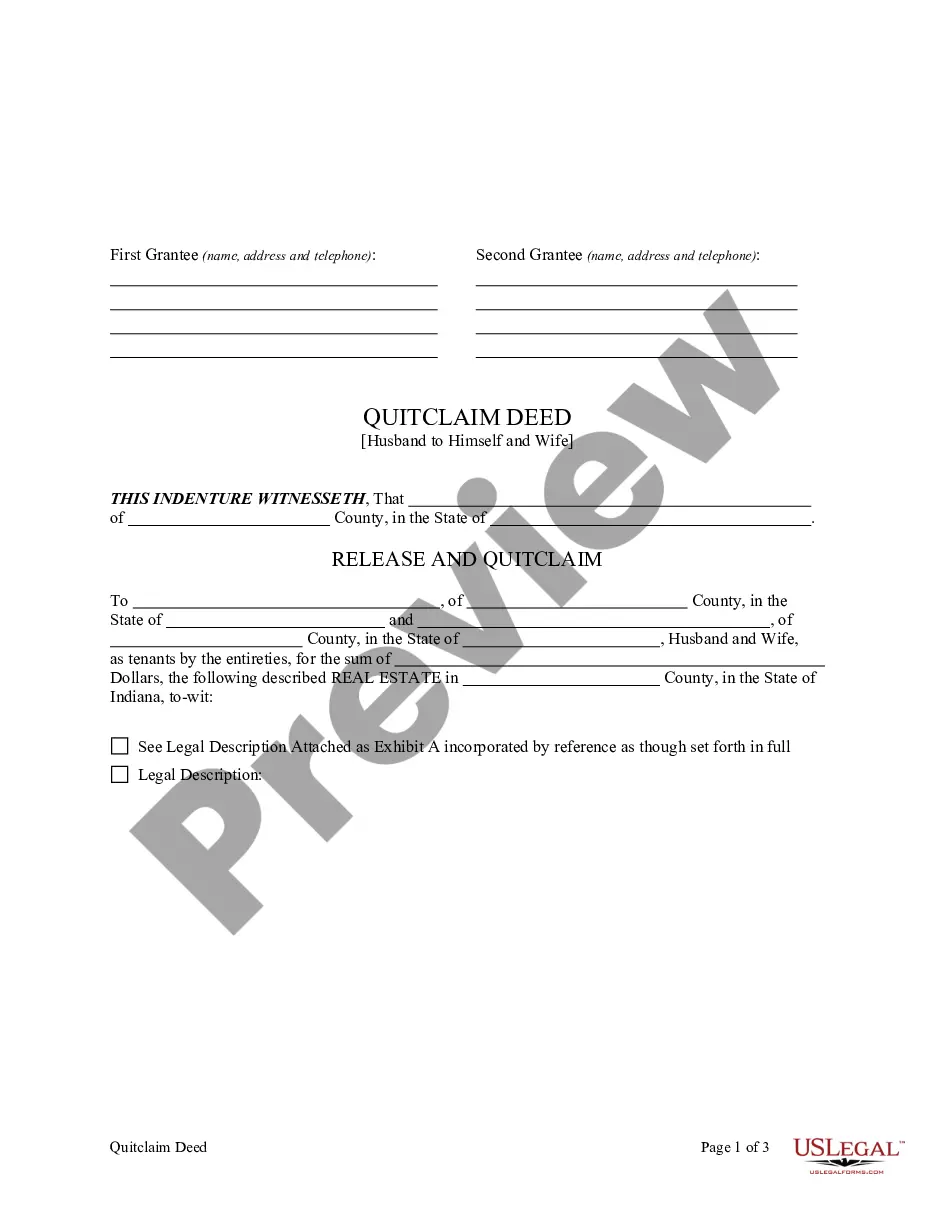

This form is a Quitclaim Deed where the grantor is the husband and the grantees are the husband and his wife. Upon ordering, you may download the form in Word, Rich Text or Wordperfect formats.

Indianapolis Indiana Quitclaim Deed from Husband to Himself and Wife

Description

How to fill out Indiana Quitclaim Deed From Husband To Himself And Wife?

Utilize the US Legal Forms to gain instantaneous access to any template you desire.

Our user-friendly website with an extensive collection of documents enables you to locate and acquire nearly any document sample you seek.

You can download, complete, and sign the Indianapolis Indiana Quitclaim Deed from Husband to Himself and Wife within minutes rather than spending hours online searching for the appropriate template.

Using our directory is an excellent method to enhance the security of your document submission.

If you have not yet created a profile, follow the instructions below.

Locate the form you need. Ensure that it is the form you intended to find: review its title and description, and utilize the Preview feature if available. If not, use the Search bar to find the right one.

- Our qualified attorneys frequently evaluate all files to ensure that the templates are pertinent to a specific state and adhere to current laws and regulations.

- How can you acquire the Indianapolis Indiana Quitclaim Deed from Husband to Himself and Wife.

