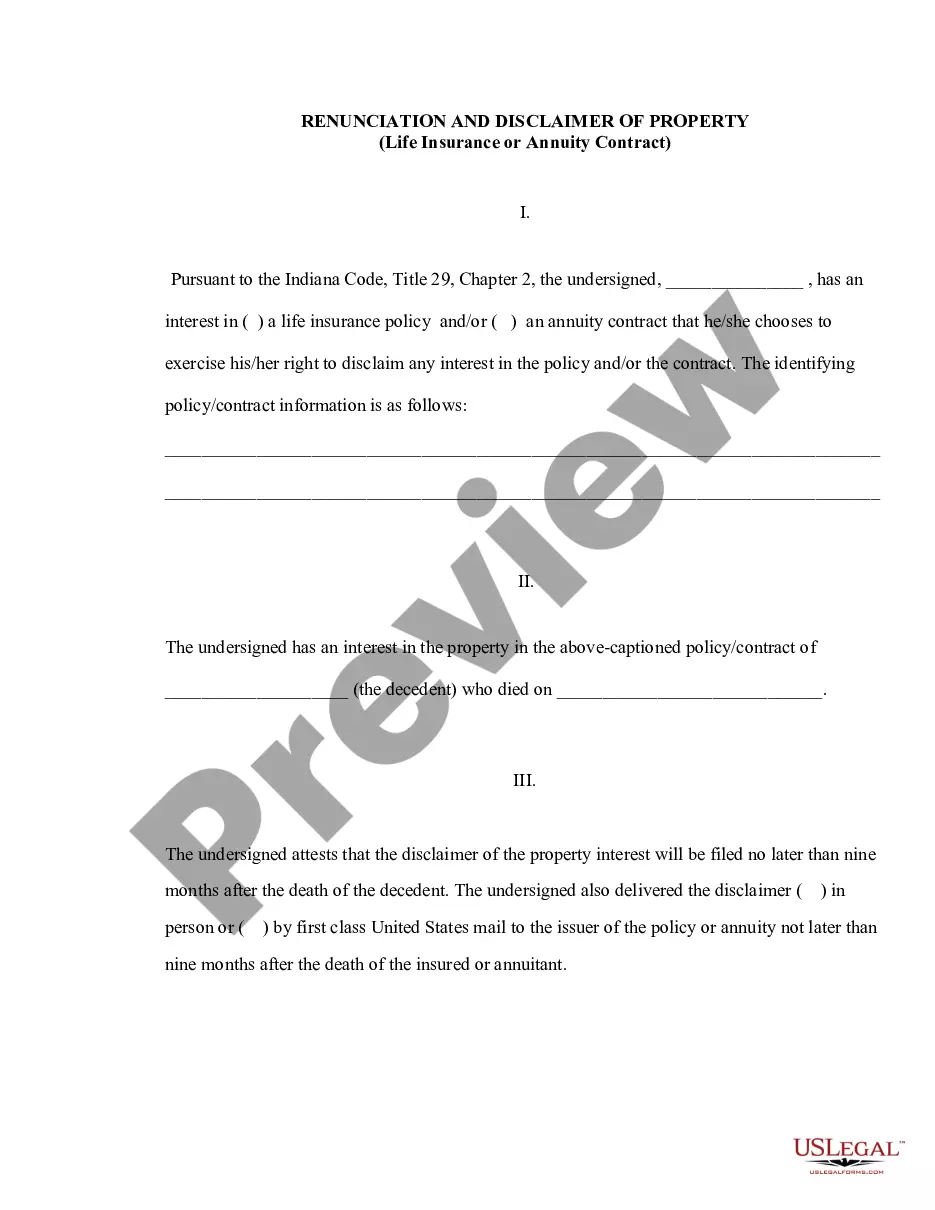

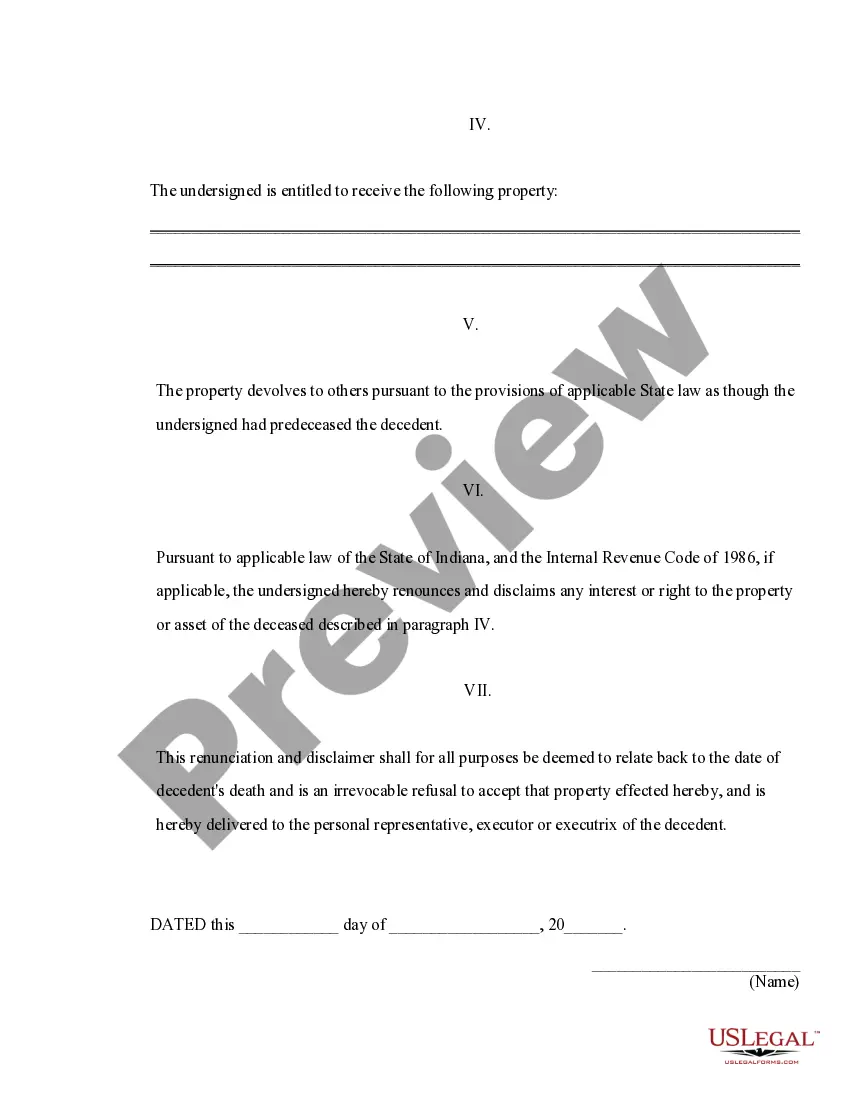

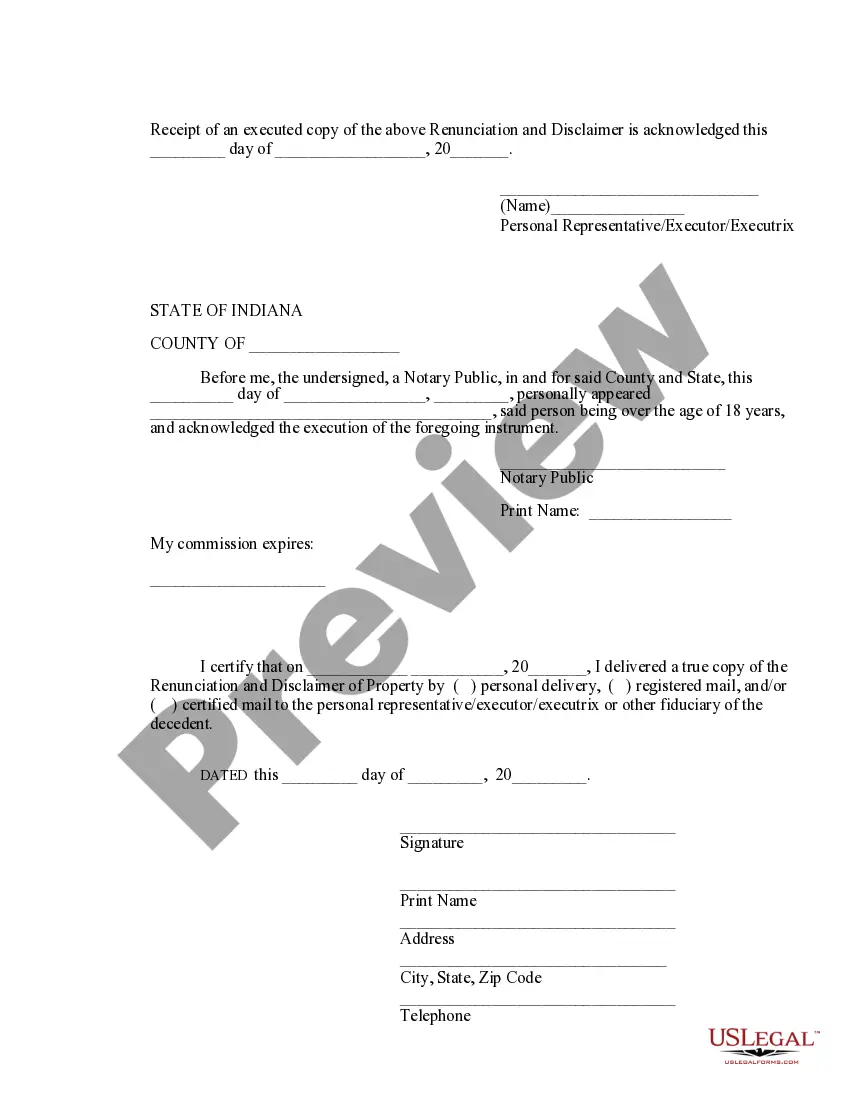

This form is a Renunciation and Disclaimer of a Life Insurance Policy and/or Annuity Contract proceeds. Upon the death of the decedent, the beneficiary gained an interest in the proceeds of the decedent's policy and/or contract. Pursuant to the Indiana Code, Title 29, Chapter 2, the beneficiary has chosen to disclaim his/her interest in the proceeds. The renunciation will relate back to the date of death of the decedent and will serve as an irrevocable refusal to accept the proceeds. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Fort Wayne Indiana Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract is a legal process that allows individuals to refuse or give up their rights to receive benefits from a life insurance or annuity contract in the state of Fort Wayne, Indiana. In Fort Wayne, Indiana, individuals have the option to renounce or disclaim their interest in the property or proceeds derived from a life insurance or annuity contract. This renunciation or disclaimer is governed by the laws of the state and involves a formal written statement declaring the individual's intention to forgo any rights or claims to receive benefits from the policy or contract. The purpose of Fort Wayne Indiana Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract is to provide individuals with the ability to decline an inheritance or gift, particularly in cases where receiving such benefits may have adverse financial or taxation consequences. By renouncing or disclaiming the property or proceeds, individuals can avoid potential liabilities or complications that may arise from accepting these assets. There may be different types of Fort Wayne Indiana Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract, depending on the specific circumstances and objectives of the individual. Some possible variations include: 1. Absolute Renunciation: This involves a complete refusal to accept any benefits from the life insurance or annuity contract. The individual relinquishes all rights to the policy or contract proceeds. 