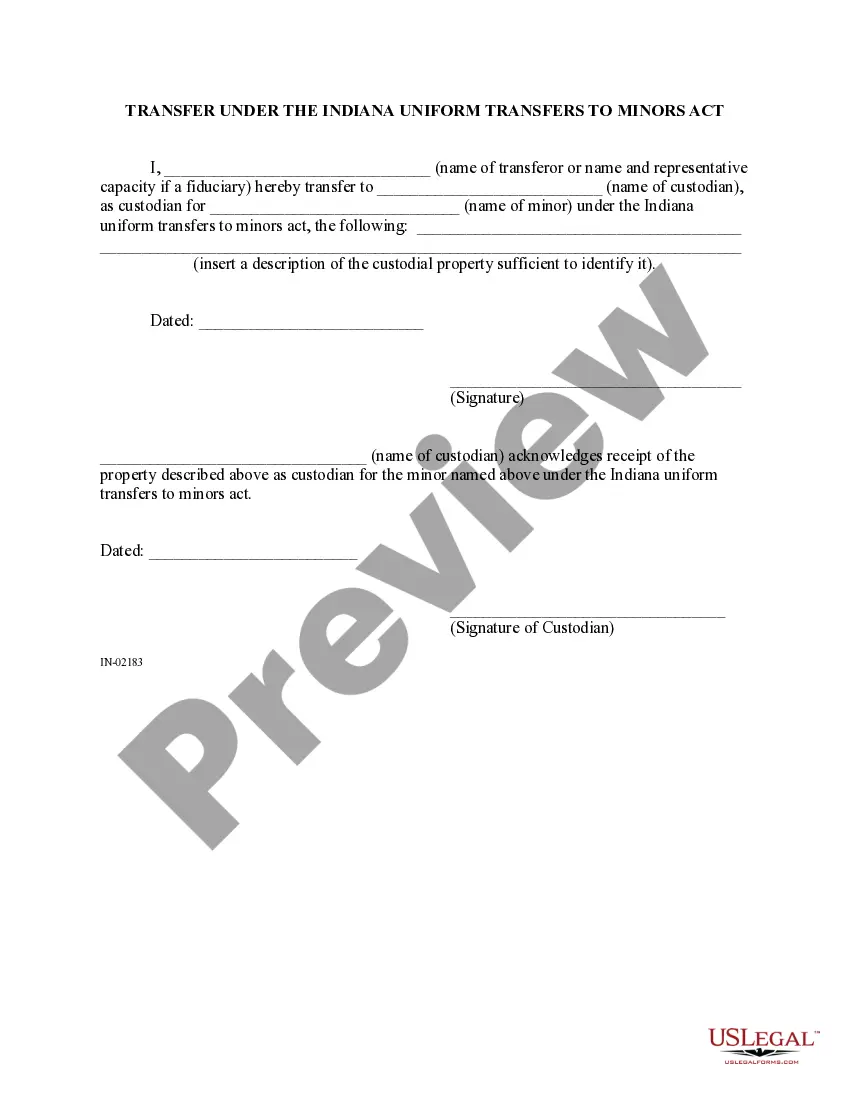

This is a statutory form of transfer under the Indiana Transfer to Minors Act. This form must be used when one desires to transfer property of any kind to a Minor.

Carmel Transfer under the Indiana Uniform Transfers to Minors Act (TMA) refers to a legal provision that allows individuals to transfer assets to minors in Carmel, Indiana. The TMA is a specific set of laws that govern such transfers, ensuring that the process is properly regulated and benefits the minor. The Carmel Transfer under the Indiana TMA offers various benefits, including tax advantages and a streamlined process for transferring assets to minors. It allows individuals, such as parents, grandparents, or legal guardians, to establish custodial accounts for minors, ensuring that the assets are protected and managed until the minor reaches the age of majority. The TMA outlines specific rules and guidelines for Carmel Transfer. The transfer must be made to a custodian, who is responsible for managing and safeguarding the assets on behalf of the minor. The custodian is entrusted with making financial decisions in the minor's best interest until they come of age, typically at 18 or 21 years old, depending on the specific terms outlined in the TMA. There are various types of transfers available under the Carmel Transfer provision of the Indiana TMA. Some common types include: 1. Cash and Bank Accounts: Money can be transferred to a custodial savings or checking account established for the minor. This allows for easy management and potential growth of the funds until the minor reaches' adulthood. 2. Securities: Stocks, bonds, mutual funds, and other investment instruments can be transferred to a custodial brokerage account. This allows for potential appreciation of the assets over time. 3. Real Estate: Property can be transferred to a custodial account, ensuring that its value is preserved until the minor reaches the age of majority. The property can be sold or managed by the custodian in the interim. 4. Intellectual Property: Intellectual property rights, such as copyrights, trademarks, or patents, can also be transferred to a custodial account under the Carmel Transfer provision. The custodian would then oversee these assets until the minor is of legal age. It's important to note that Carmel Transfer under the Indiana TMA requires proper documentation and adherence to the guidelines set forth in the act. A knowledgeable attorney can provide assistance in establishing the transfer and ensuring compliance with all legal requirements. In conclusion, Carmel Transfer under the Indiana Uniform Transfers to Minors Act allows for the transfer of assets to minors in Carmel, Indiana, while providing tax advantages and an organized process. Different types of transfers, including cash, securities, real estate, and intellectual property, can be made under this provision. Working with a professional is crucial to ensuring a smooth and lawful transfer process.Carmel Transfer under the Indiana Uniform Transfers to Minors Act (TMA) refers to a legal provision that allows individuals to transfer assets to minors in Carmel, Indiana. The TMA is a specific set of laws that govern such transfers, ensuring that the process is properly regulated and benefits the minor. The Carmel Transfer under the Indiana TMA offers various benefits, including tax advantages and a streamlined process for transferring assets to minors. It allows individuals, such as parents, grandparents, or legal guardians, to establish custodial accounts for minors, ensuring that the assets are protected and managed until the minor reaches the age of majority. The TMA outlines specific rules and guidelines for Carmel Transfer. The transfer must be made to a custodian, who is responsible for managing and safeguarding the assets on behalf of the minor. The custodian is entrusted with making financial decisions in the minor's best interest until they come of age, typically at 18 or 21 years old, depending on the specific terms outlined in the TMA. There are various types of transfers available under the Carmel Transfer provision of the Indiana TMA. Some common types include: 1. Cash and Bank Accounts: Money can be transferred to a custodial savings or checking account established for the minor. This allows for easy management and potential growth of the funds until the minor reaches' adulthood. 2. Securities: Stocks, bonds, mutual funds, and other investment instruments can be transferred to a custodial brokerage account. This allows for potential appreciation of the assets over time. 3. Real Estate: Property can be transferred to a custodial account, ensuring that its value is preserved until the minor reaches the age of majority. The property can be sold or managed by the custodian in the interim. 4. Intellectual Property: Intellectual property rights, such as copyrights, trademarks, or patents, can also be transferred to a custodial account under the Carmel Transfer provision. The custodian would then oversee these assets until the minor is of legal age. It's important to note that Carmel Transfer under the Indiana TMA requires proper documentation and adherence to the guidelines set forth in the act. A knowledgeable attorney can provide assistance in establishing the transfer and ensuring compliance with all legal requirements. In conclusion, Carmel Transfer under the Indiana Uniform Transfers to Minors Act allows for the transfer of assets to minors in Carmel, Indiana, while providing tax advantages and an organized process. Different types of transfers, including cash, securities, real estate, and intellectual property, can be made under this provision. Working with a professional is crucial to ensuring a smooth and lawful transfer process.