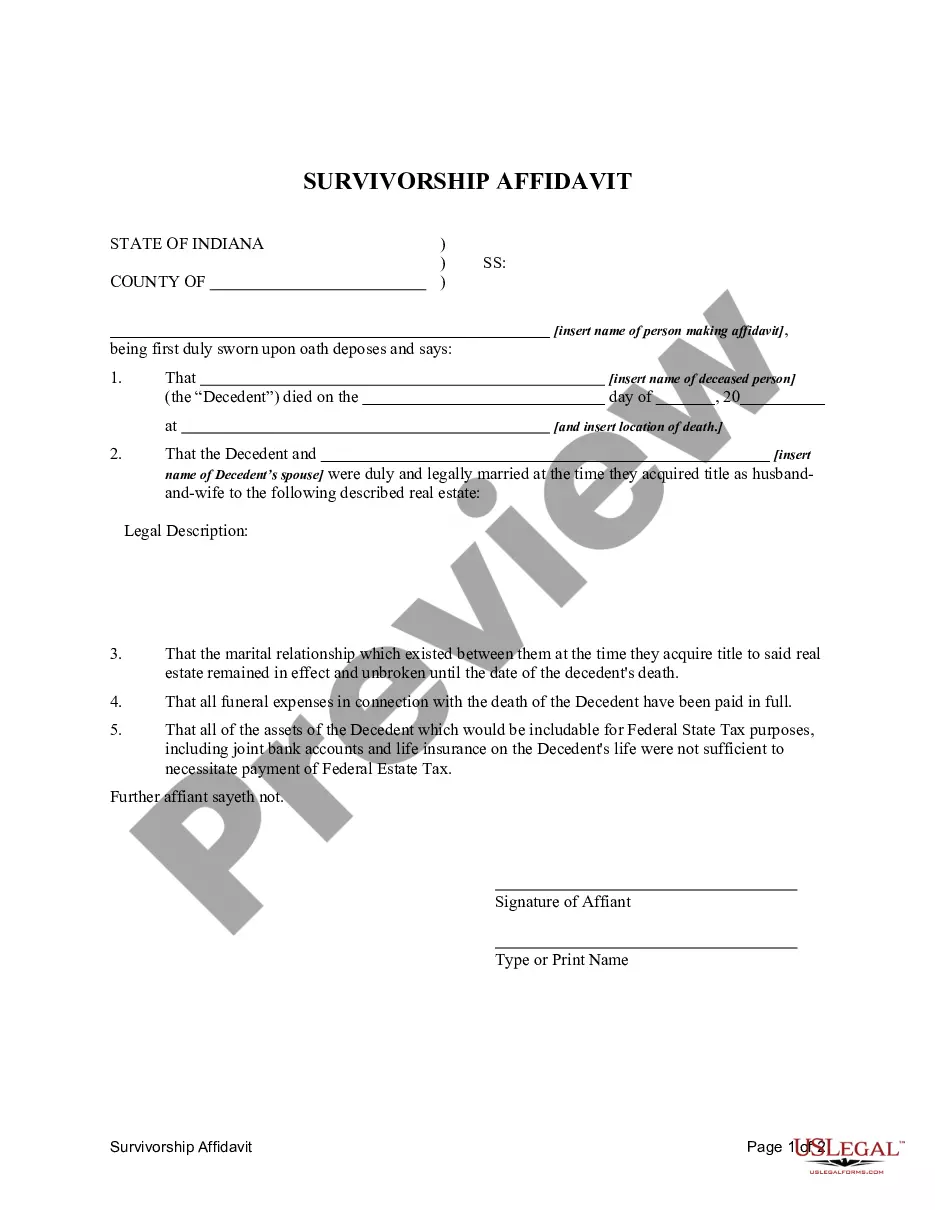

The Survivorship Affidavit is a form for a person to complete to establish the identity of the survivor in a joint tenancy or other property ownership relationship.

Affidavit Of Survivorship Indiana

Description

How to fill out Fort Wayne Indiana Survivorship Affidavit?

We consistently aim to minimize or evade legal complications when handling intricate legal or financial matters.

To achieve this, we seek legal remedies that are typically quite costly.

However, not all legal disputes are as merely intricate; many can be managed independently.

US Legal Forms is an online repository of current DIY legal documents encompassing everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Simply Log In to your account and click the Get button adjacent to it. If you misplace the document, you can always re-download it from the My documents section. The process is equally straightforward if you’re a newcomer to the platform! You can register for an account in just a few minutes.

- Our repository empowers you to manage your affairs autonomously, without needing to consult a lawyer.

- We provide access to legal document templates that aren’t always readily available.

- Our templates are specifically tailored to state and local jurisdictions, which significantly simplifies the search.

- Benefit from US Legal Forms whenever you need to obtain and download the Fort Wayne Indiana Survivorship Affidavit or any other document with ease and security.