2. Partial Renunciation: In certain situations, individuals may choose to renounce only a portion of the benefits, rather than the entire amount. This allows for a selective waiver of rights, depending on the individual's preferences and needs. 3. Conditional Renunciation: This type of renunciation is done with certain conditions attached. For example, the individual may renounce their rights to the property or proceeds if the beneficiary agrees to distribute those assets to a charity or another individual. 4. Qualified Disclaimer: A qualified disclaimer is a renunciation made in accordance with specific requirements outlined by the Internal Revenue Service (IRS), allowing individuals to disclaim a gift or inheritance for federal tax purposes. It is important for individuals considering Fort Wayne Indiana Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract to consult with a qualified attorney to understand the legal implications, potential tax consequences, and ensure compliance with applicable laws and regulations. The specific terms and conditions of the renunciation or disclaimer should be carefully reviewed and drafted to meet individual needs and objectives.Fort Wayne Indiana Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract is a legal process that allows individuals to refuse or give up their rights to receive benefits from a life insurance or annuity contract in the state of Fort Wayne, Indiana. In Fort Wayne, Indiana, individuals have the option to renounce or disclaim their interest in the property or proceeds derived from a life insurance or annuity contract. This renunciation or disclaimer is governed by the laws of the state and involves a formal written statement declaring the individual's intention to forgo any rights or claims to receive benefits from the policy or contract. The purpose of Fort Wayne