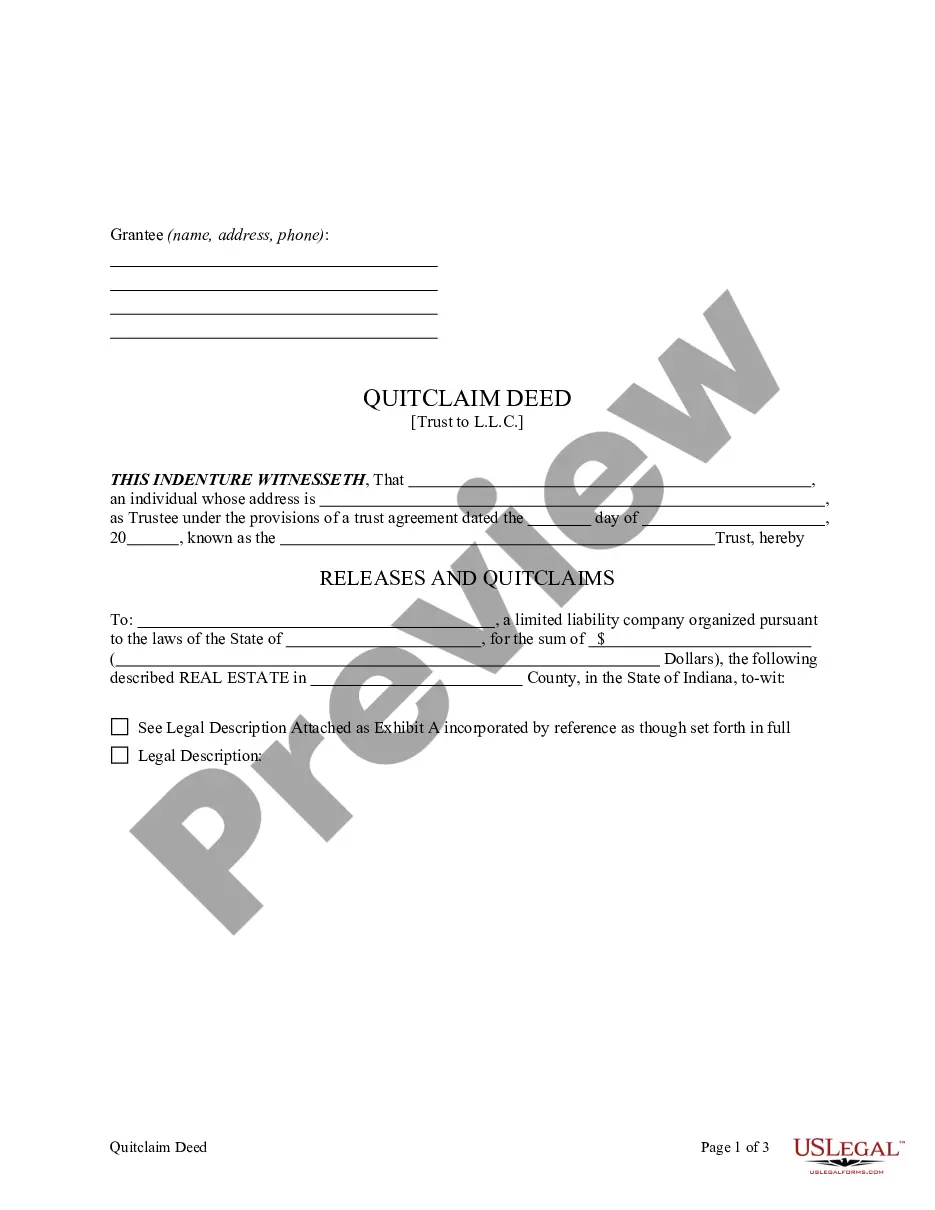

This form is a Quitclaim Deed where the Grantor is a Trust acting by and through a named Trustee and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

South Bend Indiana Quitclaim Deed from a Trust to a Limited Liability Company

Description

How to fill out Indiana Quitclaim Deed From A Trust To A Limited Liability Company?

Irrespective of societal or occupational rank, completing legal-related documentation is an unfortunate requirement in today’s workplace.

Frequently, it’s nearly unfeasible for an individual lacking any legal expertise to generate such forms from scratch, primarily due to the intricate terminology and legal nuances they entail.

This is where US Legal Forms steps in to assist.

Ensure the template you discovered is tailored to your specific area, as the laws of one jurisdiction may not apply in another.

Examine the document and read through a brief summary (if available) of scenarios for which the document can be utilized.

- Our platform provides an extensive collection of over 85,000 ready-to-use, state-specific templates suitable for nearly any legal situation.

- US Legal Forms is also a valuable asset for paralegals or legal advisors looking to conserve time with our DIY documents.

- Whether you require the South Bend Indiana Quitclaim Deed from a Trust to a Limited Liability Company or another form that is appropriate in your jurisdiction, with US Legal Forms, everything is readily available.

