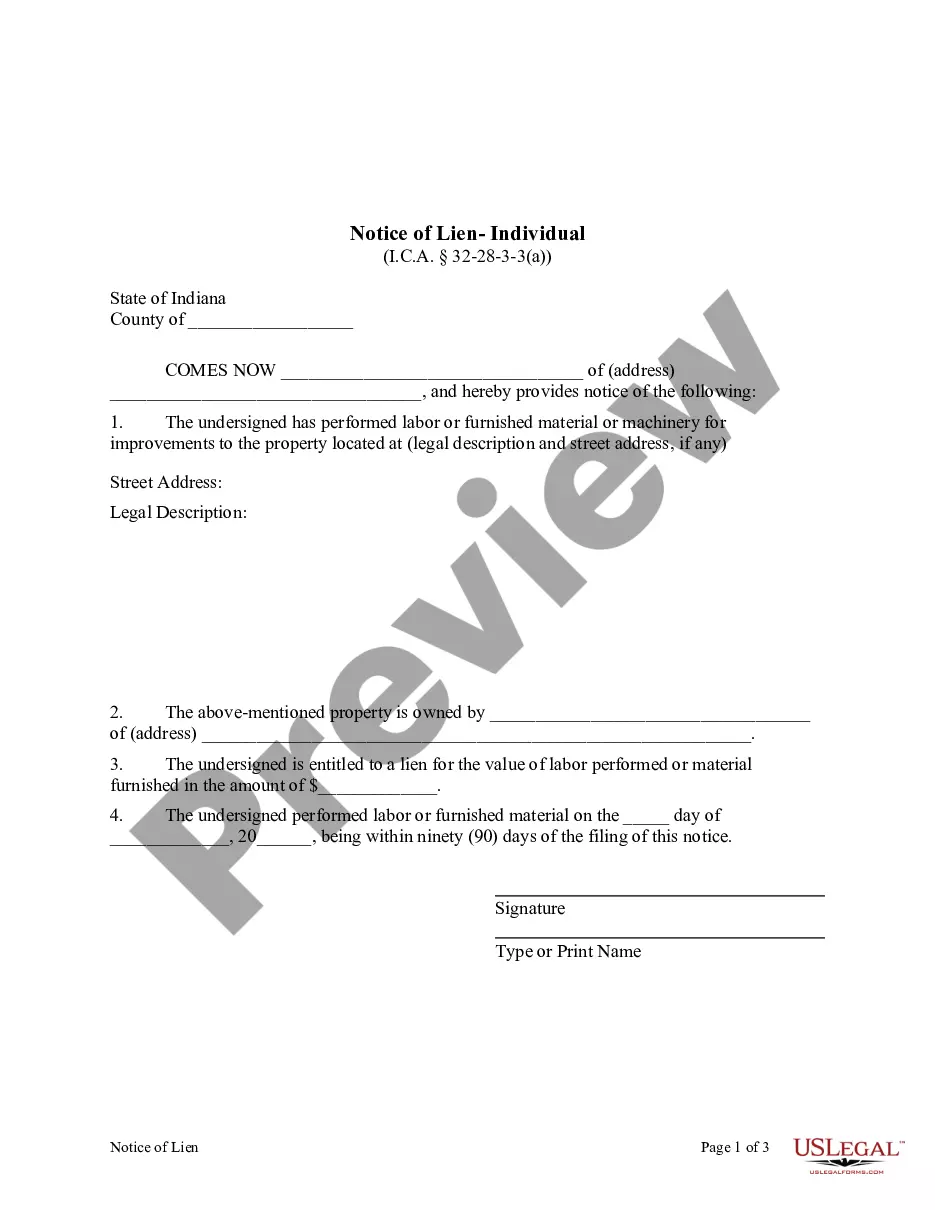

This form is used to officially record a lien. It must be filed in duplicate in the recorder's office within ninety (90) days after performing labor or furnishing materials. It sets out the amount that the lien claimant is owed, the names and addresses of the claimant and owner, and the legal description of the property. Please note that a different form is used for Class 2 structures.