Indiana Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract is to provide individuals with the ability to decline an inheritance or gift, particularly in cases where receiving such benefits may have adverse financial or taxation consequences. By renouncing or disclaiming the property or proceeds, individuals can avoid potential liabilities or complications that may arise from accepting these assets. There may be different types of Fort Wayne Indiana Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract, depending on the specific circumstances and objectives of the individual. Some possible variations include: 1. Absolute Renunciation: This involves a complete refusal to accept any benefits from the life insurance or annuity contract. The individual relinquishes all rights to the policy or contract proceeds. 2. Partial Renunciation: In certain situations, individuals may choose to renounce only a portion of the benefits, rather than the entire amount. This allows for a selective waiver of rights, depending on the individual's preferences and needs. 3. Conditional Renunciation: This type of renunciation is done with certain conditions attached. For example, the individual may renounce their rights to the property or proceeds if the beneficiary agrees to distribute those assets to a charity or another individual. 4. Qualified Disclaimer: A qualified disclaimer is a renunciation made in accordance with specific requirements outlined by the Internal Revenue Service (IRS), allowing individuals to disclaim a gift or inheritance for federal tax purposes. It is important for individuals considering Fort Wayne Indiana Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract to consult with a qualified attorney to understand the legal implications, potential tax consequences, and ensure compliance with applicable laws and regulations. The specific terms and conditions of the renunciation or disclaimer should be carefully reviewed and drafted to meet individual needs and objectives.