- Here’s how you can swiftly obtain the South Bend Indiana Quitclaim Deed from a Trust to a Limited Liability Company using our reliable service.

- If you are currently a member, simply Log In to access your account and download the necessary form.

- However, if you are new to our site, make sure to follow these instructions before downloading the South Bend Indiana Quitclaim Deed from a Trust to a Limited Liability Company.

Form popularity

FAQ

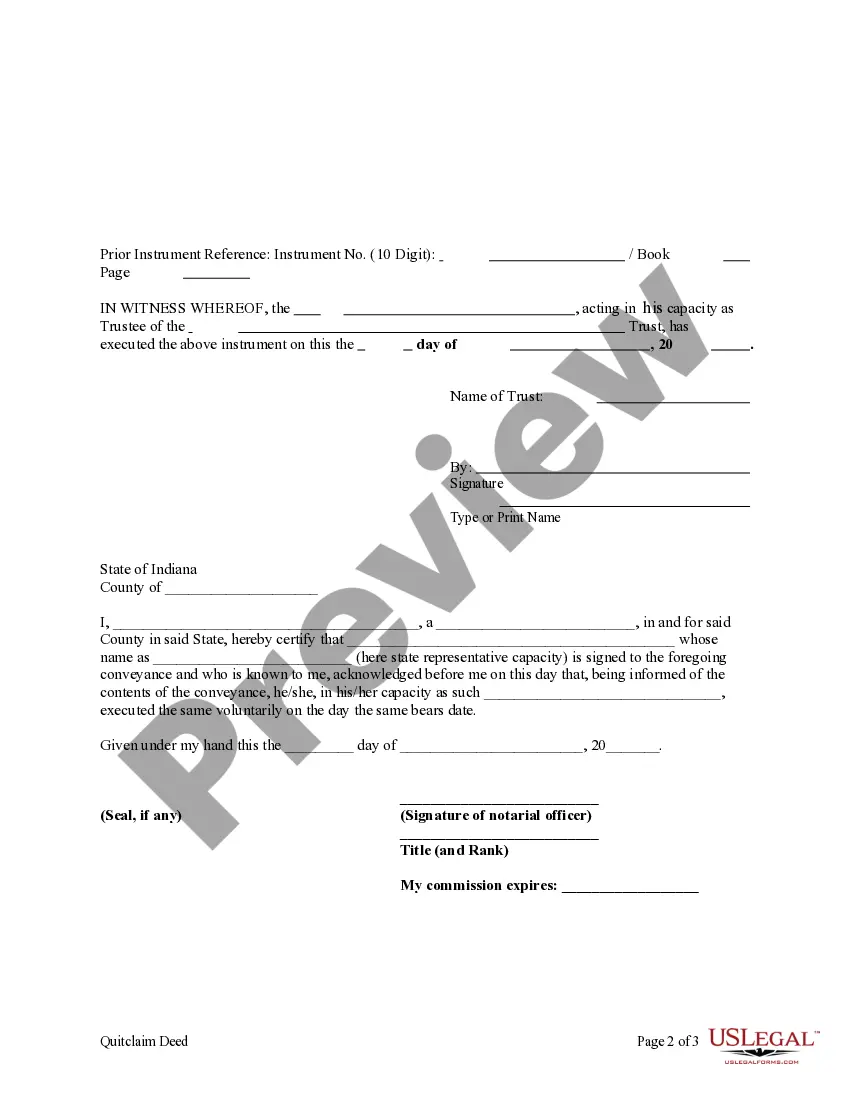

To create a valid quitclaim deed in Indiana, certain key elements must be included. You need the names of the grantor and grantee, a detailed legal description of the property, and an affirmation of your intention to transfer ownership. When using a South Bend Indiana Quitclaim Deed from a Trust to a Limited Liability Company, you should also ensure that the deed is properly notarized and filed with the county. Utilizing a platform like uslegalforms can streamline this process and provide templates to meet Indiana's legal requirements.

In Indiana, a quitclaim deed must meet specific requirements to be valid, including a clear statement of intent to convey ownership. The document should include the names of the parties, a legal description of the property, and be signed by the grantor. Furthermore, the South Bend Indiana Quitclaim Deed from a Trust to a Limited Liability Company must be notarized and recorded in the county recorder's office. This ensures that the transfer is legally recognized and protects the interests of all parties.

The primary purpose of a quitclaim deed is to transfer ownership of property without providing any guarantees regarding the title. People commonly use a South Bend Indiana Quitclaim Deed from a Trust to a Limited Liability Company to simplify the transfer process when the parties know each other well. This method helps avoid lengthy court proceedings and is often done in family or trust situations. Additionally, it can help minimize tax implications for the parties involved.