- If you already possess a profile, simply Log In to your account. The Download button will be activated on all the samples you explore. Additionally, you can access all previously saved documents in the My documents section.

Form popularity

FAQ

How to transfer property ownership Identify the donee or recipient. Discuss terms and conditions with that person. Complete a change of ownership form. Change the title on the deed. Hire a real estate attorney to prepare the deed. Notarize and file the deed.

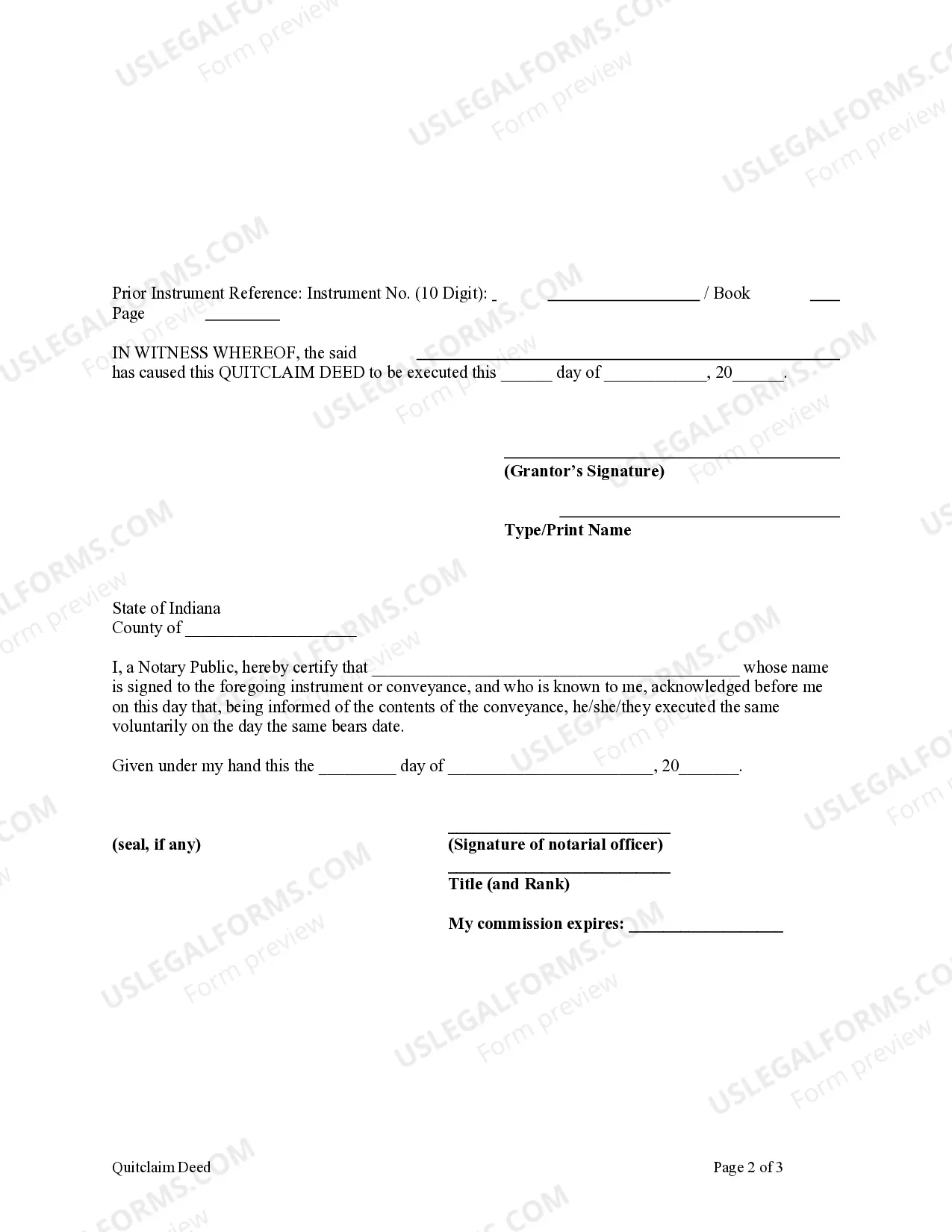

The person who owns the property signs the Quitclaim Deed stating who will now have legal title to the property. The Quitclaim Deed must be notarized, and then recorded at the County Recorder's office.

If you've recently married and already own a home or other real estate, you may want to add your new spouse to the deed for your property so the two of you own it jointly. To add a spouse to a deed, all you have to do is literally fill out, sign and record a new deed in your county recorder's office.

One good reason to add a spouse to the deed of your home is for estate planning purposes, which may allow the property to transfer to your spouse outside the probate process, depending on the transfer language utilized in the granting clause. Another reason is for creditor purposes.

The Indiana quit claim deed form gives the new owner whatever interest the current owner has in the property when the deed is signed and delivered. It makes no promises about whether the current owner has clear title to the property.

