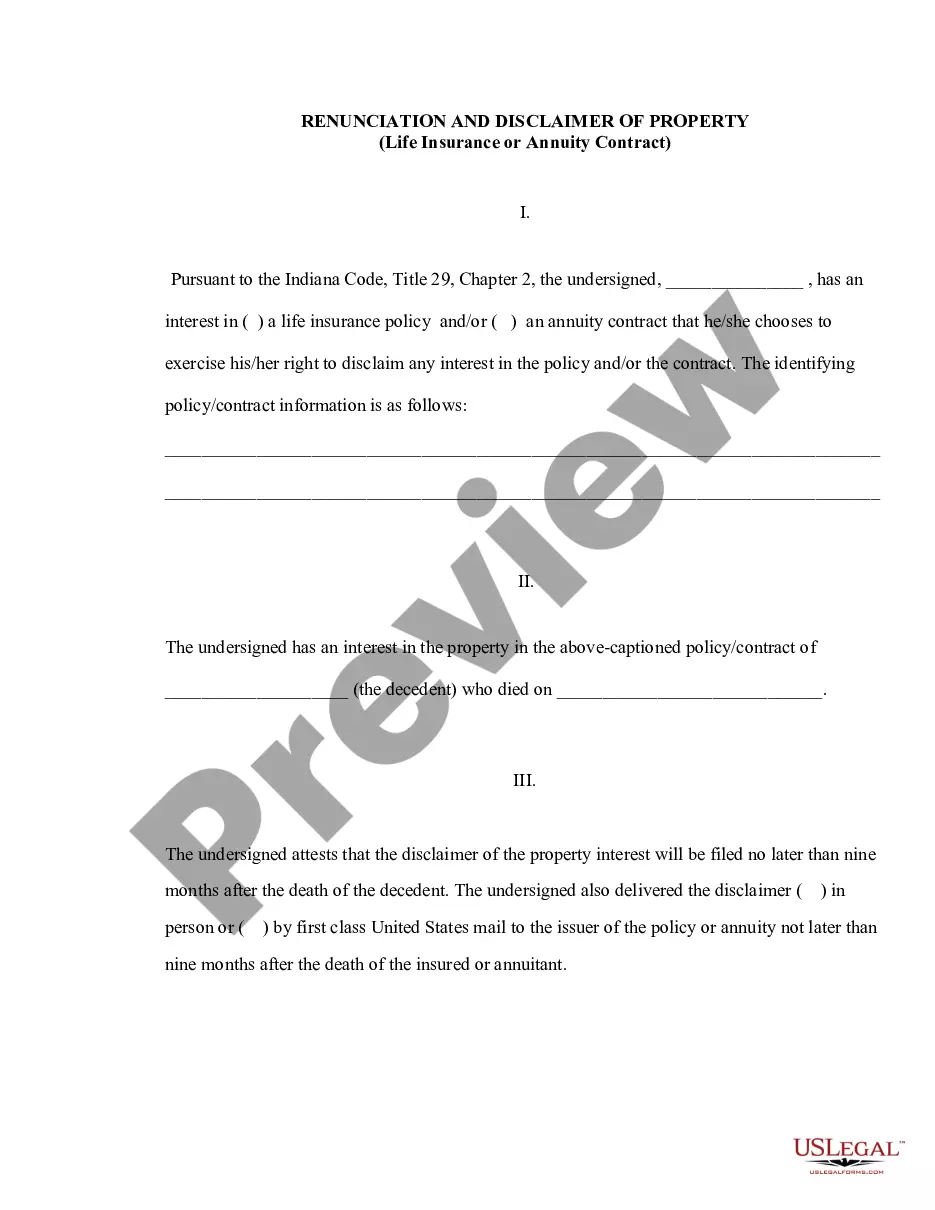

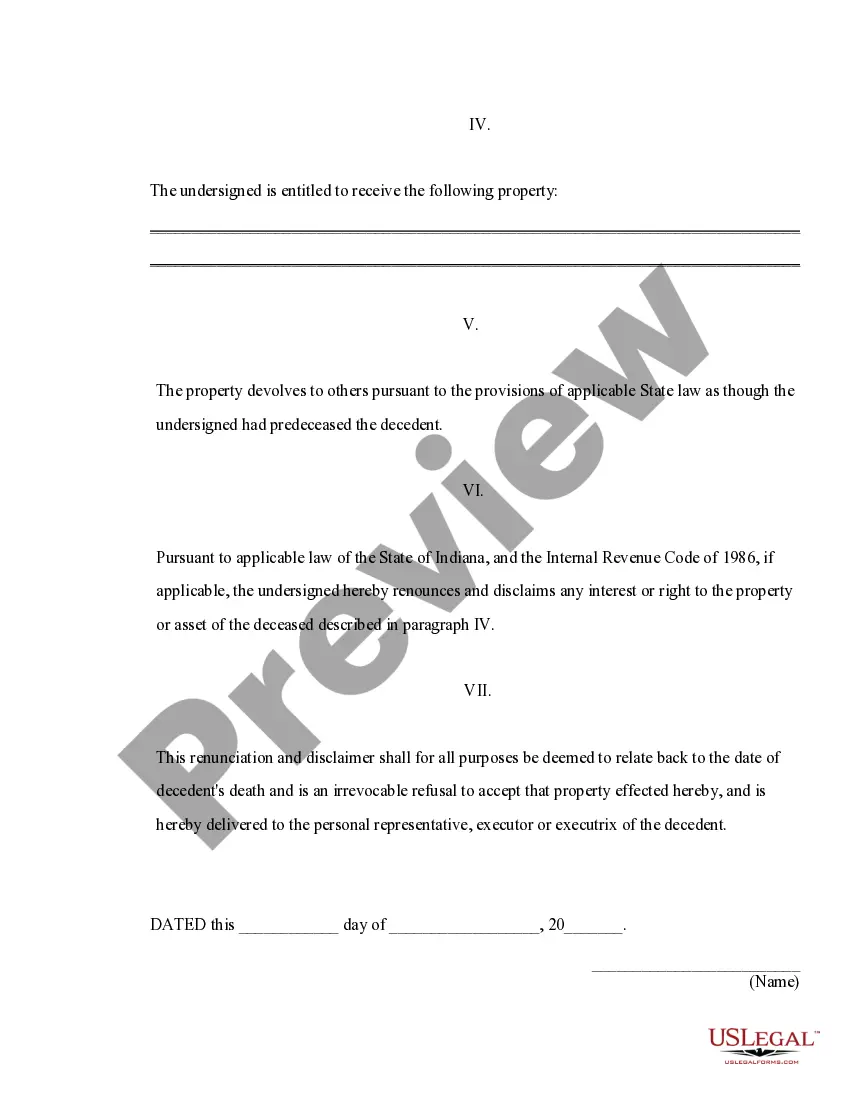

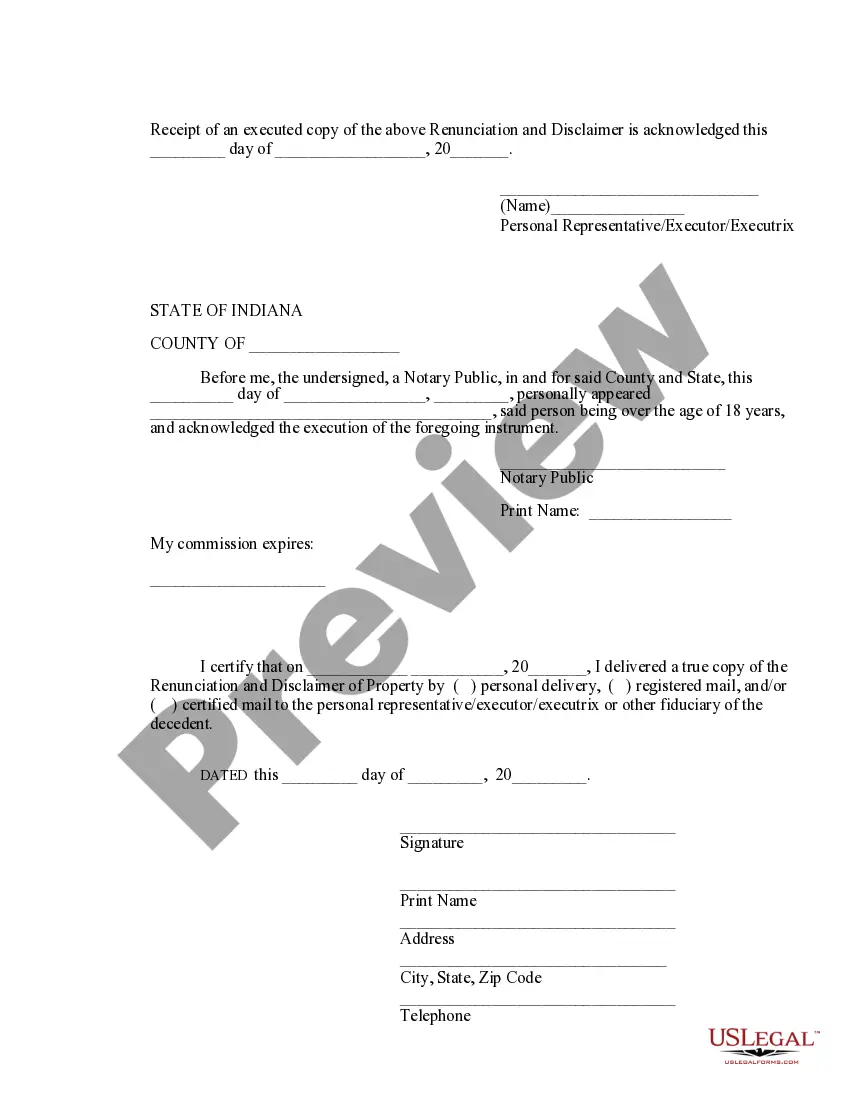

This form is a Renunciation and Disclaimer of a Life Insurance Policy and/or Annuity Contract proceeds. Upon the death of the decedent, the beneficiary gained an interest in the proceeds of the decedent's policy and/or contract. Pursuant to the Indiana Code, Title 29, Chapter 2, the beneficiary has chosen to disclaim his/her interest in the proceeds. The renunciation will relate back to the date of death of the decedent and will serve as an irrevocable refusal to accept the proceeds. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Evansville Indiana Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract When it comes to dealing with life insurance or annuity contracts in Evansville, Indiana, individuals may encounter situations where they need to renounce or disclaim their property rights. Renunciation and disclaimer of property enable individuals to legally decline their interest in the assets or benefits derived from these contracts. A renunciation or disclaimer can occur for various reasons, such as avoiding tax liabilities, relieving oneself from financial obligations, or redirecting the assets to other beneficiaries. It is important to understand the different types of renunciation and disclaimer options available in Evansville, Indiana, in order to make informed decisions. 1. Partial Renunciation/Disclaimer: This type of renunciation or disclaimer involves relinquishing only a portion of the property rights associated with a life insurance or annuity contract. Individuals may choose this option if they wish to retain some benefits while disclaiming others. 2. Full Renunciation/Disclaimer: In a full renunciation or disclaimer, individuals completely relinquish all property rights and benefits derived from the life insurance or annuity contract. This option is typically selected when an individual wants to completely disassociate from the contract and any associated obligations. 