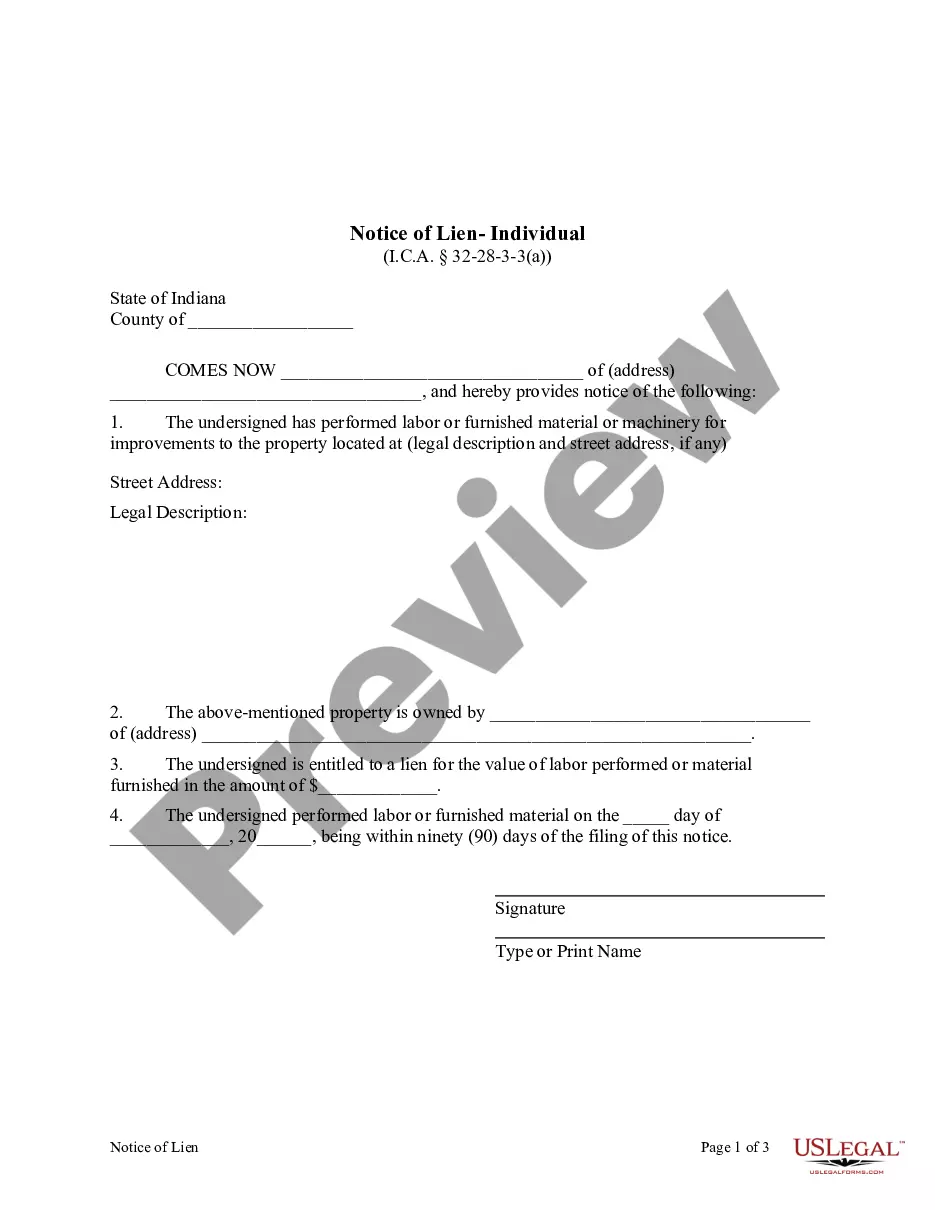

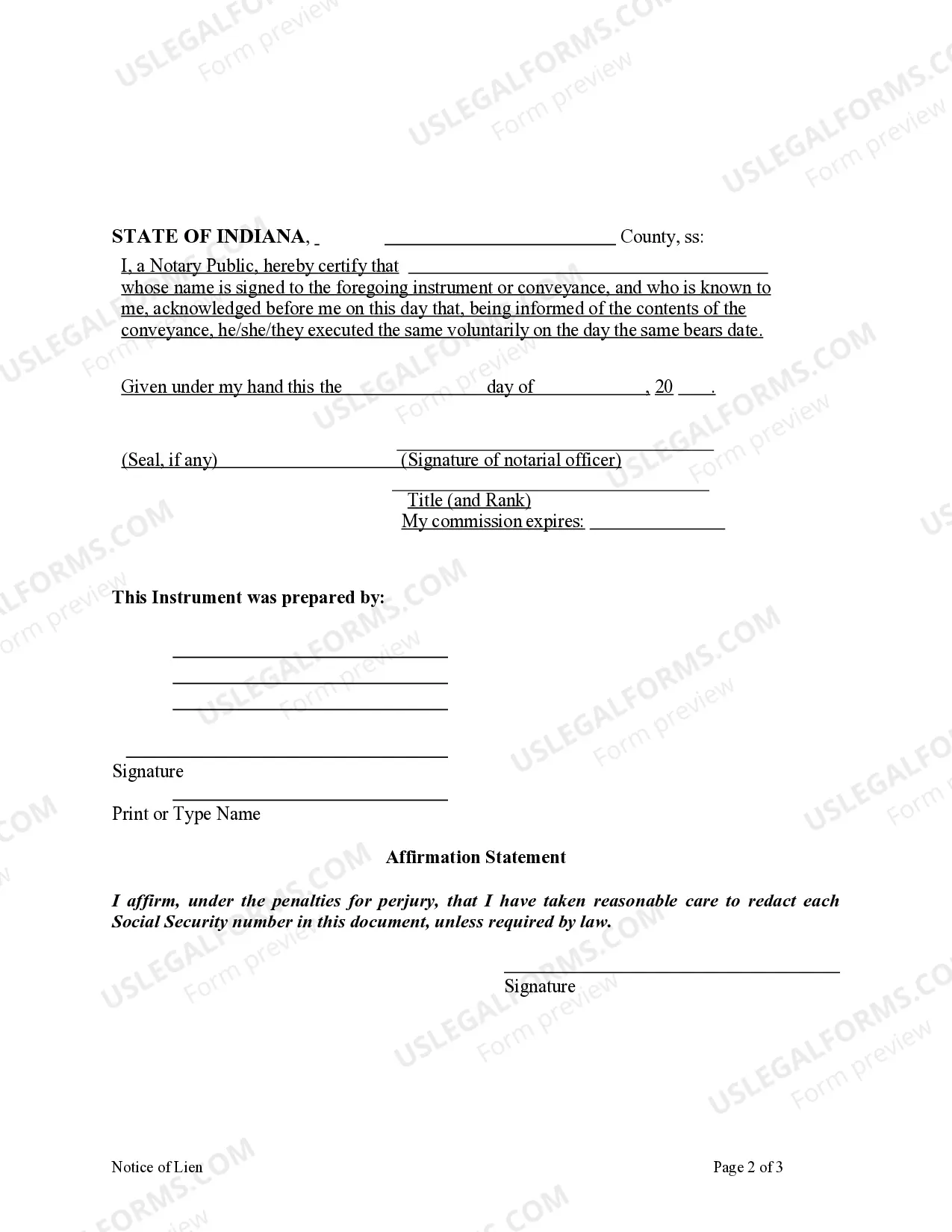

This form is used to officially record a lien. It must be filed in duplicate in the recorder's office within ninety (90) days after performing labor or furnishing materials. It sets out the amount that the lien claimant is owed, the names and addresses of the claimant and owner, and the legal description of the property. Please note that a different form is used for Class 2 structures.

