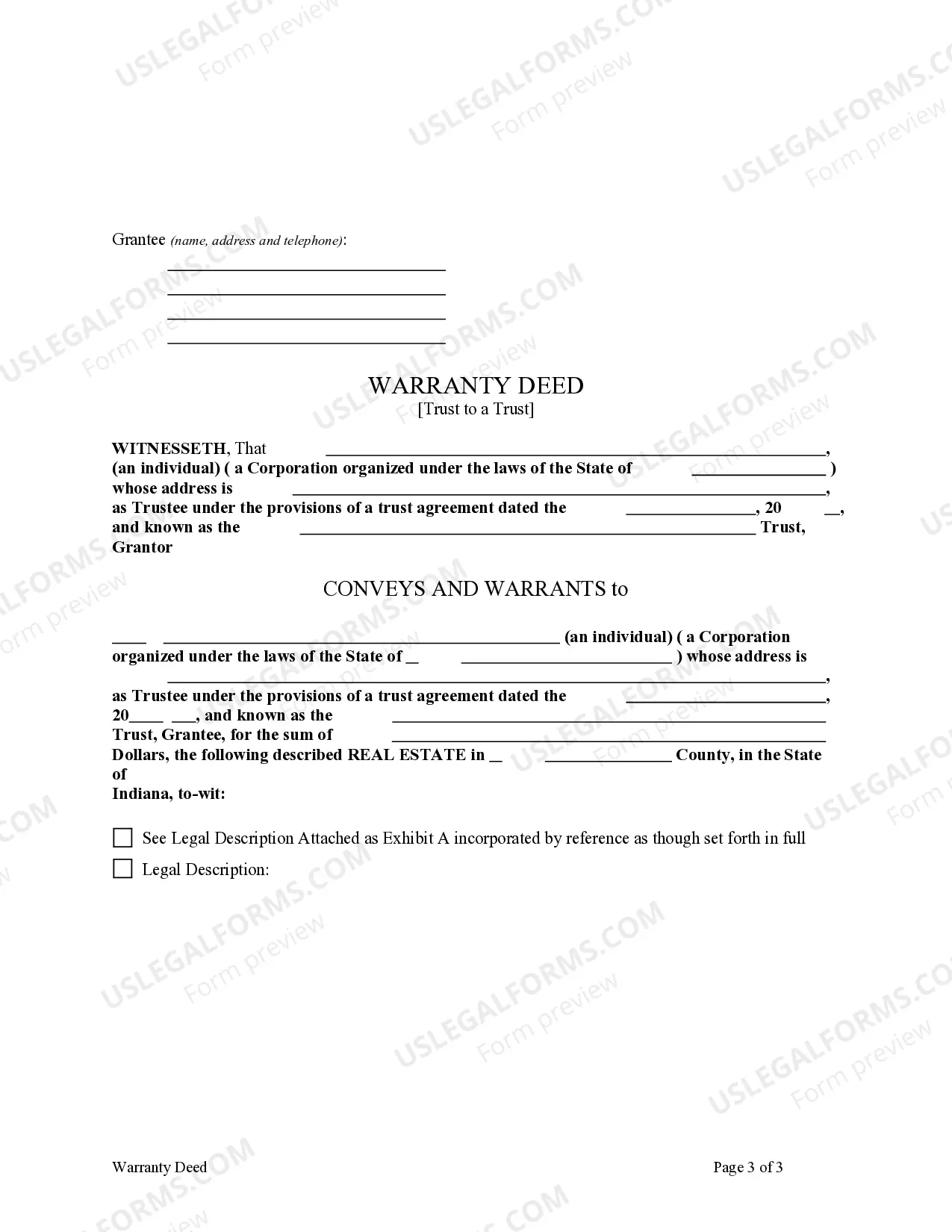

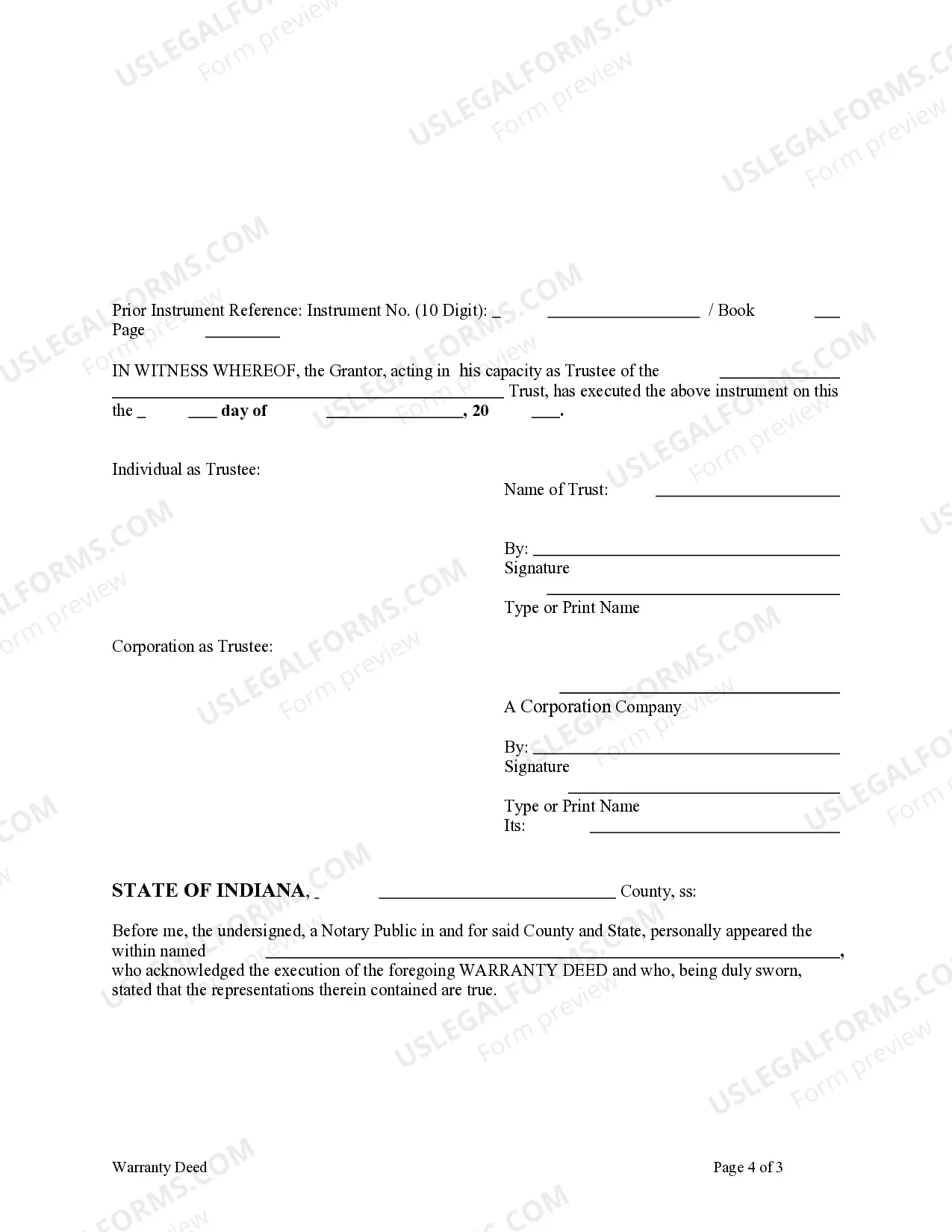

This form is a Warranty Deed where the Grantor is a Trust and the Grantee is also a Trust. Grantor conveys and warrants the described property to Trustee of the Grantee. This deed complies with all state statutory laws.