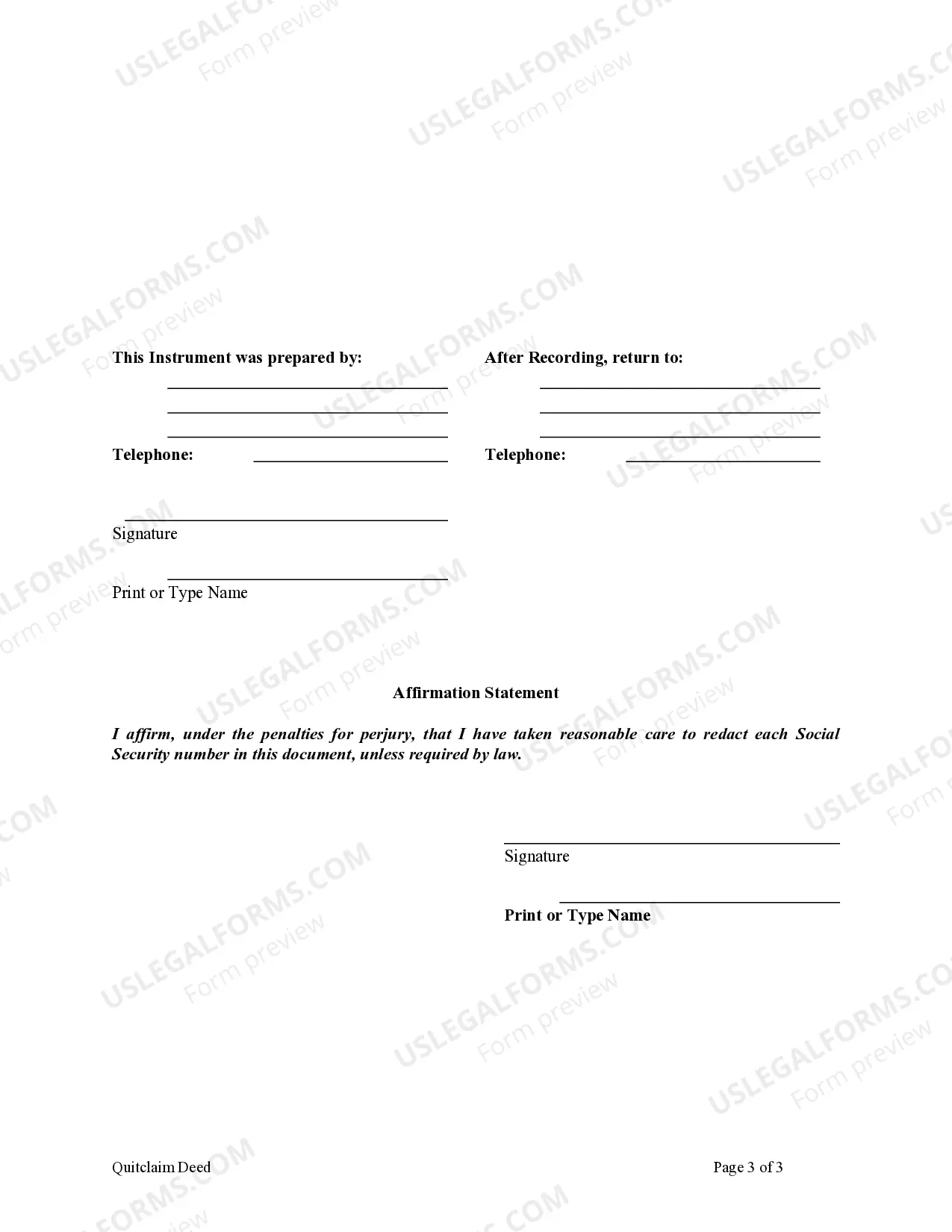

You will need to have the quitclaim deed notarized with the signatures of you and your spouse. Once this is done, the quitclaim deed replaces your former deed and the property officially is in both of your names. You must record the deed at your county office.

We recommend you consult with an experienced real estate lawyer for professional advice as each circumstance is unique. (Please note, the fee for our office to add someone to your deed is $650.00, plus recording costs and documentary stamps ? recordings costs are normally less than $50.00.)

Transfer on Death Deed Form ? A popular deed form that is specifically authorized by Indiana law to transfer property to designated beneficiaries upon the death of an owner....How to Transfer Indiana Real Estate Locate the prior deed to the property.Create the new deed.Sign the new deed.Record the original deed.

Submit your document Marion County Assessor: $10.00 per parcel per document; AND $20.00 for each Sales Disclosure, if required. Marion County Recorder: $35.00 per document. The Assessor is responsible for transferring property in Marion County. The transfer stamp from their office is required before it can be recorded.

To change the names on a real estate deed, you will need to file a new deed with the Division of Land Records in the Circuit Court for the county where the property is located. The clerk will record the new deed.