South Bend Indiana Notice of Lien — Individual: A Comprehensive Overview A South Bend Indiana Notice of Lien — Individual is an important legal document filed by an individual or a business that claims a right to a specific property as collateral for a debt owed to them. This notice serves as a formal communication to inform property owners, potential buyers, or interested parties about the existence of a lien and its legal implications. By filing this notice, the claimant aims to protect their financial interest in the property and ensure the debt owed to them is satisfied before any transfer of ownership can take place. There are various types of South Bend Indiana Notice of Lien — Individual that may be encountered. Some common types include: 1. Mechanic's Lien: This type of lien is filed by contractors, subcontractors, or suppliers who have provided labor, services, or materials for construction or improvement of a property but have not received full payment for their work. Filing a mechanic's lien ensures that the claimant has a legal right to the property and can potentially force its sale to recover the unpaid debt. 2. Tax Lien: When individuals or businesses fail to pay their taxes, the local or state government may place a tax lien on their property. This type of lien gives the government the authority to seize the property and sell it at auction to collect the unpaid taxes. 3. Judgment Lien: If someone obtains a monetary judgment against an individual or business through a lawsuit, they can file a judgment lien on the debtor's property. This lien ensures that the claimant has priority in getting paid once the property is sold or refinanced. 4. Child Support Lien: In cases where individuals fail to meet their child support obligations, a child support lien may be placed on their property. This lien emphasizes the importance of fulfilling child support obligations and may result in the forced sale of the property to satisfy the debt. When a South Bend Indiana Notice of Lien — Individual is filed, it becomes a matter of public record and can significantly impact the property owner's ability to sell or refinance their property. Potential buyers or lenders will often conduct a title search to identify any existing liens, which can affect their decision-making process. It is crucial for individuals or businesses who receive a South Bend Indiana Notice of Lien — Individual to address it promptly. They can either satisfy the debt owed to the claimant or negotiate a settlement to release the lien. Resolving the lien is vital to maintain clear title to the property and to avoid potential legal consequences. In conclusion, a South Bend Indiana Notice of Lien — Individual serves as a legal notice alerting property owners and interested parties about the existence of a lien and its associated financial obligations. Understanding the different types of liens and their implications is crucial for property owners to effectively manage their legal and financial responsibilities.South Bend Indiana Notice of Lien — Individual: A Comprehensive Overview A South Bend Indiana Notice of Lien — Individual is an important legal document filed by an individual or a business that claims a right to a specific property as collateral for a debt owed to them. This notice serves as a formal communication to inform property owners, potential buyers, or interested parties about the existence of a lien and its legal implications. By filing this notice, the claimant aims to protect their financial interest in the property and ensure the debt owed to them is satisfied before any transfer of ownership can take place. There are various types of South Bend Indiana Notice of Lien — Individual that may be encountered. Some common types include: 1. Mechanic's Lien: This type of lien is filed by contractors, subcontractors, or suppliers who have provided labor, services, or materials for construction or improvement of a property but have not received full payment for their work. Filing a mechanic's lien ensures that the claimant has a legal right to the property and can potentially force its sale to recover the unpaid debt. 2. Tax Lien: When individuals or businesses fail to pay their taxes, the local or state government may place a tax lien on their property. This type of lien gives the government the authority to seize the property and sell it at auction to collect the unpaid taxes. 3. Judgment Lien: If someone obtains a monetary judgment against an individual or business through a lawsuit, they can file a judgment lien on the debtor's property. This lien ensures that the claimant has priority in getting paid once the property is sold or refinanced. 4. Child Support Lien: In cases where individuals fail to meet their child support obligations, a child support lien may be placed on their property. This lien emphasizes the importance of fulfilling child support obligations and may result in the forced sale of the property to satisfy the debt. When a South Bend Indiana Notice of Lien — Individual is filed, it becomes a matter of public record and can significantly impact the property owner's ability to sell or refinance their property. Potential buyers or lenders will often conduct a title search to identify any existing liens, which can affect their decision-making process. It is crucial for individuals or businesses who receive a South Bend Indiana Notice of Lien — Individual to address it promptly. They can either satisfy the debt owed to the claimant or negotiate a settlement to release the lien. Resolving the lien is vital to maintain clear title to the property and to avoid potential legal consequences. In conclusion, a South Bend Indiana Notice of Lien — Individual serves as a legal notice alerting property owners and interested parties about the existence of a lien and its associated financial obligations. Understanding the different types of liens and their implications is crucial for property owners to effectively manage their legal and financial responsibilities.