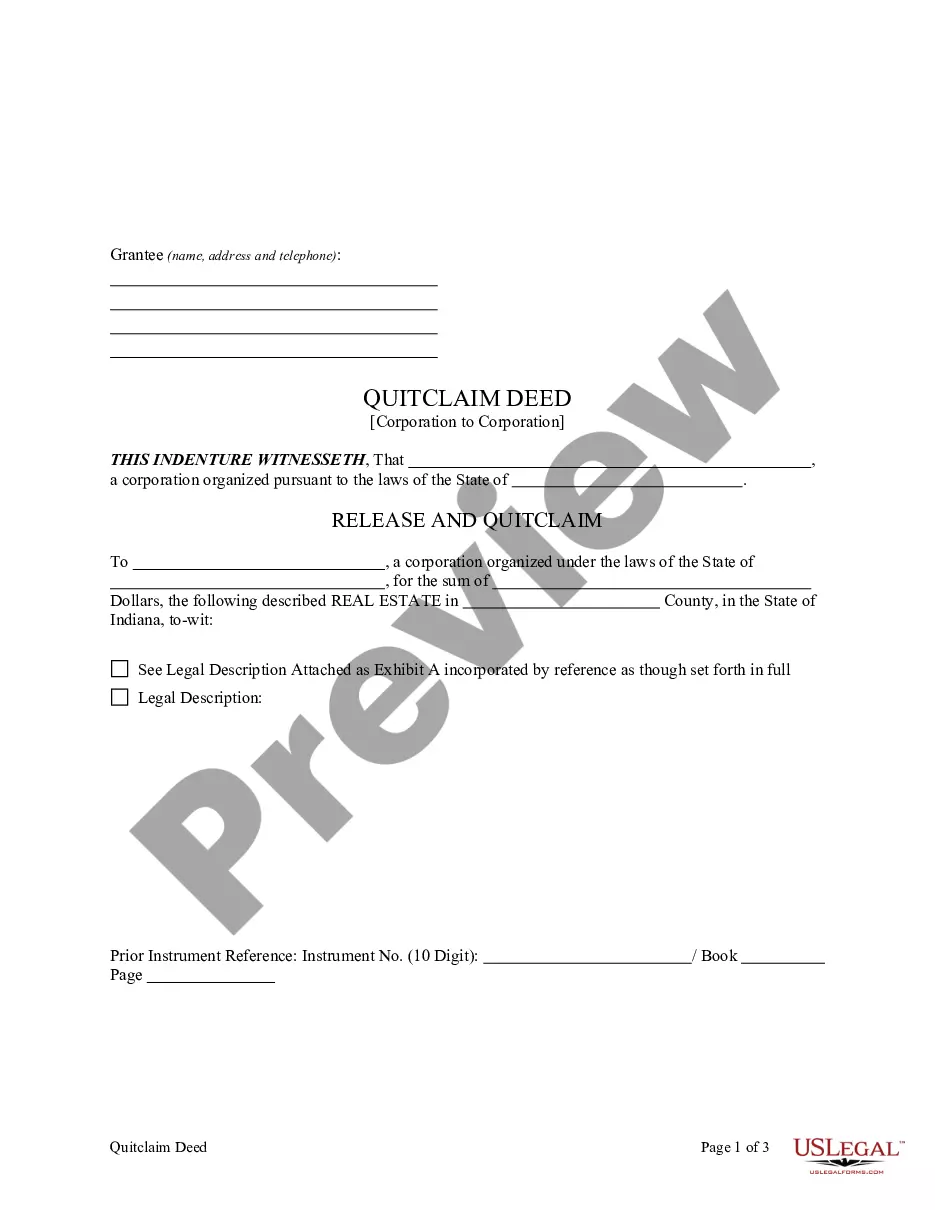

This form is a Quitclaim Deed where the grantor is a corporation and the grantee is a corporation. Upon ordering, you may download the form in Word, Rich Text or Wordperfect formats.