Form popularity

FAQ

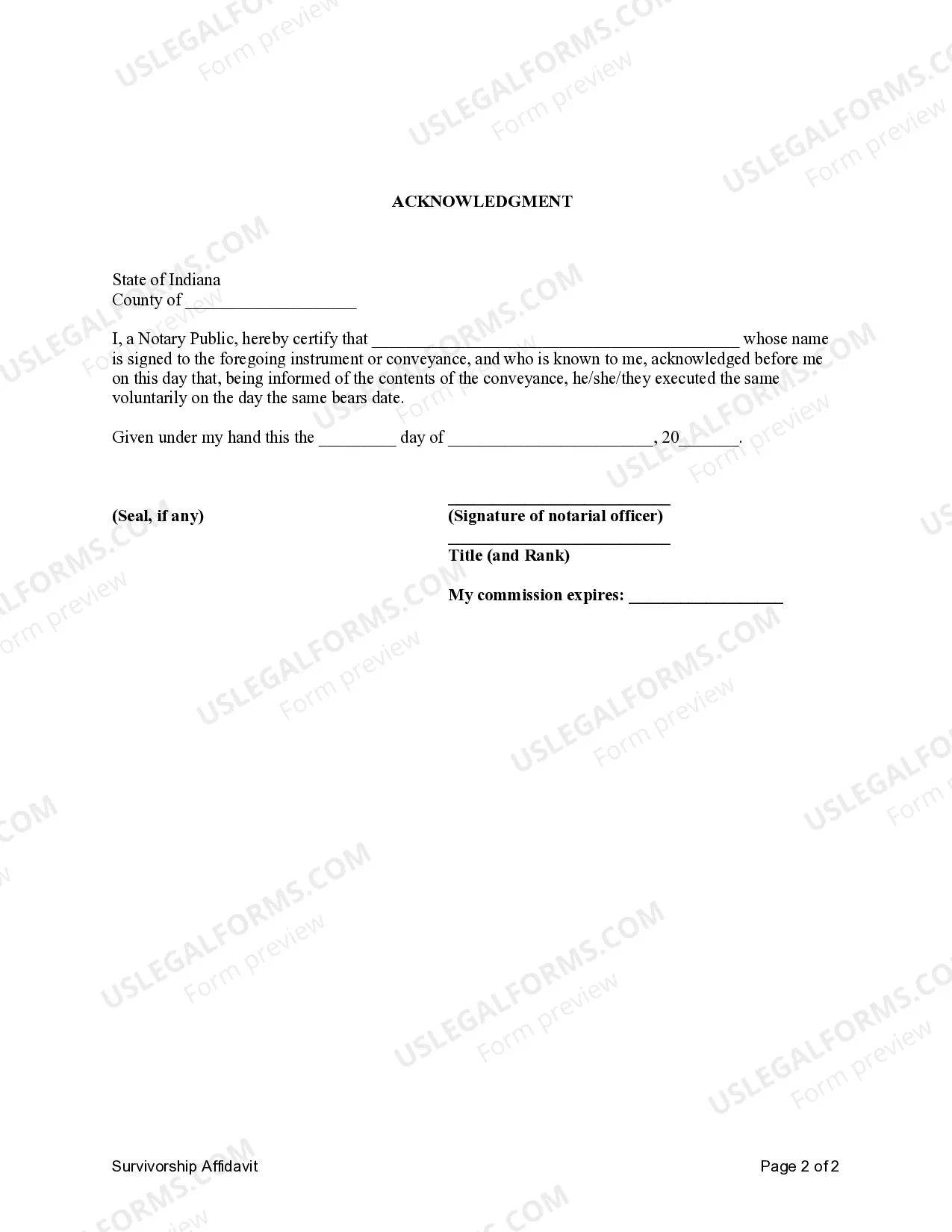

Most often, a copy of the deceased spouse's death certificate, the notarized death affidavit, and a legal description of the property are required. Once these steps are complete, your deceased spouse will have been removed and you will be the sole owner on the deed.

In Indiana, joint tenants can own real property jointly as tenants in common or as joint tenants with right of survivorship. Residents can also own certain personal property jointly as tenants in common or as joint tenants with right of survivorship.

When someone who owns real property dies, the property goes into probate or it automatically passes, by operation of law, to surviving co-owners. Often, surviving co-owners do nothing with the title for as long as they own the property. Yet the best practice is to remove the deceased owner's name from the title.

