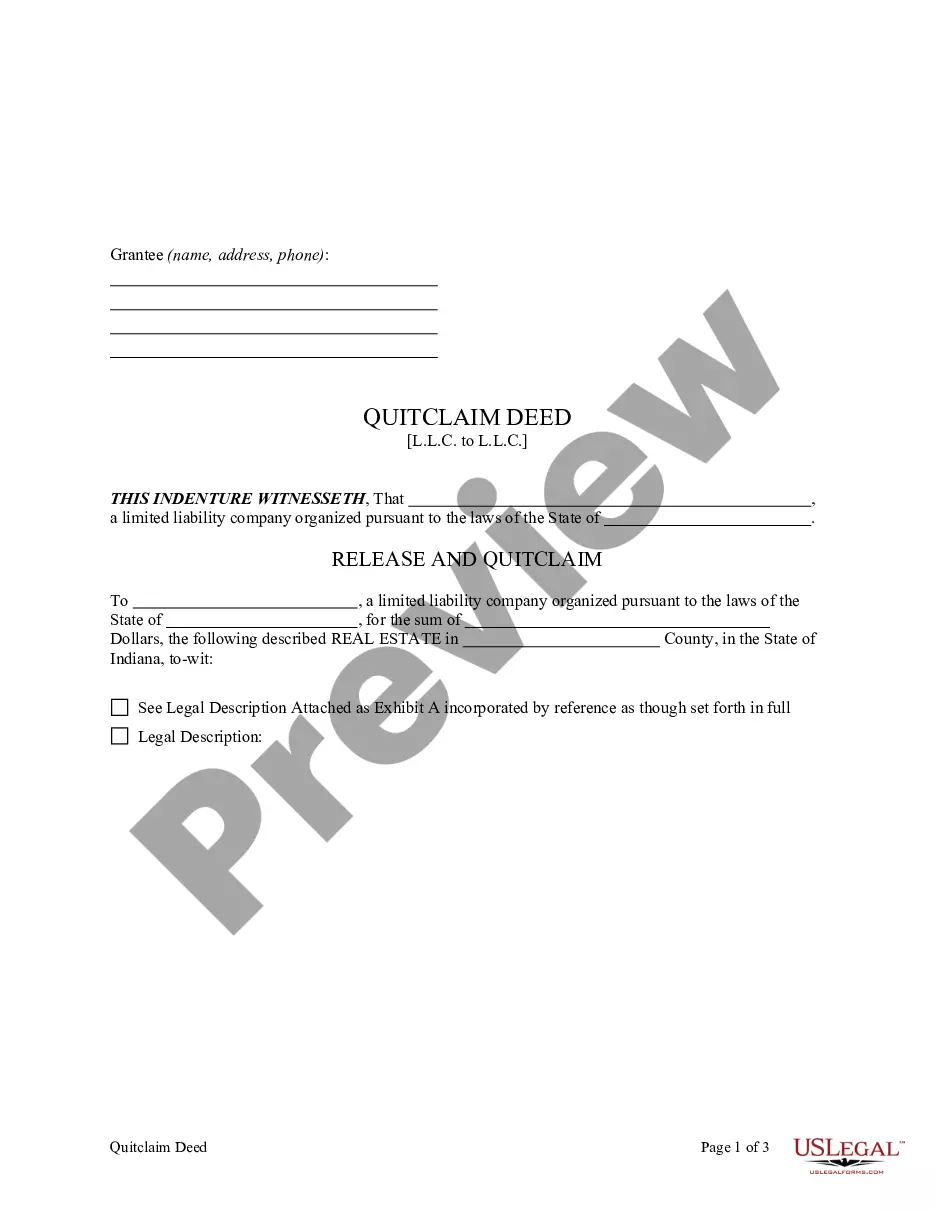

This form is a Quitclaim Deed where the grantor is a limited liability company and the grantee is a limited liability company. Grantor conveys and quitclaims the described property to grantee. This deed complies with all state statutory laws.

Indianapolis Indiana Quitclaim Deed - Limited Liability Company to Limited Liability Company

Description

How to fill out Indiana Quitclaim Deed - Limited Liability Company To Limited Liability Company?

We consistently aim to minimize or avert legal repercussions when engaging with intricate legal or financial matters.

To achieve this, we enroll in expensive legal solutions as a general practice.

However, not all legal issues are equally intricate; many can be managed independently.

US Legal Forms is an online repository of current DIY legal documents covering everything from wills and powers of attorney to incorporation articles and dissolution petitions.

Just Log In to your account and click the Get button next to it. If you misplace the document, you can always re-download it in the My documents tab. The process is equally simple if you are new to the site! You can create your account in a few minutes.

- Our platform empowers you to handle your matters independently without the need for a lawyer.

- We offer access to legal document templates that are not always readily accessible.