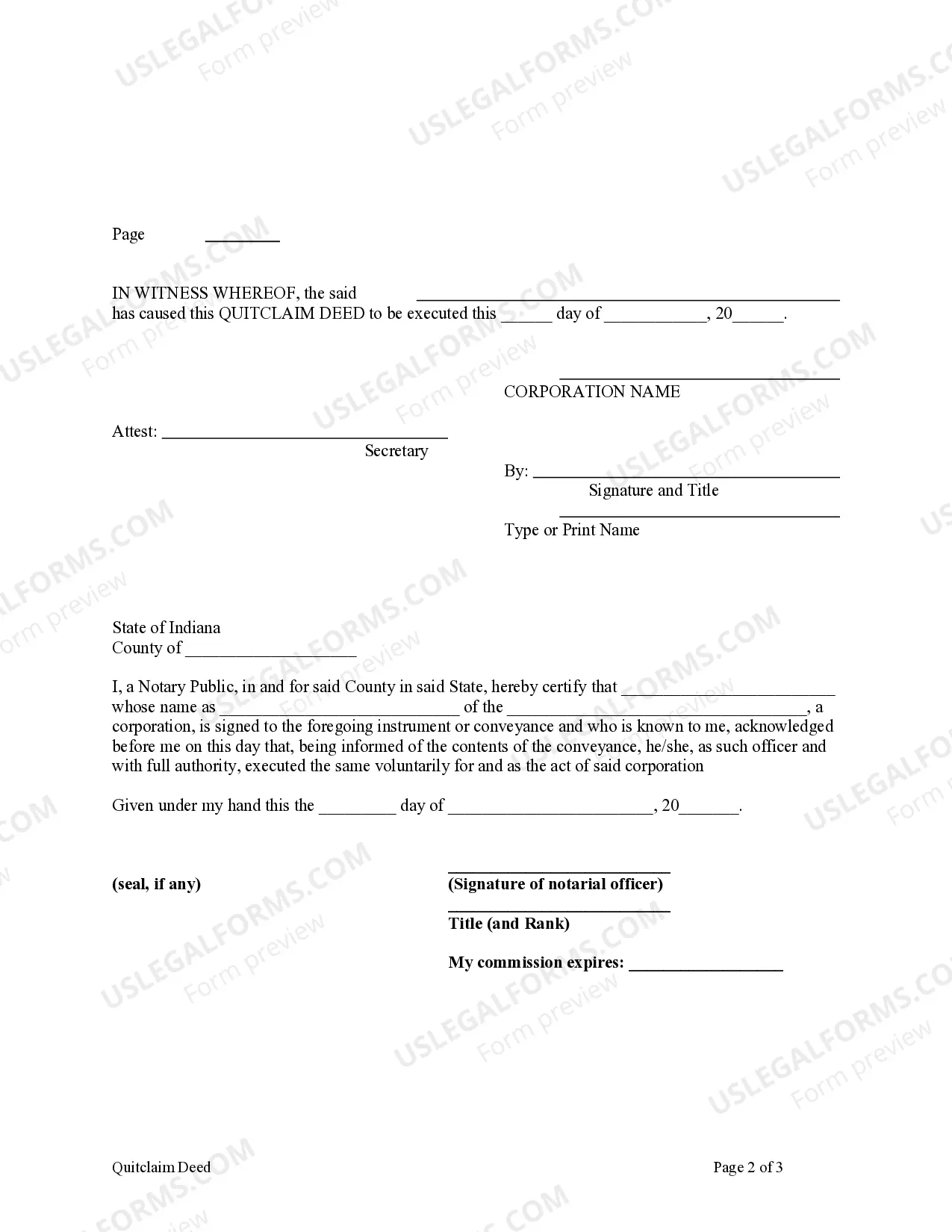

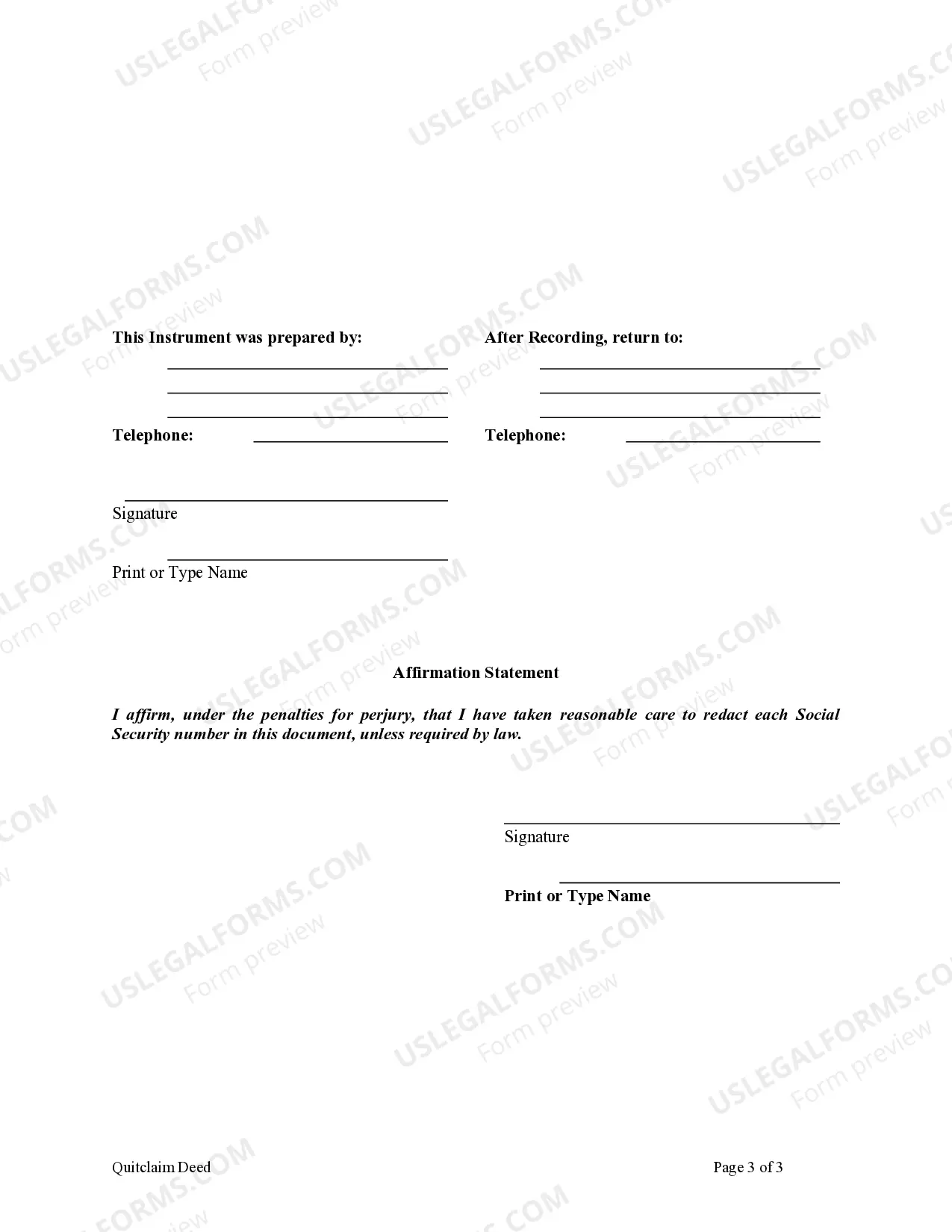

A Quitclaim Deed from Corporation to Corporation in Indianapolis, Indiana is a legal document used to transfer interest or ownership of real property from one corporation to another corporation. This type of deed is commonly used when there is a change of ownership within a corporation, such as in the case of a merger, acquisition, or restructuring. Keywords: Quitclaim Deed, Corporation to Corporation, Indianapolis Indiana, real property, transfer, ownership, change of ownership, merger, acquisition, restructuring. There are no specific types of Quitclaim Deeds from Corporation to Corporation in Indianapolis, Indiana. However, there may be slight variations in the language and format of the deed depending on the specific circumstances of the transfer. For example, if the transfer involves multiple parcels of land or if there are specific conditions or restrictions associated with the transfer, the deed may include additional clauses or provisions to address these factors. Regardless of any potential variations, a typical Quitclaim Deed from Corporation to Corporation will include certain essential information and elements. These include: 1. Parties: The names and addresses of both the granter (the corporation transferring the property) and the grantee (the corporation receiving the property) will be clearly stated in the deed. 2. Property Description: A detailed and accurate description of the property being transferred will be included in the deed. This may include the legal description, such as the lot and block number, as well as the address and other identifying information. 3. Consideration: The quitclaim deed may state the consideration or payment exchanged for the transfer of the property, although it is not always required for a quitclaim deed. 4. Signature: The deed must be signed by the authorized representative(s) of the granter corporation and notarized to make it legally binding. 5. Execution: The deed should include a section stating the date of execution, indicating when the transfer is effective. 6. Recording: It is important to record the quitclaim deed with the county recorder's office in Indianapolis, Indiana. This will provide a public record of the transfer and ensure its validity and priority. It is advisable to consult with an attorney or a real estate professional to draft and review the Quitclaim Deed from Corporation to Corporation in Indianapolis, Indiana. They can provide guidance and ensure that the deed conforms to all relevant legal requirements and accurately reflects the intentions