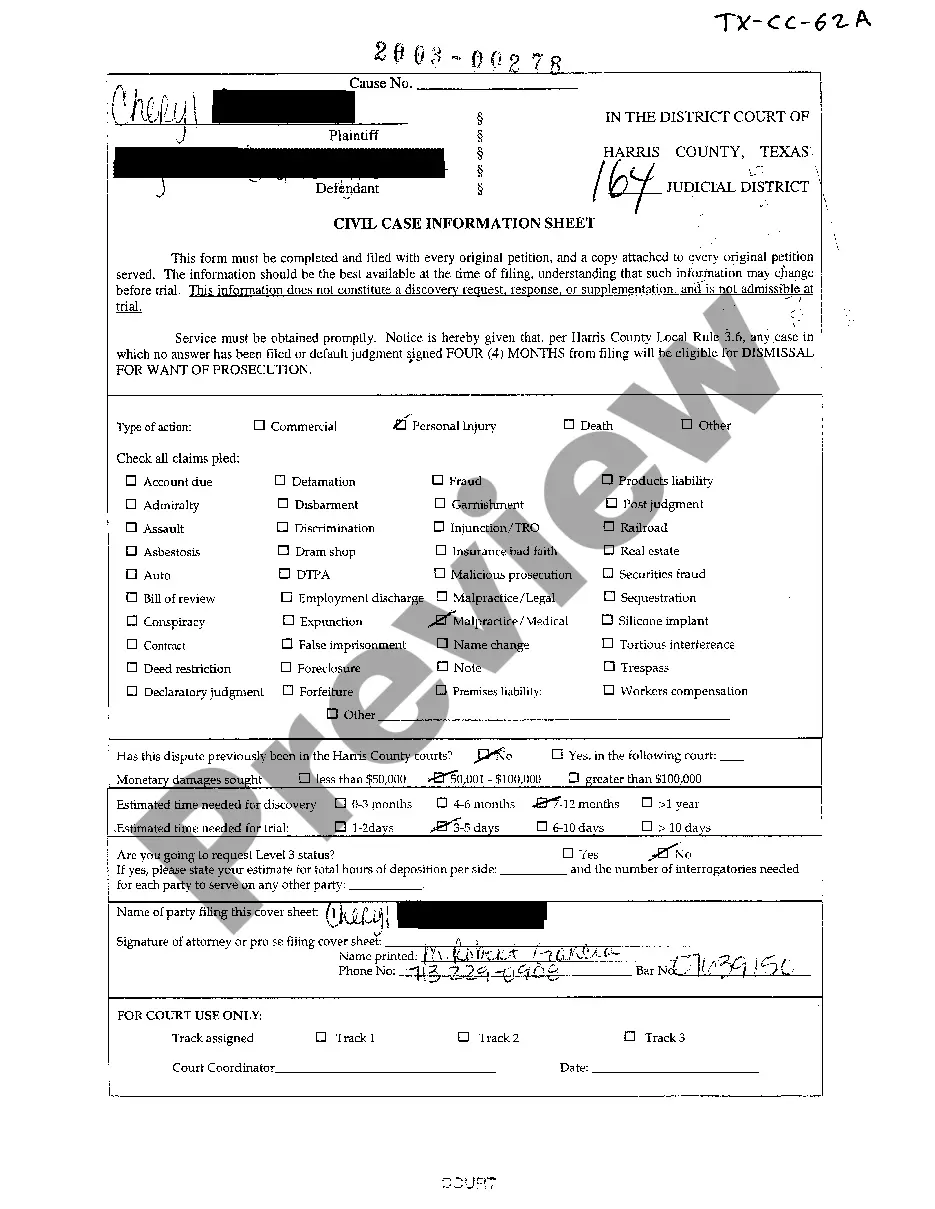

As we mentioned above, Indiana only requires probate of estates worth $50,000 or more. Smaller estates do not require administration. The family or personal representative can pay bills and transfer assets using an affidavit or written statement.

Obtaining a Grant of Probate is needed in most cases where the total value of the deceased's estate is deemed small... Going through the process of probate is often required to deal with a person's estate after they've passed away.

Transferring Indiana real estate usually involves four steps: Locate the prior deed to the property.Create the new deed.Sign the new deed.Record the original deed.

Code § 29-1-8-1), the inheritor can submit Indiana's Small Estate Affidavit (Form 54985). The inheritor must also notify all other inheritors of the plans to submit this affidavit to the court. This process can be used for actions such as: changing the title of a vehicle to the inheritor's name.

A survivorship affidavit is a legal document that removes the name of a deceased person from title on real property.

Beneficiaries or next-of-kin can then legally act as personal representatives for the deceased, meaning that they have the power and ability to then transfer ownership of the property and change the name on the deed if they so choose. They also have the power to sell the property.

Step 1 ? Wait Forty-five (45) Days. A period of forty-five (45) has to pass before you can use a small estate affidavit in the State of Indiana. Step 2 ? Prepare Affidavit. Download Form 54985.Step 3 ? Notify Every Person Identified.Step 4 ? Get It Notarized.Step 5 ? Collect the Assets.