- Our templates are tailored to specific states and regions, which significantly simplifies the search process.

- Utilize US Legal Forms whenever you need to locate and download the Indianapolis Indiana Quitclaim Deed - Limited Liability Company to Limited Liability Company or any other document conveniently and securely.

Form popularity

FAQ

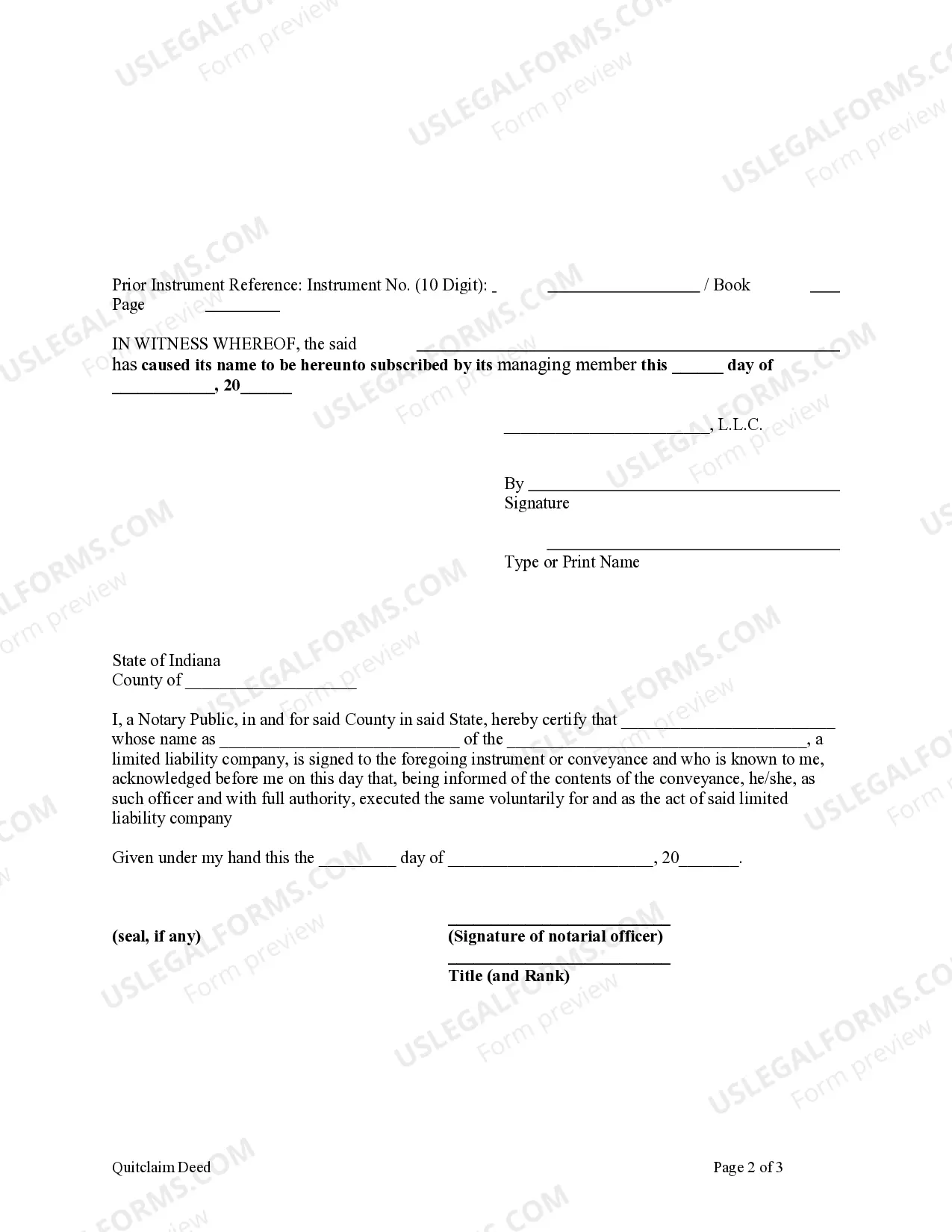

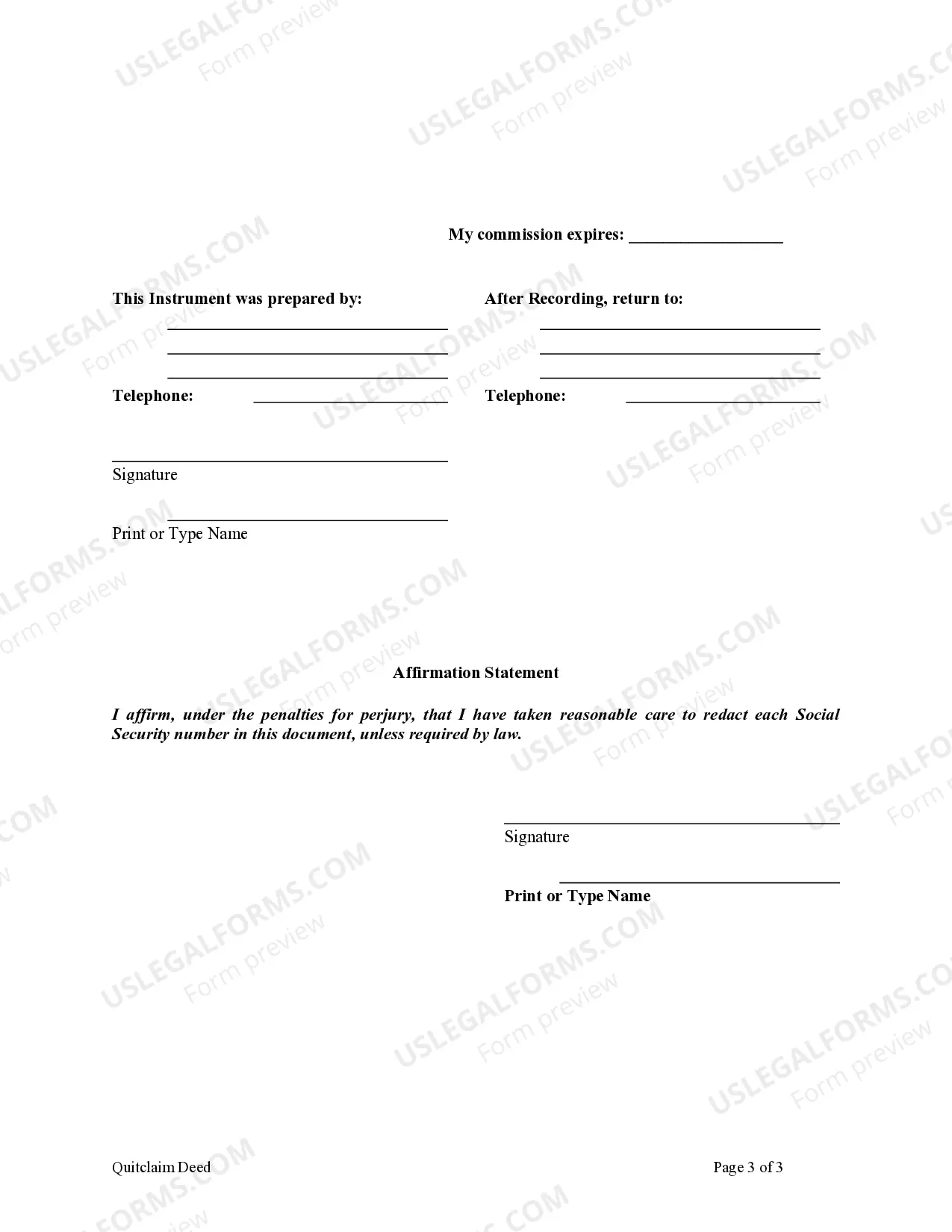

Transferring Indiana real estate usually involves four steps: Locate the prior deed to the property.Create the new deed.Sign the new deed.Record the original deed.

The Indiana quit claim deed form gives the new owner whatever interest the current owner has in the property when the deed is signed and delivered. It makes no promises about whether the current owner has clear title to the property.

What is an Indiana Quit Claim Deed? An Indiana quit claim deed form (sometimes called a quick claim deed or quitclaim deed) transfers Indiana real estate from the current owner (grantor) to the new owner (grantee) with no warrant of title.

You may find a draft deed online, through your local library, or another source. You can download this quit claim deed for simple transactions without warranties, such as adding/removing a person(s) to title.

Submit your document Marion County Assessor: $10.00 per parcel per document; AND $20.00 for each Sales Disclosure, if required. Marion County Recorder: $35.00 per document. The Assessor is responsible for transferring property in Marion County. The transfer stamp from their office is required before it can be recorded.

What is an Indiana Quit Claim Deed? An Indiana quit claim deed form (sometimes called a quick claim deed or quitclaim deed) transfers Indiana real estate from the current owner (grantor) to the new owner (grantee) with no warrant of title.

Step 1. Determine and prepare the needed requirements for a title transfer. Deed of Conveyance.Photocopies of valid IDs of all signatories in the deed.The Notary Public's official receipt for the deed's notarization. Certified True Copy of the Title (3 copies)Certified True Copy of the latest Tax Declaration.

The transfer process can take up to 3 months. There are different phases involved in the transfer of a property. These phases are: Instruction: a conveyancer receives the instruction to transfer the property.

Signing (IC § 32-21-2-3) ? All deed must be executed by one of the following: judge, clerk of a court of record, county auditor, county recorder, notary public, mayor of a city in Indiana or any other state, commissioner appointed in a state other than Indiana by the governor of Indiana, clerk of the city county