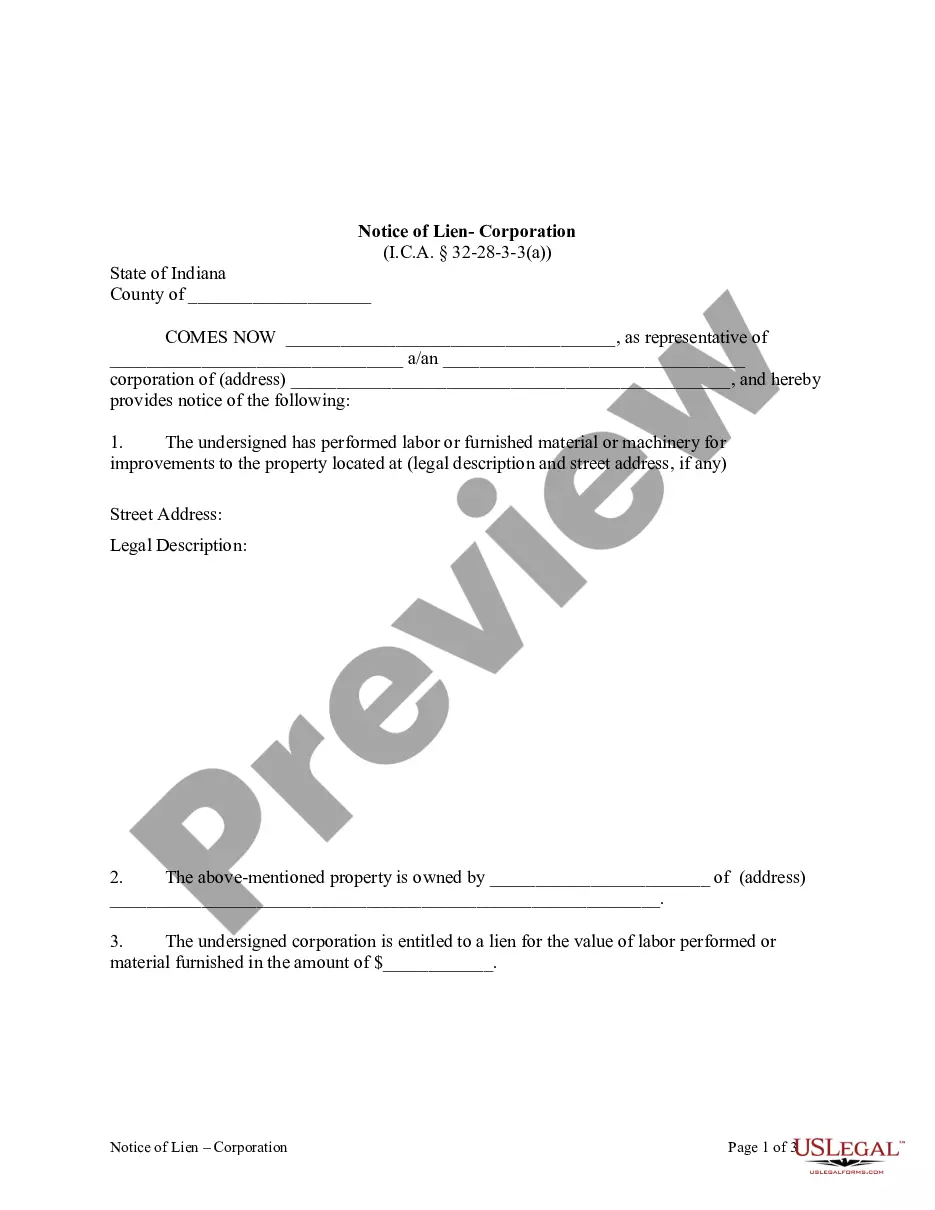

This form is used to officially record a lien. It must be filed in duplicate in the recorder's office within ninety (90) days after performing labor or furnishing materials. It sets out the amount that the lien claimant is owed, the names and addresses of the claimant and owner, and the legal description of the property. Please note that a different form is used for Class 2 structures.

