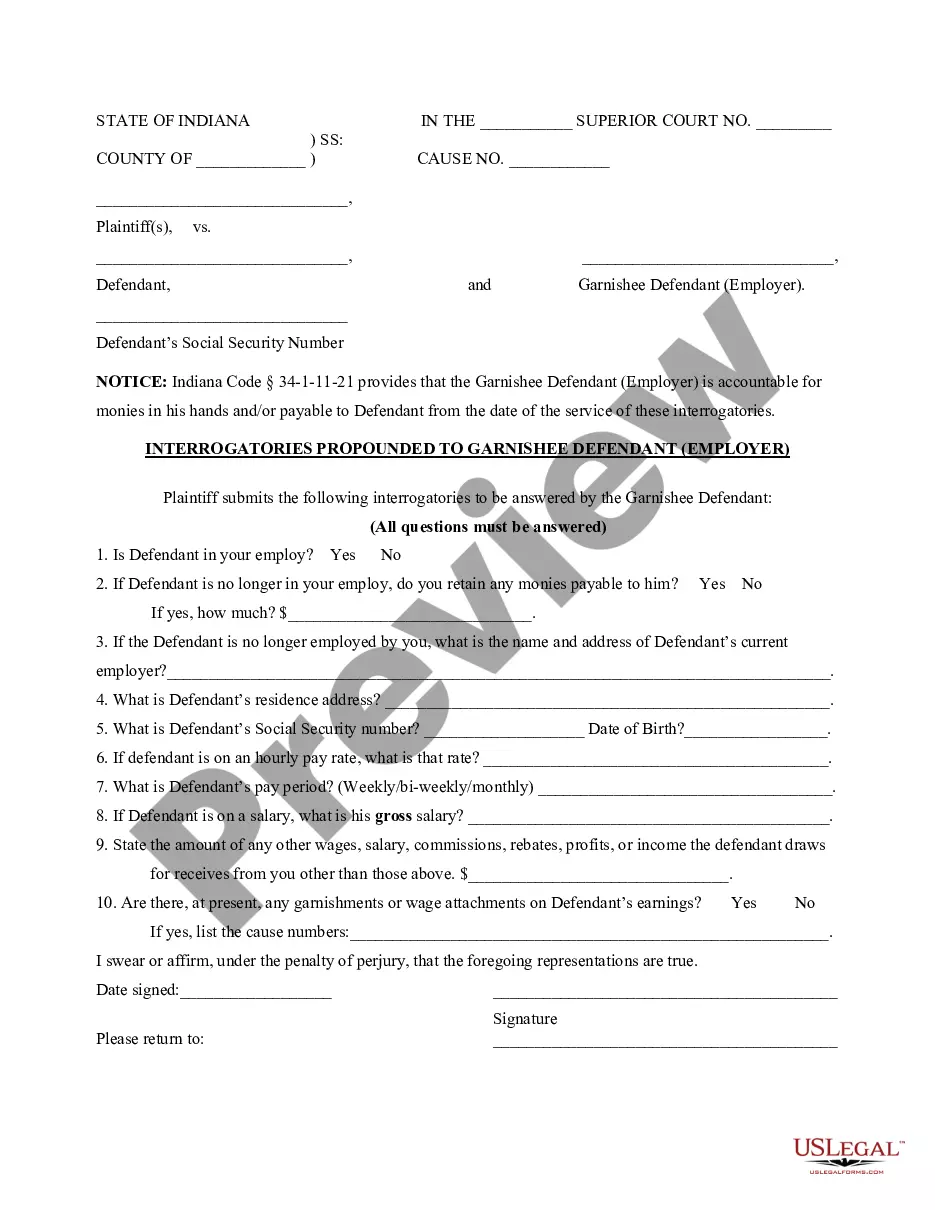

These are sample interrogatories given to a Garnishee Defendant's Employer. The Plaintiff demands information from the Employer concerning the Judgment Debtor. They are to be used simply as a model and should be modified to fit your particular cause of action.

South Bend Indiana Interrogatories Propounded to Garnishee Defendant-Employer are a set of official written questions that are used in the legal process of garnishment. These interrogatories are specifically tailored for employers located in South Bend, Indiana. They are designed to gather information about the garnishee's relationship with the debtor (employee) and assist the court in determining the appropriate amount to be withheld from the employee's wages. Here are some relevant keywords to further explain the purpose and types of South Bend Indiana Interrogatories Propounded to Garnishee Defendant-Employer: 1. Garnishment process: These interrogatories play a crucial role in the garnishment process, which is a legal procedure that allows a creditor to collect money owed from a debtor's wages if they have a court judgment against them. 2. Debt collection: Interrogatories are used as a means of assisting in the collection of debts owed by employees. By obtaining specific information about the garnishee's relationship with the debtor, the court can determine the necessary wage withholding. 3. Employer obligations: The interrogatories aim to ascertain the employer's obligations under South Bend, Indiana law when it comes to garnishing an employee's wages. This includes understanding their responsibility to comply with valid garnishment orders. 4. Financial information: The garnishee may be requested to provide detailed financial information about the debtor, such as their earnings, employment status, and any other significant deductions made from their wages. 5. Frequency of payments: These interrogatories may inquire about the frequency and stability of wage payments made to the debtor. It helps the court to understand the debtor's financial situation and determine a reasonable garnishment amount. 6. Calculation of exemptions: South Bend Indiana Interrogatories Propounded to Garnishee Defendant-Employer may also explore the calculation of exemptions that the debtor may be entitled to under state law. This can include allowances for basic living expenses or other protected earnings. 7. Multiple Garnishments: If there are multiple garnishments affecting the debtor's wages, the interrogatories may seek information regarding the priority and order in which they should be satisfied. 8. Non-compliance consequences: The interrogatories may include questions about the potential consequences of non-compliance with garnishment orders, helping educate the garnishee about their legal obligations and potential penalties for violations. It's important to note that while these keywords encompass the general area of South Bend Indiana Interrogatories Propounded to Garnishee Defendant-Employer, the specific content and types of interrogatories may vary depending on the situation and court requirements. Legal professionals should consult the relevant laws and regulations to ensure compliance and accuracy in the garnishment process.