An Indianapolis Indiana Warranty Deed — Trust to a Trust is a legal document that transfers ownership of a property from the owner, called the granter, to a trust. This type of warranty deed is commonly used in estate planning, asset protection, and in situations where the owner wants to ensure the seamless transfer of their property to a chosen trustee upon their death or incapacity. When executing an Indianapolis Indiana Warranty Deed — Trust to a Trust, it is important to include specific keywords and elements to ensure its validity and effectiveness. Some relevant keywords and details commonly included in this type of warranty deed are as follows: 1. Trust: The trust referenced in this warranty deed is a legal entity created to hold and manage assets for the benefit of one or more beneficiaries. The trust is established and governed by a trust agreement or declaration, which outlines the trustee's responsibilities and the beneficiaries' rights to the property. 2. Granter: This refers to the current owner of the property who is transferring ownership to the trust. The granter's name, address, and legal description of the property are stated in the warranty deed. 3. Trustee: The trustee is the individual or entity responsible for managing the property within the trust. The trustee's details, such as name, address, and contact information should be clearly identified. 4. Beneficiary/Successor Beneficiary: The beneficiary is the person or entity for whom the trust is created, and who will ultimately receive the property's ownership or benefits. Additionally, a successor beneficiary may also be designated in case the primary beneficiary is unable or unwilling to assume ownership. 5. Legal Descriptions: The warranty deed should include a comprehensive legal description of the property being transferred. This includes the exact boundaries, lot numbers, or any other identifying features to clearly identify the specific property involved. 6. Warranty Clause: This clause states that the granter guarantees they have valid ownership of the property and have the right to transfer it to the trust. It also asserts that the property is free from any liens, claims, or encumbrances unless otherwise stated. 7. Consideration: While a trust transfer typically involves minimal or no consideration, it is essential to indicate the nominal value (such as $1) the granter received in exchange for the transfer. 8. Recording: To ensure the document's legality and public notice of the trust property transfer, the warranty deed should be recorded with the appropriate county recorder's office in Indianapolis, Indiana. It's important to note that while the above elements are commonly included in most Indianapolis Indiana Warranty Deed — Trust to a Trust documents, the specific terms and conditions may vary depending on the unique circumstances or specific provisions tailored to the trust's objectives. Additionally, different types of trust transfers may exist, such as an inter vivos trust transfer (taking effect during the granter's lifetime), or a testamentary trust transfer (taking effect after the granter's demise).An Indianapolis Indiana Warranty Deed — Trust to a Trust is a legal document that transfers ownership of a property from the owner, called the granter, to a trust. This type of warranty deed is commonly used in estate planning, asset protection, and in situations where the owner wants to ensure the seamless transfer of their property to a chosen trustee upon their death or incapacity. When executing an Indianapolis Indiana Warranty Deed — Trust to a Trust, it is important to include specific keywords and elements to ensure its validity and effectiveness. Some relevant keywords and details commonly included in this type of warranty deed are as follows: 1. Trust: The trust referenced in this warranty deed is a legal entity created to hold and manage assets for the benefit of one or more beneficiaries. The trust is established and governed by a trust agreement or declaration, which outlines the trustee's responsibilities and the beneficiaries' rights to the property. 2. Granter: This refers to the current owner of the property who is transferring ownership to the trust. The granter's name, address, and legal description of the property are stated in the warranty deed. 3. Trustee: The trustee is the individual or entity responsible for managing the property within the trust. The trustee's details, such as name, address, and contact information should be clearly identified. 4. Beneficiary/Successor Beneficiary: The beneficiary is the person or entity for whom the trust is created, and who will ultimately receive the property's ownership or benefits. Additionally, a successor beneficiary may also be designated in case the primary beneficiary is unable or unwilling to assume ownership. 5. Legal Descriptions: The warranty deed should include a comprehensive legal description of the property being transferred. This includes the exact boundaries, lot numbers, or any other identifying features to clearly identify the specific property involved. 6. Warranty Clause: This clause states that the granter guarantees they have valid ownership of the property and have the right to transfer it to the trust. It also asserts that the property is free from any liens, claims, or encumbrances unless otherwise stated. 7. Consideration: While a trust transfer typically involves minimal or no consideration, it is essential to indicate the nominal value (such as $1) the granter received in exchange for the transfer. 8. Recording: To ensure the document's legality and public notice of the trust property transfer, the warranty deed should be recorded with the appropriate county recorder's office in Indianapolis, Indiana. It's important to note that while the above elements are commonly included in most Indianapolis Indiana Warranty Deed — Trust to a Trust documents, the specific terms and conditions may vary depending on the unique circumstances or specific provisions tailored to the trust's objectives. Additionally, different types of trust transfers may exist, such as an inter vivos trust transfer (taking effect during the granter's lifetime), or a testamentary trust transfer (taking effect after the granter's demise).