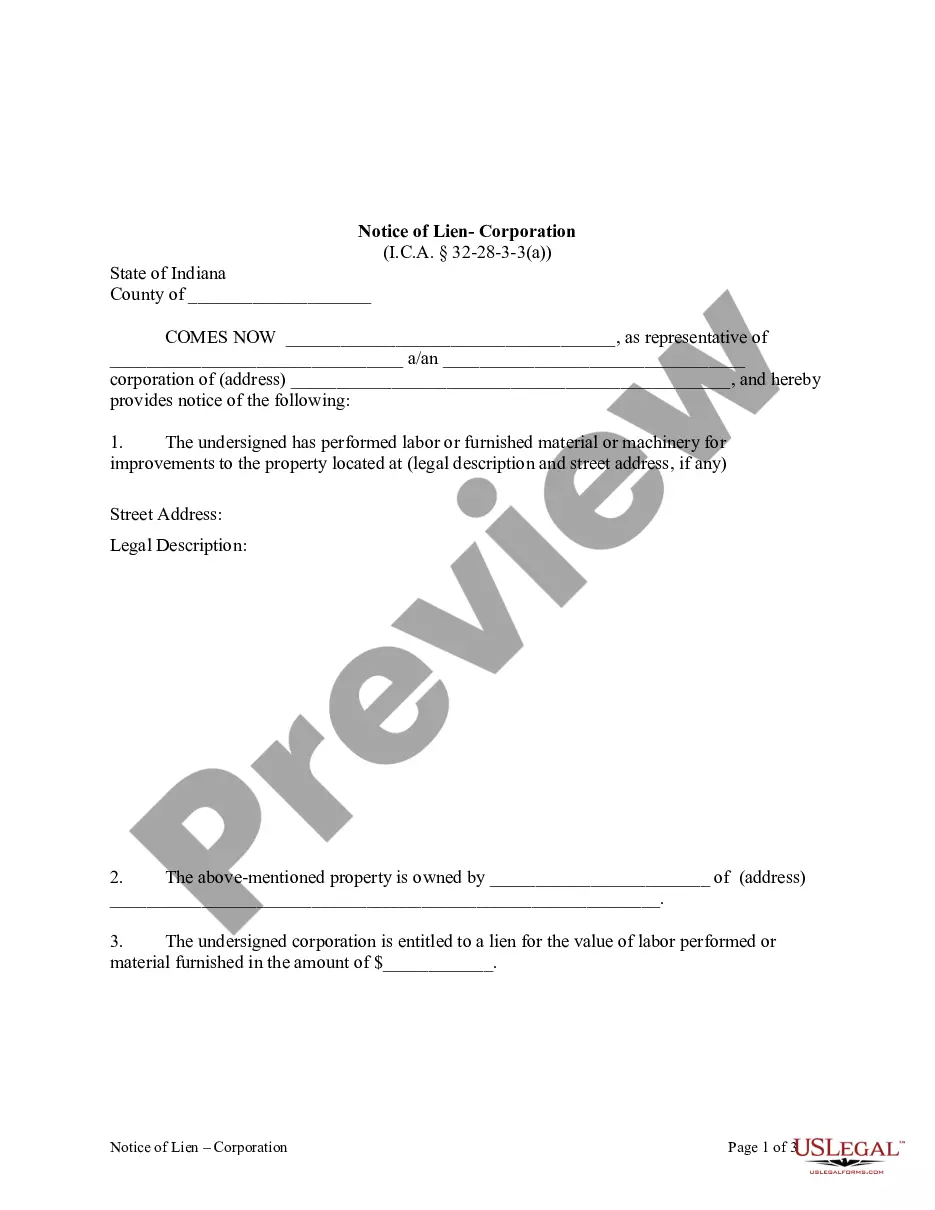

This form is used to officially record a lien. It must be filed in duplicate in the recorder's office within ninety (90) days after performing labor or furnishing materials. It sets out the amount that the lien claimant is owed, the names and addresses of the claimant and owner, and the legal description of the property. Please note that a different form is used for Class 2 structures.

