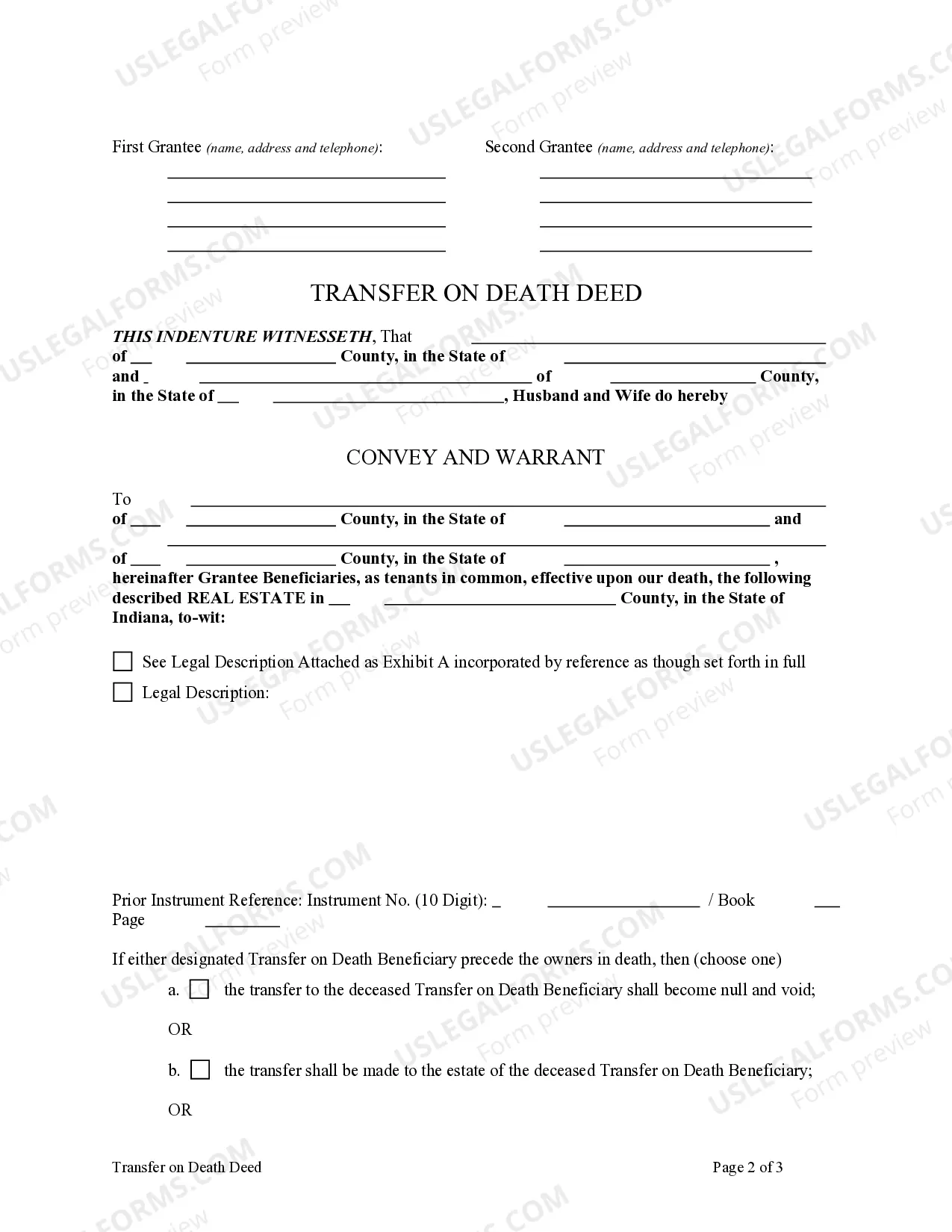

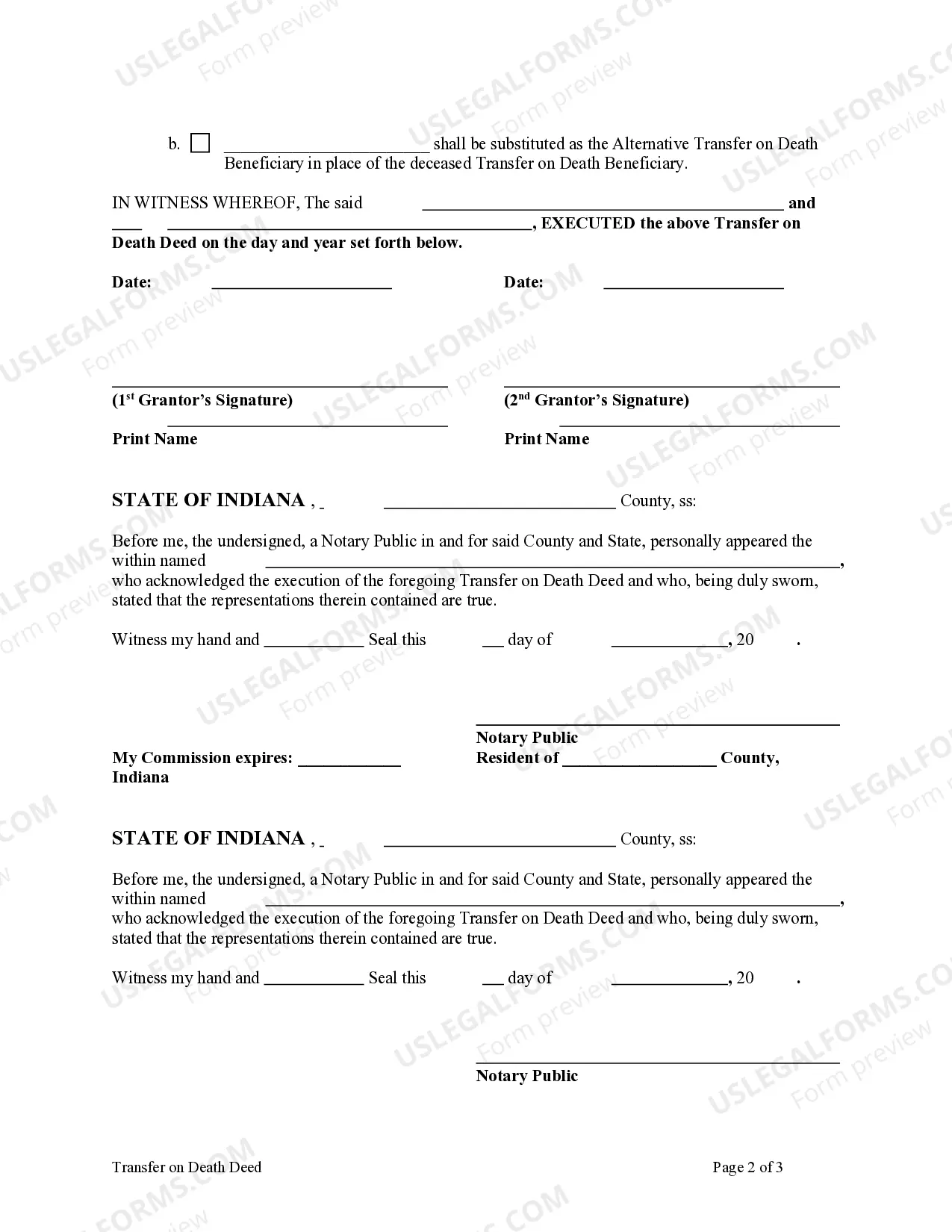

This form is a Transfer on Death Deed where the Grantors are husband and wife and the Grantees are two individuals. This transfer is revocable by either Grantor until their death and effective only upon the death of the last surviving grantor. The grantees take the property as tenants in common. This deed complies with all state statutory laws.

Evansville Indiana Transfer on Death Deed — Husband and Wife to Two Individuals is a legal document that allows married couples residing in Evansville, Indiana, to transfer their real estate property to two specified individuals upon their death, without the need for probate. This type of transfer on death deed grants the couple the ability to control the distribution of their property after their demise, ensuring that it passes directly to the designated beneficiaries. By using this legal instrument, the transfer of real estate assets becomes quick, efficient, and avoids the cumbersome probate process. There are two main variations of Evansville Indiana Transfer on Death Deed — Husband and Wife to Two Individuals: 1. Joint Tenancy with Rights of Survivorship: In this type of transfer on death deed, both spouses are considered equal owners of the property during their lifetime. Upon the death of one spouse, the surviving spouse automatically becomes the sole owner of the property, without the need for probate. Upon the death of the surviving spouse, the property transfers to the two specified individuals. This way, the property bypasses probate entirely and directly transfers to the desired beneficiaries. 2. Tenancy in Common: Unlike joint tenancy, tenancy in common allows each spouse to have separate ownership interests in the property. Each spouse can designate their own share and the portion they would like to pass on to the two specified individuals upon their respective deaths. When one spouse passes away, their designated share transfers to the specified beneficiaries, while the surviving spouse retains their ownership interest. Upon the death of the surviving spouse, their designated share also passes to the previously named individuals. Evansville Indiana Transfer on Death Deed — Husband and Wife to Two Individuals provides married couples with a convenient and effective way to ensure their property is transferred to their chosen beneficiaries according to their wishes, without