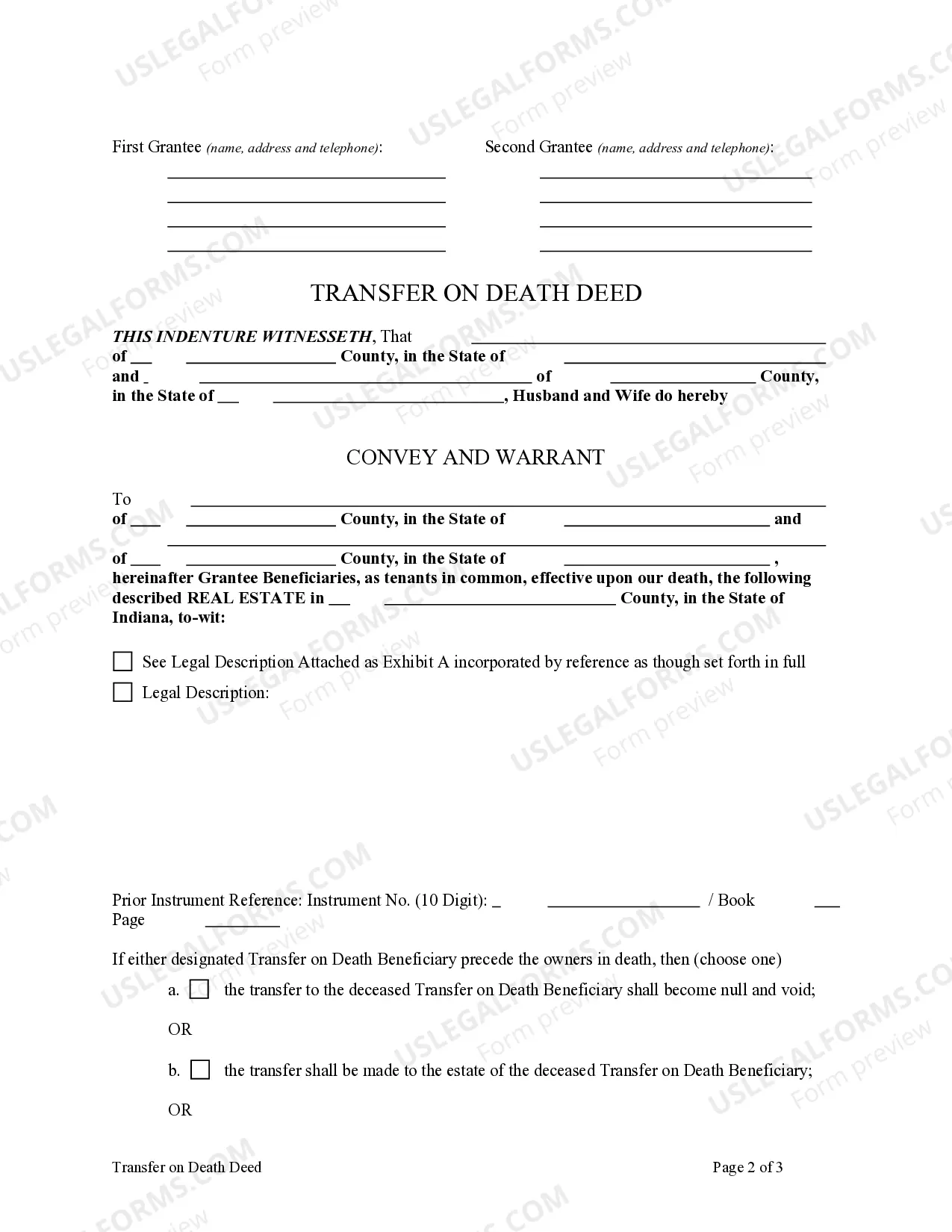

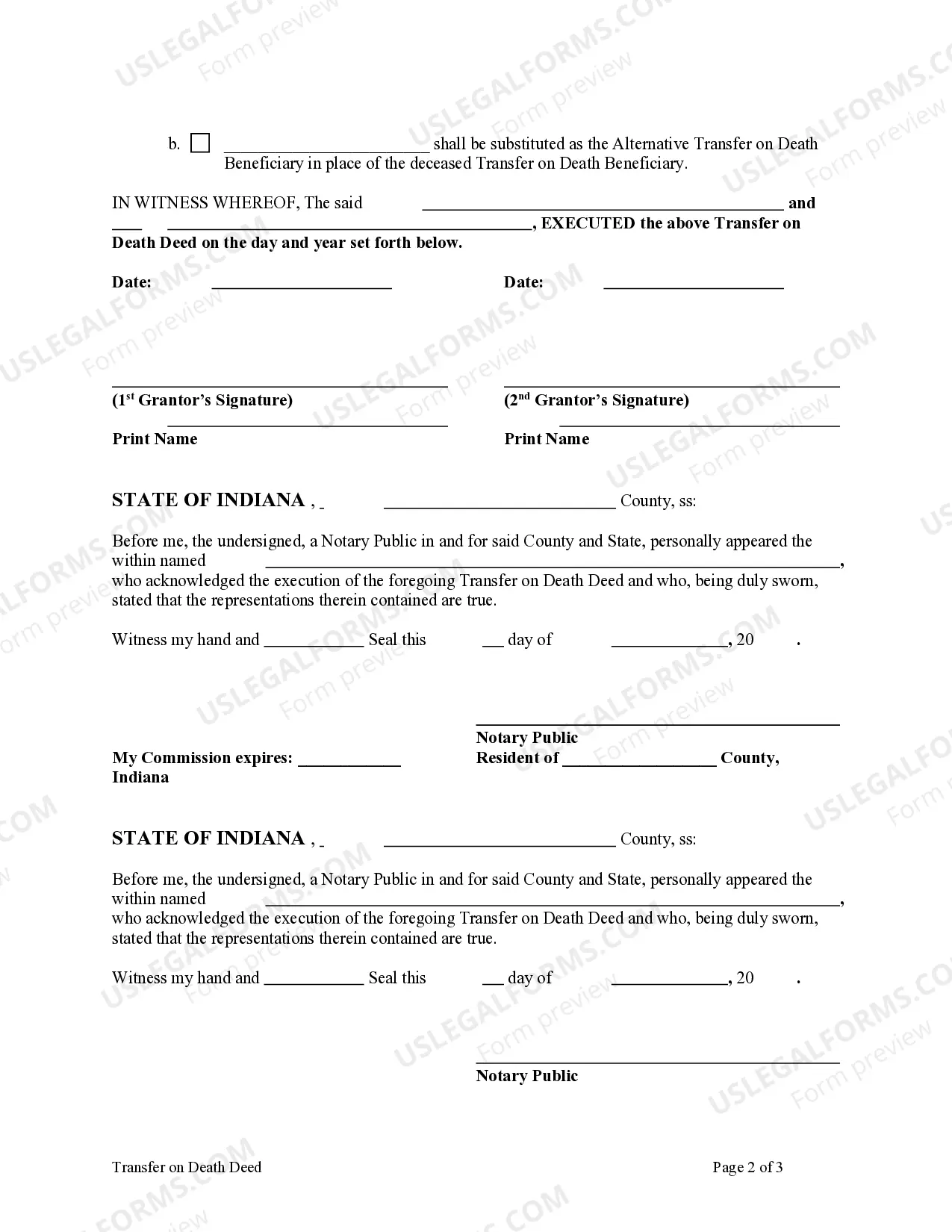

This form is a Transfer on Death Deed where the Grantors are husband and wife and the Grantees are two individuals. This transfer is revocable by either Grantor until their death and effective only upon the death of the last surviving grantor. The grantees take the property as tenants in common. This deed complies with all state statutory laws.

A Transfer on Death Deed (TOD Deed) is a legal document that allows property owners in Fort Wayne, Indiana to designate who will inherit their real estate upon their death, without the need for probate. In the case of a married couple, the TOD Deed can be used to transfer the property to two individuals of their choice. The Fort Wayne Indiana Transfer on Death Deed — Husband and Wife to Two Individuals is specifically designed for married couples who wish to leave their property to two separate individuals, such as their children or other family members, after both spouses pass away. This deed ensures that the ownership of the property is smoothly transferred to the chosen individuals without the necessity of going through the probate process. There are two different variations of the Fort Wayne Indiana Transfer on Death Deed — Husband and Wife to Two Individuals, depending on the ownership arrangement of the property: 1. Tenancy in Common: The first type of TOD Deed creates a tenancy in common, where each individual has an equal share of ownership in the property. This means that if one of the spouses passes away, their share will transfer to the designated individual, while the surviving spouse still retains their ownership interest. 2. Joint Tenancy with Right of Survivorship: The second type of TOD Deed establishes a joint tenancy with the right of survivorship. This means that if one spouse passes away, their ownership interest automatically transfers to the surviving spouse. Upon the death of the surviving spouse, the property will then pass to the designated individuals. The Fort Wayne Indiana Transfer on Death Deed — Husband and Wife to Two Individuals provides married couples with a straightforward and efficient way to ensure their property is transferred to their chosen beneficiaries after both spouses pass