A Carmel Indiana Notice of Lien — Corporation or LLC is a legal document that is used to notify the public that a corporation or limited liability company (LLC) in Carmel, Indiana has a claim or lien against a property or asset. This notice is typically filed with the appropriate governmental agency, such as the Clerk of the Circuit Court, and serves to protect the rights of the corporation or LLC in recovering any debts or obligations owed to them. There are several types of Carmel Indiana Notice of Lien — Corporation or LLC, each serving a specific purpose: 1. Mechanic's Lien: This type of lien is commonly used in construction and real estate industries. It allows a corporation or LLC to assert their rights to payment for labor, services, or materials provided for the improvement or construction of a property. This lien can be filed by subcontractors, contractors, suppliers, or other entities involved in the construction process. 2. Tax Lien: A tax lien is filed by the state or local government when a corporation or LLC fails to pay their taxes owed. This type of lien allows the government to place a claim on the property or assets of the business in order to secure the payment of taxes owed. 3. Judgment Lien: A judgment lien is typically filed by a corporation or LLC after winning a lawsuit against another party. It allows the business to claim the debtor's property or assets to satisfy the judgment amount. 4. UCC Lien: A UCC (Uniform Commercial Code) lien is filed by a corporation or LLC that has a security interest in personal property used as collateral for a loan or other financial obligation. This lien provides notice to potential creditors that the property is already encumbered. When filing a Carmel Indiana Notice of Lien — Corporation or LLC, it is crucial to provide accurate and complete information about the lien holder, the debtor, the property or asset being claimed, and the amount of the debt owed. It is also important to follow the relevant procedural requirements and deadlines set by the state to ensure the validity and enforceability of the lien. Overall, a Carmel Indiana Notice of Lien — Corporation or LLC is a vital legal tool that assists businesses in protecting their rights to payment and securing their financial interests in properties or assets. By properly filing this notice, corporations and LCS can enforce their claims and recover their debts in a legal and orderly manner.A Carmel Indiana Notice of Lien — Corporation or LLC is a legal document that is used to notify the public that a corporation or limited liability company (LLC) in Carmel, Indiana has a claim or lien against a property or asset. This notice is typically filed with the appropriate governmental agency, such as the Clerk of the Circuit Court, and serves to protect the rights of the corporation or LLC in recovering any debts or obligations owed to them. There are several types of Carmel Indiana Notice of Lien — Corporation or LLC, each serving a specific purpose: 1. Mechanic's Lien: This type of lien is commonly used in construction and real estate industries. It allows a corporation or LLC to assert their rights to payment for labor, services, or materials provided for the improvement or construction of a property. This lien can be filed by subcontractors, contractors, suppliers, or other entities involved in the construction process. 2. Tax Lien: A tax lien is filed by the state or local government when a corporation or LLC fails to pay their taxes owed. This type of lien allows the government to place a claim on the property or assets of the business in order to secure the payment of taxes owed. 3. Judgment Lien: A judgment lien is typically filed by a corporation or LLC after winning a lawsuit against another party. It allows the business to claim the debtor's property or assets to satisfy the judgment amount. 4. UCC Lien: A UCC (Uniform Commercial Code) lien is filed by a corporation or LLC that has a security interest in personal property used as collateral for a loan or other financial obligation. This lien provides notice to potential creditors that the property is already encumbered. When filing a Carmel Indiana Notice of Lien — Corporation or LLC, it is crucial to provide accurate and complete information about the lien holder, the debtor, the property or asset being claimed, and the amount of the debt owed. It is also important to follow the relevant procedural requirements and deadlines set by the state to ensure the validity and enforceability of the lien. Overall, a Carmel Indiana Notice of Lien — Corporation or LLC is a vital legal tool that assists businesses in protecting their rights to payment and securing their financial interests in properties or assets. By properly filing this notice, corporations and LCS can enforce their claims and recover their debts in a legal and orderly manner.