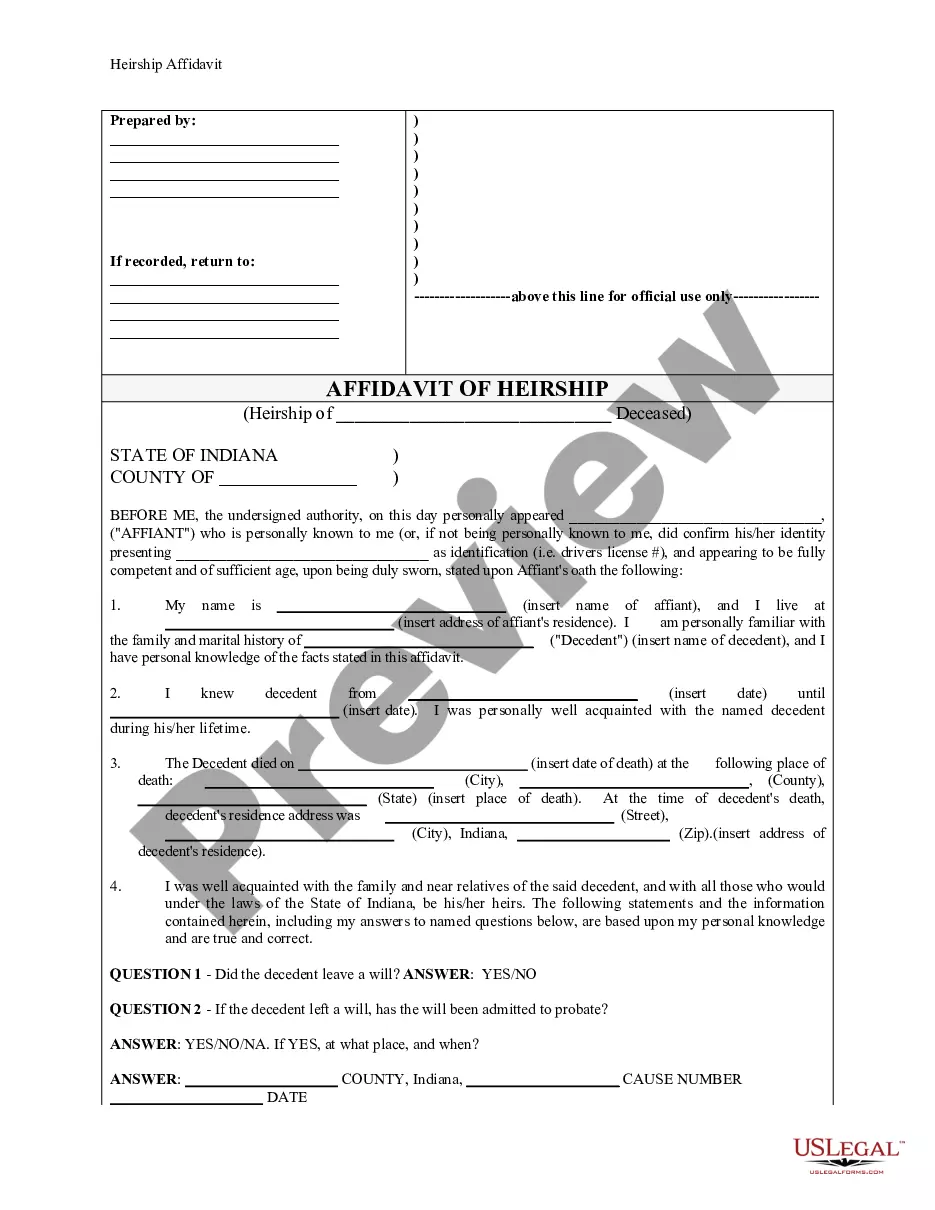

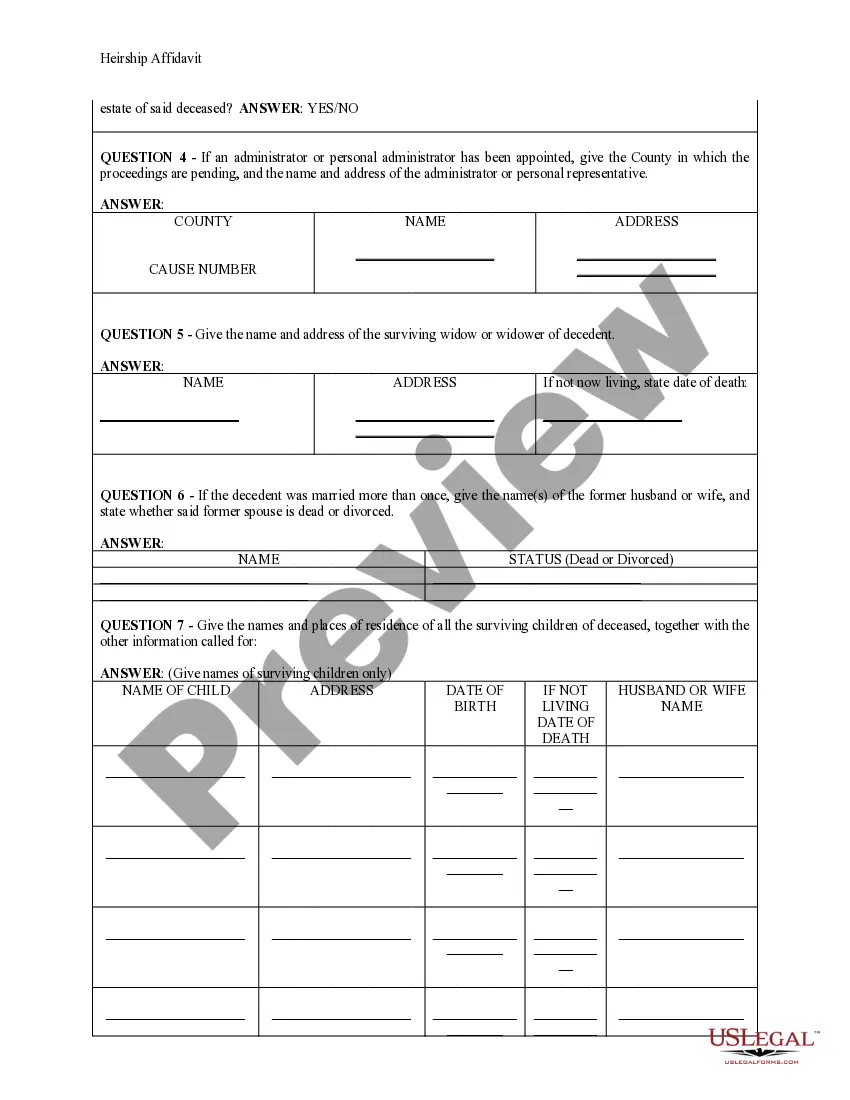

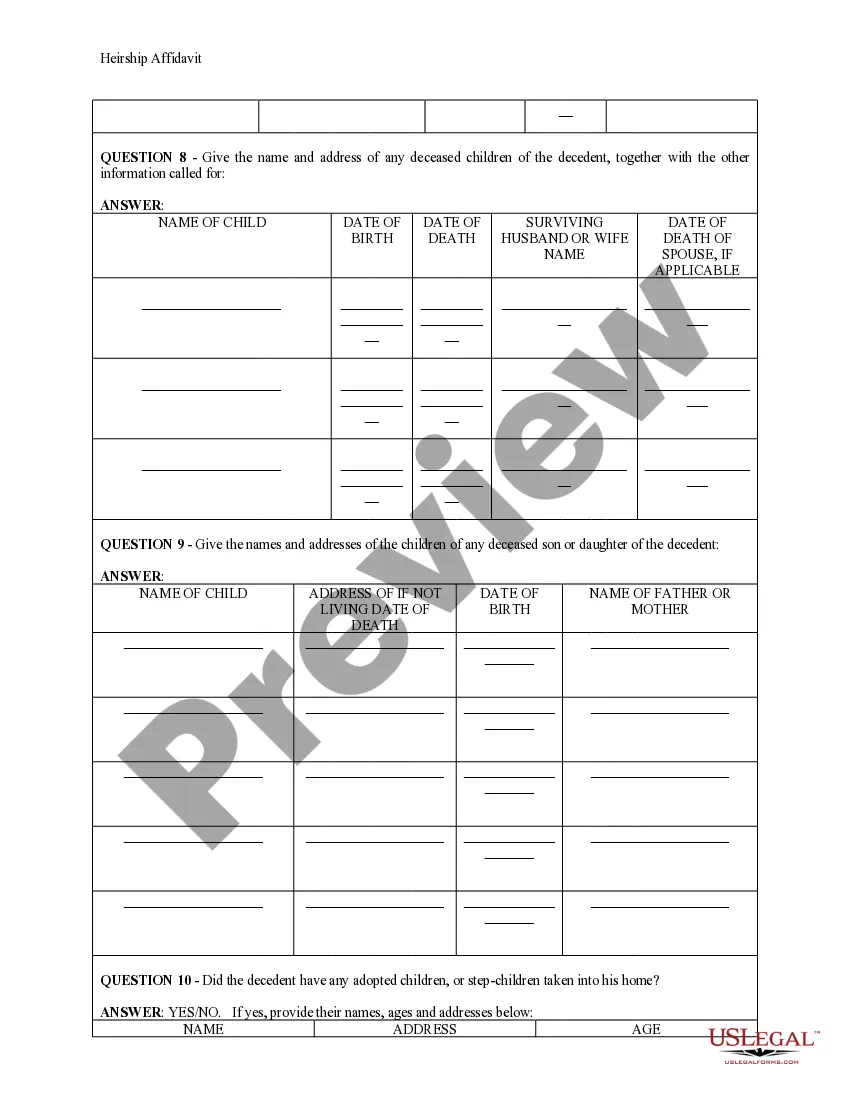

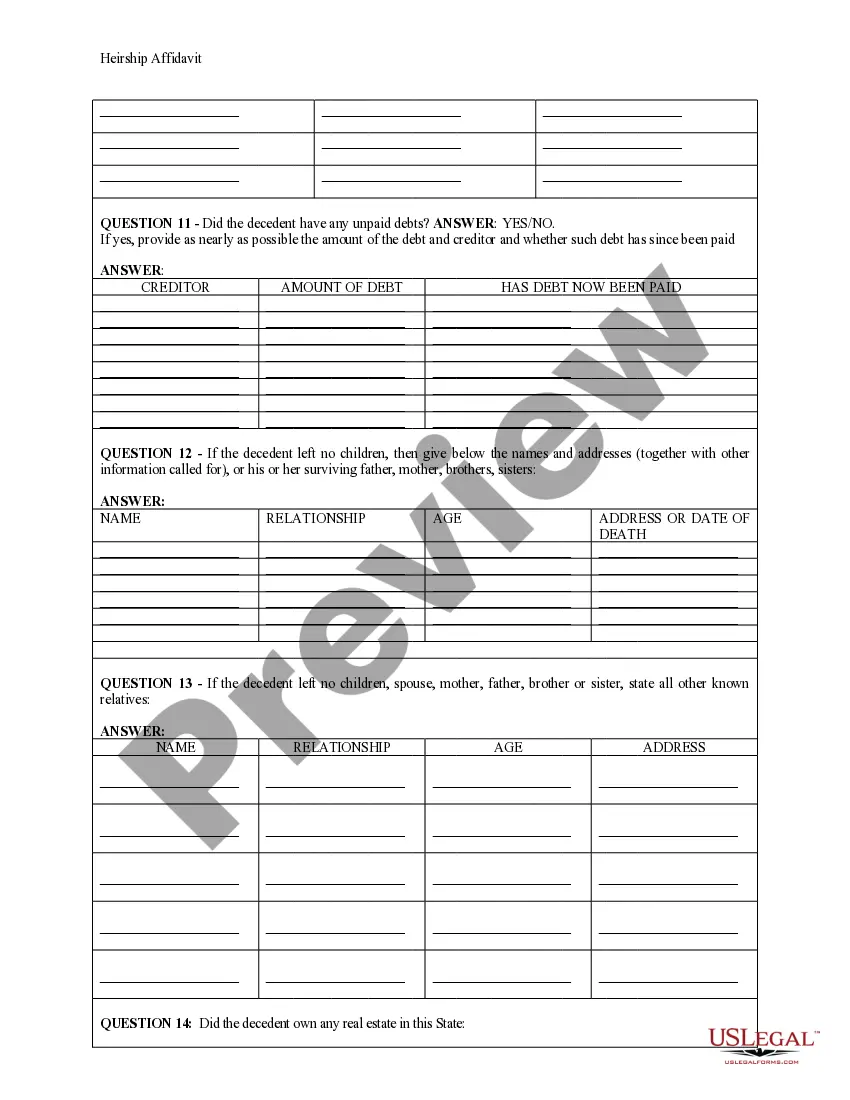

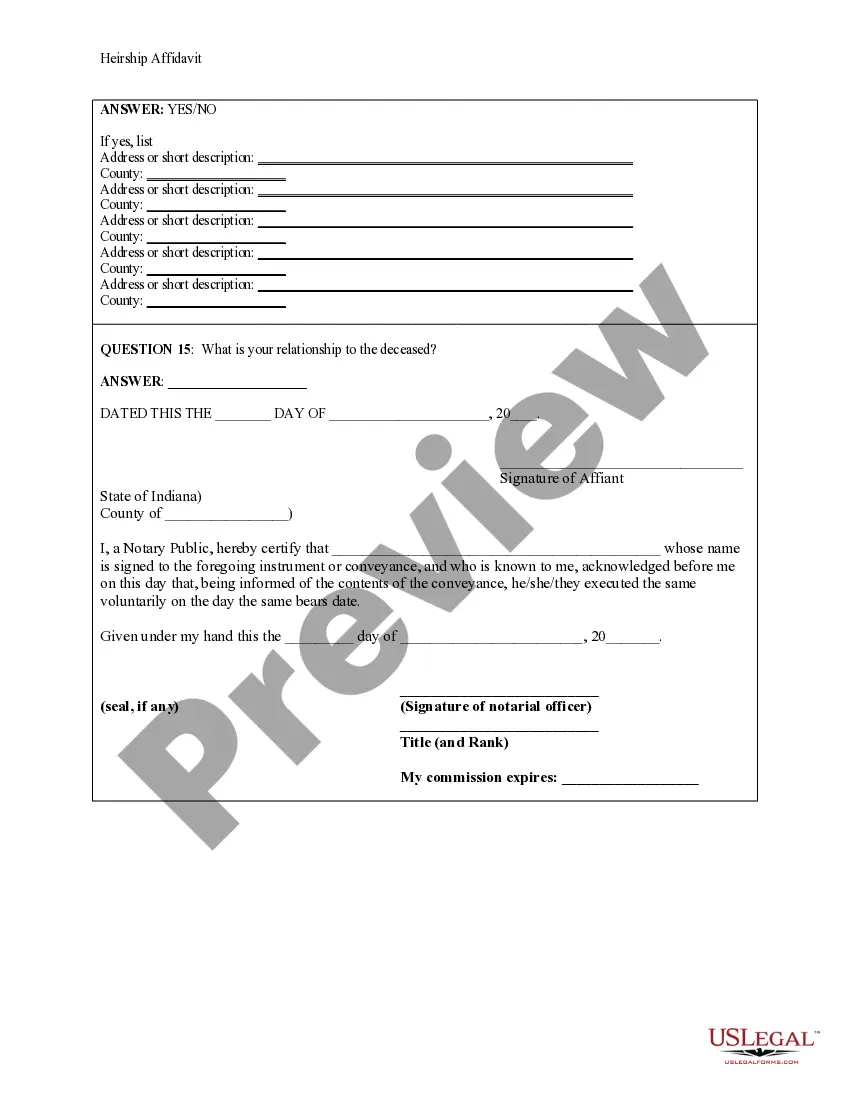

This Heirship Affidavit form is for a person to complete stating the heirs of a deceased person. The Heirship Affidavit is commonly used to establish ownership of personal and real property. It may be recorded in official land records, if necessary. Example of use: Person A dies without a will, leaves a son and no estate is opened. When the son sells the land, the son obtains an heirship affidvait to record with the deed. The person executing the affidavit should normally not be an heir of the deceased, or other person interested in the estate.

Indianapolis Indiana Heirship Affidavit - Descent

Description

How to fill out Indiana Heirship Affidavit - Descent?

Regardless of social or occupational rank, completing legal documents is an unfortunate requirement in today's society.