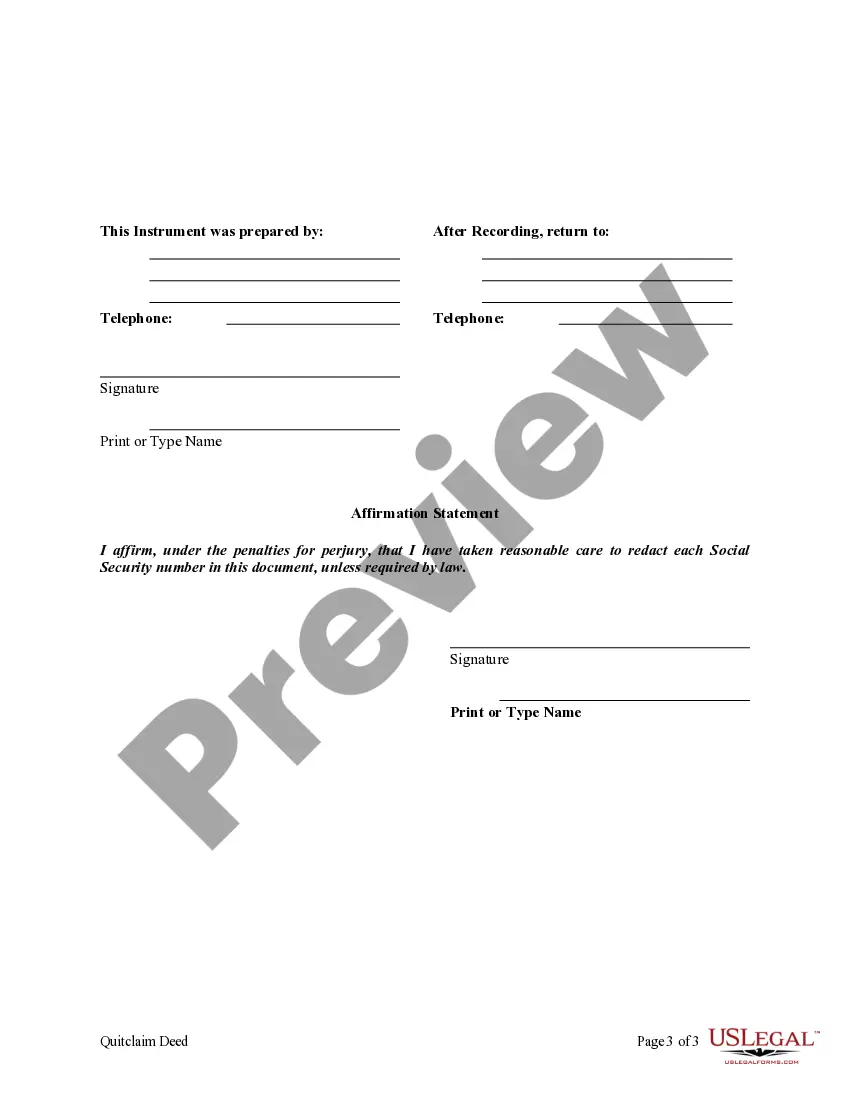

Legally, individuals who are licensed to practice law, such as attorneys, can prepare a deed in Indiana. Additionally, any resident who meets the state’s requirements can draft their own deed, like the South Bend Indiana Quitclaim Deed from a Trust to a Limited Liability Company. Consider using platforms like USLegalForms for reliable templates and tools that simplify the process and help you ensure compliance with Indiana’s legal standards.

In Indiana, several individuals can prepare a quit claim deed, including licensed attorneys and individuals familiar with real estate law. While you can draft the document yourself, having a lawyer review your South Bend Indiana Quitclaim Deed from a Trust to a Limited Liability Company can prevent possible legal issues in the future. It’s essential to have a clear understanding of the legal requirements to ensure your deed is enforceable.

Yes, you can prepare your own quit claim deed in Indiana, but it requires careful attention to detail. When creating your South Bend Indiana Quitclaim Deed from a Trust to a Limited Liability Company, you must ensure that all necessary components are included and accurately formatted. Resources like USLegalForms can provide templates and guidance to help you complete the deed correctly and efficiently.

Typically, anyone can draw up a quit claim deed, but it is advisable to seek assistance from a legal professional. You want to ensure that your South Bend Indiana Quitclaim Deed from a Trust to a Limited Liability Company is correctly structured and complies with state laws. A knowledgeable attorney can help you navigate the complexities and provide you with peace of mind as you complete the process.

To remove your property from an LLC, you must create and record a new quitclaim deed that transfers the property back to your name. This involves executing the deed and filing it with the county recorder’s office. It's a straightforward process, but you may consult with a legal expert to ensure everything is done correctly.

Yes, you can use a quitclaim deed to transfer property to an LLC. This process involves executing a South Bend Indiana Quitclaim Deed from a Trust to a Limited Liability Company and signing it in front of a notary. It effectively transfers legal ownership from an individual or trust to the LLC.

In Indiana, you file a quitclaim deed with the county recorder’s office where the property is located. This is important to ensure that the transfer is officially recorded. You should also obtain a copy of the filed quitclaim deed for your records after submitting the South Bend Indiana Quitclaim Deed from a Trust to a Limited Liability Company.