensures that the deed is officially recorded and becomes part of the public record. Filing the deed correctly is essential to establish clear ownership and protect the rights of the LLC. Always check local requirements to ensure compliance with state laws.

In the context of a Carmel Indiana Quitclaim Deed from Corporation to LLC, the grantor is the party that signs the deed. The grantor transfers the property interest to the grantee, which in this case is the LLC. It's vital for the grantor to ensure all legal documents are properly executed to avoid any future disputes. Thus, understanding the roles of each party is crucial when transferring property.

A quitclaim deed can be drawn up by an individual familiar with property law, but working with a qualified attorney is recommended for accuracy. Title companies can also assist in drafting these documents, ensuring compliance with local laws. For a Carmel Indiana Quitclaim Deed from Corporation to LLC, accessing services from a platform like US Legal Forms can help you navigate the process effectively.

In Indiana, a quitclaim deed can be prepared by anyone with knowledge of the relevant laws, although it is best to work with a lawyer or real estate professional. This ensures that the deed meets all legal requirements for the transfer process. When dealing with a Carmel Indiana Quitclaim Deed from Corporation to LLC, leveraging the support of a professional can save you time and potential legal headaches.

Yes, you can prepare your own quit claim deed in Indiana. However, it is advisable to ensure all necessary legal requirements are met, as incorrect information can lead to complications. To assist with creating a Carmel Indiana Quitclaim Deed from Corporation to LLC, you might find templates and guidelines useful. Platforms like US Legal Forms offer resources to help you get it right.

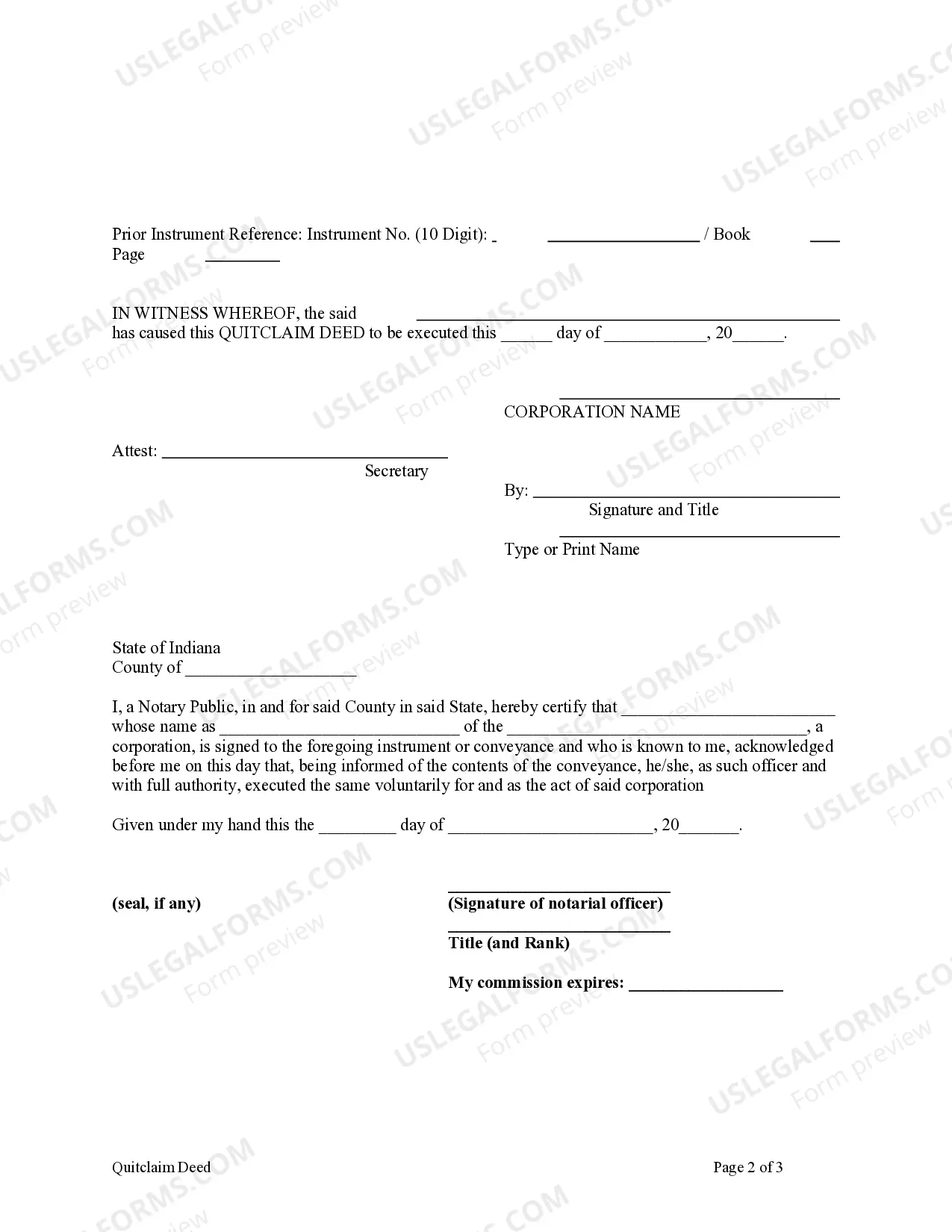

Transferring property to an LLC in Indiana requires drafting a quitclaim deed that names the LLC as the new owner. You will need to provide property details, sign, and notarize the deed. It’s important to retain copies for both your records and the LLC’s. For a smooth experience with the Carmel Indiana Quitclaim Deed from Corporation to LLC, using resources provided by US Legal Forms can simplify the process.

In Indiana, a deed can be prepared by various individuals, including an attorney or a title company, which has experience with real estate transactions. While you can also draft your own deed, it's often more effective to work with professionals. This ensures that your specific needs are met, especially when dealing with a Carmel Indiana Quitclaim Deed from Corporation to LLC. Consider using US Legal Forms to find pre-made templates for your convenience.

To transfer deeds to an LLC, you must complete a quitclaim deed. This document transfers ownership of property from the seller, which can be a corporation, to the LLC. After preparing the quitclaim deed, you will need to sign it and have it notarized before recording it with the county recorder's office. This process ensures that the Carmel Indiana Quitclaim Deed from Corporation to LLC is legally binding.

To put your property into an LLC, you first need to create the LLC and obtain an EIN from the IRS. After that, transferring the property involves signing a quit claim deed to officially designate the LLC as the new owner. For assistance, consider using US Legal Forms to generate your Carmel Indiana Quitclaim Deed from Corporation to LLC efficiently and correctly.