3. Conditional Renunciation/Disclaimer: Conditional renunciation or disclaimer allows individuals to renounce or disclaim their rights to the property but under certain predetermined conditions. For example, one may specify that the renunciation will only take effect if another beneficiary does not survive or meet certain criteria. 4. Inter Vivos Renunciation/Disclaimer: Inter Vivos renunciation or disclaimer occurs during the lifetime of the individual who chooses to renounce or disclaim their property rights. This type of renunciation is typically done through a legal document and requires the individual's consent. 5. Testamentary Renunciation/Disclaimer: A testamentary renunciation or disclaimer occurs following the death of an individual who has bequeathed property through a life insurance or annuity contract. The renunciation or disclaimer is made by the potential beneficiary mentioned in the will or contract. In Evansville, Indiana, engaging in a renunciation or disclaimer of property from a life insurance or annuity contract requires adhering to specific legal procedures. It is crucial to consult with a qualified legal professional who specializes in estate planning, contract law, and tax consequences to ensure compliance with applicable regulations and avoid any unintended consequences. Important keywords: Evansville Indiana, Renunciation, Disclaimer, Property, Life Insurance, Annuity Contract, Partial Renunciation, Full Renunciation, Conditional Renunciation, Inter Vivos Renunciation, Testamentary Renunciation.Evansville Indiana Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract When it comes to dealing with life insurance or annuity contracts in Evansville, Indiana, individuals may encounter situations where they need to renounce or disclaim their property rights. Renunciation and disclaimer of property enable individuals to legally decline their interest in the assets or benefits derived from these contracts. A renunciation or disclaimer can occur for various reasons, such as avoiding tax liabilities, relieving oneself from financial obligations, or redirecting the assets to other beneficiaries. It is important to understand the different types of renunciation and disclaimer options available in Evansville, Indiana, in order to make informed decisions. 