Evansville Indiana Notice of Lien - Individual

Description

How to fill out Indiana Notice Of Lien - Individual?

If you have previously utilized our service, sign in to your account and download the Evansville Indiana Notice of Lien - Individual to your device by selecting the Download button. Ensure your subscription is active. If it’s not, renew it according to your payment arrangement.

If this is your initial encounter with our service, follow these straightforward steps to acquire your file.

You have ongoing access to every document you have acquired: you can find it in your profile under the My documents menu whenever you wish to use it again. Take advantage of the US Legal Forms service to swiftly locate and save any template for your personal or professional needs!

- Confirm you’ve located the correct document. Review the description and utilize the Preview option, if accessible, to verify if it satisfies your requirements. If it doesn’t fulfill your need, use the Search tab above to find the suitable one.

- Purchase the template. Press the Buy Now button and select a monthly or yearly subscription plan.

- Establish an account and process a payment. Provide your credit card information or select the PayPal option to finalize the transaction.

- Retrieve your Evansville Indiana Notice of Lien - Individual. Choose the file format for your document and store it on your device.

- Complete your document. Print it out or utilize professional online editors to fill it in and sign it electronically.

Form popularity

FAQ

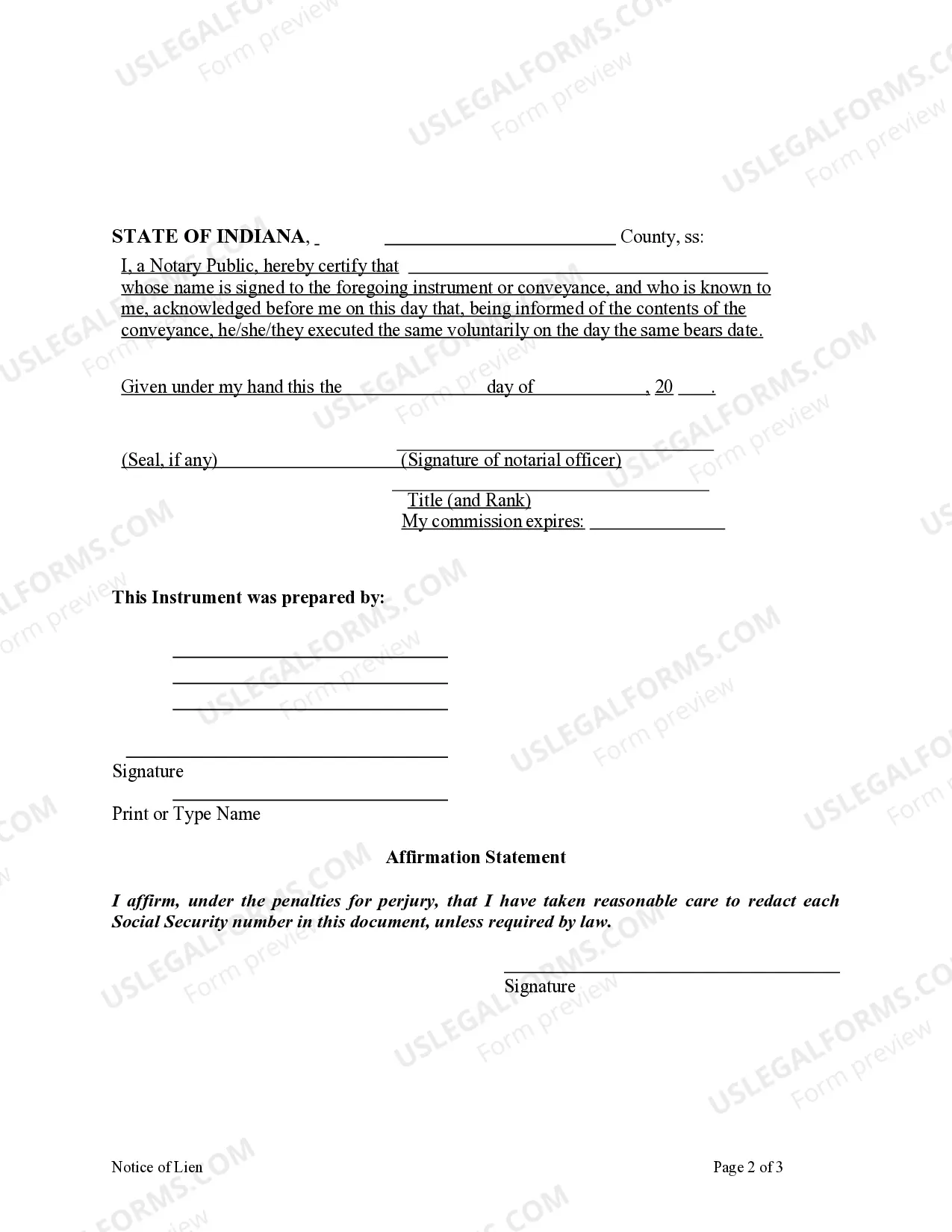

To fill out an affidavit form, start by clearly stating your name, the purpose of the affidavit, and the facts you are attesting to. Include any additional details that support your claim and ensure that it is signed and notarized. If you need guidance, consider using USLegalForms, which provides templates designed specifically for the Evansville Indiana Notice of Lien - Individual, making the process easier for you.

Filling out an affidavit of claim involves providing specific information about the claim, including the nature of the debt and identification of the property in question. Ensure that your affidavit is signed in the presence of a notary public to meet legal requirements. Accessing USLegalForms can simplify this process, enabling you to create an accurate affidavit relating to your Evansville Indiana Notice of Lien - Individual.

When writing a letter of intent for a lien, clearly state the purpose of the letter and the amount owed. Include the debtor's information and describe the property that will be affected by the lien. Make sure to convey all relevant details in a concise manner. Using resources from USLegalForms can help you structure your letter effectively for the Evansville Indiana Notice of Lien - Individual.