Evansville Indiana Notice of Lien — Corporation or LLC: A Comprehensive Overview In the realm of business and the legal framework surrounding it, liens can play a pivotal role when it comes to financial security and obligations. Evansville, Indiana, like many other jurisdictions, allows for notices of lien to be filed against corporations or limited liability companies (LCS) in specific circumstances. This comprehensive guide aims to provide a detailed description of what an Evansville Indiana Notice of Lien — Corporation or LLC entails, exploring its purpose, types, and significance in the business world. What is a Notice of Lien? A Notice of Lien is a legal document filed by a creditor to indicate their claim on the property or assets of a corporation or LLC as collateral for a debt or obligation owed to them. It serves as a public record that notifies other parties, such as potential purchasers or creditors, of the outstanding financial encumbrance affecting the business. Purpose of an Evansville Indiana Notice of Lien — Corporation or LLC: The primary purpose of filing a notice of lien against a corporation or LLC in Evansville, Indiana, is to protect the rights of creditors who are owed a debt. By formally registering a lien, the creditor ensures that their claim takes precedence over subsequent claims or transfers of ownership made by the debtor. It acts as a safeguard and helps creditors navigate complex legal processes to recover their owed funds. Types of Evansville Indiana Notices of Lien — Corporation or LLC: 1. Tax Lien: The Evansville Department of Revenue may file a tax lien against a corporation or LLC that fails to meet its tax obligations. Tax liens can be enforced against the business's assets and property to collect unpaid taxes. 2. Judgment Lien: A judgment lien is filed when a creditor obtains a court judgment against a corporation or LLC. This lien allows the creditor to collect the owed debt by attaching the lien to the business's real estate, personal property, or other assets until the debt is satisfied. 3. UCC Lien: Under the Uniform Commercial Code (UCC), a creditor may file a UCC lien against a corporation or LLC to secure their interest in the business's personal property. UCC liens typically apply to business equipment, inventory, accounts receivable, or other valuable assets. Significance and Implications: When a notice of lien is filed against a corporation or LLC in Evansville, Indiana, it serves as a cautionary sign for potential creditors or buyers interested in engaging with the business. The existence of a lien may complicate the ability to secure loans, obtain credit, or transfer ownership smoothly. Additionally, a notice of lien can negatively impact the corporation or LLC's credit rating, making it more challenging to establish trust and secure future business transactions. To address a filed notice of lien, the corporation or LLC must take the necessary steps to resolve the underlying debt or obligation promptly. This can involve negotiations with the creditor, repayment plans, or seeking legal advice to explore available options. In summary, understanding and navigating the intricacies of an Evansville Indiana Notice of Lien — Corporation or LLC is crucial for both creditors seeking to secure their rightful claims and corporations or LCS aiming to maintain a positive financial standing. Having a comprehensive understanding of the various types of liens and their implications empowers businesses to make informed decisions while ensuring proper compliance with legal requirements.Evansville Indiana Notice of Lien — Corporation or LLC: A Comprehensive Overview In the realm of business and the legal framework surrounding it, liens can play a pivotal role when it comes to financial security and obligations. Evansville, Indiana, like many other jurisdictions, allows for notices of lien to be filed against corporations or limited liability companies (LCS) in specific circumstances. This comprehensive guide aims to provide a detailed description of what an Evansville Indiana Notice of Lien — Corporation or LLC entails, exploring its purpose, types, and significance in the business world. What is a Notice of Lien? A Notice of Lien is a legal document filed by a creditor to indicate their claim on the property or assets of a corporation or LLC as collateral for a debt or obligation owed to them. It serves as a public record that notifies other parties, such as potential purchasers or creditors, of the outstanding financial encumbrance affecting the business. Purpose of an Evansville Indiana Notice of Lien — Corporation or LLC: The primary purpose of filing a notice of lien against a corporation or LLC in Evansville, Indiana, is to protect the rights of creditors who are owed a debt. By formally registering a lien, the creditor ensures that their claim takes precedence over subsequent claims or transfers of ownership made by the debtor. It acts as a safeguard and helps creditors navigate complex legal processes to recover their owed funds. Types of Evansville Indiana Notices of Lien — Corporation or LLC: 1. Tax Lien: The Evansville Department of Revenue may file a tax lien against a corporation or LLC that fails to meet its tax obligations. Tax liens can be enforced against the business's assets and property to collect unpaid taxes. 2. Judgment Lien: A judgment lien is filed when a creditor obtains a court judgment against a corporation or LLC. This lien allows the creditor to collect the owed debt by attaching the lien to the business's real estate, personal property, or other assets until the debt is satisfied. 3. UCC Lien: Under the Uniform Commercial Code (UCC), a creditor may file a UCC lien against a corporation or LLC to secure their interest in the business's personal property. UCC liens typically apply to business equipment, inventory, accounts receivable, or other valuable assets. Significance and Implications: When a notice of lien is filed against a corporation or LLC in Evansville, Indiana, it serves as a cautionary sign for potential creditors or buyers interested in engaging with the business. The existence of a lien may complicate the ability to secure loans, obtain credit, or transfer ownership smoothly. Additionally, a notice of lien can negatively impact the corporation or LLC's credit rating, making it more challenging to establish trust and secure future business transactions. To address a filed notice of lien, the corporation or LLC must take the necessary steps to resolve the underlying debt or obligation promptly. This can involve negotiations with the creditor, repayment plans, or seeking legal advice to explore available options. In summary, understanding and navigating the intricacies of an Evansville Indiana Notice of Lien — Corporation or LLC is crucial for both creditors seeking to secure their rightful claims and corporations or LCS aiming to maintain a positive financial standing. Having a comprehensive understanding of the various types of liens and their implications empowers businesses to make informed decisions while ensuring proper compliance with legal requirements.