1. Partial Renunciation/Disclaimer: This type of renunciation or disclaimer involves relinquishing only a portion of the property rights associated with a life insurance or annuity contract. Individuals may choose this option if they wish to retain some benefits while disclaiming others. 2. Full Renunciation/Disclaimer: In a full renunciation or disclaimer, individuals completely relinquish all property rights and benefits derived from the life insurance or annuity contract. This option is typically selected when an individual wants to completely disassociate from the contract and any associated obligations. 3. Conditional Renunciation/Disclaimer: Conditional renunciation or disclaimer allows individuals to renounce or disclaim their rights to the property but under certain predetermined conditions. For example, one may specify that the renunciation will only take effect if another beneficiary does not survive or meet certain criteria. 4. Inter Vivos Renunciation/Disclaimer: Inter Vivos renunciation or disclaimer occurs during the lifetime of the individual who chooses to renounce or disclaim their property rights. This type of renunciation is typically done through a legal document and requires the individual's consent. 5. Testamentary Renunciation/Disclaimer: A testamentary renunciation or disclaimer occurs following the death of an individual who has bequeathed property through a life insurance or annuity contract. The renunciation or disclaimer is made by the potential beneficiary mentioned in the will or contract. In Evansville, Indiana, engaging in a renunciation or disclaimer of property from a life insurance or annuity contract requires adhering to specific legal procedures. It is crucial to consult with a qualified legal professional who specializes in estate planning, contract law, and tax consequences to ensure compliance with applicable regulations and avoid any unintended consequences. Important keywords: Evansville Indiana, Renunciation, Disclaimer, Property, Life Insurance, Annuity Contract, Partial Renunciation, Full Renunciation, Conditional Renunciation, Inter Vivos Renunciation, Testamentary Renunciation.