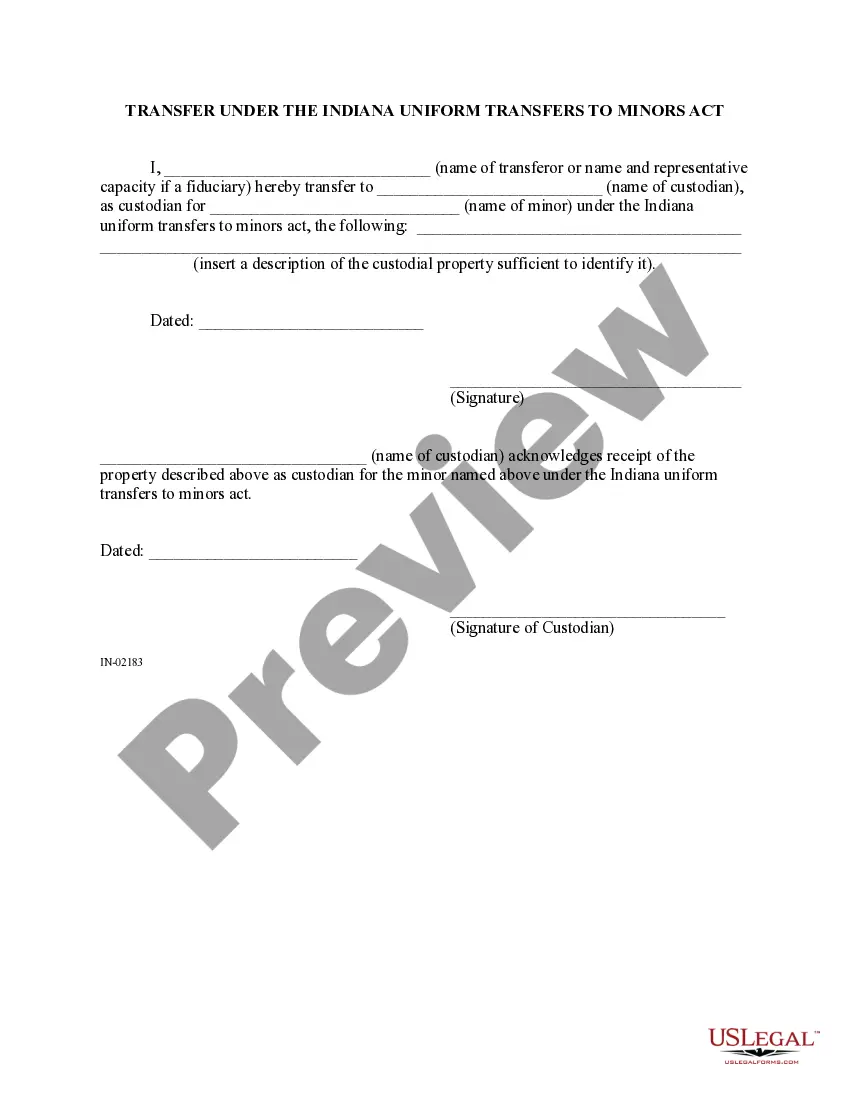

This is a statutory form of transfer under the Indiana Transfer to Minors Act. This form must be used when one desires to transfer property of any kind to a Minor.

South Bend Transfer under the Indiana Uniform Transfers to Minors Act refers to a legal mechanism that allows individuals to transfer assets to minors while safely managing and protecting those assets until the minors reach the age of majority. This Act enables parents, grandparents, or other potential donors to establish custodial accounts for minors, ensuring the smooth and efficient transfer of wealth or property. Under the Indiana Uniform Transfers to Minors Act, there are several types of South Bend Transfer options: 1. South Bend Transfer of Financial Assets: This type of transfer involves the donation or gifting of financial assets such as cash, stocks, bonds, mutual funds, or other securities to a custodial account for the benefit of a minor. The custodian, usually a responsible adult, manages these assets until the minor comes of age. 2. South Bend Transfer of Real Estate: This form of transfer involves transferring real estate property, including land, houses, or commercial buildings, to a custodial account for the minor. The custodian oversees the property on behalf of the minor and ensures its proper maintenance and potential growth. 3. South Bend Transfer of Intellectual Property: This transfer pertains to the donation or transfer of intellectual property rights, such as patents, copyrights, or trademarks, to a custodial account for the benefit of a minor. The custodian ensures the protection and management of these rights until the minor becomes an adult. 4. South Bend Transfer of Personal Belongings: This type of transfer involves gifting personal belongings, including jewelry, art, collectibles, or antiques, to a custodial account established for the minor. The custodian safeguards and maintains these items until the minor reaches the age of majority. Parents or donors often utilize South Bend Transfer under the Indiana Uniform Transfers to Minors Act to ensure a secure and efficient transfer of their assets to their children or grandchildren. By utilizing this legal provision, they can provide for the minor's financial well-being, educational needs, or other future endeavors until they attain legal adulthood. Understanding the South Bend Transfer under the Indiana Uniform Transfers to Minors Act is vital for donors and custodians involved in such transfers as it ensures the proper administration, management, and protection of the transferred assets until the minor beneficiaries are ready to assume control.