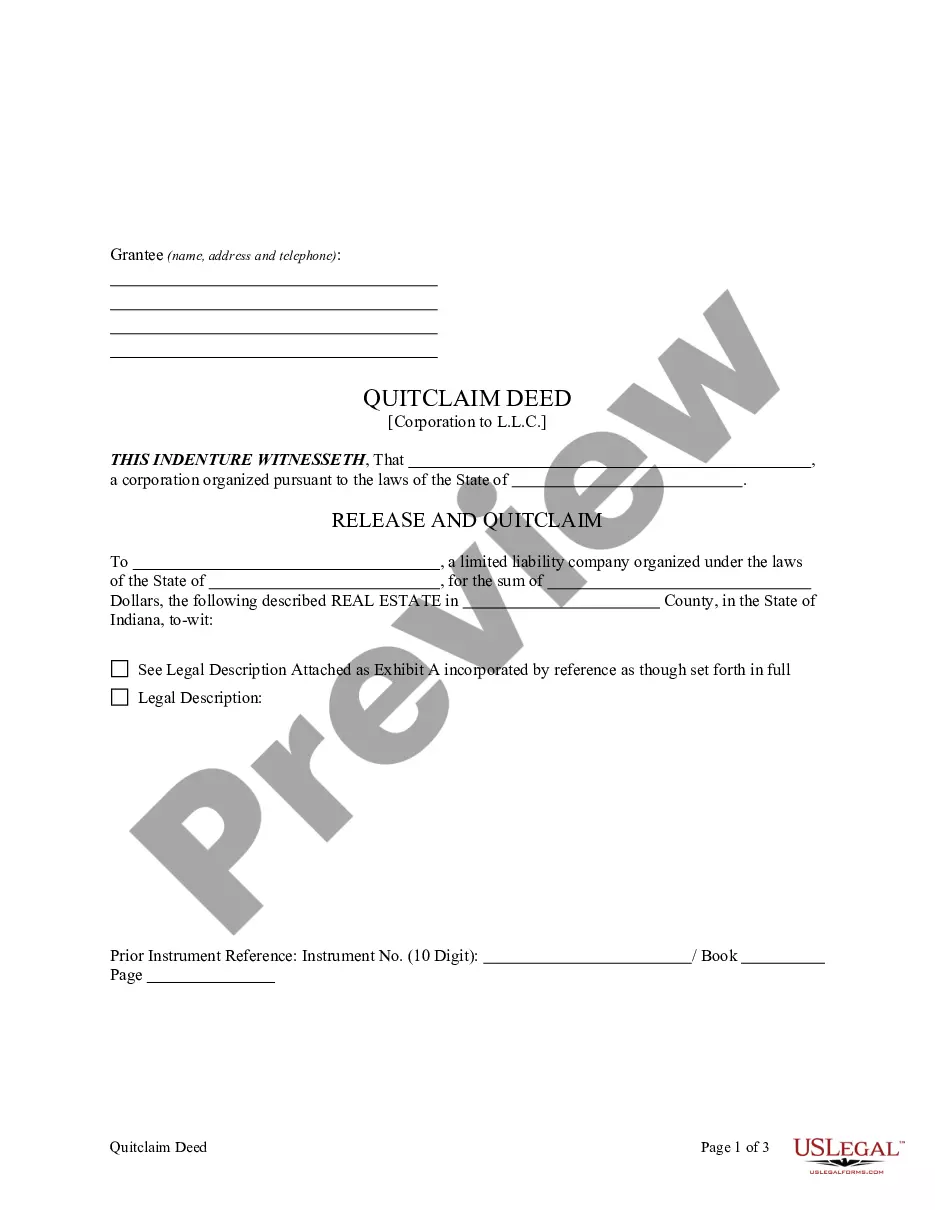

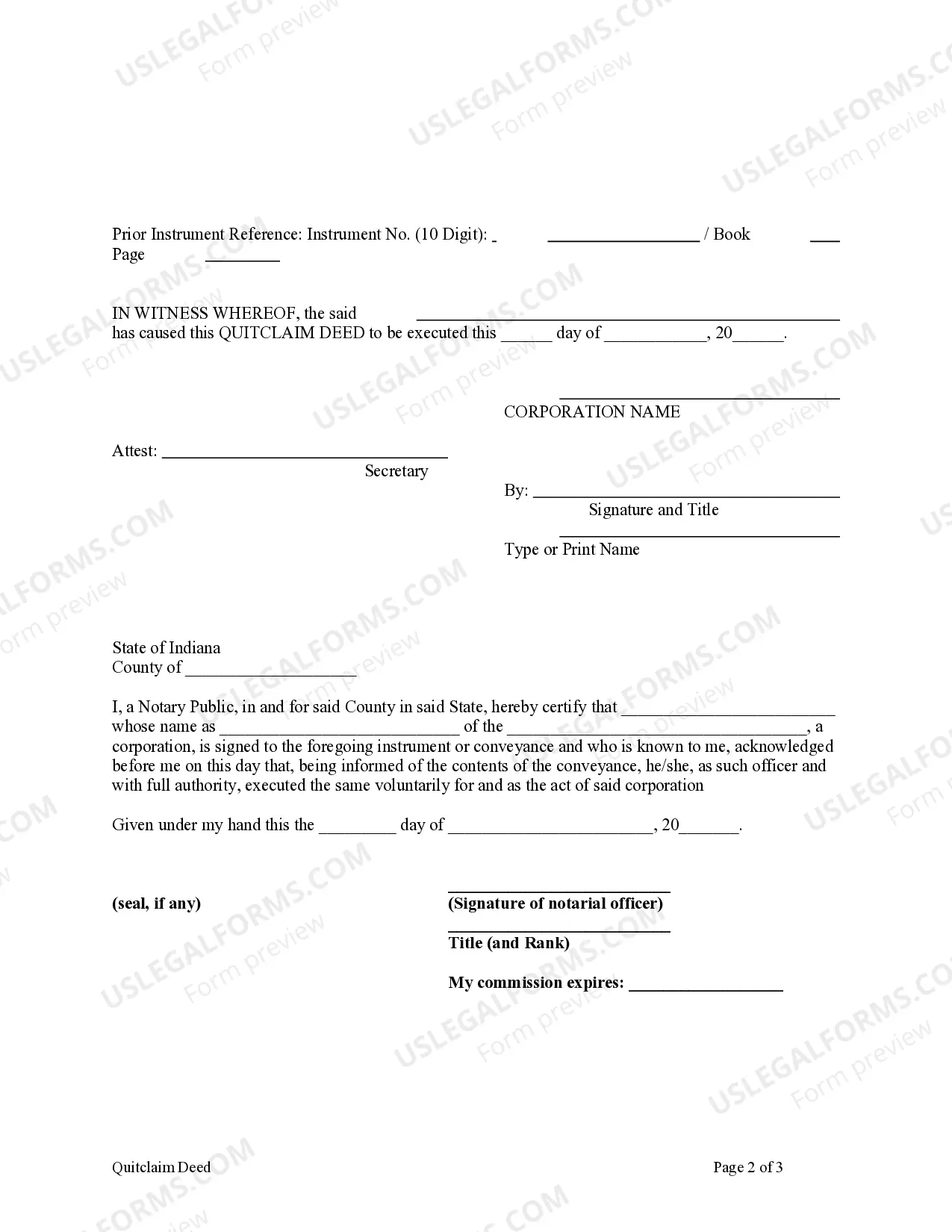

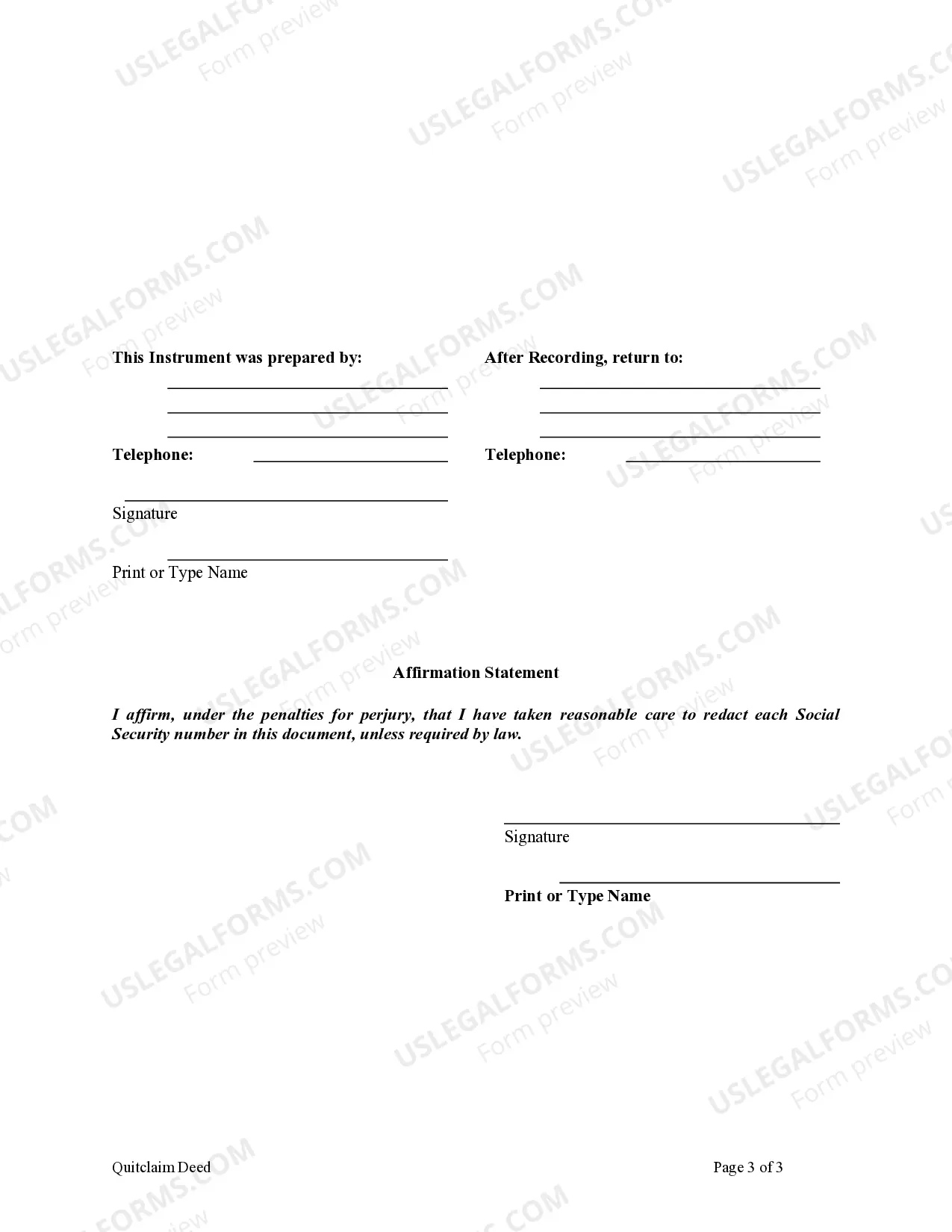

This form is a Quitclaim Deed where the grantor is a corporation and the grantee is a limited liability company. Upon ordering, you may download the form in Word, Rich Text or Wordperfect formats.