Too frequently, it's nearly unfeasible for an individual without legal training to produce this type of documentation from scratch, primarily due to the complex language and legal nuances involved.

This is where US Legal Forms steps in to assist.

Ensure that the template you have located is appropriate for your area since regulations from one state or region may not apply to another.

Check the document and read a brief overview (if available) of the situations for which the document may be utilized.

- Our service provides an extensive collection of over 85,000 state-specific templates suitable for nearly any legal scenario.

- US Legal Forms is also a valuable resource for associates or legal advisors seeking to save time with our do-it-yourself paperwork.

- Whether you require the Indianapolis Indiana Heirship Affidavit - Descent or any other applicable document in your state or locality, US Legal Forms has everything readily available.

- Here's how you can quickly obtain the Indianapolis Indiana Heirship Affidavit - Descent using our dependable platform.

- If you are already a member, you can go ahead and Log In to your account to retrieve the form you need.

- If you are not acquainted with our platform, make sure to follow these steps before acquiring the Indianapolis Indiana Heirship Affidavit - Descent.

Form popularity

FAQ

An inheritance tax is a state tax that you're required to pay if you receive items like property or money from a deceased person. Indiana repealed the inheritance tax in 2013. This means: You do not need to pay inheritance tax if you received items from an Indiana resident who died after December 31, 2012.

This group includes the deceased person's parents, children, stepchildren, grandparents, grandchildren, and other lineal ancestors and lineal descendants. These people don't owe tax unless they inherit more than $100,000.