away. It is important to consult with a qualified attorney to properly prepare and execute this legal document, as well as to accurately determine the most suitable ownership arrangement for your specific circumstances.A Transfer on Death Deed (TOD Deed) is a legal document that allows property owners in Fort Wayne, Indiana to designate who will inherit their real estate upon their death, without the need for probate. In the case of a married couple, the TOD Deed can be used to transfer the property to two individuals of their choice. The Fort Wayne Indiana Transfer on Death Deed — Husband and Wife to Two Individuals is specifically designed for married couples who wish to leave their property to two separate individuals, such as their children or other family members, after both spouses pass away. This deed ensures that the ownership of the property is smoothly transferred to the chosen individuals without the necessity of going through the probate process. There are two different variations of the Fort Wayne Indiana Transfer on Death Deed — Husband and Wife to Two Individuals, depending on the ownership arrangement of the property: 1. Tenancy in Common: The first type of TOD Deed creates a tenancy in common, where each individual has an equal share of ownership in the property. This means that if one of the spouses passes away, their share will transfer to the designated individual, while the surviving spouse still retains their ownership interest. 2. Joint Tenancy with Right of Survivorship: The second type of TOD Deed establishes a joint tenancy with the right of survivorship. This means that if one spouse passes away, their ownership interest automatically transfers to the surviving spouse. Upon the death of the surviving spouse, the property will then pass to the designated individuals. The Fort Wayne Indiana Transfer on Death Deed — Husband and Wife to Two Individuals provides married couples with a straightforward and efficient way to ensure their property is transferred to their chosen beneficiaries after both spouses pass away. It is important to consult with a qualified attorney to properly prepare and execute this legal document, as well as to accurately determine the most suitable ownership arrangement for your specific circumstances.