of both parties involved in the transfer.A Quitclaim Deed from Corporation to Corporation in Indianapolis, Indiana is a legal document used to transfer interest or ownership of real property from one corporation to another corporation. This type of deed is commonly used when there is a change of ownership within a corporation, such as in the case of a merger, acquisition, or restructuring. Keywords: Quitclaim Deed, Corporation to Corporation, Indianapolis Indiana, real property, transfer, ownership, change of ownership, merger, acquisition, restructuring. There are no specific types of Quitclaim Deeds from Corporation to Corporation in Indianapolis, Indiana. However, there may be slight variations in the language and format of the deed depending on the specific circumstances of the transfer. For example, if the transfer involves multiple parcels of land or if there are specific conditions or restrictions associated with the transfer, the deed may include additional clauses or provisions to address these factors. Regardless of any potential variations, a typical Quitclaim Deed from Corporation to Corporation will include certain essential information and elements. These include: 1. Parties: The names and addresses of both the granter (the corporation transferring the property) and the grantee (the corporation receiving the property) will be clearly stated in the deed. 2. Property Description: A detailed and accurate description of the property being transferred will be included in the deed. This may include the legal description, such as the lot and block number, as well as the address and other identifying information. 3. Consideration: The quitclaim deed may state the consideration or payment exchanged for the transfer of the property, although it is not always required for a quitclaim deed. 4. Signature: The deed must be signed by the authorized representative(s) of the granter corporation and notarized to make it legally binding. 5. Execution: The deed should include a section stating the date of execution, indicating when the transfer is effective. 6. Recording: It is important to record the quitclaim deed with the county recorder's office in Indianapolis, Indiana. This will provide a public record of the transfer and ensure its validity and priority. It is advisable to consult with an attorney or a real estate professional to draft and review the Quitclaim Deed from Corporation to Corporation in Indianapolis, Indiana. They can provide guidance and ensure that the deed conforms to all relevant legal requirements and accurately reflects the intentions of both parties involved in the transfer.