A South Bend Indiana Quitclaim Deed from Corporation to LLC is a legal document used to transfer ownership of property from a corporation to a limited liability company (LLC) in South Bend, Indiana. This type of deed serves as a means of conveying property without any warranties or guarantees of ownership or title from the corporation to the LLC. The South Bend Indiana Quitclaim Deed allows the corporation to release any claim it may possess over the property and transfers its interest to the LLC. This transaction is often carried out when a corporation decides to restructure its ownership or when it wants to transfer its property to a newly formed LLC for various reasons. It is crucial to note that a Quitclaim Deed does not provide as much legal protection as a warranty deed, as it only transfers the interest the corporation has in the property at the time of the transfer. There may be different variations or subtypes of South Bend Indiana Quitclaim Deed from Corporation to LLC, depending on specific circumstances or requirements. For example: 1. Voluntary Transfer Quitclaim Deed: This type of quitclaim deed is typically used when a corporation voluntarily chooses to transfer its property to an LLC. It signifies a consensual agreement between the corporation and the LLC, ensuring a smooth transfer of ownership. 2. Dissolution Transition Quitclaim Deed: If a corporation is dissolving or merging with an LLC, a Dissolution Transition Quitclaim Deed may be used. This type of quitclaim deed facilitates the transfer of the corporation's property to the LLC as part of the dissolution process. 3. Succession Planning Quitclaim Deed: When a corporation plans for its long-term future and wishes to transfer property to an LLC for management or succession purposes, a Succession Planning Quitclaim Deed can be utilized. This ensures a smooth transition of ownership and continuity in managing the property. 4. Asset Protection Quitclaim Deed: Sometimes, a corporation may choose to transfer property to an LLC to shield or protect the asset from potential risks or legal liabilities. An Asset Protection Quitclaim Deed is used in such circumstances, offering an added layer of security to safeguard the property. In summary, a South Bend Indiana Quitclaim Deed from Corporation to LLC is an essential legal instrument that allows for the transfer of property ownership from a corporation to an LLC. Whether it's a voluntary transfer, a dissolution transition, succession planning, or asset protection, these various types of quitclaim deeds help facilitate property transfers in South Bend, Indiana. It is advisable to consult with legal professionals to ensure compliance with local laws and regulations when executing such deeds.A South Bend Indiana Quitclaim Deed from Corporation to LLC is a legal document used to transfer ownership of property from a corporation to a limited liability company (LLC) in South Bend, Indiana. This type of deed serves as a means of conveying property without any warranties or guarantees of ownership or title from the corporation to the LLC. The South Bend Indiana Quitclaim Deed allows the corporation to release any claim it may possess over the property and transfers its interest to the LLC. This transaction is often carried out when a corporation decides to restructure its ownership or when it wants to transfer its property to a newly formed LLC for various reasons. It is crucial to note that a Quitclaim Deed does not provide as much legal protection as a warranty deed, as it only transfers the interest the corporation has in the property at the time of the transfer. There may be different variations or subtypes of South Bend Indiana Quitclaim Deed from Corporation to LLC, depending on specific circumstances or requirements. For example: 1. Voluntary Transfer Quitclaim Deed: This type of quitclaim deed is typically used when a corporation voluntarily chooses to transfer its property to an LLC. It signifies a consensual agreement between the corporation and the LLC, ensuring a smooth transfer of ownership. 2. Dissolution Transition Quitclaim Deed: If a corporation is dissolving or merging with an LLC, a Dissolution Transition Quitclaim Deed may be used. This type of quitclaim deed facilitates the transfer of the corporation's property to the LLC as part of the dissolution process. 3. Succession Planning Quitclaim Deed: When a corporation plans for its long-term future and wishes to transfer property to an LLC for management or succession purposes, a Succession Planning Quitclaim Deed can be utilized. This ensures a smooth transition of ownership and continuity in managing the property. 4. Asset Protection Quitclaim Deed: Sometimes, a corporation may choose to transfer property to an LLC to shield or protect the asset from potential risks or legal liabilities. An Asset Protection Quitclaim Deed is used in such circumstances, offering an added layer of security to safeguard the property. In summary, a South Bend Indiana Quitclaim Deed from Corporation to LLC is an essential legal instrument that allows for the transfer of property ownership from a corporation to an LLC. Whether it's a voluntary transfer, a dissolution transition, succession planning, or asset protection, these various types of quitclaim deeds help facilitate property transfers in South Bend, Indiana. It is advisable to consult with legal professionals to ensure compliance with local laws and regulations when executing such deeds.