The Inheritance tax was repealed. No inheritance tax returns (Form IH-6 for Indiana residents and Form IH-12 for nonresidents) have to be prepared or filed. No tax has to be paid.

Once all assets have been distributed, you must provide the court with the full details of the estate transactions so that the estate can be formally closed. This is accomplished by providing a final accounting of the actions you have taken, and filing a petition to settle the estate.

An Affidavit of Heirship is not a formal adjudication like probate is. Rather, it is an affidavit outlining the deceased person's family history and the identity of heirs. Nothing is filed in the Probate Court. Rather, the affidavits are filed in the public records of any counties in which the decedent owned property.

A Letter of Testamentary is a document granted to the Executor of an estate by the probate court. This document gives the Executor the authority he or she will need to formally act on behalf of the decedent. It gives the right to handle financial and other affairs related to closing out the estate.

If an Executor was nominated in the Will, then they must file for Probate within 30 days of the person's death. Otherwise, they may be waiving their right to the Executor appointment. If the family chooses to file a small estate affidavit instead, then they must wait until 40 days have passed after the date of death.

Though Indiana does not have an estate tax, you still may have to pay the federal estate tax if you have enough assets. The exemption for the federal estate tax is $11.70 million in 2021 and increases to $12.06 million in 2022.

An Indiana small estate affidavit is used to gather the assets of a person who has died and left behind an estate worth less than $100,000. The affidavit cannot be filed earlier than forty-five (45) days after the date of death and must be signed in front of a notary public.