the need for probate. It is advisable to consult with an experienced estate planning attorney to understand the legal implications and requirements associated with executing such a deed in Evansville, Indiana.Evansville Indiana Transfer on Death Deed — Husband and Wife to Two Individuals is a legal document that allows married couples residing in Evansville, Indiana, to transfer their real estate property to two specified individuals upon their death, without the need for probate. This type of transfer on death deed grants the couple the ability to control the distribution of their property after their demise, ensuring that it passes directly to the designated beneficiaries. By using this legal instrument, the transfer of real estate assets becomes quick, efficient, and avoids the cumbersome probate process. There are two main variations of Evansville Indiana Transfer on Death Deed — Husband and Wife to Two Individuals: 1. Joint Tenancy with Rights of Survivorship: In this type of transfer on death deed, both spouses are considered equal owners of the property during their lifetime. Upon the death of one spouse, the surviving spouse automatically becomes the sole owner of the property, without the need for probate. Upon the death of the surviving spouse, the property transfers to the two specified individuals. This way, the property bypasses probate entirely and directly transfers to the desired beneficiaries. 2. Tenancy in Common: Unlike joint tenancy, tenancy in common allows each spouse to have separate ownership interests in the property. Each spouse can designate their own share and the portion they would like to pass on to the two specified individuals upon their respective deaths. When one spouse passes away, their designated share transfers to the specified beneficiaries, while the surviving spouse retains their ownership interest. Upon the death of the surviving spouse, their designated share also passes to the previously named individuals. Evansville Indiana Transfer on Death Deed — Husband and Wife to Two Individuals provides married couples with a convenient and effective way to ensure their property is transferred to their chosen beneficiaries according to their wishes, without the need for probate. It is advisable to consult with an experienced estate planning attorney to understand the legal implications and requirements associated with executing such a deed in Evansville, Indiana.