To file a lien on property in Indiana, you start by completing the necessary forms, which typically include a Notice of Lien. You will need to include specific details about the debt owed and the property in question. Once completed, submit the lien to the appropriate county office where the property is located. For assistance, consider using USLegalForms, which offers user-friendly templates for your Evansville Indiana Notice of Lien - Individual.

In Indiana, property liens typically last for ten years if they are not renewed or satisfied. However, certain types of liens can have different durations depending on the nature of the debt and the actions taken by the lienholder. It's essential to act promptly to either resolve any outstanding debts or to contest any disputes relating to the lien. Our information on Evansville Indiana Notice of Lien - Individual can further clarify these timelines.

You can look up liens in Indiana by visiting the local county recorder's office or utilizing various online services that compile lien records. Searching by the property address or owner's name can yield important information regarding any existing liens. Being proactive about this research can save you from surprises later on. For more details, our Evansville Indiana Notice of Lien - Individual page offers essential tools to assist you.

To check for a lien on a property in Indiana, you can visit the county recorder's office to access public records or use online databases that provide this information. Look for the property owner’s name and review any related filings or documents. Understanding this can help you avoid potential issues before purchasing or selling a property. Our Evansville Indiana Notice of Lien - Individual resources can guide you through these queries.

To conduct a title search on a property in Indiana, you typically start at the county recorder's office where the property is located. You can request access to property records, including information on any existing liens or claims. Additionally, numerous online platforms exist that facilitate these searches. Utilizing tools related to Evansville Indiana Notice of Lien - Individual can make this process more efficient.

A notice of intent to lien is a formal alert that a creditor intends to file a lien against your property if debts remain unpaid. This notice provides you with an opportunity to settle the debt before the lien is officially recorded. In Indiana, it plays a crucial role in protecting your rights and providing clarity on potential financial claims. To better understand this process, explore our Evansville Indiana Notice of Lien - Individual offerings.

A lien filing notice is an official document that informs all parties involved that a lien has been placed on a property. This notice typically includes details about the debt and the party that filed the lien. It serves as a public record to ensure transparency regarding ownership and any pending financial claims. For insights on handling lien filings, consider our Evansville Indiana Notice of Lien - Individual resources.